There Is No Labor Shortage But There Is a Shortage of Dignity and Respect For Workers

Regarding the job market, the dominant narrative over the past few months has been that an unprecedented labor shortage is to blame for all sorts of nasty maladies afflicting the nation – evils ranging from the murder of the economic recovery and the detonation of your credit card at the grocery store to the abduction of Santa Claus who is apparently being held hostage in a cargo container off Long Beach until the nation’s supply-chain issues are resolved – maybe even on the very same ship whose anchor tore open the oil pipeline.

And depending on the news source, the angle and tone of the narrative ranges from respectful analysis of ‘The Great Resignation’ to scathing disparagement of the selfish, cowardly, dead-beat anarchists who have abandoned their $7.25 an hour post waiting tables or driving a school bus to play video games. But in almost every story, it is workers who, because they have the nerve to think they’re entitled to a living wage or affordable childcare, or maybe even just deserve the right to work from home a few days a week or wear a mask during a pandemic without getting abused, are solely to blame for all the hardship being inflicted on helpless businesses across the country and the resulting pain and misery being imposed on an innocent public.

But as we’ve written here for nearly 6 months, the country is not, in fact, plagued by a labor shortage – there are still 18.2 million Americans who are unemployed, underemployed, or not ‘officially’ in the workforce but want a job. What there is, rather, is a Grand Canyon-sized bid-ask spread between employers and employees that has essentially locked up the job market.

Like a massive earthquake resulting from tectonic forces built up over decades, Covid unleashed a seismic event that had been building for decades within the American workforce that, collectively, has finally had enough of the growing tension and accelerating inequity between labor and capital. Stagnant wages, epic income inequality, inadequate healthcare, unaffordable childcare, institutional racism and sexism, rising student debt, unsafe workplaces, miserable corporate culture, shredded work-life balance, and a general overlay of inhumane treatment have all gotten prevalent enough in the aggregate that the American workforce has finally revolted, walked out, and gone on strike.

Not until workers’ terms are sufficiently met – not until businesses (as well as policymakers in Washington and the general public) address the decades-long shortage of dignity and respect shown for workers – will there be a bridging of this chasm between employers and employees. Until then, we’re stuck with the world we’re in.

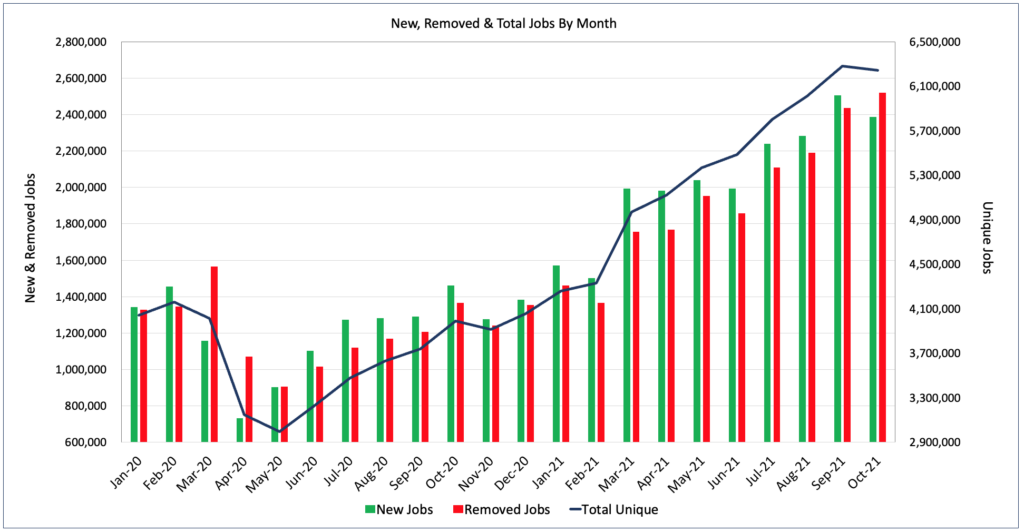

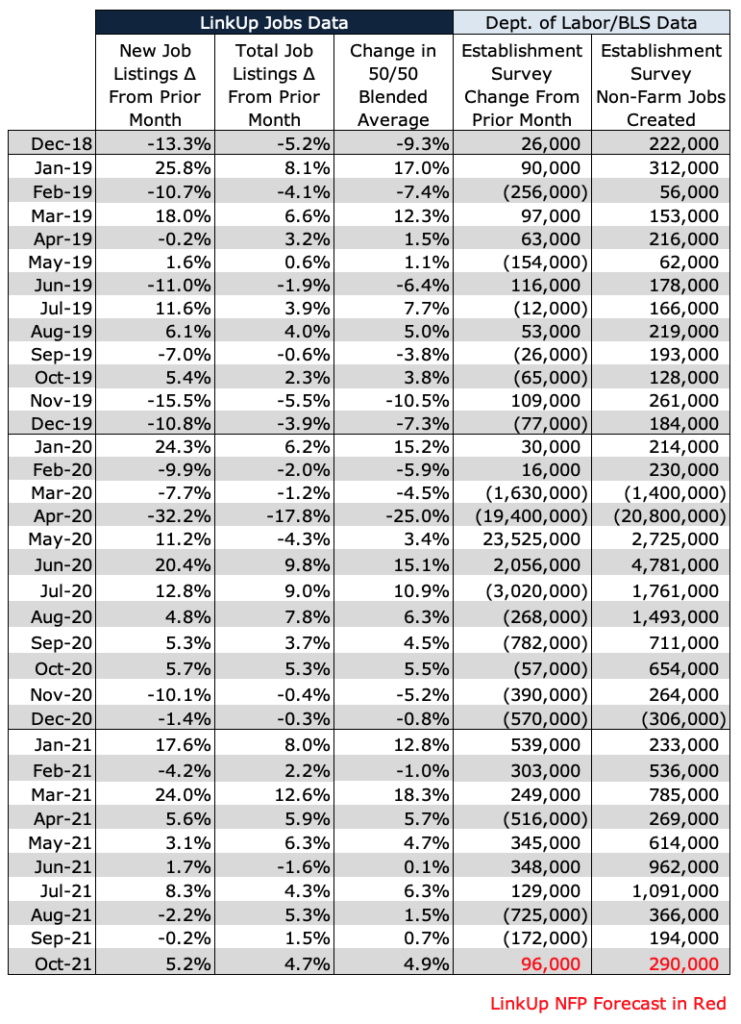

And unfortunately, based on our job market data for October, we’re forecasting that Friday’s jobs report will evidence the fact that very little of that chasm was bridged last month as measured by net job growth. Total job openings in the U.S. actually fell 1% to 6.24 million and new job openings fell 5% while removed jobs rose 4%. Because companies tends to be quite disciplined about removing jobs from their corporate career portal when they are filled with a new hire, our jobs removed metric stand as a great proxy for jobs having been filled, so it is equally as important a metric as new and total job openings.

As an aside, our non-farm payroll forecasts are based on LinkUp’s job market data – a global database of job openings indexed every day directly from company websites around the world. As a result of our unique approach, our high-frequency data is accurate, powerful, and insightful. And because a job opening posted on a company’s website signals the intent to make a hire, our data is predictive and highly correlated to job growth in future periods.

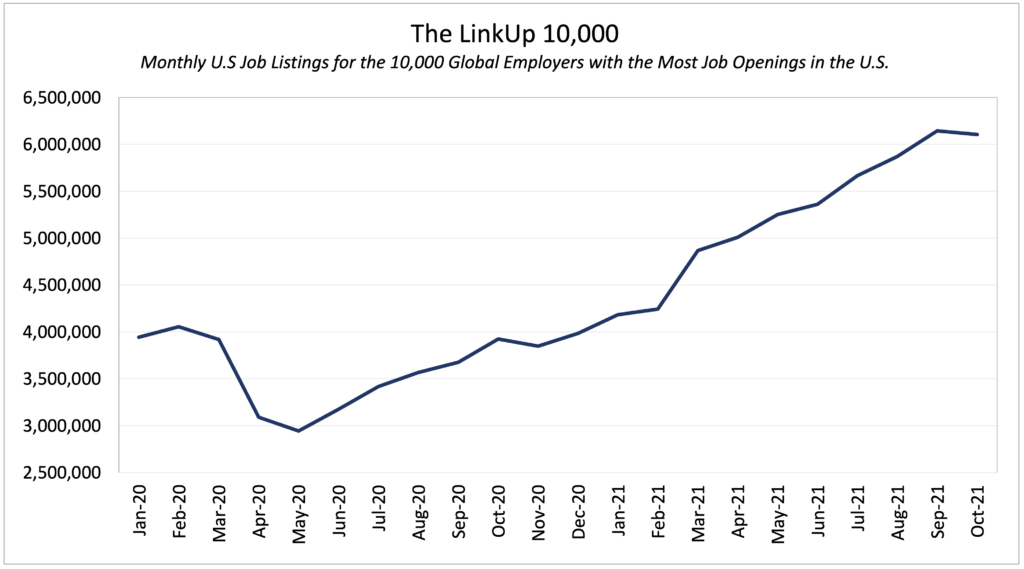

Similarly, The LinkUp 10,000 fell 1% to 6.1 million. The LinkUp 10,000 is an analytic we created to normalize our data and tracks the total job openings from the 10,000 global employers that have the most job openings in the U.S. Since January, The LinkUp 10,000 has risen 46% and since May of 2020, it’s up 107%.

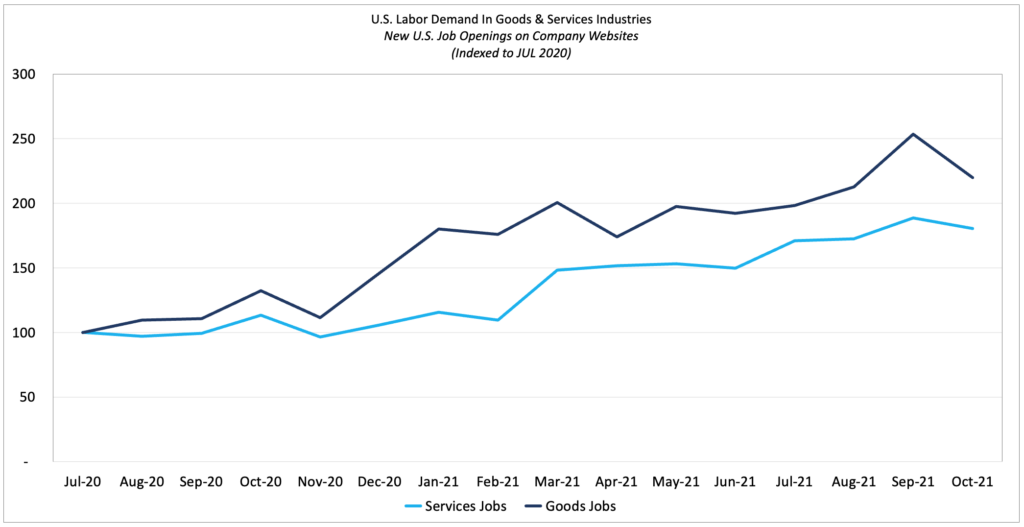

Since July of last year, new job openings in service industries have lagged behind goods-producing industries by a considerable margin and both components of the economy fell in October with new job openings in goods-producing industries dropping sharply.

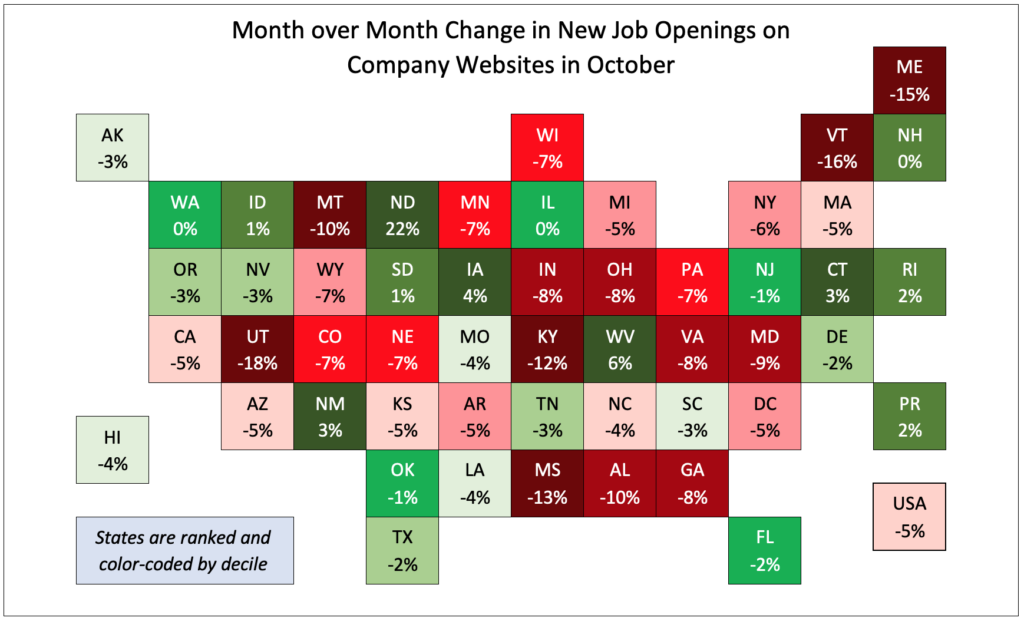

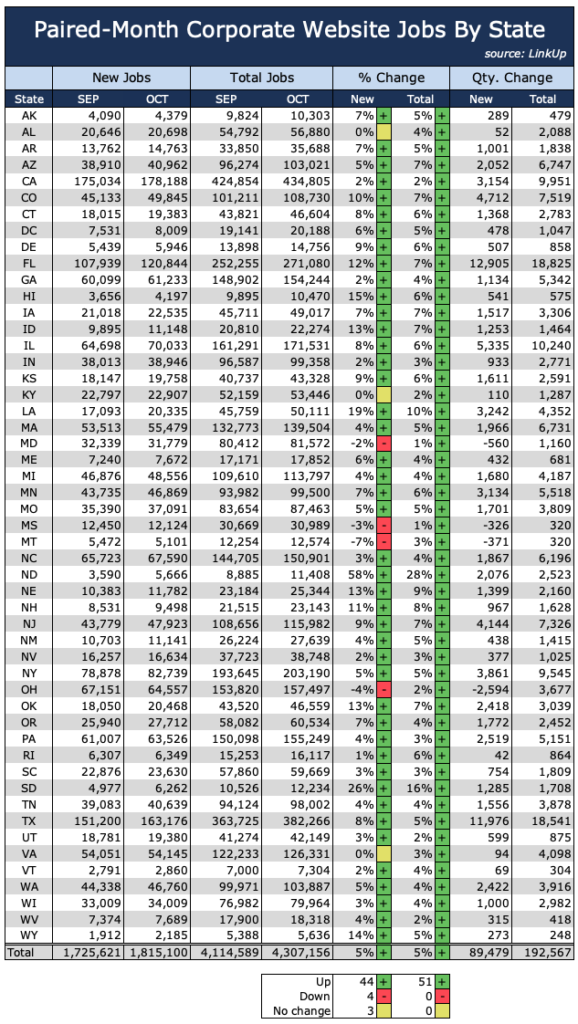

Looking at the month-over-month change in new job openings by state with states color-coded by decile rank, it’s evident that, generally speaking, there is still a modest correlation between labor demand and vaccination rates among states, but that correlation has faded considerably over the past few months.

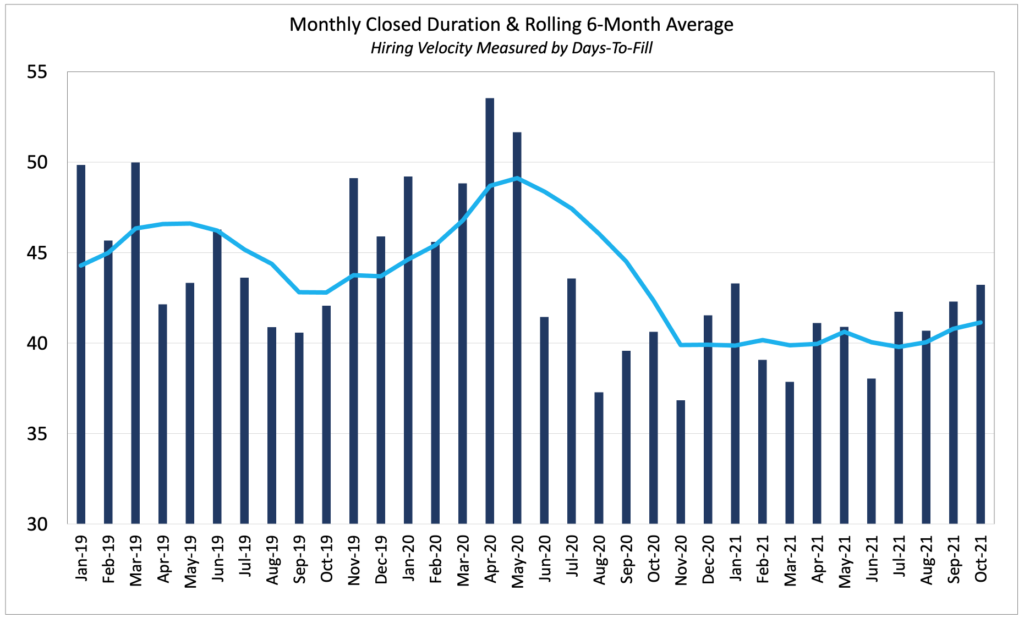

Job Duration, the average number of days that job openings are posted on company websites before they are removed – presumably because the job was filled – essentially measures hiring velocity across the economy. And in October, hiring velocity slowed to 43 days as companies continue struggling to fill openings. Even more noteworthy is the fact that the 90-day rolling average rose to its highest level since October of last year.

Looking at our paired month data which tracks job openings for a common set of companies that were hiring in both September and October, new and total job openings both rose 5% which, in our model, points to net job gains above the prior month’s level.

So based on our data, we are forecasting a disappointing net gain of 290,000 jobs in October, well below the 450,000 consensus estimate.

Given our rather dismal NFP forecast track-record over the past few months as we’ve seen sharply rising labor demand with little corresponding job growth, it’s entirely possible that we finally get the break-out jobs number that we’ve been anticipating since late spring. We certainly hope so.

As Blerina Uruci noted on Bloomberg earlier today, labor markets matter a lot for all kinds of reasons, but as a measure of how fast the giant bid-ask spread between employees and employers gets resolved, it’s particularly relevant. And while we’re not optimistic about what we’ll see on Friday, we remain hopeful that we’ll finally get the blow-out number we all want (and need) to see.

Insights: Related insights and resources

-

Blog

08.26.2022

"Must Keep At It Until The Job Is Done"

Read full article -

Blog

02.04.2022

Data shows continued tight labor market in the U.S.

Read full article -

Blog

01.31.2022

How Omicron is affecting the latest US jobs data

Read full article -

Blog

12.10.2021

November 2021 Jobs Recap: a substantial slowdown with far fewer job listings

Read full article -

Blog

11.12.2021

October 2021 Jobs Recap: Autumn brings falling job listings

Read full article -

Blog

08.29.2017

Labor Market Turtles and Hares: Sector-level Growth Rates Vary

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.