The S&P 500 LinkUp Jobs Index

S&P Dow Jones Indices (S&P DJI), the world’s leading index provider, and LinkUp, the leading provider of global job market information to the financial industry, have collaborated to create the S&P 500® LinkUp Jobs Index.

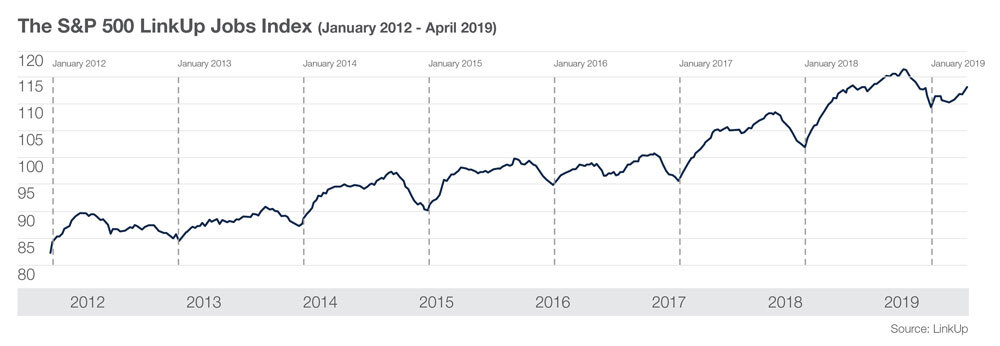

S&P Dow Jones Indices (S&P DJI), the world’s leading index provider, and LinkUp, the leading provider of global job market information to the financial industry, have collaborated to create the S&P 500® LinkUp Jobs Index. As the first index of its kind, the S&P 500 LinkUp Jobs Index measures labor demand for companies within the S&P 500 at an aggregate, sector, and individual company level and provides a strong indicator of the health of the overall labor market and the economy as a whole.

Released weekly every Wednesday morning, the S&P 500 LinkUp Jobs Index is constructed from job openings in LinkUp’s job search engine that are sourced directly from corporate websites on a daily basis. As a result of LinkUp’s highly unique approach to the online job space, the S&P 500 LinkUp Jobs Index provides accurate, real-time insight into labor demand of the 500 companies and their subsidiaries in the S&P 500.

LinkUp’s data has proven to be highly correlated to and predictive of non-farm payrolls, unemployment, and the general health of the economy as a whole. And by combining LinkUp’s powerful, predictive job market data with S&P DJI’s deep expertise in creating influential indices, a truly innovative, multi-dimensional tool has been introduced that can be leveraged across a wide variety of financial and economic use cases.

Use Case: Correlation to S&P 500 price index

The S&P 500 LinkUp Jobs Index is well correlated to and predictive of the S&P 500 price index. Stock prices reliably rise and fall on the heels of changes in job listings. When job counts go up, index value goes up, and conversely, when jobs go down typically the index value does as well. The correlation coefficient for the S&P 500 Price Index vs. S&P 500 LinkUp Jobs Index is greater than .9.

Use Case: Job Market Seasonality

Understanding the seasonal patterns of job gains and losses can inform investment strategy. The S&P 500 LinkUp Jobs Index demonstrates the seasonality of the job market overall and at the GICS sector level. Typically seasonal patterns include hiring pushes in spring and fall, and lulls in summer and over the holidays.

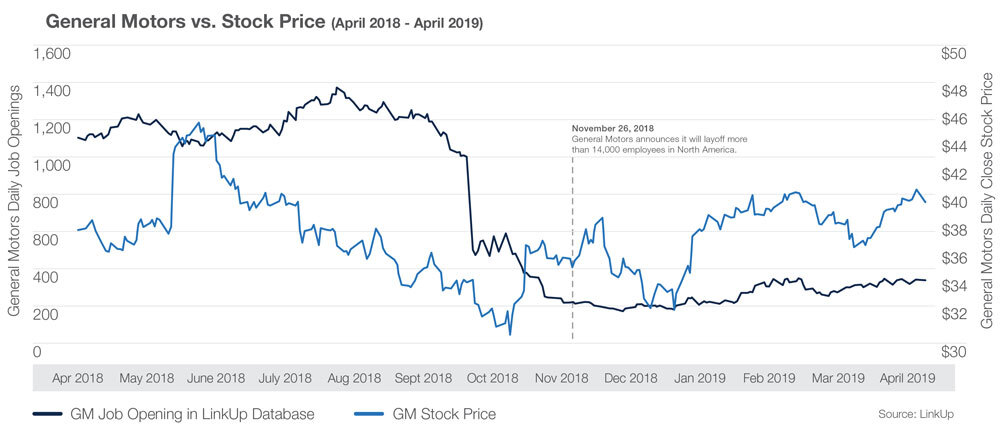

Use Case: General Motors Job Openings vs. Stock Price

Data from the S&P 500 LinkUp Jobs Index is available down to the ticker-level where company-specific insights provide investors important indicators of company health and strategy. A great example of the power of ticker-level jobs data is S&P 500 company General Motors. Just two months prior to announcing layoffs in November 2018, GM’s job listings began to decline sharply. Large changes in job openings are a valuable insight to investors on the lookout for strategic signals from the companies in which they invest.

For more information, view the S&P 500 LinkUp Jobs Index.

Insights: Related insights and resources

-

Blog

12.01.2022

LinkUp Forecasting a Net Gain of 220,000 Jobs In November

Read full article -

Blog

02.10.2021

S&P 500 LinkUp Jobs Index movement

Read full article -

Blog

02.12.2020

Forecasting JOLTS Data with LinkUp's Jobs Data

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.