With the Recent Economic Data, It's Clear the Soft Landing Has Occurred

The debate around wheel touch-down duration is irrelevant - core inflation has reached the Fed's target and unemployment has barely moved since rate hikes began.

With the cavalcade of horrific headlines these days, the job market has, understandably, faded to some degree from front page news, but the jobs numbers for October come out next week and given its significance in relation to and understanding of the state of the U.S. economy, the job market continues to be paramount.

As we’ve done for the past few months, we’ll provide some commentary on the job market in this post, followed by a post next week that will include our job market data for October along with our non-farm payroll forecast for the month.

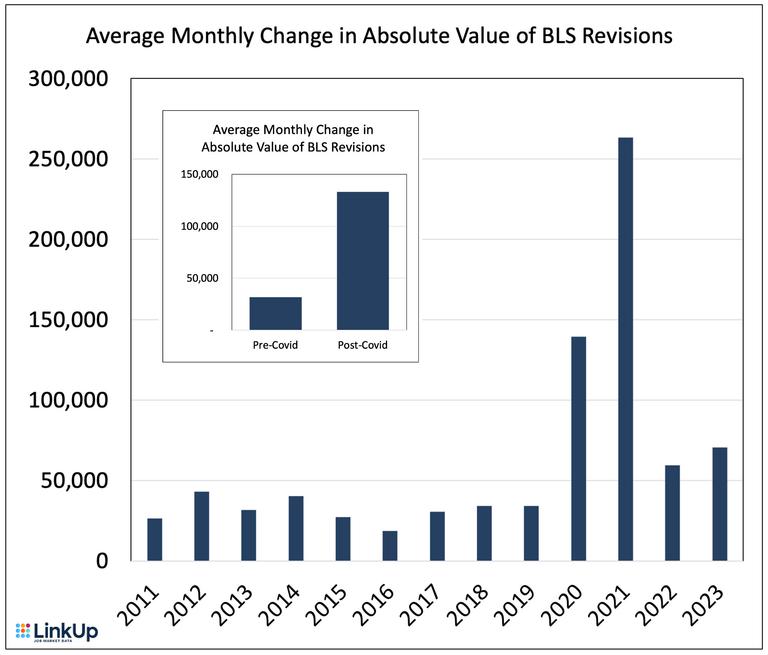

We’ll start by touching on the increasing volatility of the monthly jobs numbers released by the Bureau of Labor Statistics (BLS) between initial release and subsequent 30 and 60-day revisions. It’s something we’ve been paying close attention to for some time but the phenomena attracted national attention in March and it’s been growing steadily since.

While a recent WSJ article entitled “Frustrating Revisions to Jobs Data Slow Wall Street Trading” focused on the persistence of downward revisions this year and its impact on muting trading on what has historically been the highest-volume trading day of the month, it’s also the case that the spread between initial release and the ‘final’ revision released two months later has grown markedly in the covid era.

While things have calmed down a bit since 2021, the magnitude of monthly BLS revisions remains well above historical levels and has gotten even worse in 2023.

The increasingly unreliable ‘official’ data has exacerbated an already challenging set of circumstances relating to understanding the economy in general and the job market in particular (and the situation is even worse in Britain). No doubt, that underlying challenge has never been more real, but the extent of how baffled and consistently wrong most economists have been over the past year is incredible.

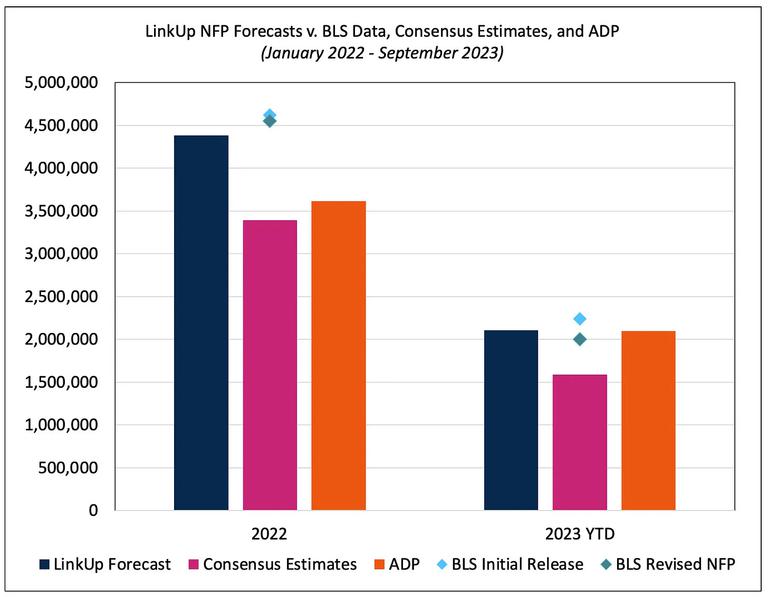

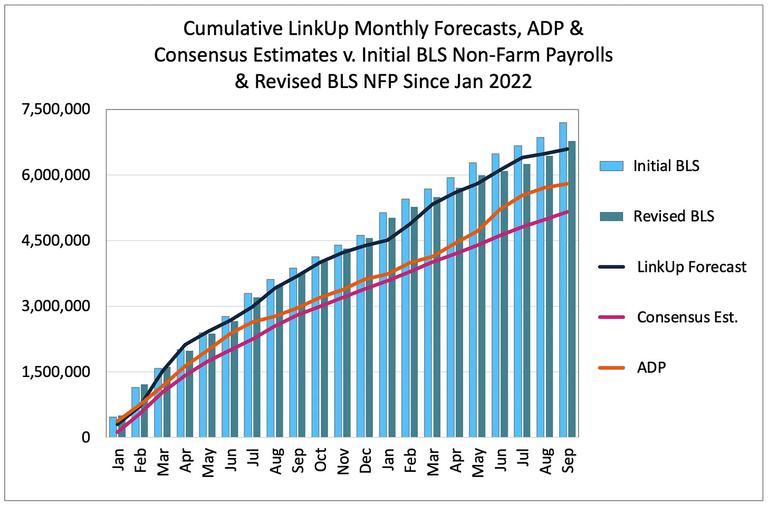

As it pertains to both the underlying challenges of deciphering the job market and the lack of reliable data from the BLS, there are better datasets (LinkUp among them) that are for more accurate, timely, and reliable than survey-based, lagged data that is consistently and materially revised. Better data can often lead to better forecasting models around critical aspects of the economy that help generate a more accurate narrative around what is likely to happen in the future.

And while the soft landing we’ve been forecasting for well over a year has been achieved (finally becoming the predominant view among economists now that it’s actually occurred), it’s still worth piling on about how phenomenal the U.S. economy is these days.

Inflation is under control (3.7%) with core inflation (2.4%) effectively at the Fed’s target level, GDP growth in Q3 (4.9%) was extraordinary, consumers are continuing to spend (up 0.7% in September), and the job market, with unemployment at near-record lows (3.8%), keeps chugging along at a solid clip.

So despite the fact that a lot of economists still talk about the soft landing as some probabilistic event that may or may not happen in the future (with a majority having now come around to seeing it - after the fact - as increasingly likely to occur and a minority that see nothing but storm clouds on the horizon), the indisputable fact is that it has already occurred. Inflation is well under control and unemployment has barely budged since the Fed began hiking rates.

Full stop.

The soft landing has happened.

Of course, just as we spent excessive energy debating how long a generally accepted duration was for the word ‘transitory’ (as in inflation), many will most assuredly exhaust themselves debating how long the wheels must touch down for a landing to qualify as soft. Given the fact that we called the soft landing in FEB ‘23, it shouldn’t be surprising that we’d view that debate as irrelevant - in our mind the plane’s been on the tarmac for more than enough time.

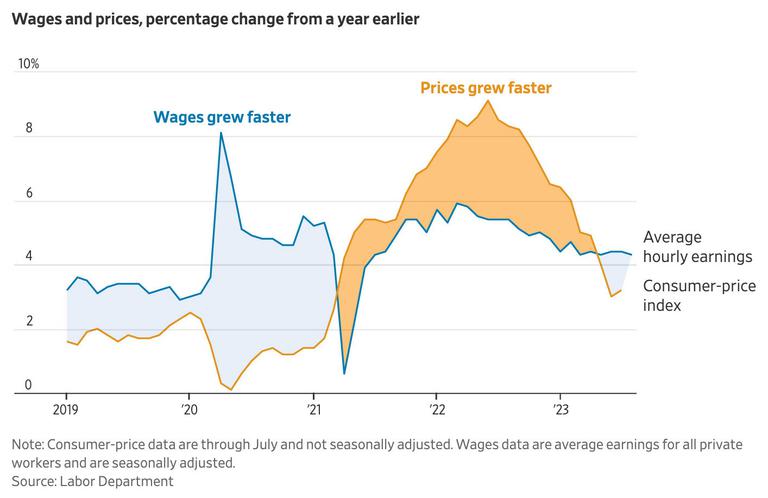

We’ll return in future posts to those increasingly ominous storm clouds, the not-surprising resilience of the job market, and what both mean to the economy going forward, but for now we’ll leave things with one last chart (WSJ) that most succinctly captures not only the U.S. economy in the covid era, but also the criticality of the labor market and the inherent value of accurate, reliable, and forward-looking job market data.

So for now, let’s all take a moment to sit back, relax, and enjoy the soft landing.

Insights: Related insights and resources

-

Blog

10.11.2023

LinkUp's September 2023 JOLTS Forecast

Read full article -

Blog

10.10.2023

Q3 2023 Economic Indicator Report Released

Read full article -

Blog

11.06.2023

October 2023 Jobs Recap: Labor Market Analysis

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.