WSJ Article Captures Perfectly What We've Been Saying for Years...

...job openings sourced directly from company websites provide far better view on U.S. job market. BLS data sourced from surveys (not to mention horrifically polluted job board data) is essentially irrelevant in understanding what's happening in the job market.

With August’s ‘Jobs Friday’ falling on September 1st, we separated our non-farm payroll forecast from the commentary we typically provide in those posts, noting that we’d soon be publishing a post with some of the observations we’d make regarding the job market these days.

That commentary, however, will have to wait a few more days, however, because we wanted to highlight a perfectly-timed story in today’s WSJ titled “The Problem with Economic Data Is Getting Worse.”

The subtitle of the article elaborates further - ‘Data revisions are occasionally so big that they upend our shared understanding of what’s going on.’ As examples, the article cites U.K. GDP and the U.S. job market as arguably the two most flagrant examples of errant data that is entirely dependent on increasingly flawed and ineffective survey data.

As the article notes:

Early reporting of figures that are later revised away can send investors in entirely the wrong direction. It can embed an understanding of the economy that takes a long time to be corrected. At worst it can lead to the misallocation of capital and influence government policy or interest rates.

“Markets don’t tend to react to revisions and especially to revisions like we’ve just had to GDP because your average trader or investor is interested in what’s the latest data, not what happened two years ago,” says Paul Donovan, chief economist of UBS Global Wealth Management.

Worse still, “people cling to the idea that the numbers are accurate and precise and they’re just not,” he says.

In regard to the U.S. job market specifically, the article notes that:

Investors in the U.S. have been wrong-footed by the jobs market this year, which turned out much cooler than expected. Some of the surprise was simply that economists predicted more jobs would be created than in fact were, which is the normal uncertainty about the future that investing is all about. But revisions contributed, as initially strong jobs figures were later revised down sharply, with a quarter of a million fewer jobs created over the past six months than first thought. That turned out to be good for stocks, reducing the pressure for profit-sapping wage rises and easing the need for higher rates.

The sentiment and facts of the story couldn’t be more accurate with the sole exception being the fact that economists have consistently predicted smaller monthly job gains and a far weaker job market than what has occurred since 2022, even after the persistent downward revisions by the Department of Labor’s Bureau of Labor Statistics (BLS).

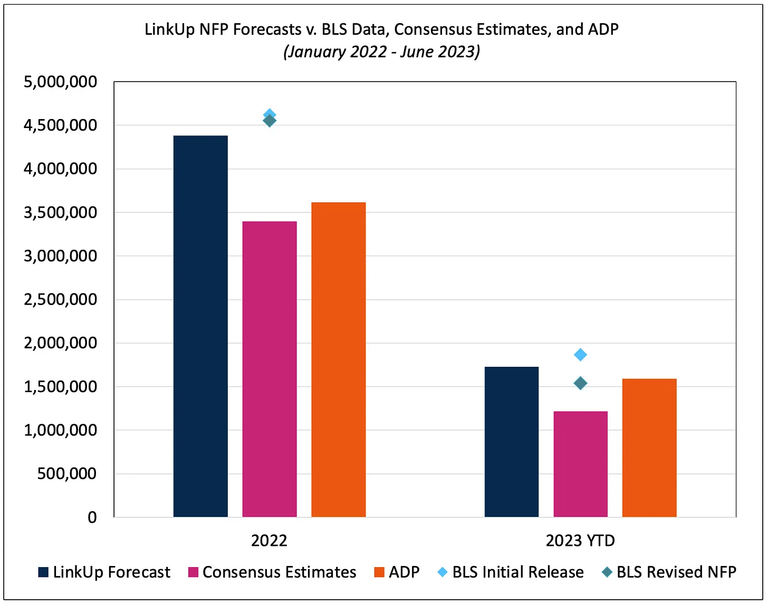

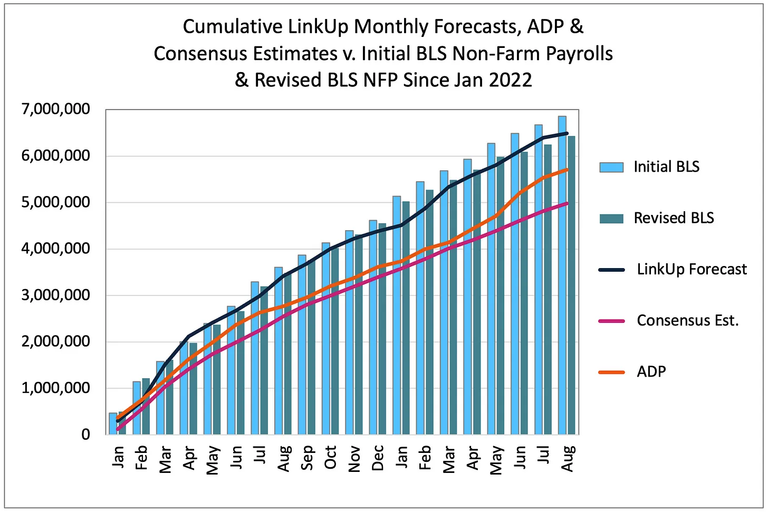

Those economists collectively forecasted that the U.S. economy would add 4.98M jobs since January 2022 while the economy actually added 6.44M jobs (and we forecasted a total gain of 6.49M jobs).

On a cumulative basis, that same data is precisely what we’ve been publishing and highlighting emphatically on our blog for the past few years (actually for more than a decade, but who’s keeping track?).

On a cumulative basis since January of 2022, LinkUp’s NFP forecasts are off from BLS revised data by 0.8% while ADP is off by 11.3% and consensus estimates are off by 22.6%.

And specifically pertaining to the worsening reliability of ‘official’ government data, BLS revised its 2022 data downward by a total of 132,000 jobs while downward revisions in 2023 so far have totaled 355,000 jobs.

So on that note, we couldn’t possibly agree more with the article’s (and Donovan’s) conclusion:

Investors should brace for more of this. Shifts such as working from home and new job categories like social-media influencers aren’t captured in much of the data, Donovan points out.

The timely data that drives markets on a day-to-day basis has become less reliable. The response rate for the survey of 651,000 businesses behind the payrolls data was steady at about 60% before the pandemic, but has since dropped to just 42%.

It’s even worse for the important Job Openings and Labor Turnover Survey used to work out how many vacancies there are and how many people are quitting their jobs. Investors have followed it fanatically over the past two years as a gauge of the labor market. The response rate has more than halved to just 32%.

Investors should be aware of this uncertainty, and try to back up any position based on economic data by checking other data and surveys too. Anecdote can help a little, but can also lead to too much focus on one’s own social group. Understanding the details of the data can help…But ultimately narratives drive markets, and one has to be really sure the narrative is based on a mistake to take the opposite view.

The only additional point we’d make is that in regard to the ‘other data’ mentioned above, one need look no further than LinkUp and our entirely unique job openings data - millions and millions of job openings that we index every single day directly and solely from employer websites around the world - the most accurate and timely source imaginable.

It is that data - comprised of actual job openings posted on company and employer websites rather than ineffective surveys or insanely polluted job board data - that arms us and our clients, investors included, with the ability to accurately forecast the U.S. job market.

Insights: Related insights and resources

-

Blog

09.06.2023

August 2023 Jobs Recap: Labor Market Analysis

Read full article -

Blog

09.05.2023

LinkUp's August Job Openings Data Provides Further Evidence That The U.S. Job Market Is In Perfect Equilibrium

Read full article -

Blog

08.31.2023

LinkUp Forecasting Gain of Only 90,000 Jobs In August As Job Market Continues to Gradually Cool Off

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.