What job listings tell us about big banks

There has been a lot of recent news about large banks; the possibility of cutting dividends and generally not having the best looking balance sheets.

There has been a lot of recent news about large banks; the possibility of cutting dividends and generally not having the best looking balance sheets. As we near the end of June and the Federal Reserve’s annual stress tests on the biggest banks in the U.S. wrap up, investors are concerned about whether regulators will require dividend cuts. We decided to take a deeper look at this, hoping that recent job listings could shed some light on the direction large banks are heading.

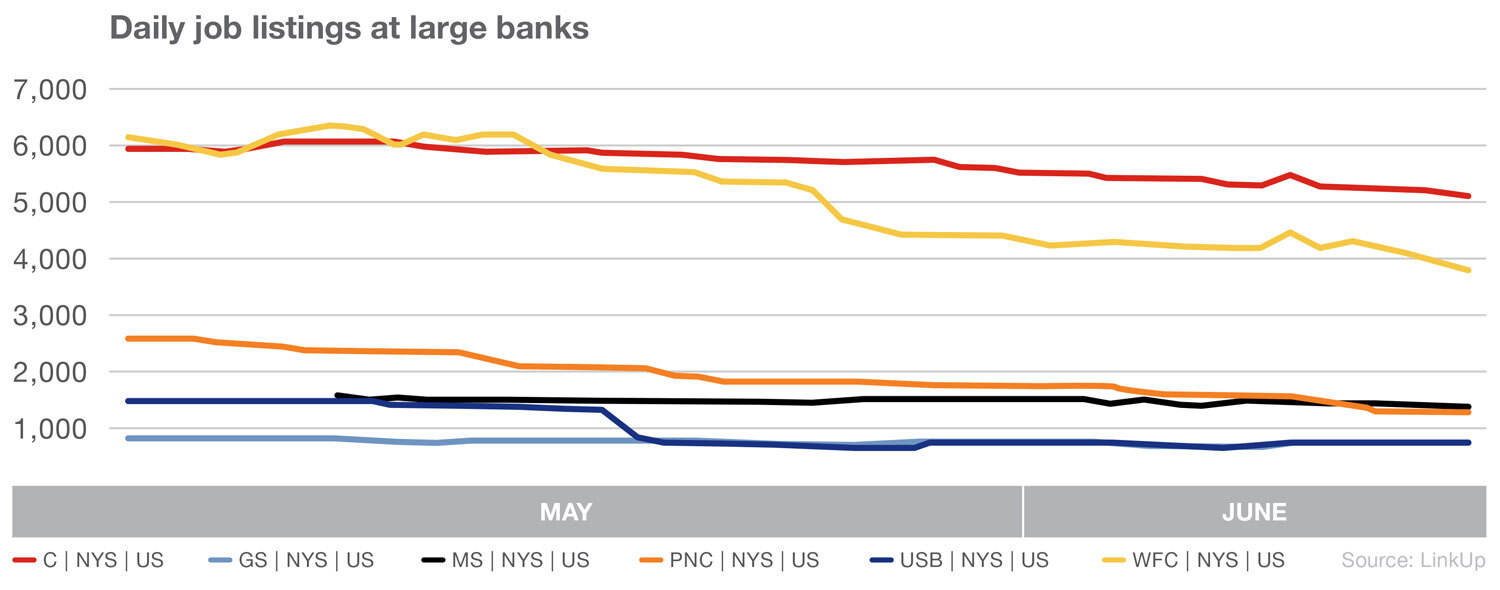

First, we looked at active job listings since May for six large banks (Citibank, Goldman Sachs, Morgan Stanley, PNC, US Bank, and Wells Fargo), to see if we can discern any hiring patterns. We chose May as a starting point for this analysis to avoid the steep drop in jobs that was seen across the majority of companies in response to COVID-19.

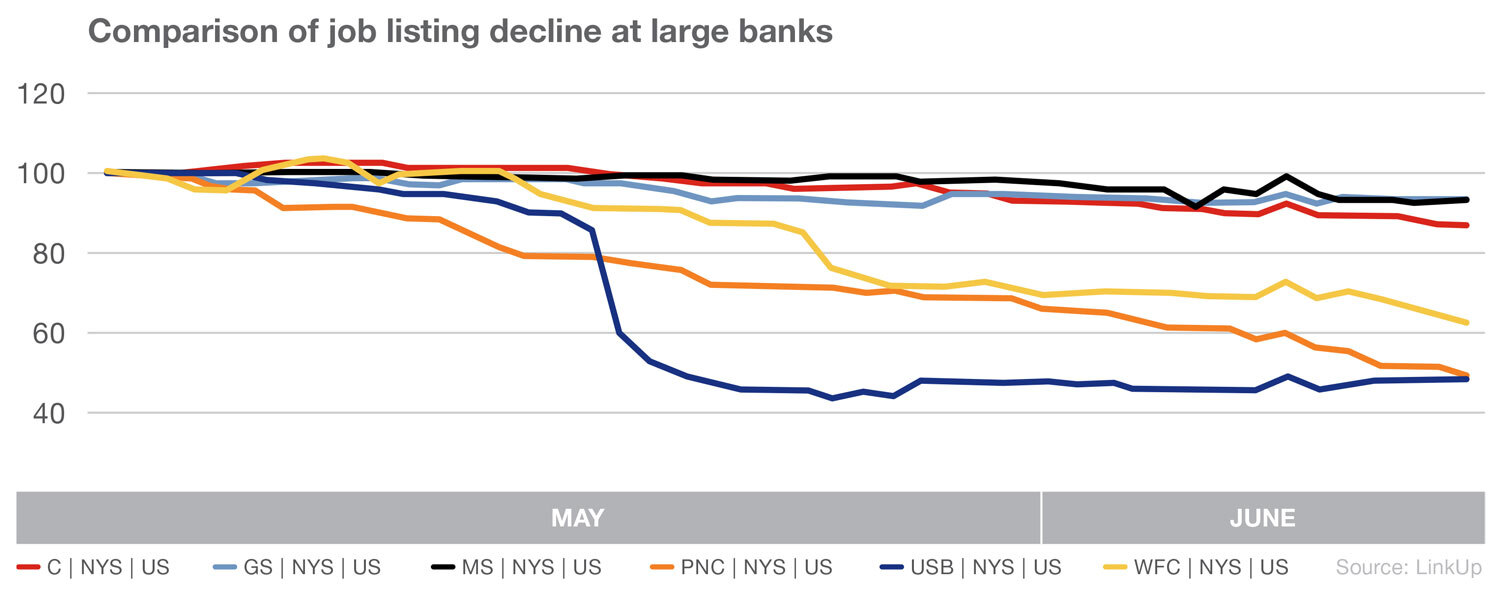

Here we can see that there is a decline, though it’s difficult to tell exactly how much. Giving each bank an even starting point of 100, the comparison becomes clearer.

Here we can see that all six large banks are showing some signs of decreased job listings, but banks with large retail operations seem to be cutting jobs at a larger rate. It would be logical to assume COVID-19 and the need to cut jobs to decrease operating expenses is the likely culprit here.

But when we drill down to what jobs were deleted at the PNC, Wells Fargo, and US Banks in May we see that Wells Fargo had large cuts in technology; US banks had the majority of its cuts in a mix of mortgage lending and technology; while PNC had a mix of cuts in technology and retail jobs. It appears we are looking at larger scale efforts to reduce expenses, outside of the direct impact of coronavirus on retail operations.

Next, we examined which banks are currently doing the majority of the hiring, and what positions they’re looking to fill. Wells Fargo has a large number of technology listings active, which is common across the six. Also noteworthy is that PNC and Wells Fargo both have a large amount of listings for mortgage related positions. This is interesting for 2 reasons. The first is that this could be an indicator that the housing market is poised to grow in the midst of COVID and beyond. This second is that it shows a diverging strategy between the three banks that have drastically reduced their job listings since May 1st; with US Bank moving away from mortgage roles, while Wells Fargo and PNC are moving into the space.

Overall, we can see that three of the six large banks analyzed have cut positions significantly, though these positions are not what one would expect as a direct result of COVID-19. We can see signs of a strong housing market with a high demand for mortgage related positions.

Get more with LinkUp’s jobs data

Interested in the job data behind this post? Contact us to learn more about LinkUp job market data.

Insights: Related insights and resources

-

Blog

08.05.2021

Just released: Economic Indicator Report Q2 2021

Read full article -

Blog

06.12.2021

May 2021 Jobs Recap: Another month of steady growth

Read full article -

Blog

03.24.2020

New: LinkUp COVID-19 Jobs Report

Read full article