Where does the money go?

Private companies go public for many reasons; to pay off debts, to provide exits for founders, to generate publicity or to fuel growth. Often companies on the verge of growth will increase their expenses, hiring employees to fuel that growth.

Private companies go public for many reasons; to pay off debts, to provide exits for founders, to generate publicity or to fuel growth. Often companies on the verge of growth will increase their expenses, hiring employees to fuel that growth. LinkUp job data can provide a unique insight into the type of roles these companies are willing to spend money to fill.

For this analysis, we will take a look at 11 of the higher profile IPOs of 2019. LinkUp does have data for more recent IPOs, but for the purpose of this analysis, we want to examine how these companies performed historically. Below is a list of the Stock symbols for these companies:

- AVTR | NYS | US

- BYND | NAS | US

- NET | NYS | US

- PINS | NYS | US

- PTON | NAS | US

- ZM | NAS | US

- DOYU | NAS | US

- LYFT | NAS | US

- SDC | NAS | US

- UBER | NYS | US

- WORK | NYS | US

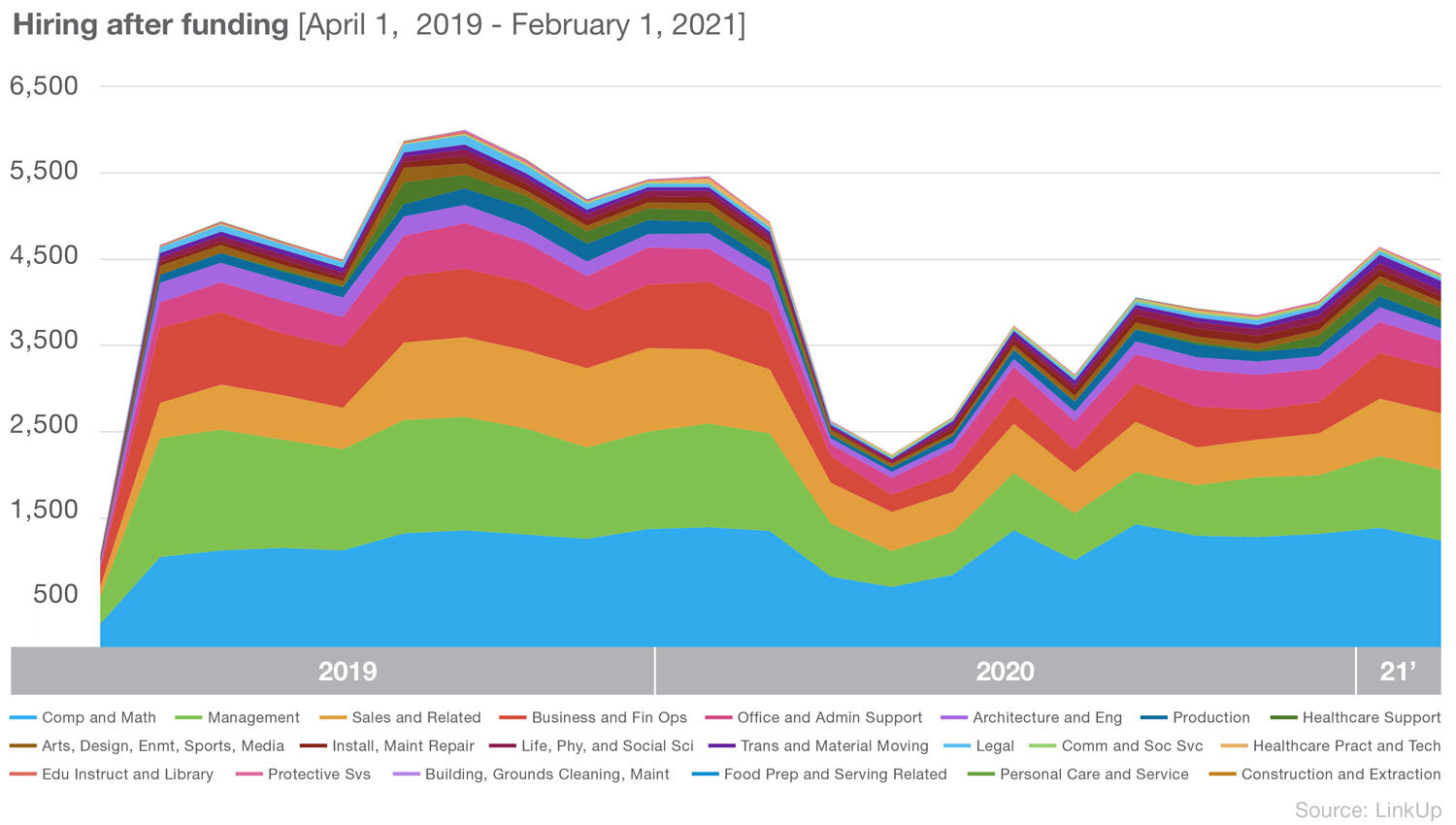

Let’s start by taking a look at all of these companies to see what hiring looked like after they went public.

From the above graphs, we can see that hiring certainly increased for the highlighted companies as a result of new capital. We can also see the top three types of roles the companies were hiring for: Tech, Management, and Sales. Lastly, we can observe that even companies with capital to spend held back on hiring during the early stages of CV. This is only half the story. Some of these securities performed far better than others in the future. To differentiate, we will group these securities into two groups: Winners and Losers. Winners outperformed the S&P 500 while the Losers, at the time of this writing, did not. Below are our two groups:

Winners

- AVTR | NYS | US

- BYND | NAS | US

- NET | NYS | US

- PINS | NYS | US

- PTON | NAS | US

- ZM | NAS | US

Losers

- DOYU | NAS | US

- LYFT | NAS | US

- SDC | NAS | US

- UBER | NYS | US

- WORK | NYS | US

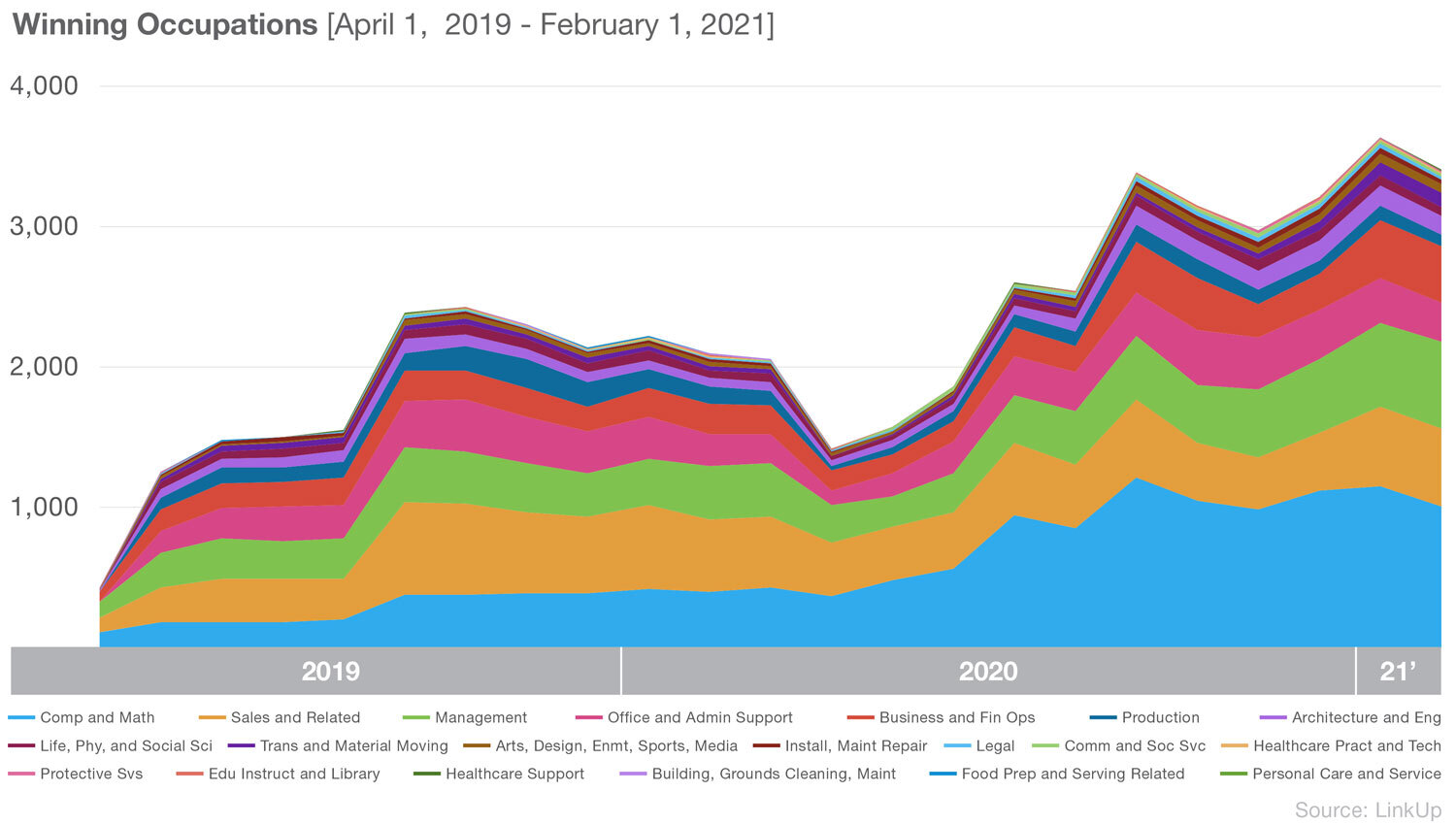

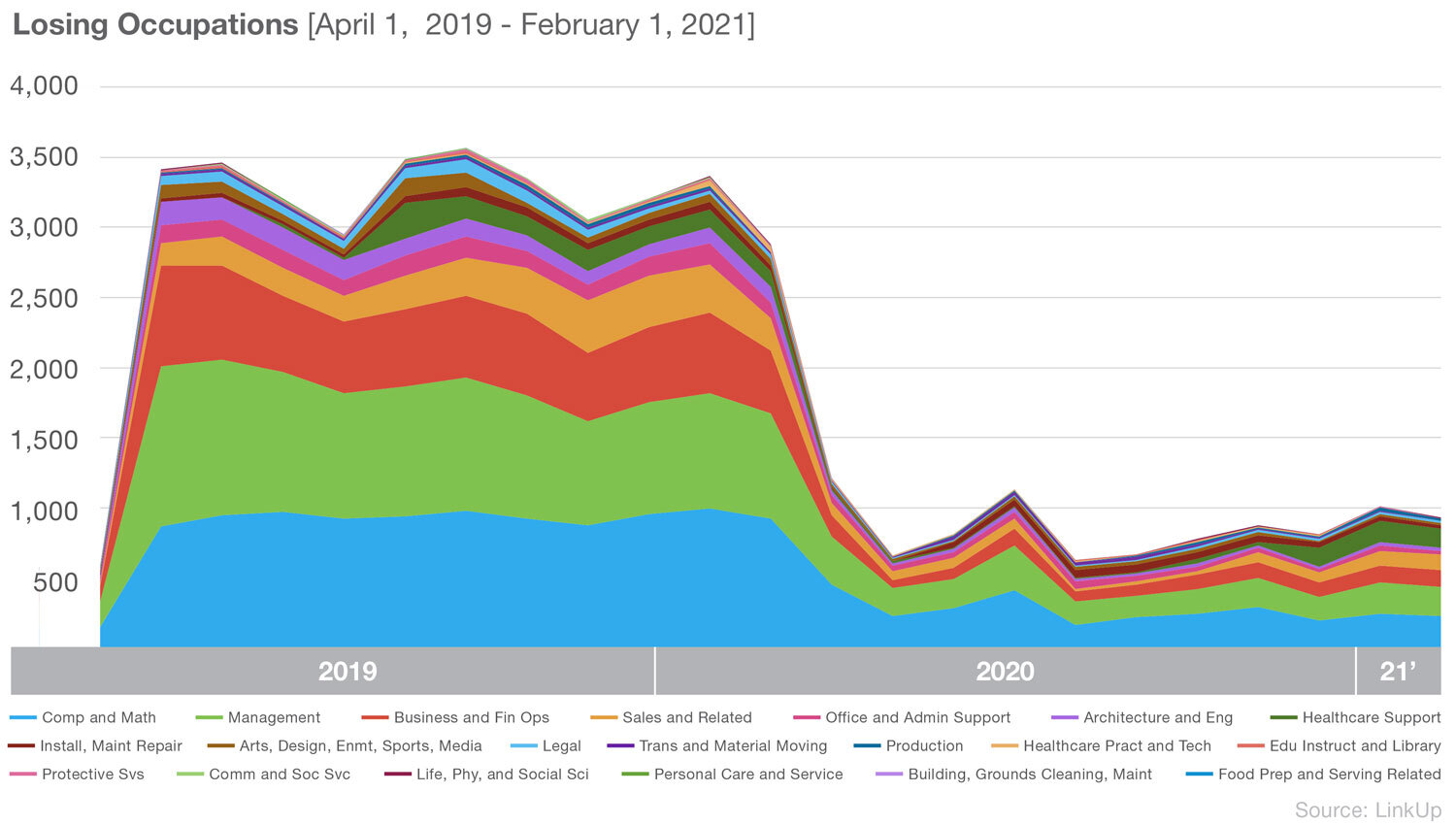

Now, let’s take a look at the hiring patterns of both these groups.

When comparing the Winners and Losers, two things are immediately obvious. Winners seem to hire more slowly out of the IPO, possibly more thoroughly assessing what roles are needed. It is also clear that the Winners hiring patterns were affected far less than that of the Losers. Undoubtedly, this is partly fueled by the fact both Uber and Lyft fell into our Loser bracket.

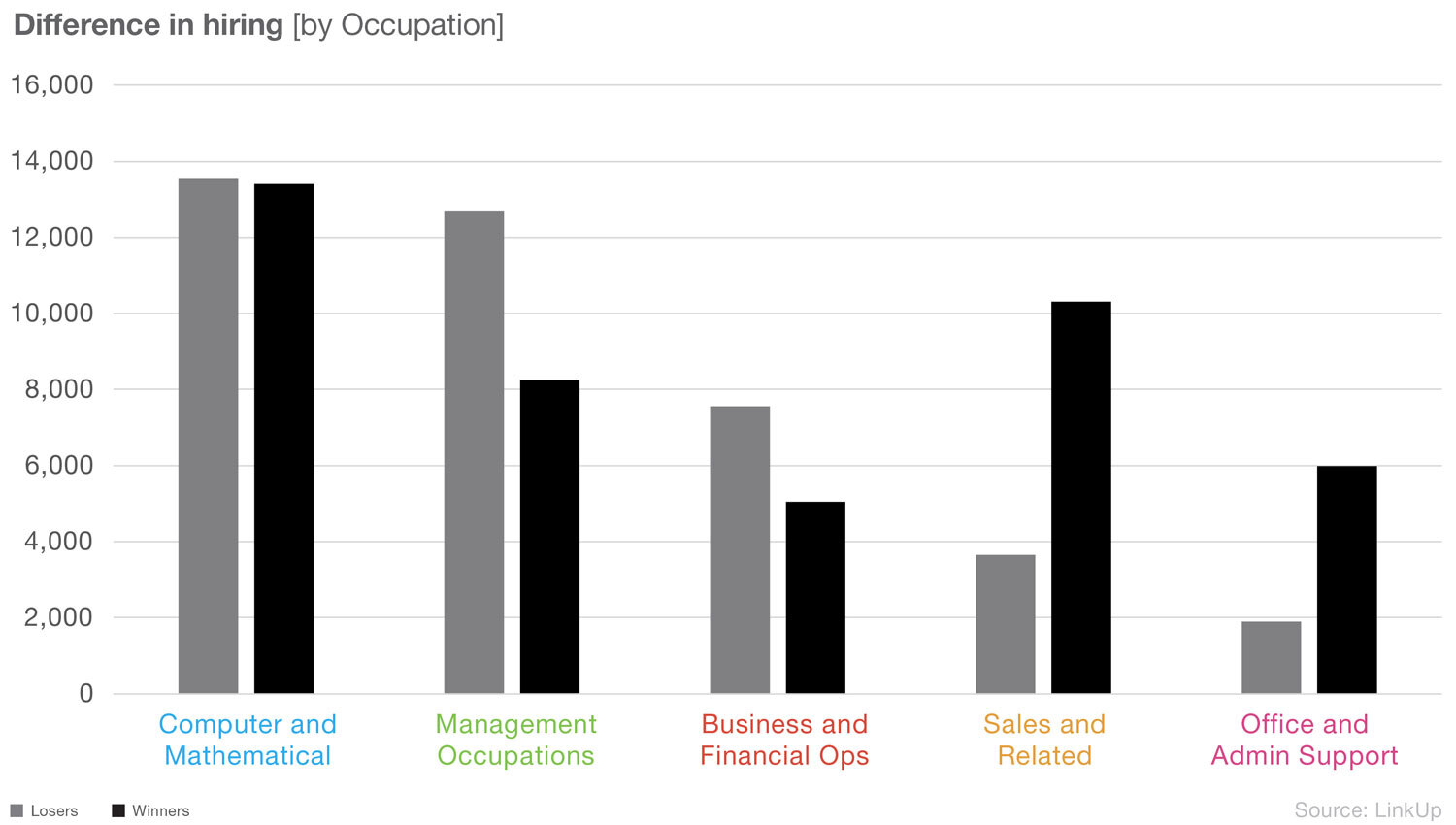

Comparing the top 5 roles both groups hired for, we can see that they focused on tech as a top priority. Beyond that, we start to see the differences in each group’s approach.

The Losers group hired far more Management roles than that of the Winners. More interesting, we see that the Winners placed a greater priority on sales. It’s likely this strategy could have led to a better growth rate, and ultimately, better performance than that of the Losers group.

Interested in the job data behind this post? Contact us to learn more about LinkUp job market data.

Insights: Related insights and resources

-

Blog

01.11.2022

ESG investing on the rise

Read full article -

Blog

04.01.2021

Answering sustainability questions with employment data

Read full article -

Blog

03.12.2021

Hiring trends at SPACs

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.