The Sahm Rule Won't Kick In Anytime Soon; Consumers Should Sustain The U.S. Economy For The Foreseeable Future

There is no doubt that hiring is slowing down.

There are a lot of questions swirling around the U.S. economy these days, but two of the most central are whether the slowdown in hiring is due to weakening demand or shrinking supply and secondly, how long the U.S. consumer can continue buoying an economy being buffeted by global headwinds, erratic and expensive trade policy, and the chaos, ineptness, and uncertainty emanating from the White House.

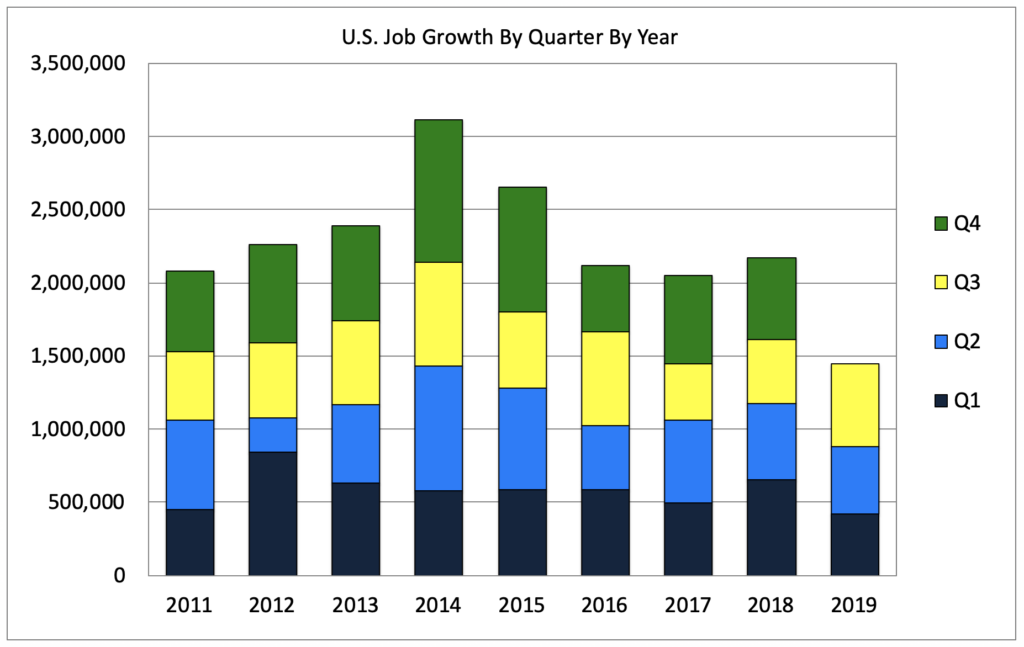

On the first question, there is no doubt that hiring is slowing down. Including the revision the BLS announced in August, monthly job gains this year have averaged 157,000, down from last year’s average monthly gain of 180,000.

As to the question regarding the cause of the slowdown in hiring, a recent WSJ article indicated that among economists surveyed, 45% cited the tight labor market while 38% blamed ebbing labor demand among employers.

Only 17% indicated, in our estimation correctly, that the slower pace of monthly jobs gains is due to both the supply and demand sides of the hiring equation – there aren’t enough candidates in certain parts of the economy and there aren’t enough job openings in parts of the economy.

Given the size, complexity, and fluidity of the job market, combined with the fact that it is not very efficient or highly liquid and lacks perfectly sufficient information, it is not perfectly clear precisely where all of the supply/demand imbalances exist. As such, it’s akin to the old marketing adage about not knowing which half of one’s marketing budget is effective and which half is worthless.

Having said that, however, there is plenty of evidence indicating that not only are supply and demand both contributing to declining job gains, but where in the economy that is most apparent.

On the supply side, unemployment remains at historic lows, unit labor costs have recently risen faster than expected (3.6% v. 2.2% estimates), and job openings exceed the total number of unemployed people by nearly 1.3 million, all of which point to a very tight labor market with little slack.

On the other hand, both the employment population ration and the labor force participation rate among 25-54 year olds have resumed their steady rise after a brief downturn, indicating that as the expansion continues further and further into record territory, wages keep rising (slowly but surely), employers keep working more diligently and creatively to find talent, and more and more people keep entering the workforce.

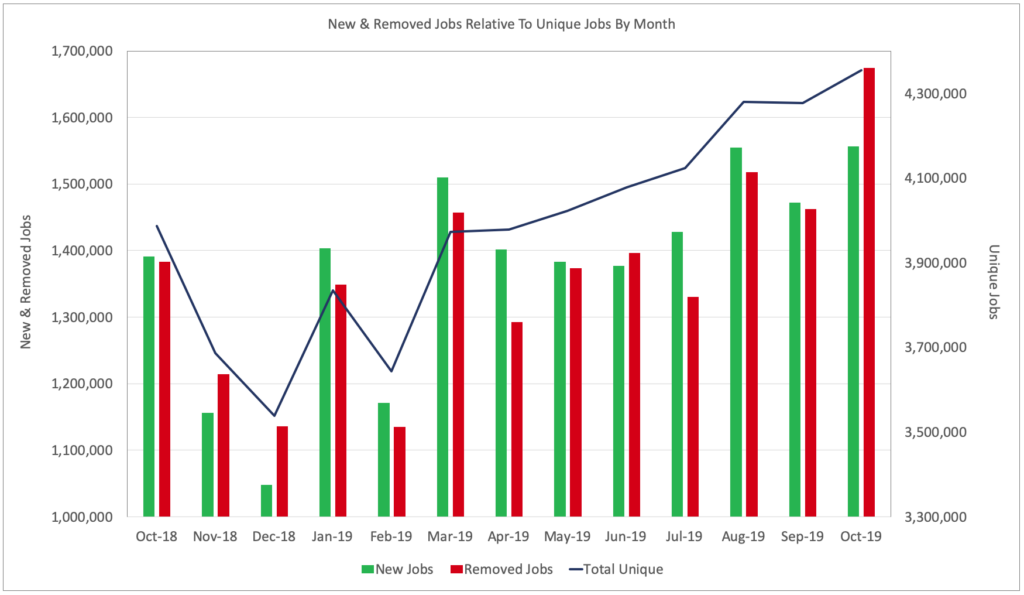

On the demand side of the equation, job openings in LinkUp’s search engine, which are indexed only from corporate websites throughout the country (arguably the best indicator of labor demand), have steadily risen all year, reaching a peak of 4.35 million in October.

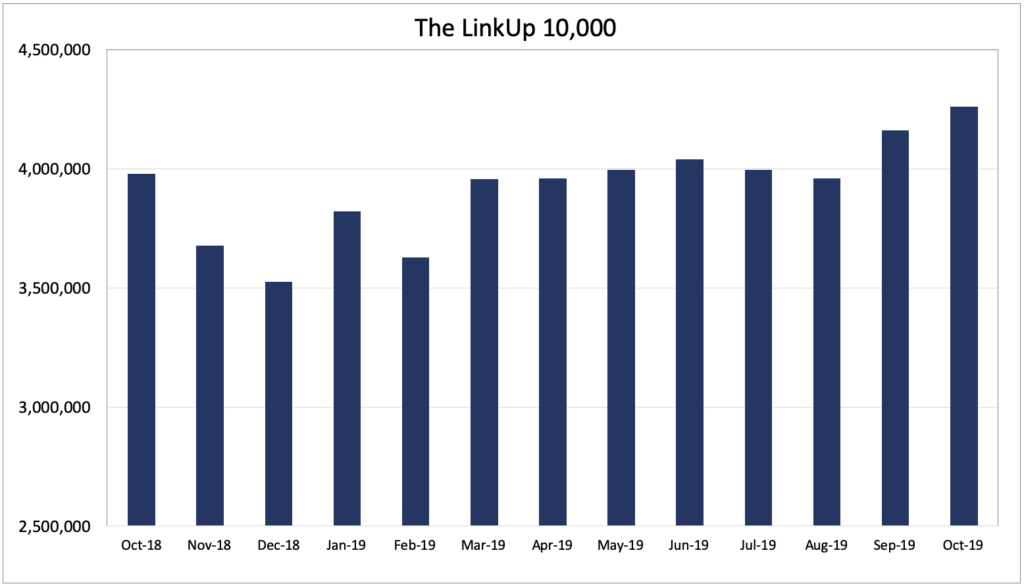

But because we are always adding new companies to our job search engine, the graph above is skewed to the upside. In order to account for the addition of new companies, we normalize the data for The LinkUp 10,000 which aggregates the number of job openings for the 10,000 global employers that have the most job openings in the U.S. in any given month.

And there, too, job openings have increased throughout the year.

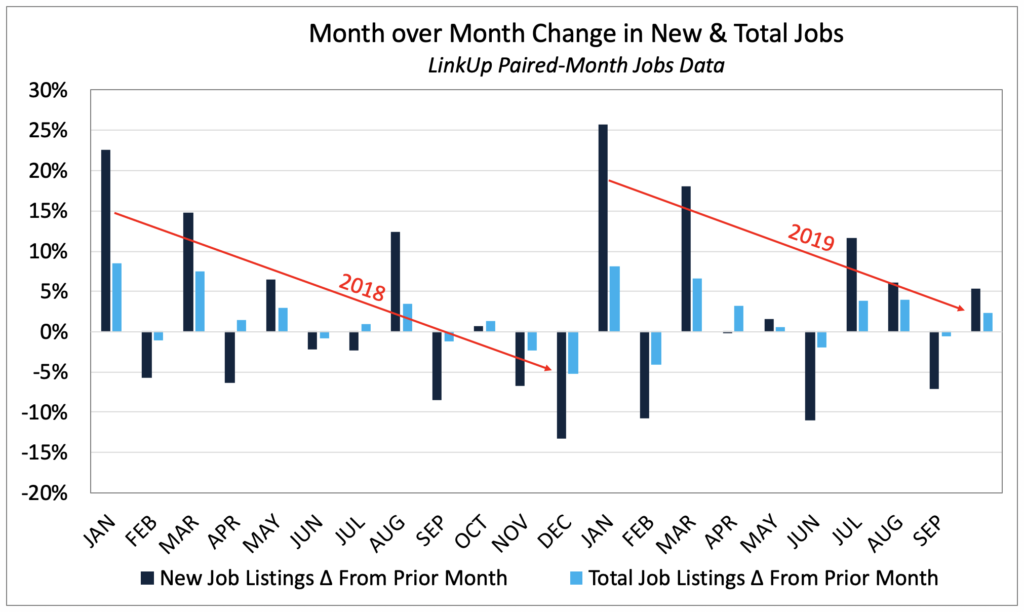

So demand is generally up across the board, and yet the rate of increase is slowing down. While the pattern is nearly identical to years past, the month-over-month increases in job openings using our paired-month methodology (another data series we use to account for the addition of new companies) are on a downward slope.

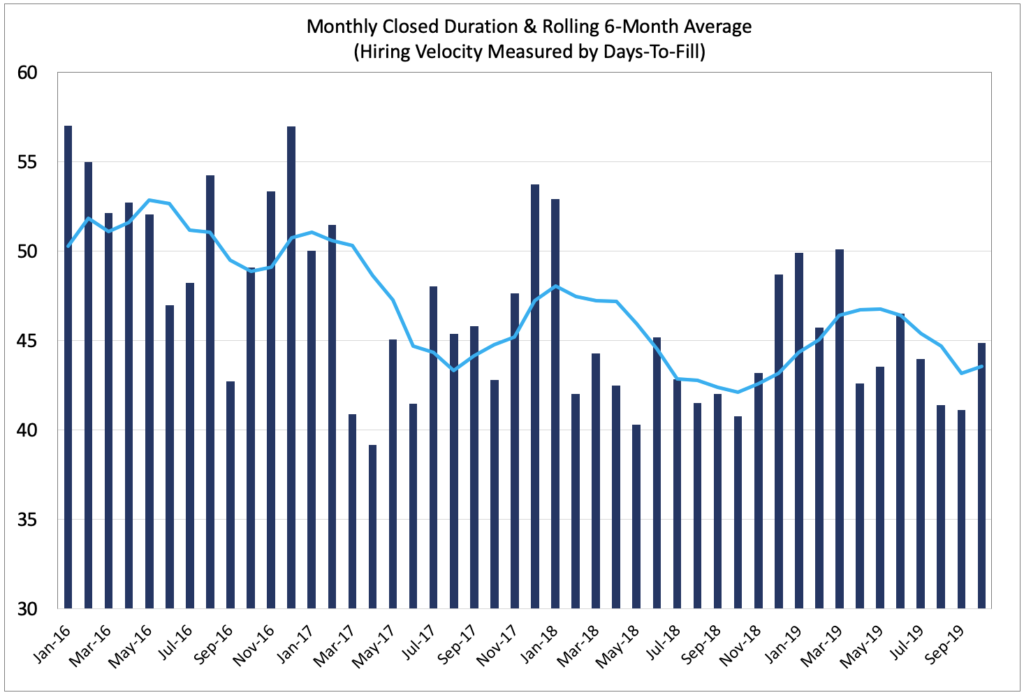

And while hiring velocity has accelerated this year as companies race to fill openings as fast as possible given the tightening labor market, LinkUp’s Duration metric increased in October.

But as we indicated last month in our commentary around our non-farm-payroll forecast, a slowdown in hiring velocity can either mean that companies are getting more cautious about hiring or they cannot find candidates to fill positions.

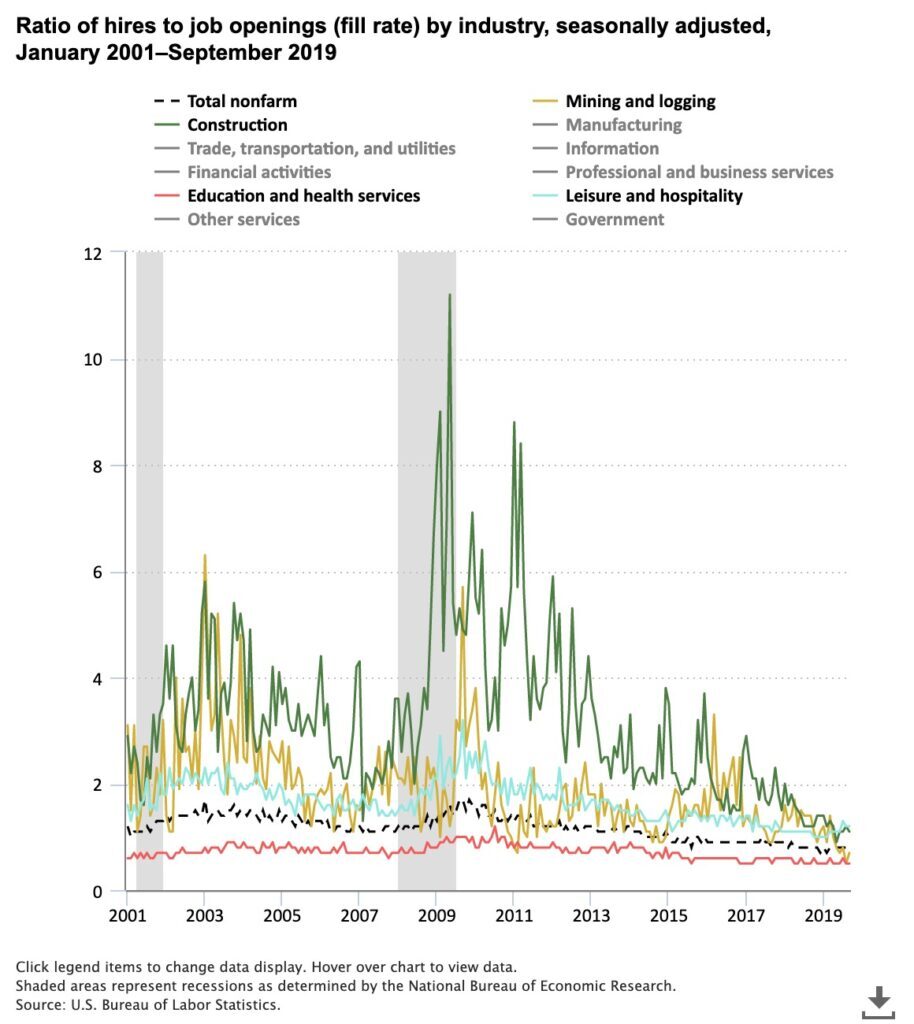

In terms of supply/demand, one last interesting data point was released this week by the BLS. In September, Fill Rates, measuring the ratio of hires in a month to the number of openings at the end of the prior month, were 0.8 across the entire economy.

In the report, the BLS indicated that 9 industries had fewer hires than openings while 2 industries (construction and hospitality/leisure) had more hires than openings.

The two industries with fill rates greater than 1.0, particularly hospitality/leisure, are a perfect segue to the second question raised at the outset – that is the extent to which the strong U.S. consumer can continue carrying the U.S. economy on its back.

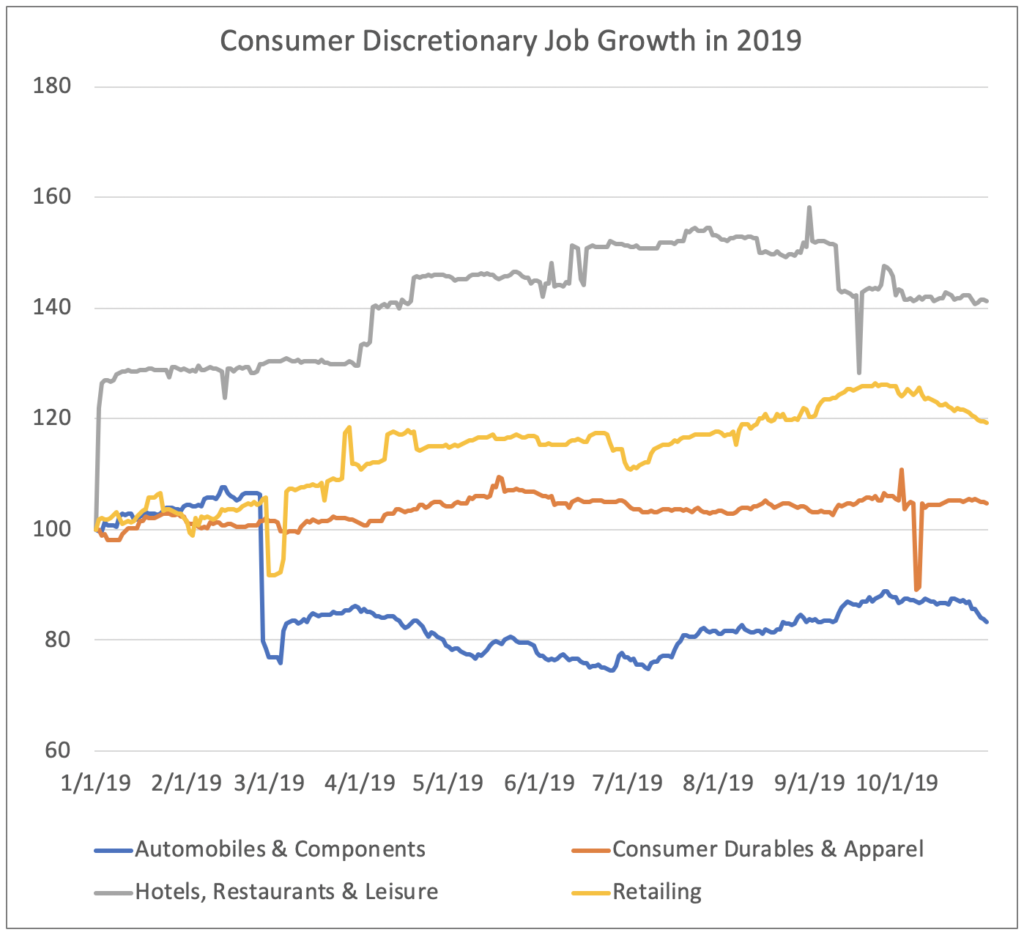

To gauge the strength of the U.S. consumer, in terms of both spending and hiring, we can look at The S&P 500 LinkUp Jobs Index and the two consumer-related sub-sectors: Consumer Staples and Consumer Discretionary.

In a post yesterday, we wrote that while job openings in Consumer Staples had risen sharply, the gains have been entirely attributable to strong hiring by Walmart. While not insignificant, it certainly does not demonstrate a broad-based increase in spending or hiring across the Consumer Staples category.

In the Consumer Discretionary category, however, labor demand has increased in 2019 in 3 of the 4 sub-categories.

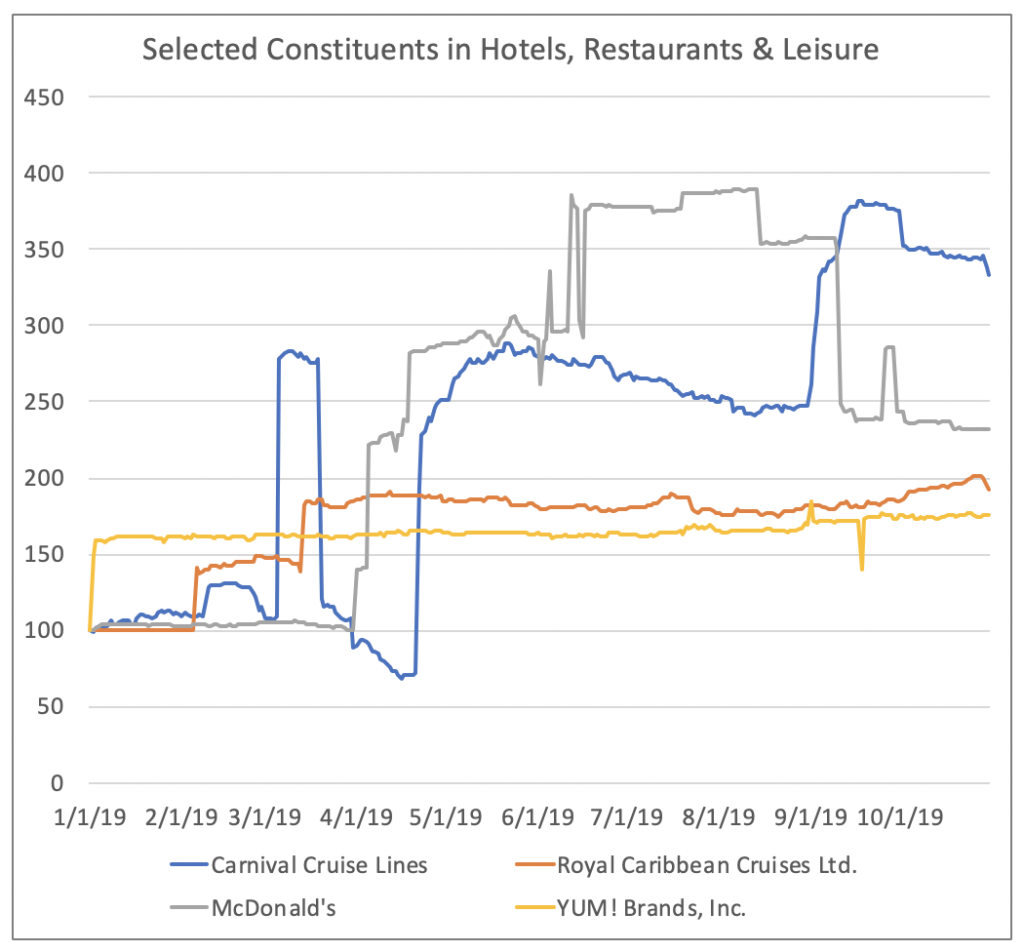

In the Hotels, Restaurants & Leisure category, job openings for Carnival Cruise Lines have grown the most, but gains are pretty consistent throughout the entire category.

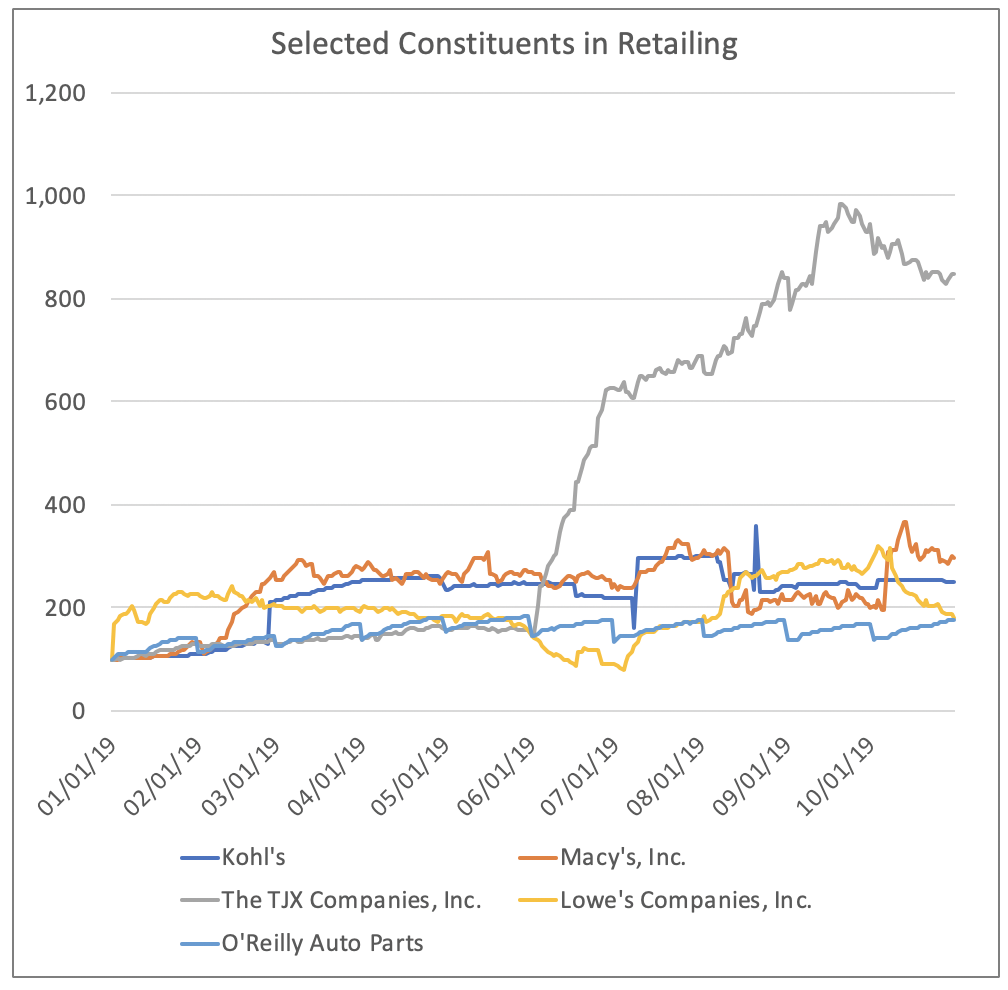

Similarly in Retailing, job openings for TJX Companies have grown the most, but gains are broad-based throughout the category.

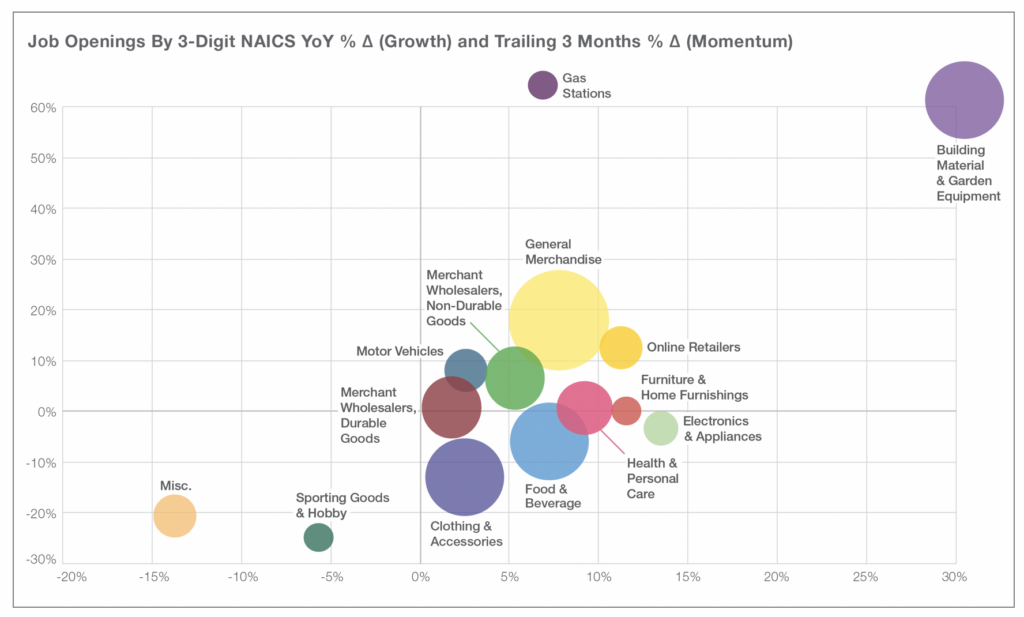

Looking at job openings in October for all retailers in LinkUp’s dataset shows that a majority of retail categories have shown year-over-year increases in job openings and nearly all have increased hiring in the past 3 months.

Based on labor demand in the Consumer Discretionary sector, particularly in both Hospitality & Leisure and Retail, there is little doubt that the U.S. consumer is in pretty solid shape.

Strong consumer spending is driving the need for more hires which in turn grows jobs throughout the country which allows for more spending and then more hiring and so on – a powerful and positive reinforcing cycle.

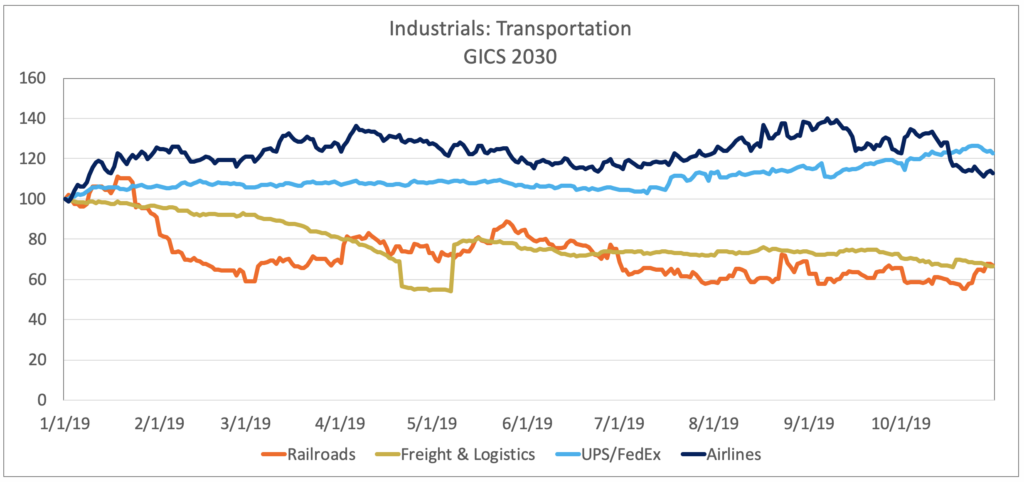

In sharp contrast, labor demand among the Railroads and Freight/Logistics has plummeted due to growing weakness in manufacturing, industrials, and agriculture.

No chart more perfectly captures the dichotomy of the U.S. economy at the moment than looking at job openings in the Transportation category within Industrials in the S&P 500.

As confident consumers travel and shop freely, airlines and FedEx/UPS are hiring aggressively to keep up. But as manufacturing, industrials, and agriculture, among others, get increasingly nervous about the future, they have dramatically slowed down the pace of hiring.

So the overarching question is whether the slowdown in monthly job gains this year is simply a slowdown as the economy continues to extend the expansion or a more troubling indicator of a recession looming close on the horizon.

The markets have recently signaled that it’s the former, and we’d tend to agree based on what we’re seeing in our job market data, particularly as it relates to strong consumer activity.

We’d also point to the Sahm Rule, named after Claudia Sahm, a Fed economist who has developed a simple, ingenious metric for determining whether or not we’re in a recession.

The Sahm Rule states that we are in a recession if the 3-month average unemployment rate is at least 0.5% above the prior 12-month low-water unemployment rate. With September’s unemployment rate of 3.5%, that would mean that unemployment has to reach 4% and stay there for at least 3 months before we are in a recession.

Given the insanity of the world we live in these days and the fact that nearly any scenario is conceivable at the moment, our discomfort grows significantly when speculating beyond the immediate, near-term future.

Rest assured, however, that we are not currently in a recession, nor are we likely to be in one before the end of the year. And based on our current job market data, we’d even speculate that Q1 is safe as well.

Beyond that, it’s anyone’s guess. Luckily for us, we have a continuous stream of predictive job market data that provides us with insights into when we believe the Sahm Rule might kick in.

We’ll keep you posted.

Insights: Related insights and resources

-

Blog

06.16.2022

May 2022 Jobs Recap: May job listings down 4.2%

Read full article -

Blog

05.17.2022

April 2022 Jobs Recap: Companies put the brakes on hiring

Read full article -

Blog

09.02.2019

Despite Trump's Best Efforts, The U.S. Job Market Refuses To Cool Off

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.