U.S. Labor Demand Is Growing But January Jobs Numbers Will Disappoint Tomorrow

Before we jump into our data for January, which is generally positive, there are some particular patterns related to how companies manage their job openings on their own company website that have a material impact on our data every January.

Before we jump into our job data for January, which is generally positive, there are some particular patterns related to how companies manage their job openings on their own company website that have a material impact on our data every January.

It’s been a long time since I’ve seen anyone write about ADP’s Purge Effect where HR departments clean up their payroll systems at year-end and remove people that are no longer employed at the company because they left or were let go during the year, but the increase in activity around job openings in January is quite similar.

At the turn of the year, HR departments typically clean up their corporate career portals by removing old, stale jobs that were either filled during the prior year but had not been taken down or that were not filled and that they no longer intend to fill in the coming year.

As well, companies will often ‘refresh’ job listings (especially ‘evergreen’ openings) with updated descriptions, job titles, benefits, etc. Similar to the aforementioned ‘Purge Effect’, the pattern is consistent every year and needs to be accounted for when analyzing job openings data, particularly new and removed job openings.

So with that preamble, we can jump into our data for January.

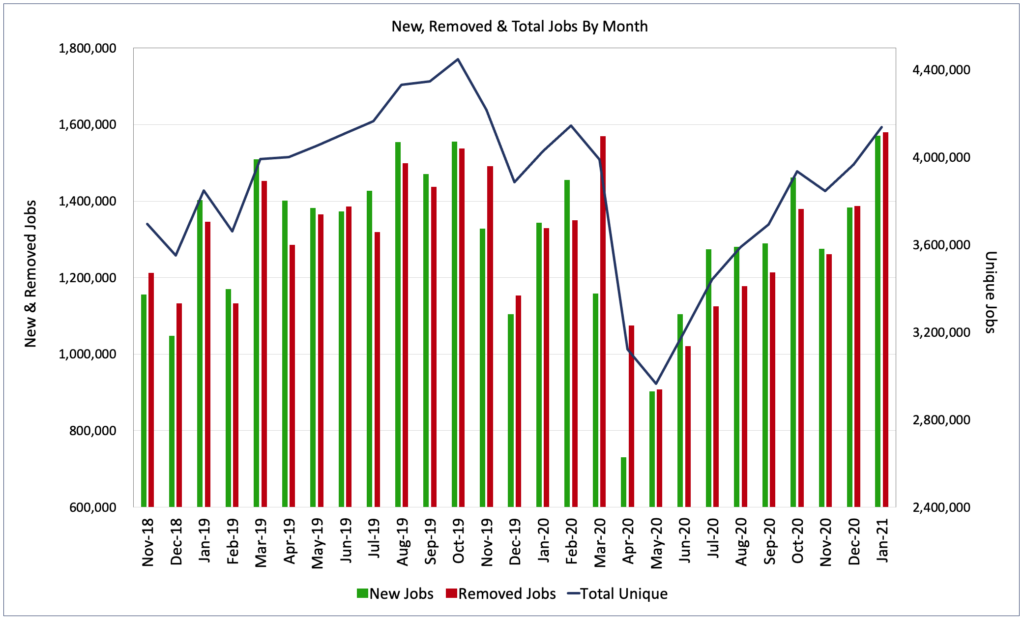

During the month, total unique job listings in the U.S. indexed daily directly from company websites globally rose 4.3% to 4.14M.

Since the worst of the COVID impact on the job market in May of last year, labor demand in the U.S. has risen 40% and the number of job openings in the U.S. is now precisely where it stood in February last year before the pandemic hit.

Slightly less relevant in January because of the context we set above, but still worth mentioning, is that new job openings during the month rose 13.5% to 1.57M and job listings removed from company websites rose 13.9% to 1.58M.

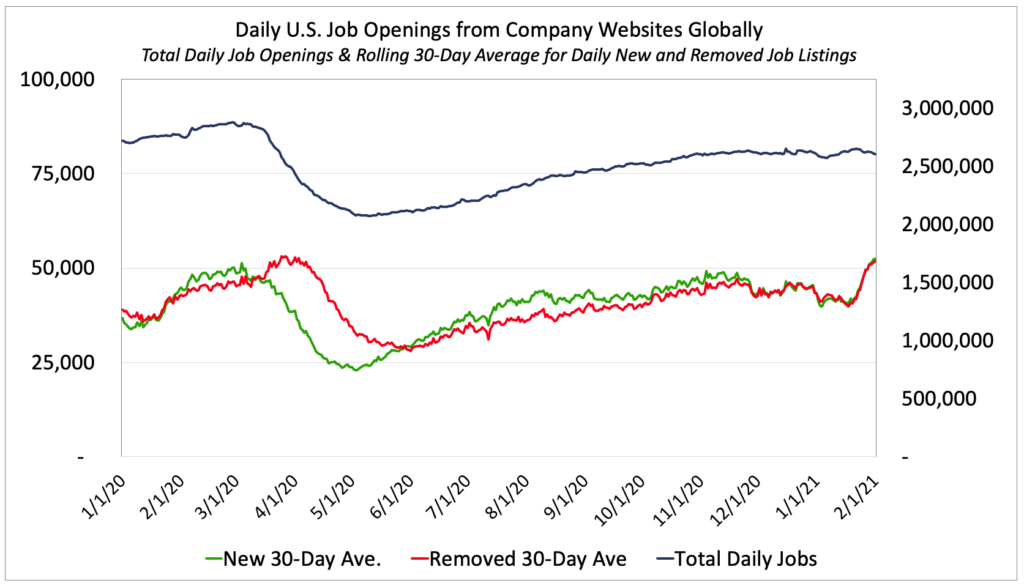

The same data on a daily basis indicates that new and removed job listings started rising sharply in the middle of January and have continued increasingly steadily for the past few weeks.

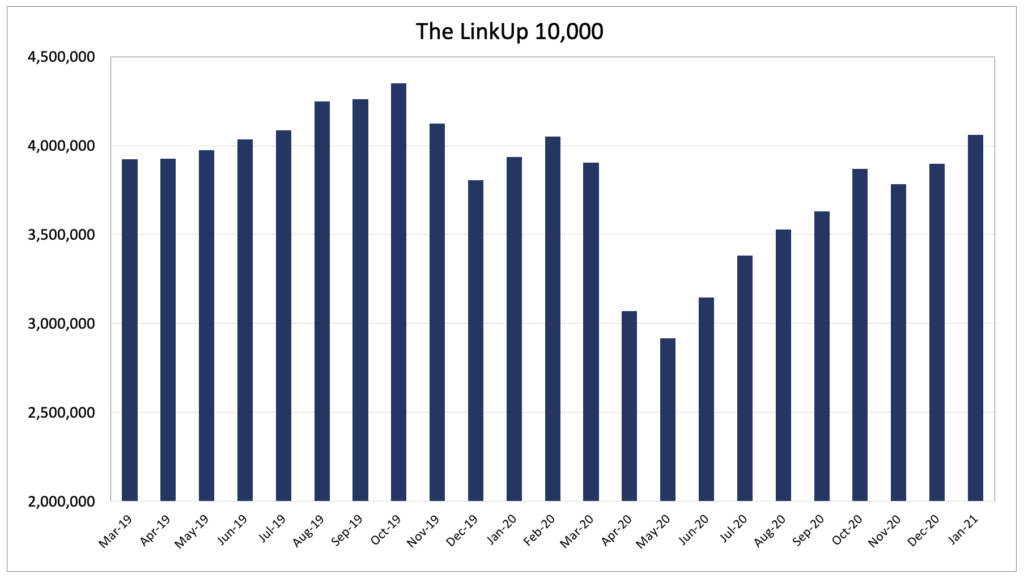

The LinkUp 10,000, which measures U.S. job openings for the 10,000 global employers with the most job openings each month, rose 4.1% in January and, again, reached precisely the same level as February of last year.

LinkUp’s Job Duration metric typically measures hiring velocity – the number of days that job postings are open before they are taken down off of an employer’s website because they are filled with a new hire.

But in January, the number of job openings removed from corporate career portals typically spikes as a result of the Purge Effect mentioned above and those job openings typically have a longer duration than average which drives up our duration metric every January.

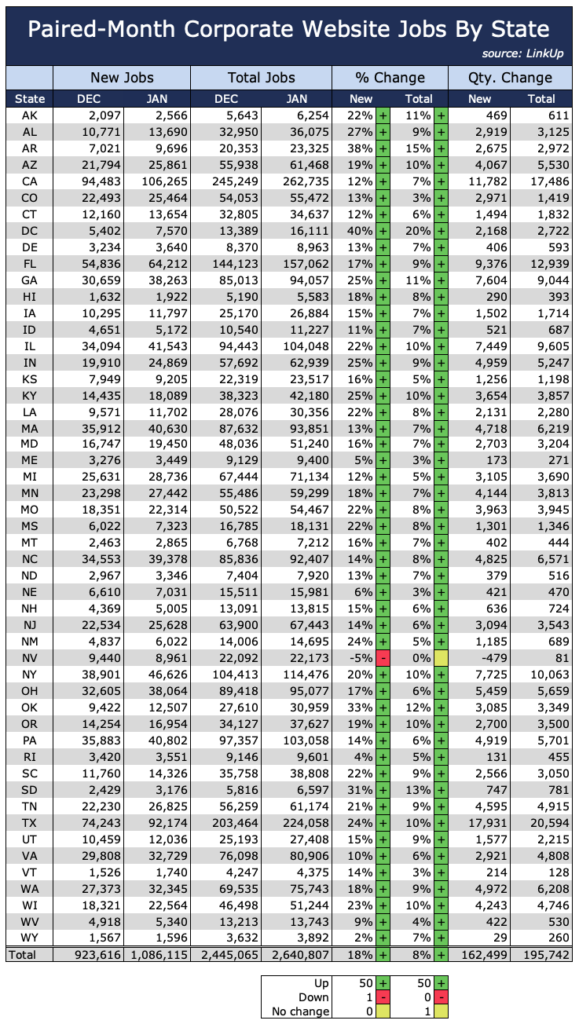

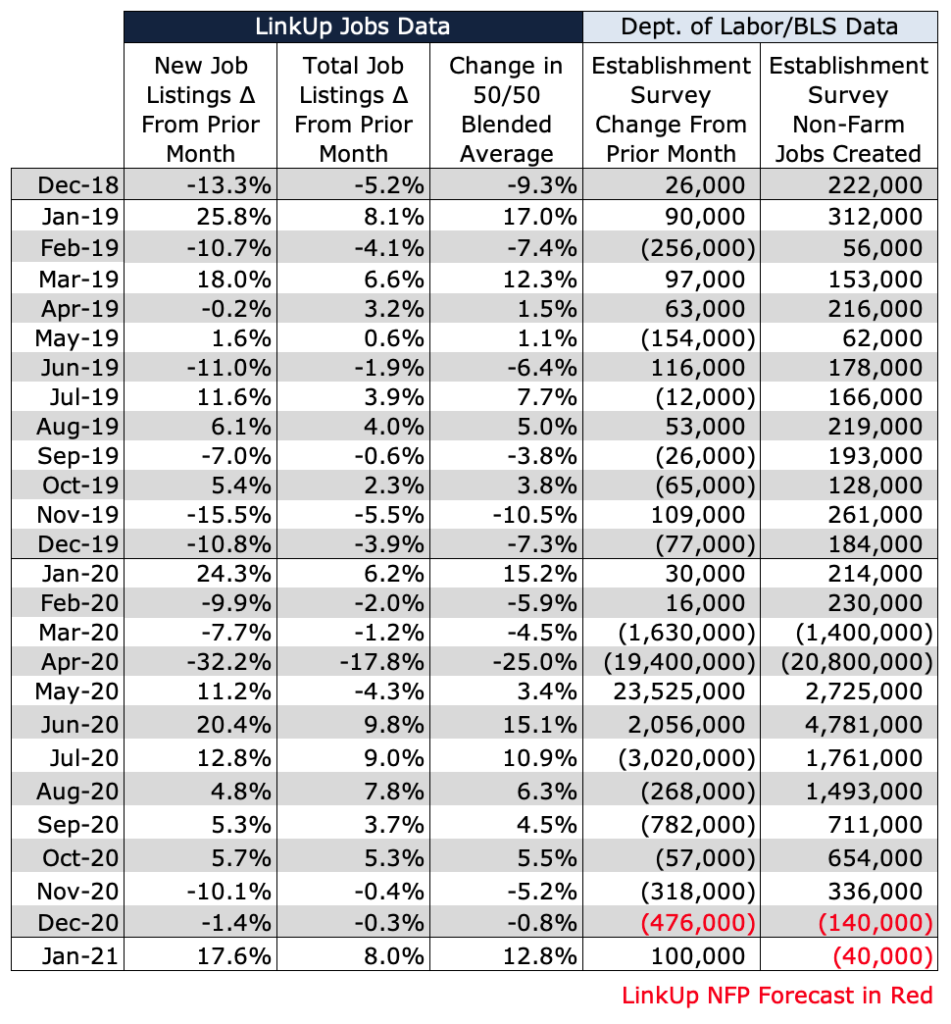

For our non-farm payroll (NFP) forecast, we use paired-month data which looks at new and total job openings for a set of companies that were hiring in consecutive months – in this case December and January.

In January, new job openings rose 18% while total job openings rose 8%.

So while the increase in total job openings during the month is definitely positive news and will lead to a jobs report tomorrow that is better than December’s, we are nonetheless forecasting that the U.S. economy still lost 40,000 jobs during the month.

One other positive aspect of tomorrow’s disappointing jobs report is that it will add even more weight to the already solid case for a $1.9T COVID relief package.

Happy New Year and, as always, stay safe and healthy and wear a mask.

Insights: Related insights and resources

-

Blog

02.06.2020

LinkUp Forecasting Strong Job Gains of 225,000 in January

Read full article -

Blog

01.07.2020

LinkUp Forecasting Job Gains of Only 116,000 For December

Read full article -

Blog

03.05.2019

LinkUp Job Market Data Points To Softening Labor Demand & Below-Consensus Job Gains In February

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.