The Absurd Myth of 'Ghost Jobs'

Other than overshooting the magnitude of our better-than-consensus forecast, everything about Friday’s jobs report for March came in precisely as we expected.

Other than overshooting the magnitude of our better-than-consensus forecast (which we admittedly overshot by a wide margin, although we'll see what happens in the 30 and 60 day BLS revisions), everything about Friday's jobs report for March came in precisely as we expected.

Job gains were solid, wages ticked down, labor force participation ticked up, and the consensus view has finally gravitated toward acknowledging the soft landing we've been detailing for nearly a year. As Preston Caldwell, chief U.S. economist at Morningstar Research, said in the Times, albeit with an laughably excessive dose of conservatism, “It does look like the range of options that are adjacent to what we might call a soft landing is expanding. Wage growth has mostly normalized now without a massive uptick in unemployment. And a year ago, a lot of people were not predicting that.”

No need to be so meek. As we said two months ago, the plane has long since landed safely on the tarmac and the only question since then has been whether or not the Fed would be patient enough to let us deplane without injury. While yesterday's report suggests that should be the case, we'll see what happens when the surge in job openings we saw in our data in March (6% increase in total openings and a 22% jump in new openings) ripples into the jobs numbers in the next month or two.

But for now, however, we want to shift gears and focus on a slightly different topic - so-called 'Ghost Jobs.' A WSJ article last month, reporting rather carelessly on the results from a shoddy survey (most definitely part of a larger - and obviously successful - SEO strategy) by a company that makes small business loans, described a perceived increase in job openings that hiring managers do not intend to fill. The Journal article was then subsequently reported on in even more ludicrous fashion by, among others, Mashable and Fortune (both of whom have clearly become nothing more than click-bait farms) and it now seems as if we're facing an epidemic of fake job openings.

What the report from a survey of 1,000 hiring managers concluded was that 68% of hiring managers had an opening posted for more than 30 days, 10% had at least one posting open for more than 6 months, and that 50% of hiring managers are 'always open to new people.' From that last point, Mashable absurdly claimed that 'basically' half of all job openings are fake. And by the way, what hiring manager isn't open to new people?!?

Because actual primary data (hundreds of millions of job openings sourced directly from company websites globally every day for the past 15 years) is always better than a random survey of 1,000 small businesses about talent acquisition conducted by an invoice factoring company over two days in August of 2022, we thought we'd weigh in on the topic given our 20 years of experience in human capital management and employment data.

So first off, what we want to look at is a metric we track closely called Job Duration - the number of days that a job opening is posted on a company's corporate career portal on their company website. Uninformed opinions to the contrary, employers tend to be very disciplined about posting jobs only when they intend to fill the opening with a hire and removing them when they fill the opening.

One of the major trends in human capital over the past decade or so is the care and attention employers pay to their employment brand and only the dumbest businesses are stupid enough to believe that they can appease over-worked employees by posting job openings that are not legitimate or create the impression to competitors, investors, or their lender that they are growing when they are not (two of the reasons cited in the survey results).

It's also critical to note that the data we are looking at applies only to job openings sourced directly from company websites. Duration data pertaining to job openings sourced from job boards, staffing firms, aggregators, and other 3rd party intermediaries is far less reliable and, for the most part worthless, because job boards are plagued by sponsored jobs, syndicated job ads, pay-to-post listings, duplicate listings, expired jobs, and other job board pollution that leads to a very noisy duration signal.

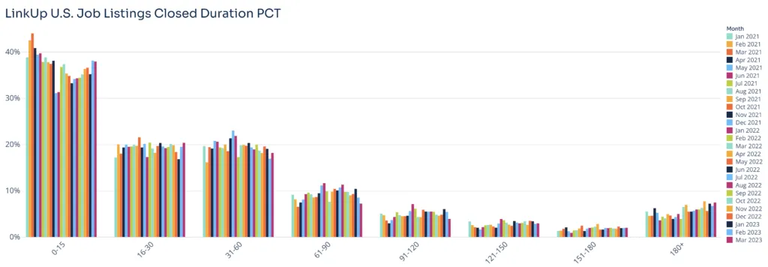

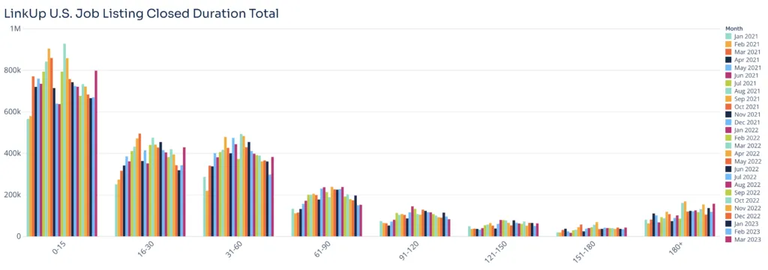

The two types of Duration we track are Closed Duration which is the number of days an opening was posted before it was removed, most often because it was filled with a hire (but not always because sometimes companies decide not to fill the position and take it down). The second duration metric is Open Duration which is the number of days an opening has been posted for jobs that are 'open' or still active on an employer's website.

Every month we analyze, in exhaustive detail, closed and open duration be compiling data from every single job opening, active and closed both, indexed during a given month (typically between 5-7 million openings in the U.S. and roughly 10-11 million globally).

Looking first at closed duration, the average number of days that job openings are posted on company websites before being removed was 45.6 days in March and the average number of days that it took employers to fill openings in the U.S. over the previous 12 months was 46 days.

Of the 2.14 million unique jobs removed from company websites in March, 1.23 million jobs (58% of the total) were removed after having been up for less than 30 days, 720,000 jobs (35%) had been posted for between 1-6 months, and 160,000 (7%) had been posted for more than 6 months.

As a percent of total removed jobs, the number of removed jobs older than 6 months has risen from 4% to 7% since last May but still remains small relative to all removed jobs. And in any case, the vast majority of removed jobs are active positions where the employer intends to fill them and removes them when the opening is filled with a new hire.

As the Closed Duration data clearly illustrates, nearly a million jobs are filled every month in the U.S. economy for positions where the job opening had been posted for more than 30 days. Again, the average position takes 45 days to fill - not surprising given the multiple steps an employer has to go through to fill an opening, steps that include posting the job, attracting candidates, interviewing them, drafting and presenting an offer, and finally setting a start date with the new employee. And that's just the average - there are millions of jobs that take longer to fill due to the conditions of the job market, the requirements of the job, the location of the job, and the particular nature of the position.

So the notion that an opening that has been open for more than 30 days should not be considered a legitimate job or characterized as a 'ghost' job is patently absurd - it demonstrates complete ignorance about the manner in which hiring and talent acquisition actually work.

Having said all of that, however, there is a category of job openings called 'Evergreen' openings that are essentially posted on a permanent basis. These evergreen job openings, which we can very specifically identify, are very much legitimate openings for real jobs that employers not only intend to fill but do fill with new hires.

The openings are always open because the jobs themselves are typically entry-level, low-paying jobs where the nature of the work and/or the working conditions are difficult or unappealing to the vast majority of the U.S. workforce. As a result, these jobs have extraordinarily high turnover and are extremely hard to fill so companies keep the openings up all the time because they are constantly trying to fill them with the hires they need to keeping running their business.

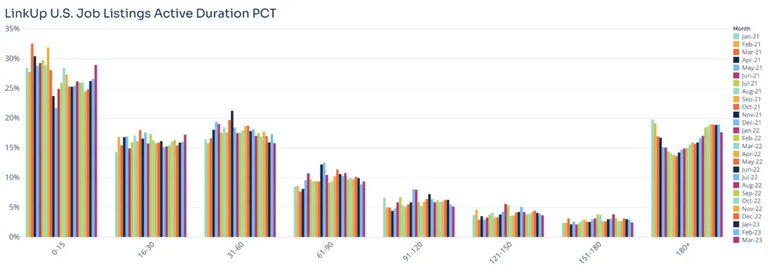

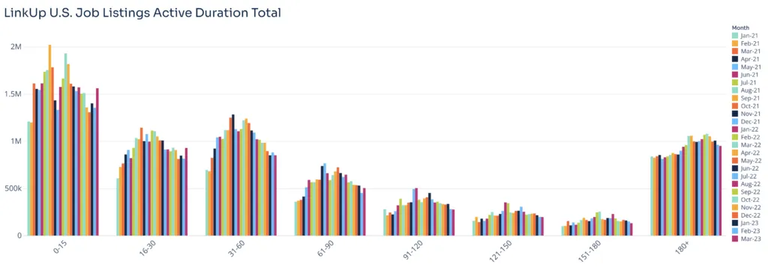

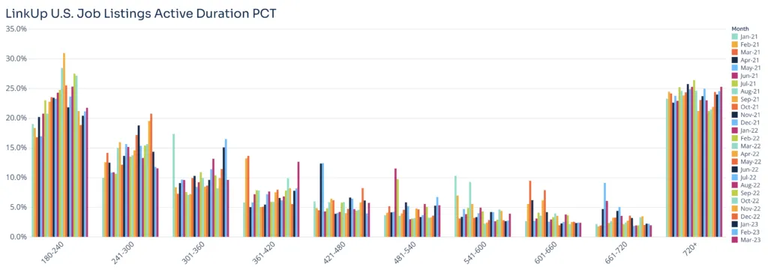

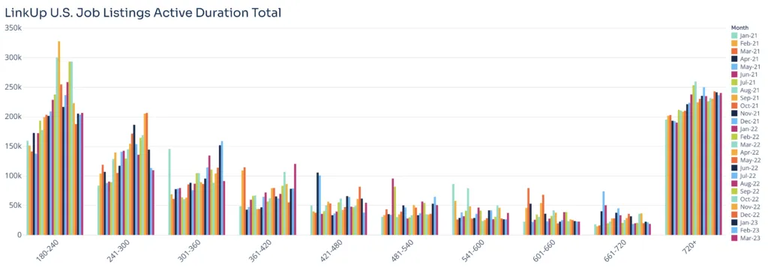

As mentioned previously, we can clearly identify these openings by looking at Open Duration. Among active jobs that were still open at the end of the March, 18% have been open for at least 6 months. This is down from 19% over the past 5 months and below the pre-pandemic norm of 20%.

So 950,000 of the 5.4 million total job openings in the U.S. have been listed on an employer's website for at least 6 months. And the fact that the number of 6+ month-old openings varies month to month is evidence that these jobs are actively monitored and maintained by the companies posting them.

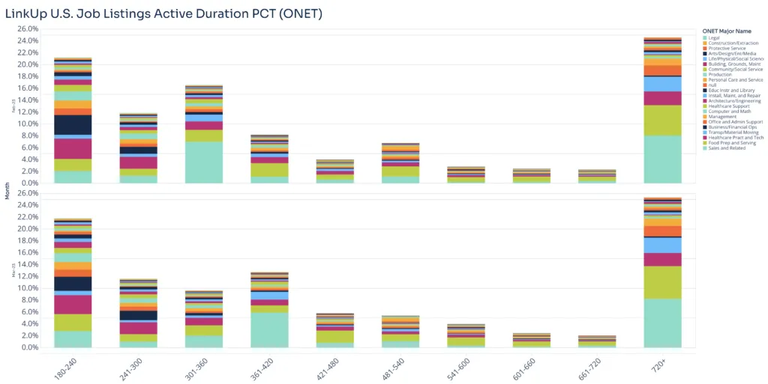

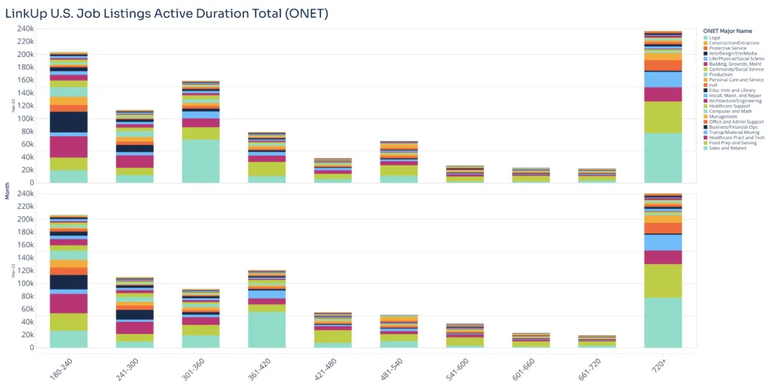

Drilling into a more detailed break-down of duration for these evergreen jobs shows even more month-to-month variability.

As the charts above and below show, 25% of the evergreen jobs in March, a total of roughly 240,000, have actually been posted for at least 24 months.

And again, while one might naively conclude that a job opening that has been posted for two years or more should not be considered a real job opening, we would argue, and rightly so, to the contrary. Because we index jobs directly from every employer's website, the quality and accuracy of our data provides us granular data on who the employer is, what industry they're in, and what the specific, individual positions are that they're trying to fill.

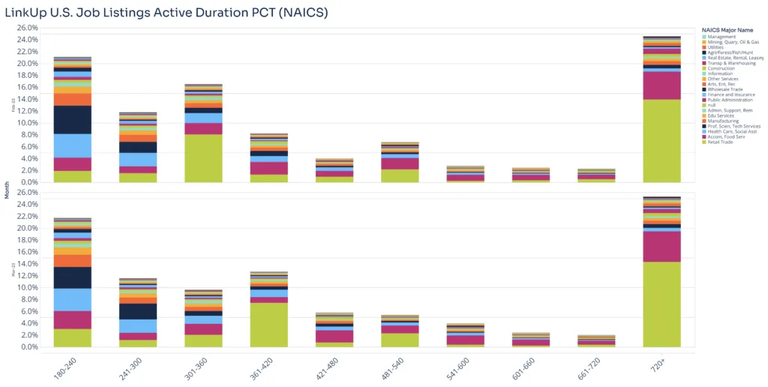

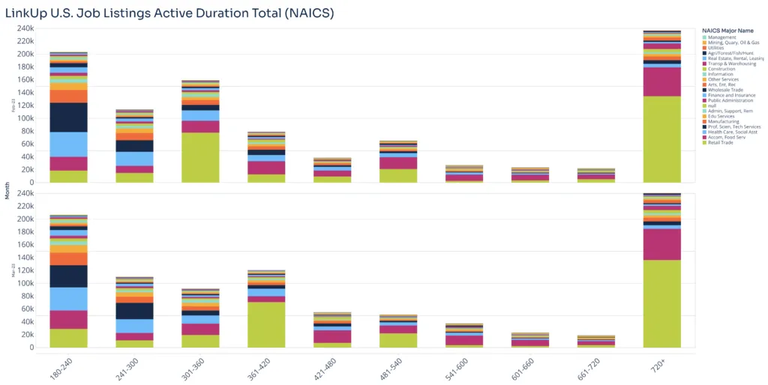

The chart above shows groups all the evergreen jobs by industry using the North American Industry Classification System (NAICS) and breaks down evergreen jobs in February (the top series of bars) and March (the series below February's).

Looking specifically at the longest duration jobs, those open for at least 24 months - the most evergreen jobs in the dataset, 136,000 are in Retail and 49,000 are in Accommodation and Food Services. Together, these 185,000 jobs (77% of the total 240,000) are in arguably the two industries most substantially characterized by predominantly low-wage, entry-level jobs with extremely high turnover.

Not surprisingly given the charts above, 78,000 are Sales jobs and 52,000 are in Food Preparation.

Additionally, 25,000 are Transportation jobs and 17,000 are Office Administration jobs.

So clearly, by analyzing accurate, high-quality job openings with a proper understanding of how employers actually hire employees and fill openings, ghost jobs are not a real thing. And while evergreen jobs are definitely a real thing, they absolutely represent real openings that employers most assuredly intend and need to fill to operate their businesses.

Insights: Related insights and resources

-

Blog

12.16.2025

The U.S. Labor Market Is Weaker Than Consensus & Recession Risk Is Higher

Read full article -

Blog

12.10.2025

LinkUp Forecast: November JOLTS report by the BLS

Read full article -

Blog

12.10.2025

November 2025 Jobs Recap: U.S. Labor Demand Cools as Job Listings Drop 7.4%

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.