With Data Pointing To Clear Skies Ahead, LinkUp Forecasts Robust Job Growth In September

Fed Chair Jerome Powell stated that the U.S. economy was experiencing ‘a particularly bright moment’ and the Fed described economic conditions as ‘strong.’

In discussing the decision this week to raise rates as most people expected, Fed Chair Jerome Powell stated that the U.S. economy was experiencing ‘a particularly bright moment’ and the Fed described economic conditions as ‘strong.’ Even with the possibility of some tariff-induced turbulence and leaving aside for the moment the inevitability of a recession somewhere out on the horizon, there is no alternative way to look at the current data.

Focusing specifically on the labor market, recent highlights include the following:

- 95 straight months of positive job gains

- Job quits rose to 3.58 million in July, the highest level since 2001

- Job openings rose to nearly 6.94 million in July (and will undoubtedly jump markedly higher in August)

- Hourly wages rose 2.9% in August, the fastest rate since 2009

- Initial jobless claims reached a 49-year low

- A recent NFIB survey found that 38% of small businesses had unfilled job openings, the highest level in 45 years of records.

- Ex-felons are seeing the job market slowly open

- The job market is so strong that the Army fell short of its recruiting goal for the first time in 13 years

- The tight labor market is giving more confidence to workers to demand concessions through strikes

- Companies are expanding training, even down to high-school students

- Retailers started their holiday hiring earlier than ever with 757,000 retail job openings in July, 100,000 higher than the prior year. And they are doing everything they can to sweeten offers to attract new hires, including increased pay, profit-sharing, paid-time off for part-time positions, and discounts on merchandise.

But as irrefutable as the data is around the strength of the labor market and the massive challenges employers are facing in trying to find qualified applicants, the continued absence of wage gains (and the resulting lack of broader inflation in general) has created a serious debate about how the Fed should proceed with future rate hikes. As the WSJ pointed out yesterday:

Wednesday’s interest-rate projections show two different schools of thought about how the Fed might proceed.

One camp of officials says so long as unemployment keeps falling farther below the level they project is consistent with low and stable inflation, the Fed will need to raise rates to prevent the economy from overheating. This is an uncontroversial strategy, because it is what the central bank always does at this point in an expansion.

Another camp argues for a relatively radical departure from this norm. These officials say if inflation doesn’t appear to be accelerating beyond 2%, the Fed could stop raising rates after reaching a neutral setting that neither spurs nor slows growth.

And as the Journal’s James Mackintosh points out, Powell and the Fed did little to help clarify which path they’re likely to head down. As Mackintosh states, referring to the removal of the word accommodative in the Fed statement, “The focus on a single word highlights two important market truths: The Fed isn’t focused on supporting the economy, which is doing very well by itself; and the Fed no longer feels such a need to talk down future policy rates in order to get investors to help. The result is that things are likely to get a lot more confusing for markets.”

As inflation’s absence continues to confound economists, every rock is being turned over to find a possible explanation. Maybe wages are actually rising faster than the data suggests. Maybe the growing use of non-cash benefits and perks is obscuring actual wage gains. Maybe we aren’t looking at the right data. Maybe the Phillips Curve is dead. Maybe inflation is no longer a relevant indicator of Full Employment.

But as Aaron Sojourner, an Economics professor at the University of Minnesota’s Carlson School of Management and a former with the Council of Economic Advisers for both the Obama and Trump administrations points out, even if wages have risen to some extent, the growth rate is so low that it essentially rounds down to zero. As Sojourner said to Lee Schafer recently,”No matter what measure you use, real wage growth is low, like close to zero, and lower than it was a couple of years ago. Those things aren’t in dispute.”

And more important than the past year or two, stagnant wages over the past few decades has resulted in seismic shifts in the nation’s share of income going to workers. As William Galston recently wrote in a Wall Street Journal op-ed entitled ‘Wage Stagnation Is Everyone’s Problem’:

For much of the postwar period, American wage and salary earners received an average of 64% of gross domestic product. Although signs of weakness emerged in the mid-1980s, the labor share of national income stood at 64% as recently as the first quarter of 2001. Then the world changed. The labor share fell almost without interruption for more than a decade, bottoming out at 56% in the final quarter of 2011 and now resting at about 58%. More than half of this decline occurred between 2001 and the end of 2007, before the onset of the Great Recession…In the past year economic growth has accelerated and unemployment has fallen to the lowest level in two decades. This is supposed to help wage earners, but pay rates haven’t ticked up. Between July 2017 and July 2018, workers’ average inflation-adjusted earnings fell by 0.4%.

If workers in 2016 had received the share of national income they averaged over most of the postwar period, their total earnings would have been $1.2 trillion higher in that year alone. This equates to an annual salary boost of more than $7,500 for each worker.

There is only one way to go. The high-earning Americans who have done so well in recent decades must pay higher taxes to support the portion of the workforce that is falling behind. This isn’t charity, nor is it welfare. It’s simple common sense, or self-interest rightly understood, because an economic system that fails to offer broad gains will end up with disruption.

Not often does one see a call for higher taxes on the wealthy in an op-ed in the Wall Street Journal.

and speaking of disruption, and turning back, unfortunately, to the present, the President seems to be doing everything in his power to maximize disruption through his completely misguided trade wars. And while there is some debate as to the how big an impact tariffs will have on the job market and the economy as a whole, some signs are beginning to emerge.

Elkhart, Indiana, for example, the RV capital of the world and an economic bellwether, is flashing a massive warning signs as RV shipments have dropped 18.7% in June from a year ago. And Josh Wright, Chief Economist at iCims, points out in a recent blog post that the drop in employment in the auto sector in August is likely the result of tariffs.

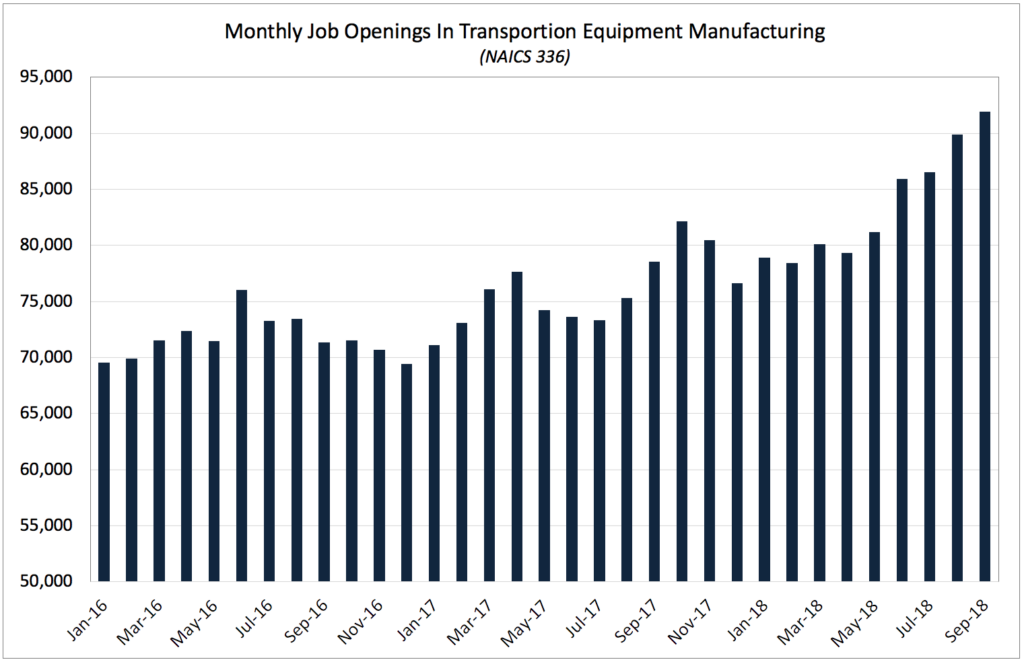

On the other hand, job openings on LinkUp (which only indexes jobs directly from a company’s website) paint a different picture. As the graph below indicates, labor demand in Transportation Equipment Manufacturing (NAICS 336), which includes autos as well as the broader transportation industry, has grown steadily throughout the year. In August, job openings across the 336 sub-sector rose 4%, while labor demand among auto companies specifically rose 7%.

It is true, however, that growth in labor demand in transportation equipment manufacturing in August lagged the broader economy and might have otherwise been higher were it not for The Trump Tariffs.

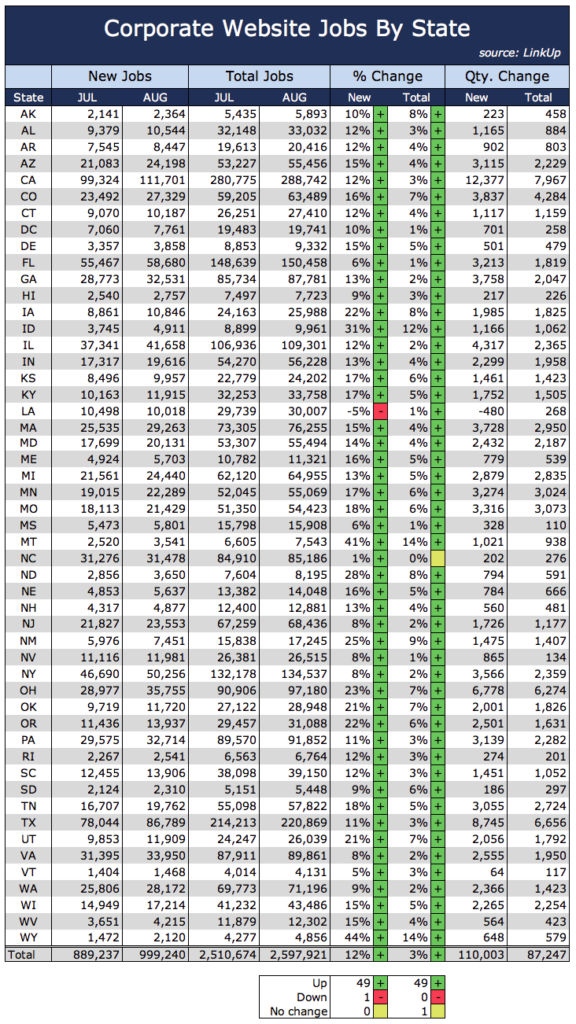

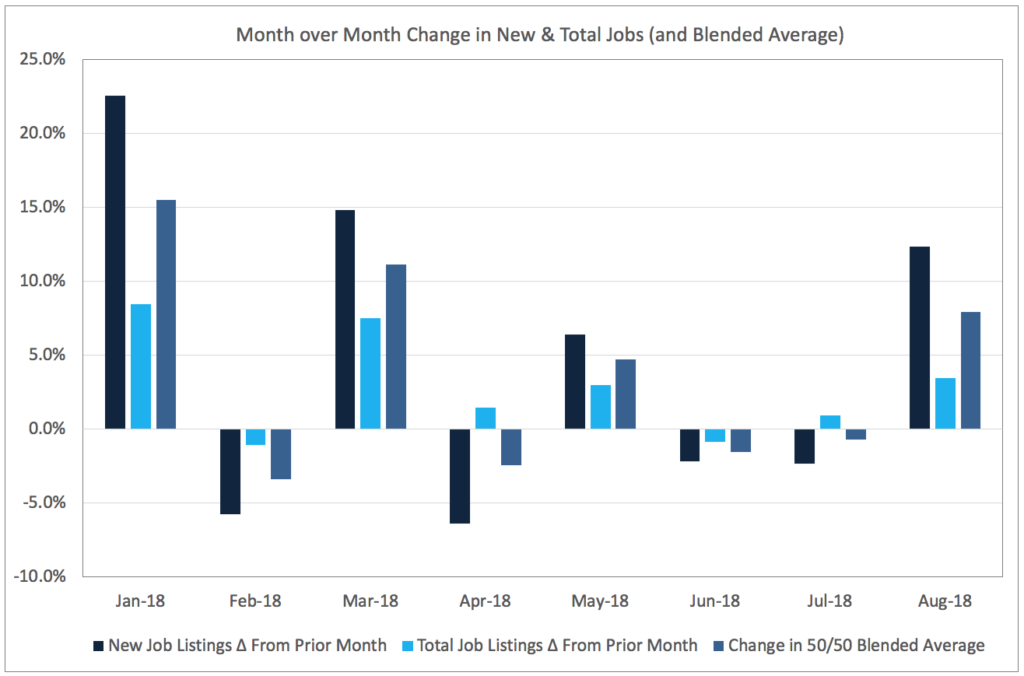

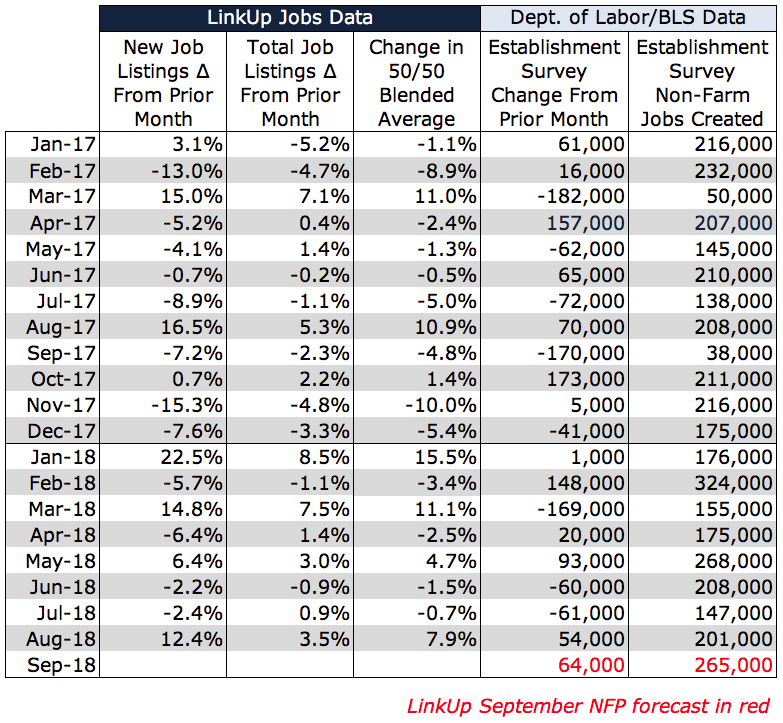

Looking at job openings across the entire country using our paired-month data (where we only count job openings for companies that are present in both July and August’s data), new and total job postings across the entire economy rose 12% and 3% respectively.

The significant jump in labor demand in August reverses, at least for the moment, what had been a persistent downward trend throughout the year in the number of new and total ‘Paired-Month’ job openings in LinkUp’s job search engine. And because the best indicator of a future hire being added to the economy is when an employer posts an opening for that position on their company website, the rise in job openings in August bodes well for September’s jobs report.

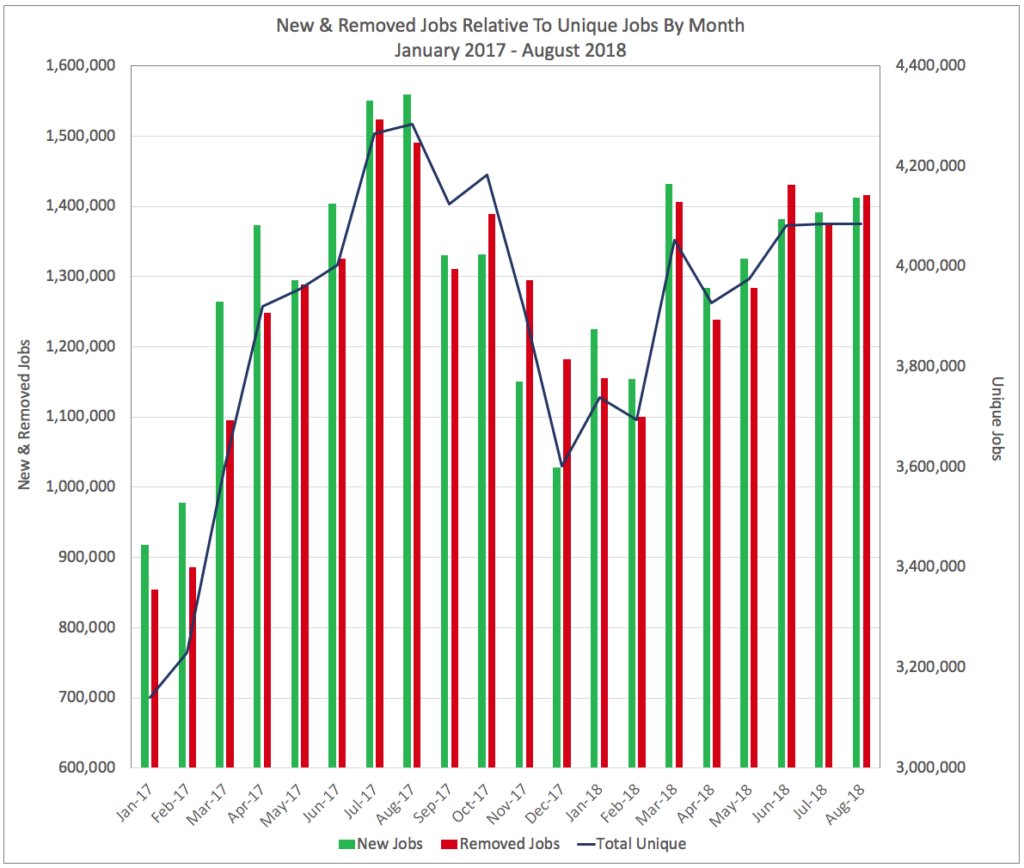

Looking at our jobs data for all companies in the index, one can see that new listings and removed listings (which serve as a solid proxy for filled jobs), as well as total unique job openings, have generally trended up this year but have flattened out over the summer (with a slight bump of 1.5% for new job openings in August).

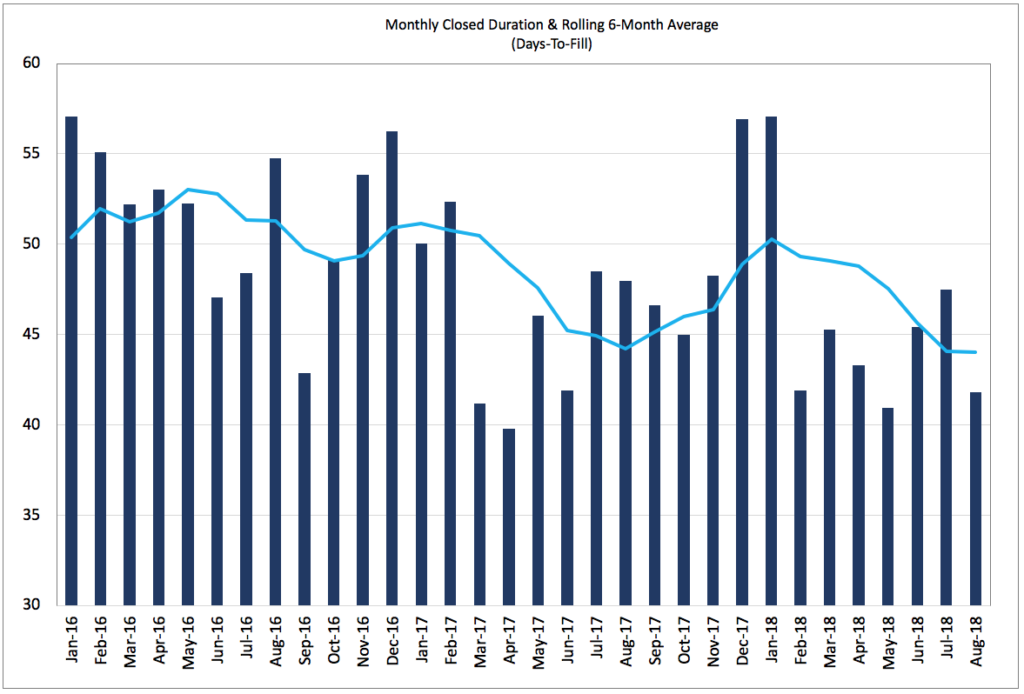

One other positive data point is the fact that monthly Closed Duration has fallen in 2018 from a peak in 2016. Closed Duration measures how many days a job listing has been on a company’s corporate career portal before it is taken down, presumably because the opening was filled with a new hire. So Monthly Closed Duration effectively measures ‘Time-To-Fill’ or the number of days it takes a company to fill an open position. This ‘Velocity’ metric provides powerful insights into whether or not the pace of hiring is accelerating or slowing down which can have different implications or causes depending on the condition of the economy generally and the job market specifically.

In 2016, it took companies an average of 52 days to fill a job. That dropped to 47 days last year and in 2018, Closed Duration has fallen to 45 days. A drop in duration could be the result of new entrants coming into the job market, an increase in wages (and/or benefits and perks), more churn or liquidity in the labor market, a higher degree of urgency among hiring managers to fill positions faster in a tight labor market (and thus relaxing standards, cutting steps in the process, paying employees referral bonuses, adding sign-on bonuses, etc.), or any combination thereof.

Regardless of what’s driving it, accelerating hiring velocity is a positive indicator for sustaining a strong job market. So combining our paired-month data and paying attention to duration, we are forecasting a strong jobs report next week for September. With an increase of 7.9% in the blended average gains in new and total job openings in August, we are forecasting a net gain of 265,000 jobs in September.

Looking beyond September, there are plenty of people for whom dark clouds on the horizon loom heavily. Real or imagined, there is no disputing the fact that this record-setting recovery cannot last forever. A storm will eventually arrive and the chorus of people who point out the obvious that with each passing month or quarter of positive data we are that much closer to its arrival will certainly grow louder and louder.

On the other end of the spectrum are people like Larry Summers who are measuring its arrival in terms of years (or at least are appearing to). At the recent Aspen Ideas Festival Summers stated that if the recovery continues for three more years, he’d be “a bit surprised.” If it runs for five more years, he’d be “very surprised.” As Mike Meyers would say on Coffee Talk, undoubtedly a bit verklempt, “Prescient insight or brilliant hedge? Discuss amongst yourselves.”

Insights: Related insights and resources

-

Blog

06.01.2022

LinkUp Forecasting Disappointing Jobs Numbers For May and Continued Weakness in June

Read full article -

Blog

04.01.2022

LinkUp Forecasting Net Gain of 800,000 Jobs in March as Jobs Data Points to Accelerating Labor Demand in U.S.

Read full article -

Blog

08.30.2021

Labor Demand in Goods Producing Industries Outpacing Labor Demand in Service Industries

Read full article -

Blog

09.03.2020

August Jobs Report Will Beat Consensus Estimates

Read full article -

Blog

02.02.2017

LinkUp Forecasting Solid Job Gains In January and Continued Strength In February

Read full article -

Blog

12.02.2015

November NFP Should Be Decent But December Looks Grim

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.