The Wage Inflation Narrative Is About To Be Upstaged By A Nasty Jobs Report

By almost every measure, the U.S. labor market vastly exceeded everyone’s expectations in 2018, including our own.

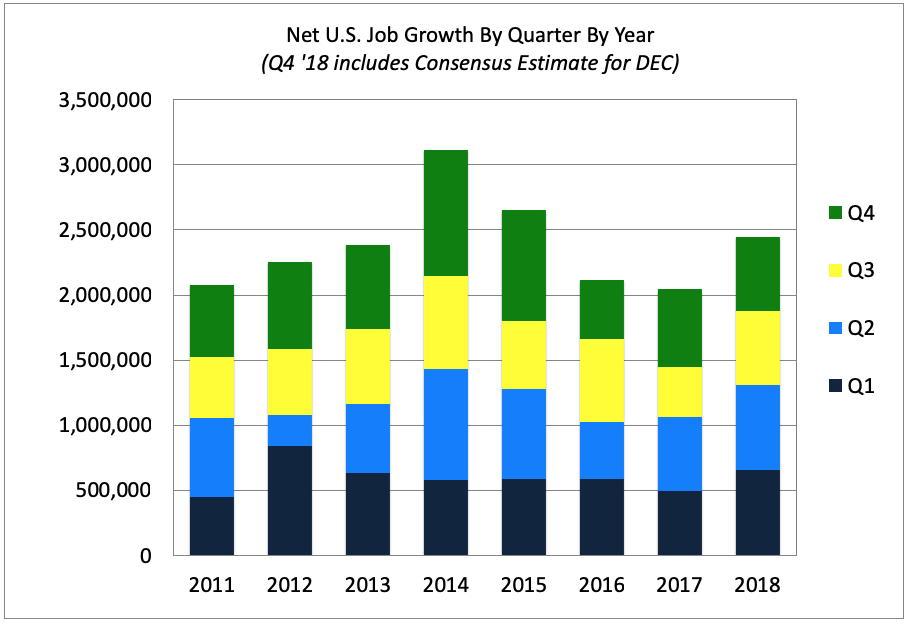

By almost every measure, the U.S. labor market vastly exceeded everyone’s expectations in 2018, including our own. Reversing what was largely seen as an incontrovertible continuation of the 3-year decline from a peak of 3.1 million jobs added in 2014, the U.S. economy added roughly 2.3 million jobs last year (assuming Bloomberg’s consensus estimate of 180,000 jobs for December).

Not only did the streak of positive monthly net job gains surpass 8 years in October, job gains were robust throughout most of the country and most of the economy. The total number of unemployed people dropped 10% through November to 6 million people, unemployment fell below 4%, and the labor force participation rate ticked up slightly, as did the employment population ratio.

For certain, it wasn’t all roses as meaningful wage inflation (at least in the official numbers) remained elusive for much of the year (a topic we’ll return to in a minute), the number of long-term unemployed barely budged, and the number of both involuntary part-time and marginally attached workers didn’t move at all. Nonetheless, the job market was one of the exceptionally bright spots in what was otherwise a pretty dismal year.

But as we wrap up 2018 and turn forward to 2019, wage inflation continues to command the spotlight of attention just as it has for the past few years. In fact, it has consumed the greater part of our attention since May of 2016 when we first wrote that the U.S. economy had transitioned into a full-employment environment. With the benefit of having the best job market data in the world, combined with the fact that every day we help thousands of employers across the entire economy attract qualified candidates for their job openings, we’ve known, seemingly forever, that it was only a matter of time before wage inflation breached the Wall and marched south, laying waste to everything in its path (an apt analogy for all things market-related though clearly not so much for those whose wages are finally rising). And yes, with HBO’s GoT marathon over New Year’s, my favorite, albeit overused analogy is once again top of mind.

But more often than not over the past few years, we’ve felt like John Snow struggling to convince anyone that the Night King and the White Walkers are real. In a May, we concluded a post entitled The Phillips Curve Is Not Dead by stating:

We remain confident in our estimates that wage inflation will not only continue to move towards center stage, but single-handedly start carrying the entire storyline of the U.S. economy and eventually stealing the show.

This is why we were so heartened to be introduced to The Epsilon Theory and specifically Ben Hunt’s outstanding posts on wage inflation and the broader Inflation Narrative. Of particular note is a post from April The Narrative Giveth and The Narrative Taketh Away, an outstanding read with the highlight being that, “the inflation narrative will surge again, as wage inflation is, in truth, not contained at all.”

Beyond the shared sentiment, it was awe-inspiring to see the visualization, via The Narrative Machine, of the traction of the Inflation Narrative from 2016/2017 to 2017/2018 as represented by the natural language processing of 2,400 inflation articles which, by the way, very much does lay waste to my pathetic bullet point list of a scant 14 inflation-related articles listed in our May Phillips Curve blog post.

In a follow-up piece in October that would make Leonard Cohen proud, Ben wrote that

Everyone knows that everyone knows that inflation is happening in the U.S. Everyone knows that everyone knows that the Fed is going to keep tightening to “stay ahead of the curve”. This is today’s Common Knowledge, and the Common Knowledge Game can work just as strongly to the downside as to the upside.

Evidence attesting to the prescience of those two sentences couldn’t possibly be stronger than what took place in December with both a rate hike and the worst December for market returns since 1931.

In the same October post, Ben also writes that

To be clear, I don’t know the inflation Truth. I don’t have any sort of special insight into the balance of real-world inflationary pressures and inflationary reliefs that combine to make real world prices run hot or cold. But I do know the inflation Narrative. It’s a Narrative that the Fed, the White House, and Wall Street are each pushing, each for its own purposes. And for a market that has run on Narrative rather than reality for the past 10 years, that will be enough.

For us, too, in regard specifically to wage inflation, we remain extremely hesitant to claim possession of special insight. We are not a large employer. We are not a payroll company. We do not collect wage data. We do not survey employees or employers about wages.

But what we do have is an enormous dataset of millions of job listings indexed every day directly from tens of thousands of employer websites around the world. And while we can and do analyze job titles and job descriptions for clues about wage inflation, our job data is far more directly relevant to delivering insights into labor demand.

Because of our unique approach to the online job space (scraping jobs only from company websites), our dataset does NOT include duplicate jobs, expired listings, or job board pollution. As a result, our data provides accurate, real-time insight into labor demand across the entire economy. And, as everybody knows, labor demand is highly correlated to job growth in future periods.

On a number of occasions, we’ve compared our dataset to an alethiometer, and as such, while we frequently struggle to get the reading precisely right, we remain steadfast in our conviction regarding the tool’s ability to deliver meaningful, unique, and sustainable alpha at a macro, sector, and individual company level.

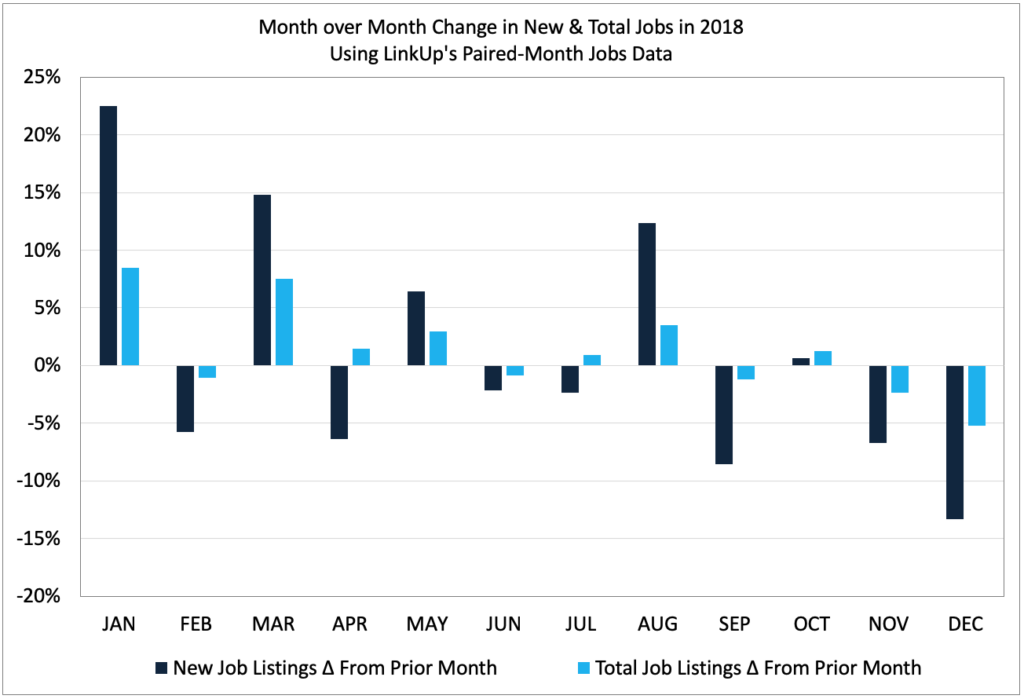

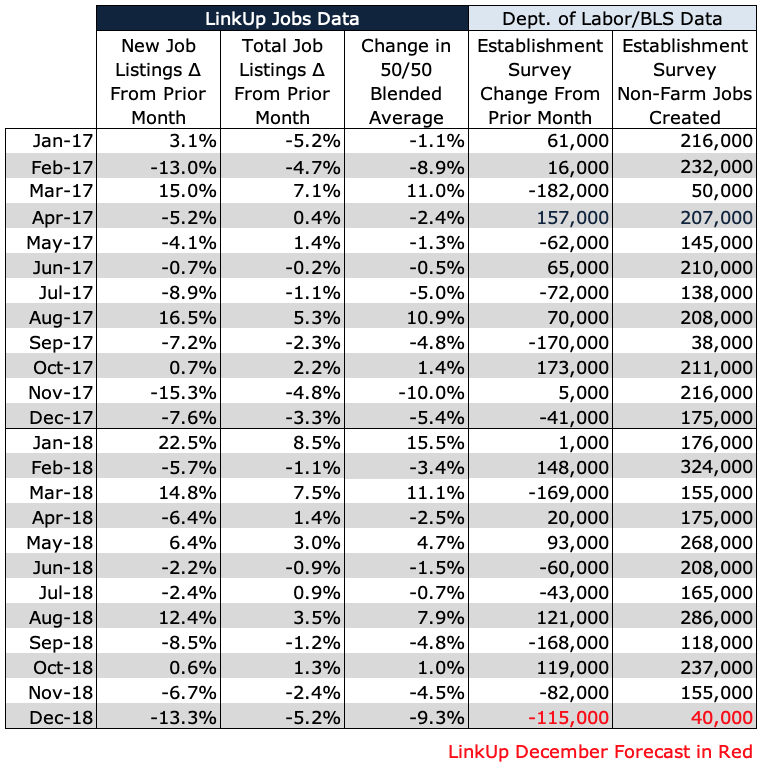

And what our alethiometer is telling us at the moment, in no uncertain terms, is that labor demand is slowing down. In fact, it’s been slowing down all year. The chart below shows the percentage change, month-to-month, in new and total job openings (using our paired-month methodology) in LinkUp’s job search engine. While it’s no Narrative Machine (yet), the story couldn’t be clearer.

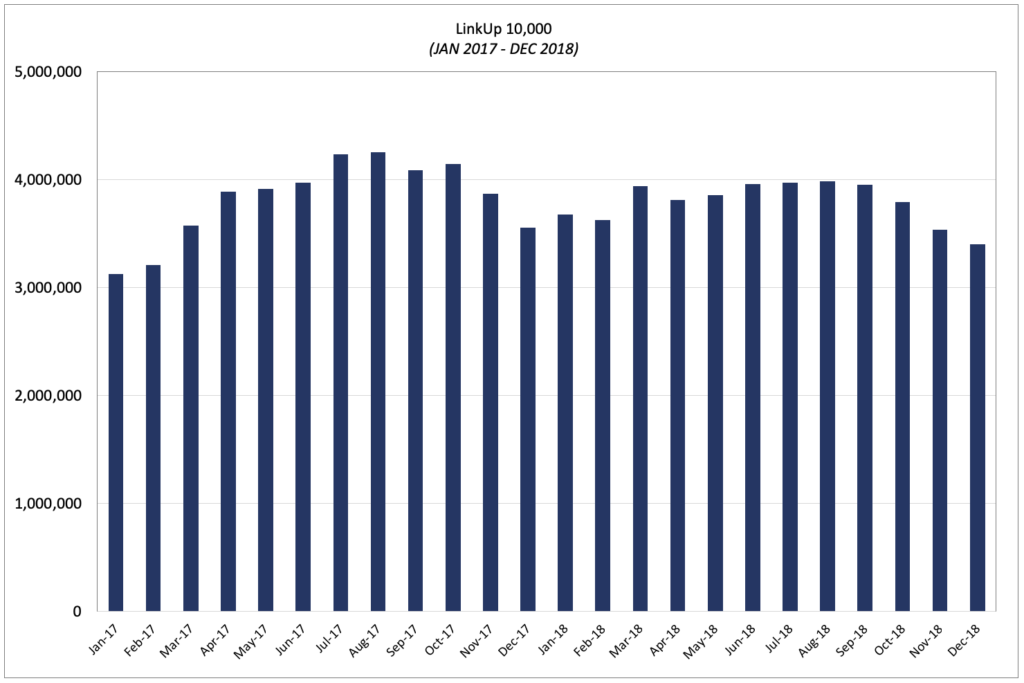

The LinkUp 10,000 tells a similar story, at least post-August.

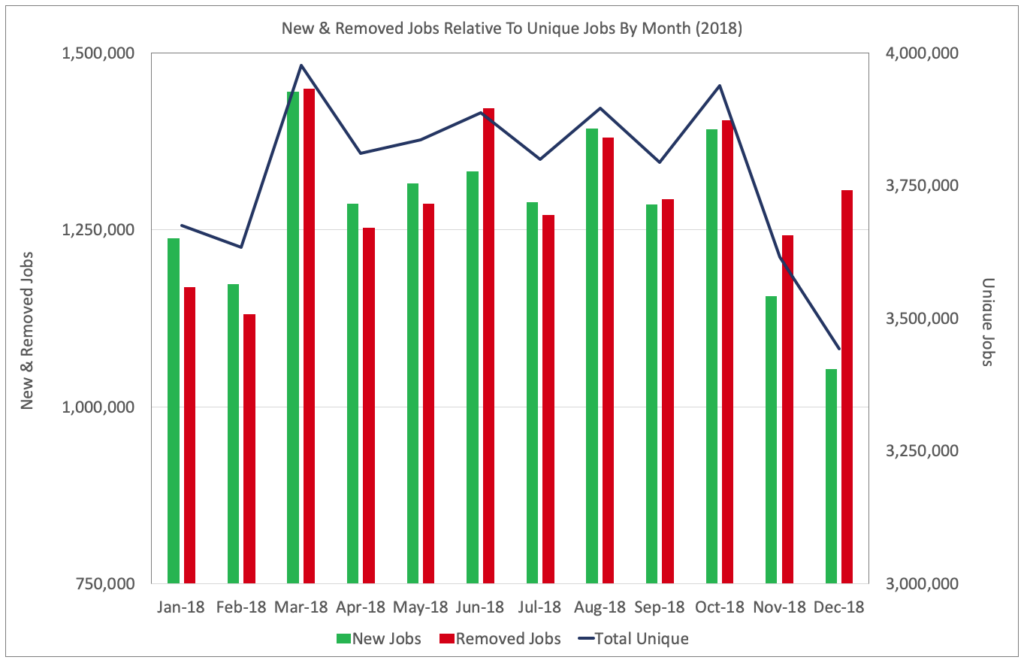

As does new, removed, and total unique jobs by month.

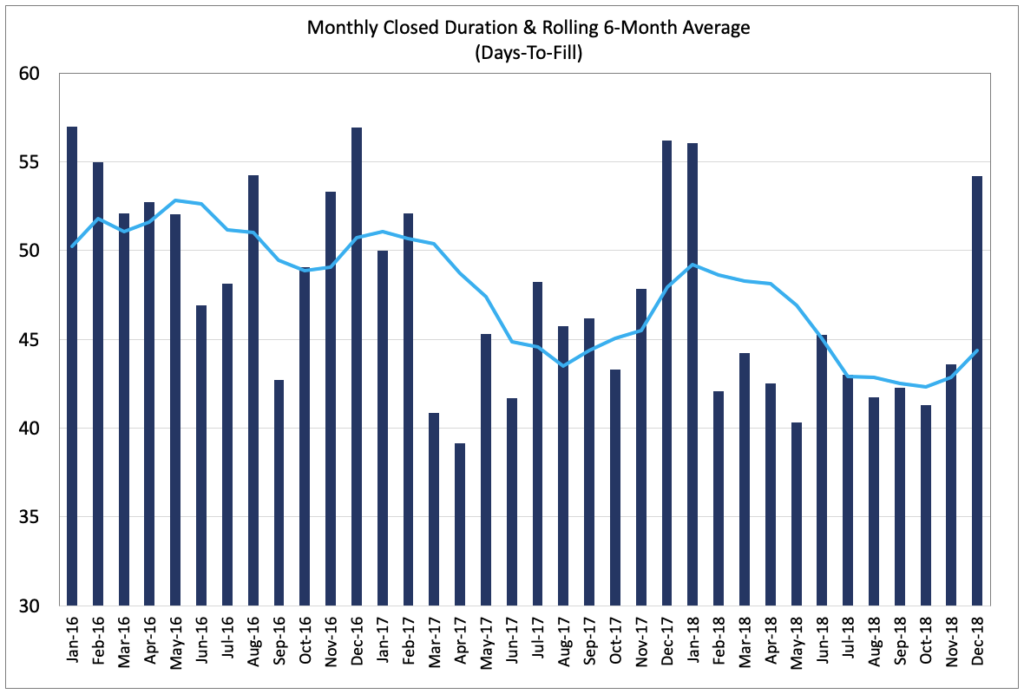

And the velocity of hiring, as measured by our Closed Duration analytic (which measures the average number of days that job listings were open and stands as a very close proxy for aggregate ‘time-to-fill’), has also been slowing down. To be fair, however, the spike in duration in December (and sometimes January) is likely exaggerated by a phenomena, similar to ADP’s Purge Effect, where employers clean up their corporate career portals and take down ‘evergreen’ jobs that had been listed for extended periods of time.

It could be argued, given 98 consecutive months of net job gains, that tapering demand and a slowdown in job growth was inevitable and incontrovertible, perhaps even common knowledge. And it might to be now. But it certainly wasn’t common knowledge to the Chairman of the Federal Reserve or the 75 economists surveyed by Bloomberg last month just prior to November’s jobs report.

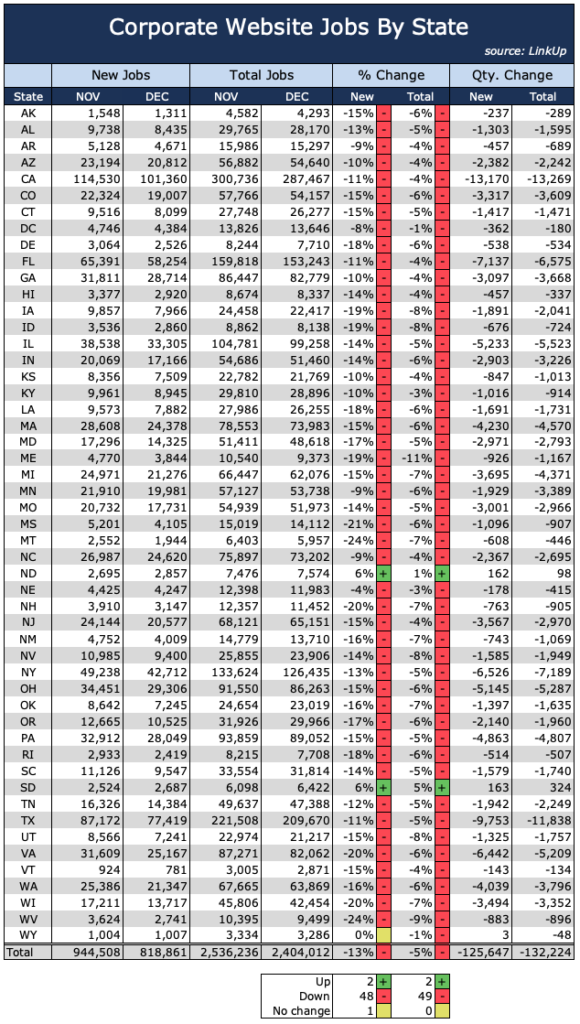

What also isn’t common knowledge (yet) is the extent to which labor demand hit the brakes in December. Returning again to our paired-month data (where we track a set of companies common in both periods), new job openings dropped 13% in December while total job openings fell 5%. And save for 328 jobs in North Dakota, South Dakota, and Wyoming, labor demand plummeted throughout the country.

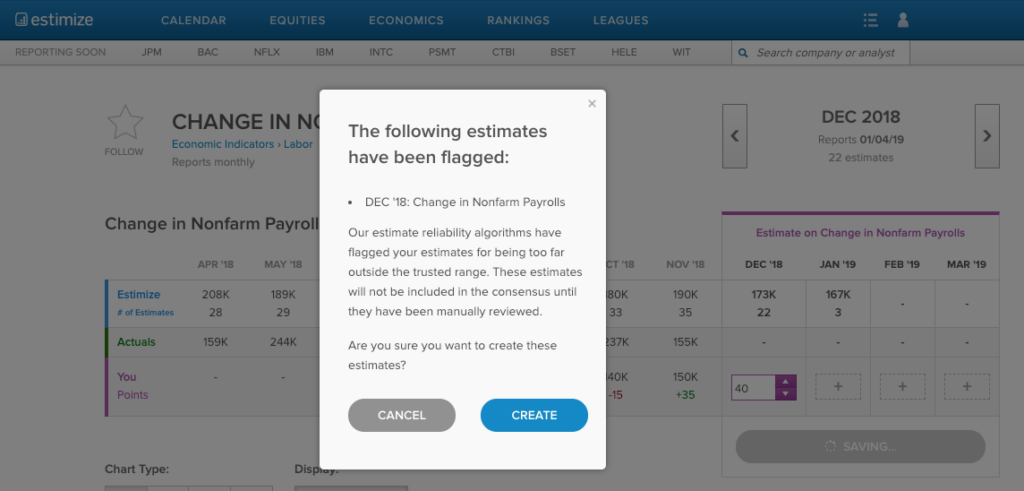

Based on the data and our forecasting model, we are forecasting a net gain of 40,000 jobs for December.

So what happens when wage inflation, very real but just off-stage, is preparing, we remain convinced, to make its long-awaited appearance in the official numbers, on center stage so to speak, and Falstaff, in the form of a shockingly rude jobs report, stumbles on-stage unexpectedly? And if that appearance so thoroughly offends as to scare wage inflation from making an ‘official’ appearance, could we have a repeat of the Invisible Recession of 2016 – no less real but never fully recognized, acknowledged, or appreciated? The rumors of the death of the Phillips Curve will certainly be greatly exaggerated.

And finally, returning back to what may or may not be common knowledge, we are a healthy number of standard deviations below the lowest NFP forecast for tomorrow…

…a point that was driven home when we posted our forecast to Estimize…

Insights: Related insights and resources

-

Blog

10.05.2016

The Big Grind: LinkUp Forecasting Net Gain Of 125,000 Jobs in September

Read full article -

Blog

09.01.2016

LinkUp Forecasting Net Gain of 220,000 Jobs In August

Read full article -

Blog

08.05.2016

Despite the Chaos Syndrome, LinkUp Is Forecasting That The U.S. Added 215,000 Jobs In July

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.