Wage inflation: Overhyped or rising concern?

Wage inflation has been a hot topic of late, with many employers saying that they are having to raise compensation to attract workers.

Wage inflation has been a hot topic of late, with many employers saying that they are having to raise compensation to attract workers. This is an area that touches every corner of the economy as labor is a key input in almost every industry. Even the Federal Reserve is starting to take note, last week indicating via its “dot plot” a median estimate of two rate hikes before the end of 2023. Since a dovish Fed has been a central thesis of bullish equity markets, investors will continue to pay close attention to wages.

To get a window into wage inflation, U.S. Bureau of Labor Statistics (BLS) wage data can be used to join wage information to LinkUp’s job posting dataset by using the O*NET code. This can give us insights into the expected pay for various roles, however the BLS data is not updated that often, making it a lagging indicator of wage inflation and mitigating its value for time-sensitive, anxious investors.

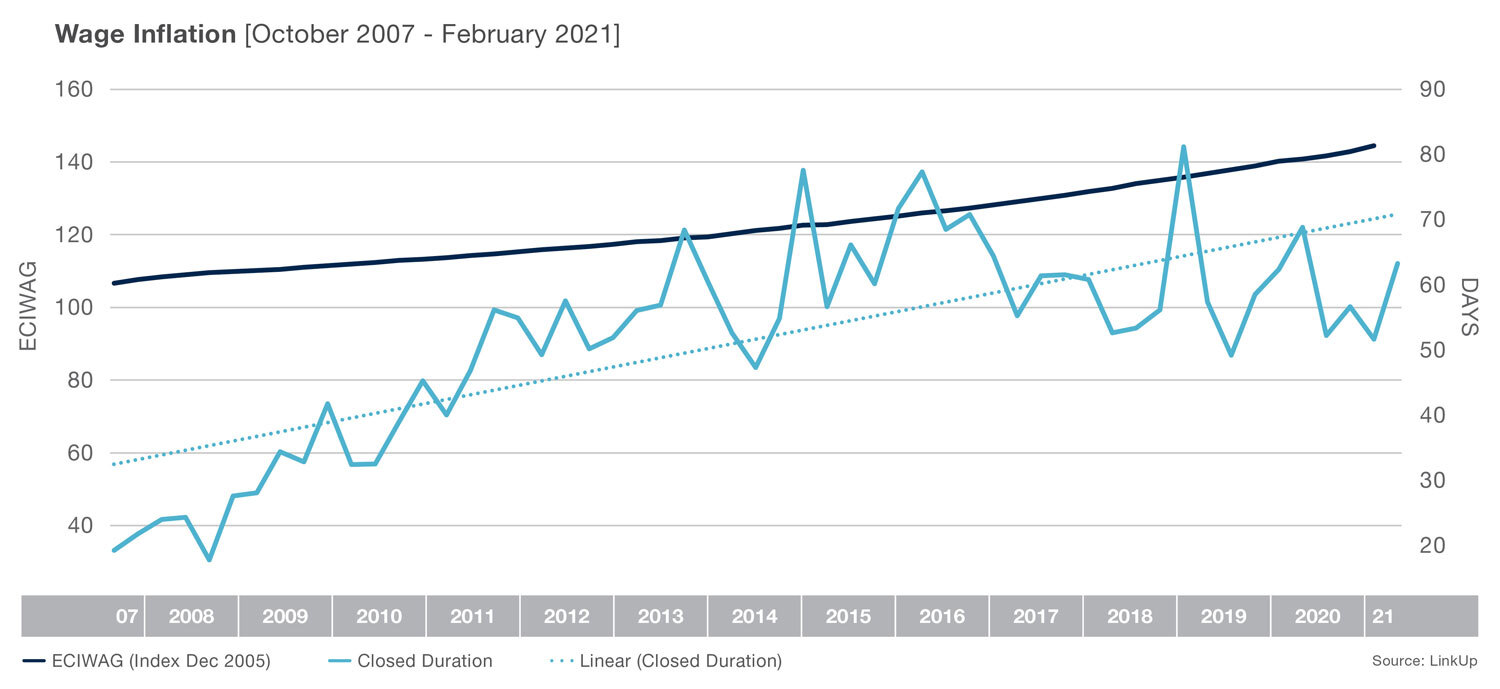

Using LinkUp’s job data, we can look for alternative ways to find more timely indicators of wage inflation, or evidence that the wage inflation concerns are overblown. The first thing we can examine is the “closed duration,” this is the average amount of time it takes for a job posting to be closed. We view the closing of a job posting as equivalent to the advertising employer filling the role. The general thesis here being that as roles take longer to fill, advertising employers will have to increase incentives to fill that role. Comparing closed duration to the Employment Cost Index: Wages and Salaries: Private Industry Workers we see that the general linear trend line of closed duration tracks roughly parallel to the ECIWAG data.

The above chart would suggest that wages are likely rising right now. But with a moderate correlation value of 0.65, it is hard to draw confident conclusions from these relatively limited data points.

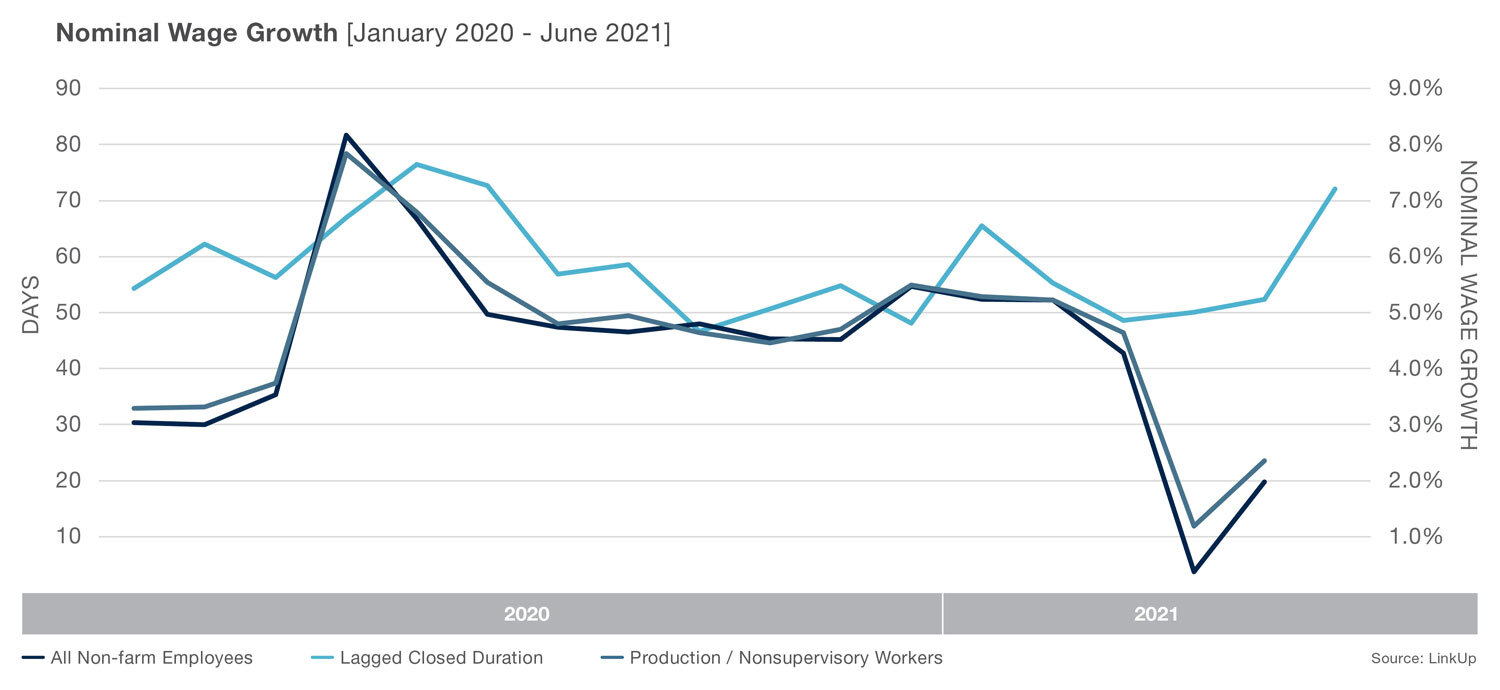

Looking more granularly, we will turn to the Economic Policy Institute (EPI) for their nominal wage growth tracker. It’s important to first point out that the EPI is arguing that the Fed should not be concerned about inflation until the nominal wage growth reaches 3.5-4%, a level not seen in many years. After last week’s Federal Reserve meeting, the Fed Chairman, Jerome Powell, appears to be in agreement with this position.

Over the history of the LinkUp dataset, there is limited meaningful correlation between nominal wage growth and closed duration. Since 2020, however, when lagging closed duration one period, moderate correlation can be observed between both the production and all employees data series. Meaning that our closed duration metric could give leading insights into nominal wage growth. Currently, it is indicating a substantial increase in nominal wage growth.

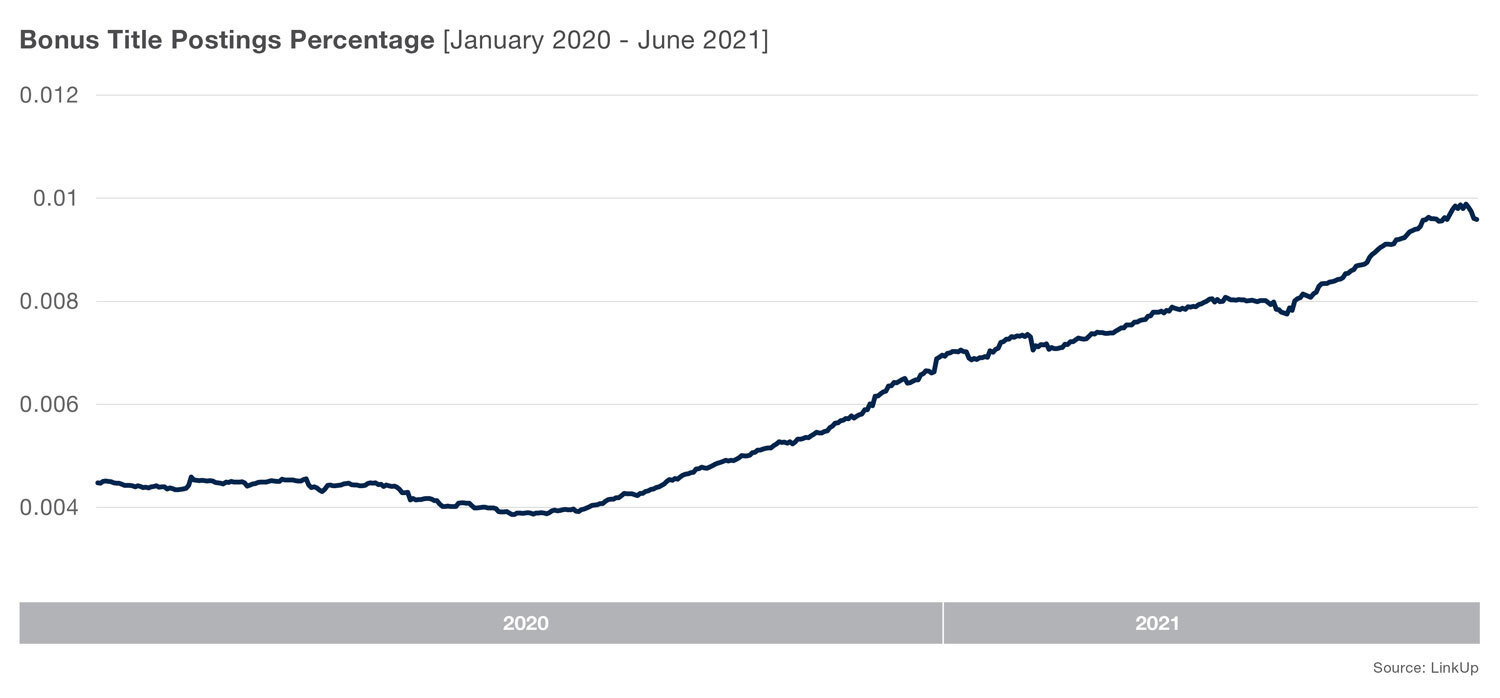

Lastly, we can look to an unconventional but possibly more telling indicator of wage inflation in the economy, jobs with the word “bonus” in the title. The hypothesis being that as competition for qualified employees increases, more signing bonuses will be paid to those sought after hires and employers will advertise these bonuses in the job titles themselves. To eliminate false positives on roles that normally will pay bonuses, we will only search for the terms “hiring bonus,” “signing bonus,” “sign-on bonus,” “signon bonus” and “sign on bonus” as opposed to just “bonus.”

This returns a sizable dataset. We will divide that data by the total number of jobs on any given day, to come up with a percentage for how many “bonus roles” we are seeing. There certainly has been a sharp increase in titles containing our keywords mentioned above.

What’s perhaps more interesting is that we can see that these roles have exploded coming out of the recovery from Covid.

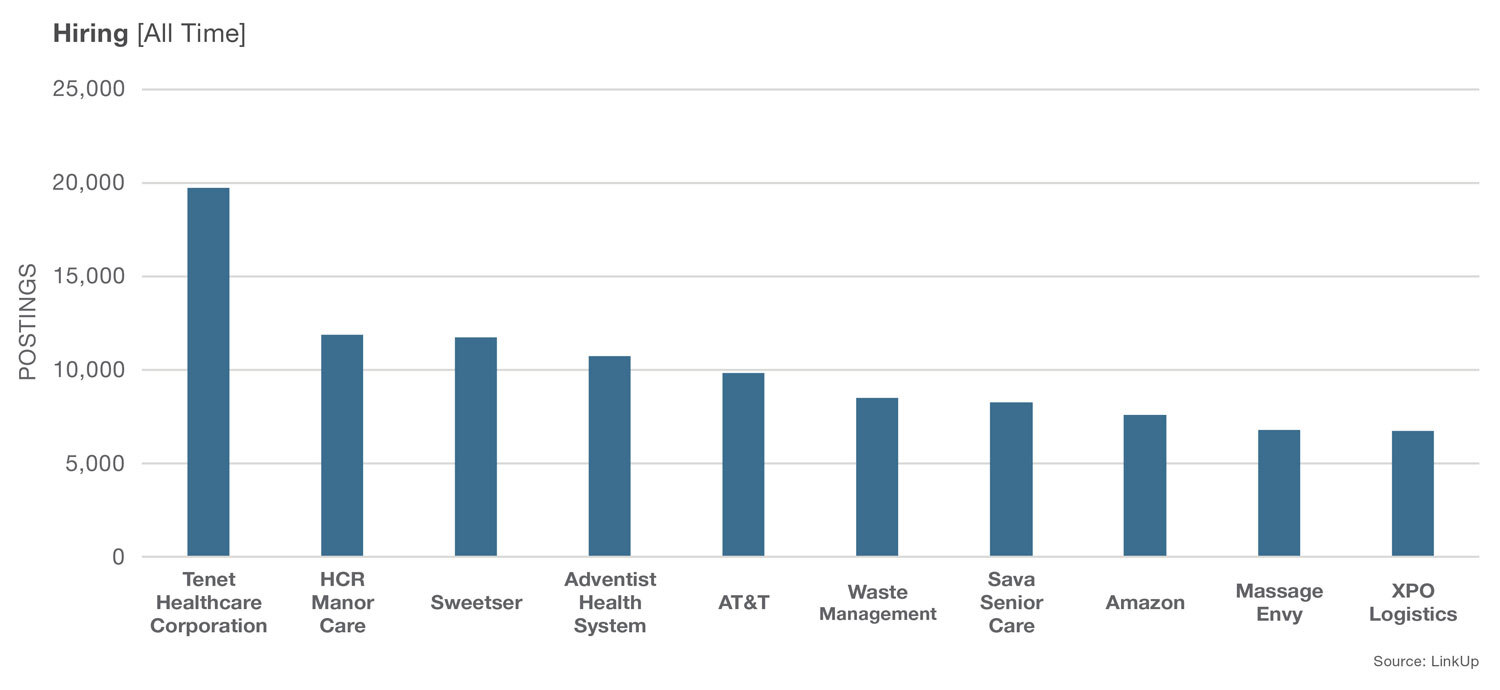

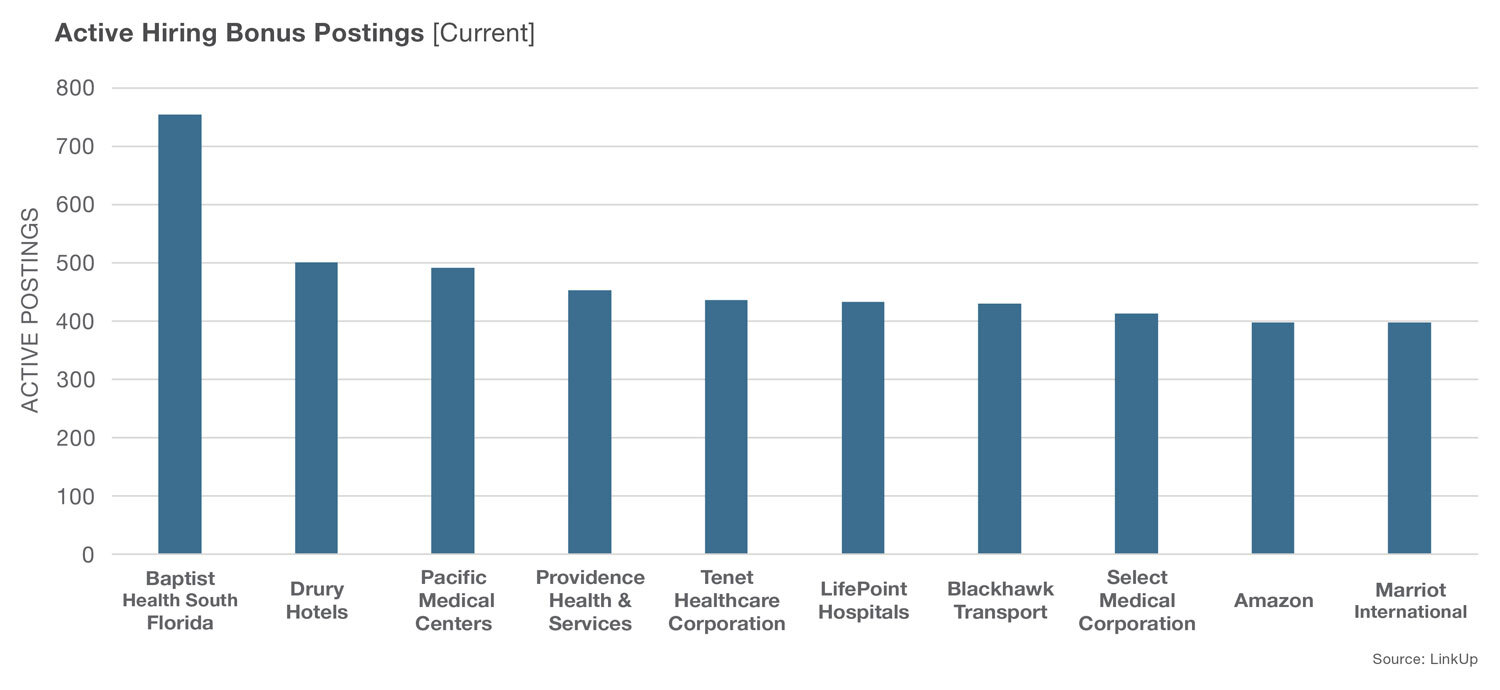

Looking at the company level, it can be observed that the companies who have throughout the entire history of our dataset posted the most jobs with our keywords in the title, are not the same companies with the most active jobs containing those keywords presently.

We see that the group that has the highest amount of bonus jobs currently active is far different than the group that historically offered the most hiring bonuses. Meaning new companies are finding that they have to increase the incentives for employees to join their firm.

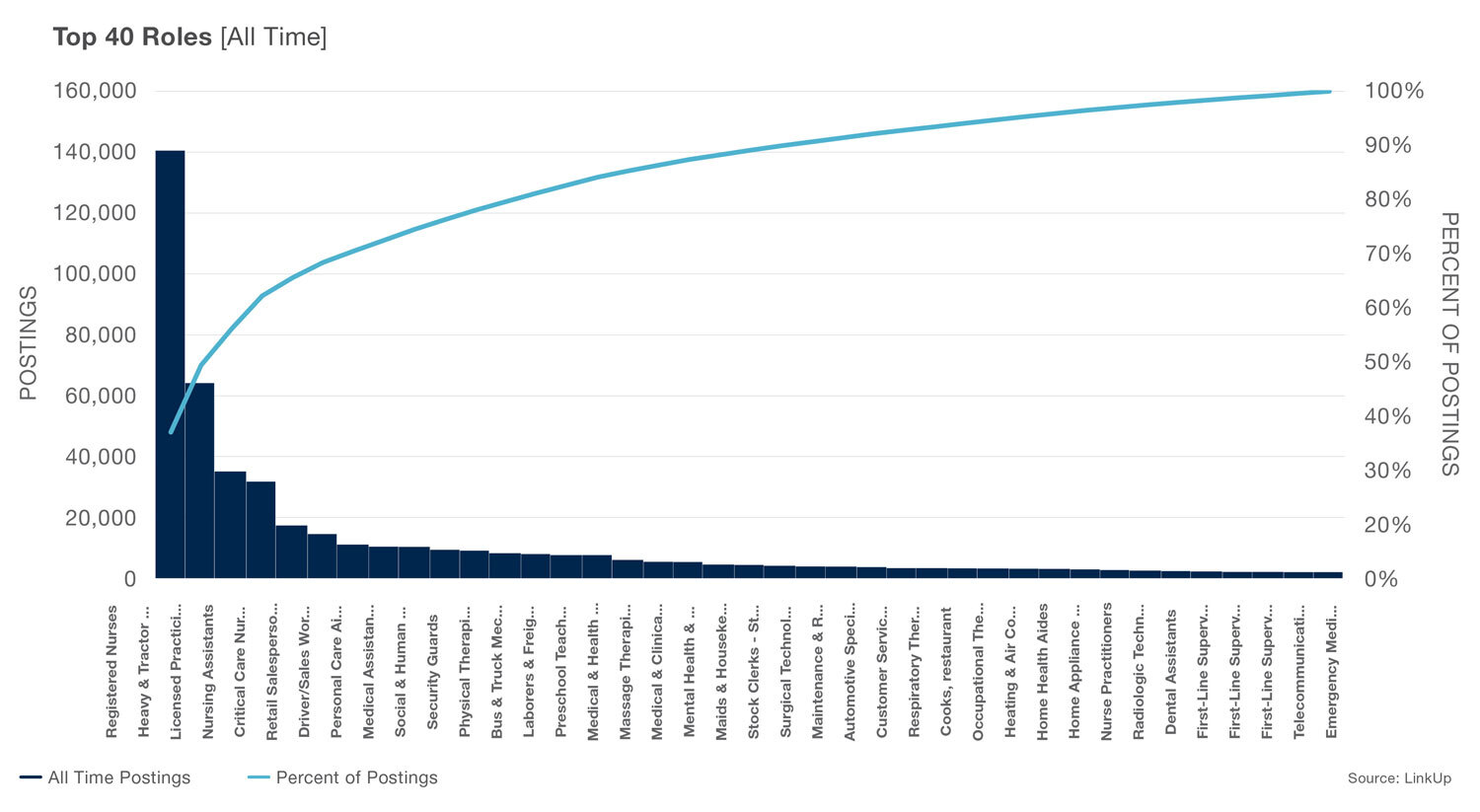

One thing that appears to remain largely constant is the occupational bias that can be observed. Most of these roles are either in trucking or healthcare. This has not changed much in comparison to all-time hiring.

This seems to be our most conclusive indicator of wages rising as competition for qualified workers increases. It will be interesting to observe if this trend continues, and, if so, the how the Fed adapts to pressures in the most critical input in the economy. The Fed has been promoting the idea that any inflation we see is likely to be “transitory” and a one-time bonus would certainly be more consistent with this view than a higher ongoing wage level. But competition for qualified workers remains intense and it might well be the case that long-term compensation promises will be far more attractive than one-time bonuses.

Investors—and employers—will be paying close attention.

If you’re interested in the job data behind this post, contact us to learn more.

Insights: Related insights and resources

-

Blog

08.04.2022

Heads I Win, Tails You Lose; Reflections on the Still-Cooling But Strong Job Market

Read full article -

Blog

02.18.2022

Good news, bad news

Read full article -

Blog

01.03.2019

The Wage Inflation Narrative Is About To Be Upstaged By A Nasty Jobs Report

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.