The Phillips Curve Is Not Dead; Beware (or Cheer) The Paulsen Inflection Point

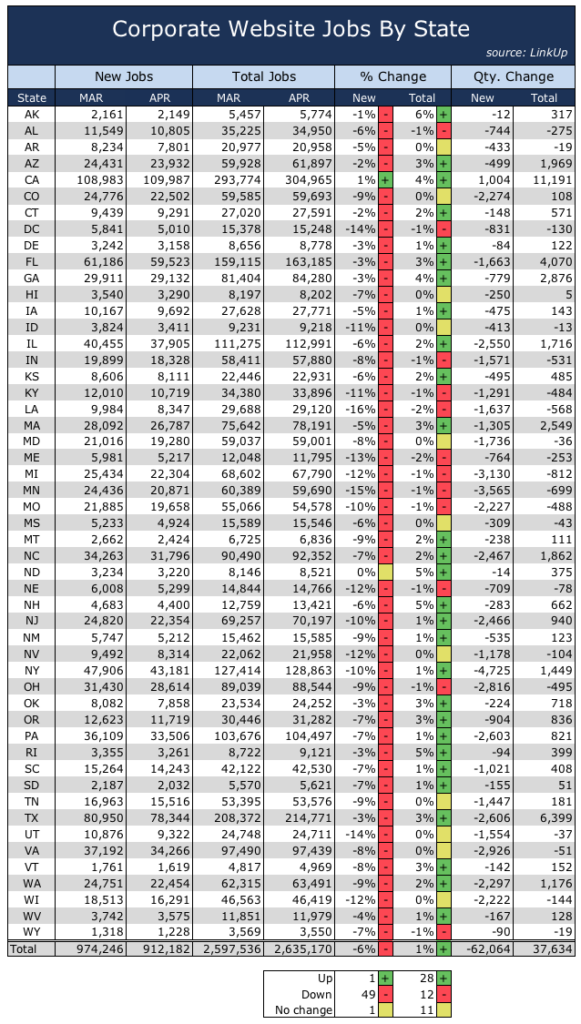

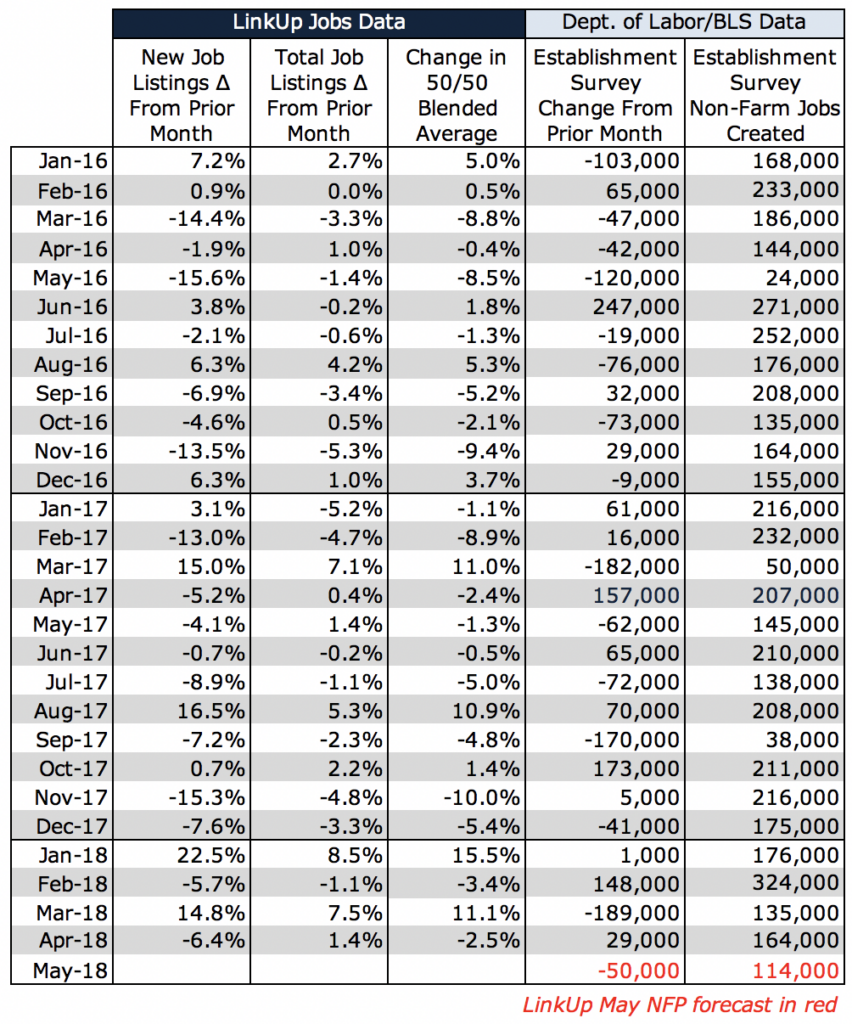

New jobs indexed entirely from company websites fell 6% and total jobs from company sites only rose 1%

Right behind the chaos in the White House, The Mueller Investigation, North Korea, Michael Cohen, The Royal Wedding, The Avengers, Yanny/Laurel, Elon Musk, Season 14 of the Bachelorette, community adjusted EBITDA (and deep junk), Roseanne (seriously, WTF!?!), on-again/off-again/on-again trade wars with China, Europe, Canada and Mexico among others, and the Vegas Golden Knights, inflation is capturing the hearts, minds, and rapt attention of the country.

Well, maybe not exactly, but it is certainly top of mind for the Fed, economists, and the capital markets. And while the obsession until recently with inflation, and particularly wage inflation, for the past 3 years or so had been its perplexing absence and whether or not the Phillips curve had been rendered obsolete, the fascination (and debate) has shifted quite abruptly to how ferocious inflation’s rise will be now that it has finally appeared on the scene.

A small sample of how the next stage of the inflation debate is taking shape includes the following articles:

• Raises and Bonuses Are About Economics, Not Politics

• On Wage Growth, You Ain’t Seen Nothing Yet

• Paychecks Are Getting Bigger. Don’t Get Too Used To It

• Wage Growth at Lower Tiers Is Outpacing That At Upper Tiers

(Bloomberg View, March 25, 2018)

• In a Hot Global Economy, a Surplus of Frowns

• Fed Officials Worry Economy Is Too Good. Workers Still Feel Left Behind

• U.S. Inflation Hits Federal Reserve’s 2% Target Level

• Key Inflation Measure Hits 17-Month High

(Financial Times, April 30, 2018)

• Inflation Puts Scrutiny On Fed’s Rate-Rise Plans

• US Jobless Rate Falls to 3.9% But Room For Wage Growth

(Financial Times, May 4, 2018)

• Fed Faces a Goldilocks Conundrum

• Economic Milestone: There Is a Job For Everyone Who Wants One

• Inflation Split Highlights Fed Challenge

• How the Unfettered Fed Flattened the Phillips Curve

But still very critical to the debate is not only how material, in fact, inflation’s presence is today, but why it was so dormant for so long, what is changing now to finally draw inflation to center stage, and how impactful will those changes be in fueling a steep and accelerated rise in inflation.

To recap, most people point to one or more of the following as to why inflation was so dormant for so long:

• Didn’t actually reach full employment until very recently

• Took forever to truly claw back from Great Recession

• Abundance of hidden slack

• Bad official data

• Globalism eliminated pricing power

• Lack of productivity gains prevented wage growth

• Hidden productivity gains/technology/automation reduced need for hiring

• Replacing retiring, ‘expensive’ baby-boomers with ‘cheap’ millennials kept wages down

• Employers will suffer through people shortages longer than expected before raising wages

• Changing way employers ’employ’ keeps wages low (gig, temp, project, outsource, etc.)

• Wages are growing but only in isolated pockets of the economy and/or country

• Wage inflation is bifurcated – lots in service economy, none in goods economy

• 24 months of flat labor demand (Mar ’15-Feb ’17) kept wage inflation in check

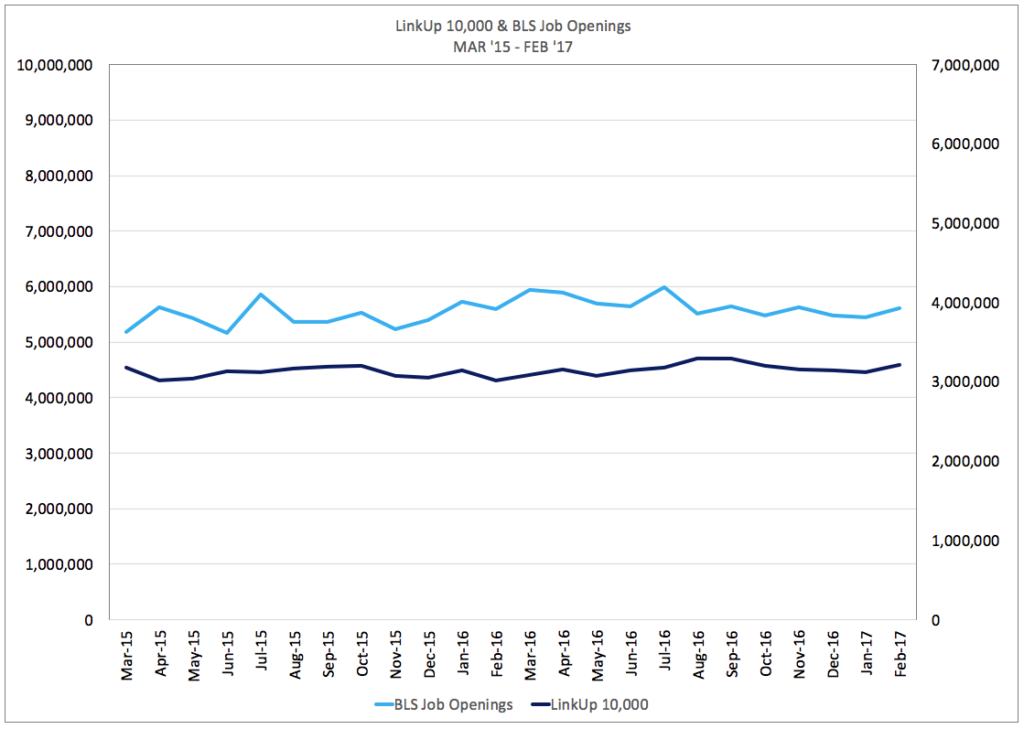

It’s a long list so I hope I didn’t miss anything (at least not any big, glaring omissions), and the reality is probably a combination of many if not all of the above. On the last point regarding the number of job openings, an interesting initial observations around The LinkUp 10,000 (which we recently launched) is that the total number of job openings for the largest 10,000 employers in the U.S. stayed relatively flat from March 2015 to March 2017. Not surprisingly, The LinkUp 10,000 data is highly correlated to BLS job openings/JOLTS data for the same 24-month period. During that period, the U.S. economy added a net gain of 4.75 million jobs and unemployment dropped from 5.5% to 4.7%, but neither the labor force participation rate nor the employment population ratio moved much and both remained well below historical averages during the past 40 years (and have remained stubbornly low since then as well).

So while labor demand and job growth remained solid during that stretch, the fact that labor demand was not increasing meant that employers didn’t necessarily have an increasing incentive to raise wages. To be certain, the long list of additional factors listed above had to have also played a role, perhaps a far larger one even, but the fact that job openings were flat for 2 years is highly noteworthy in the debate surrounding the absence of wage inflation until recently.

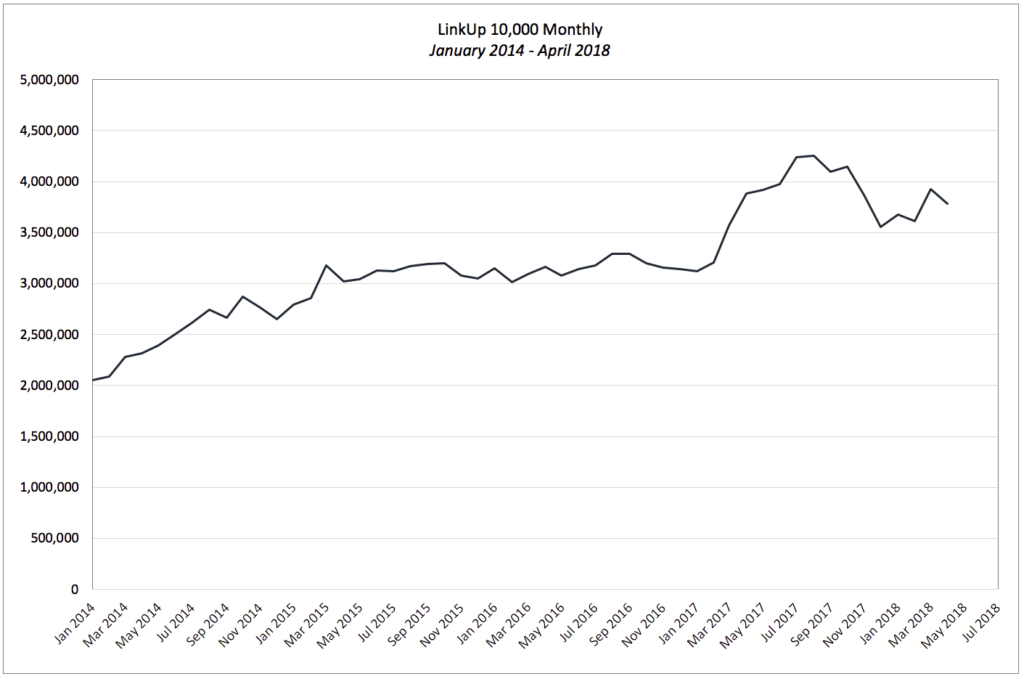

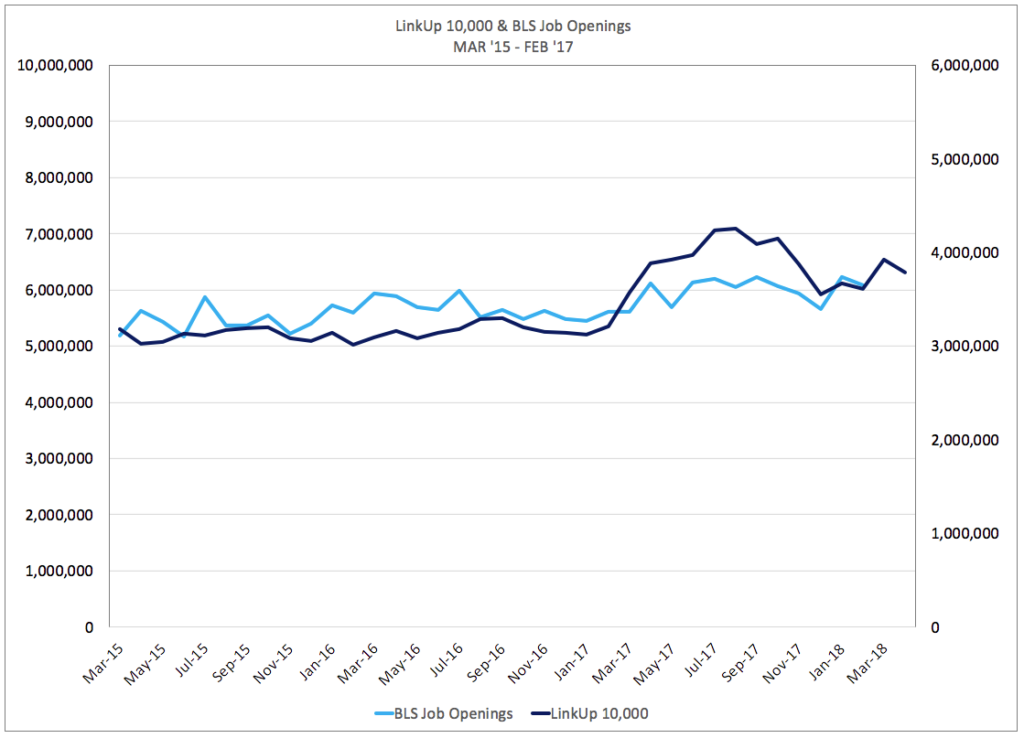

Equally as noteworthy, job openings in The LinkUp 10,000 increased considerably in 2017, peaking at 4.2 million in August of 2017, a 36% increase from January of last year. And while job openings decreased from August 2017 to December of 2018, they have risen 10% since the beginning of the year.

That increase in job openings in The LinkUp 10,000 is far more pronounced than what we see in the BLS JOLTS data.

As background, The LinkUp 10,000 is an analytic, published both daily and monthly, that captures the sum total of U.S. job openings from the 10,000 global employers in LinkUp's job market history database with the most U.S. job openings. Representing the entire U.S. economy, the LinkUp 10,000 is a macro indicator designed to measure real-time changes in U.S. labor demand. And because job openings are highly correlated to job growth in future periods, the predictive attributes of the LinkUp 10,000 deliver valuable insights into the future direction of the U.S. labor market.

Before getting to our non-farm payroll forecast for May, I’d add two additional points to the wage inflation discussion. The first is that in his excellent book ‘The New Geography of Jobs,’ Enrico Moretti adds another contributor to the lack of inflation in the economy. Moretti posits that rising rents in innovation hubs (large cities with diverse job markets centered around the innovation economy) are sucking up all the wage gains of millennials so there is no disposable income or excess purchasing power for high-paid knowledge workers to spend money on.

The second point is that Jim Paulsen, Chief Investment Strategist at the Leuthold Group, makes a number of extremely interesting observations about wage inflation. First is his claim that the Phillips Curve is not dead in the least bit. The second is that when nominal GDP growth is higher than unemployment, wage inflation will inevitably materialize. Paulsen postulates that this relationship between nominal GDP growth and unemployment stands as a huge marker for the economy and notes that in the 4th quarter of 2018, nominal GDP growth finally rose above unemployment – an enormous inflection point that we’d term ‘The Paulsen Inflection Point.’

So having said all of that, we’ll now turn to our NFP forecast for May. And unfortunately, based on job openings on LinkUp’s job search engine in April, a month in which new jobs indexed entirely from company websites fell 6% and total jobs from company sites only rose 1%, we are forecasting a disappointing jobs report this Friday.

With a 50/50 blended average between new and total job openings growth of -2.5% in April, we are forecasting a net gain of just 114,000 jobs in May.

But while net job gains in May are likely to come in below consensus estimates, we remain confident in our estimates that wage inflation will not only continue to move towards center stage, but single-handedly start carrying the entire storyline of the U.S. economy and eventually stealing the show.

Insights: Related insights and resources

-

Blog

08.04.2022

Heads I Win, Tails You Lose; Reflections on the Still-Cooling But Strong Job Market

Read full article -

Blog

04.01.2021

The S&P 500 at 4,000, Kitten NFTs for $1M, and Job Gains of 800,000

Read full article -

Blog

01.03.2019

The Wage Inflation Narrative Is About To Be Upstaged By A Nasty Jobs Report

Read full article -

Blog

09.28.2018

With Data Pointing To Clear Skies Ahead, LinkUp Forecasts Robust Job Growth In September

Read full article -

Blog

04.27.2018

Like a Stray Dog Gone Defective

Read full article -

Blog

03.26.2018

LinkUp Forecasting Net Gain of 235,000 Jobs In March; Wage Inflation Will Accelerate in Months Ahead

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.