Solid May Jobs Report & Full Employment Environment Will Push Fed To Raise Rates In June

Bloomberg’s caption from yesterday morning’s discussion about the May jobs report says everything one needs to know about the significance of Friday’s report from the Department of Labor.

Bloomberg’s caption from yesterday morning’s discussion about the May jobs report says everything one needs to know about the significance of Friday’s report from the Department of Labor. It is arguably the most significant jobs report since the end of the Great Recession, and no amount of elaboration or additional commentary could possibly lend more weight to the simple pronouncement above that:

FED HIKE PLANS HINGE ON MAY JOBS DATA

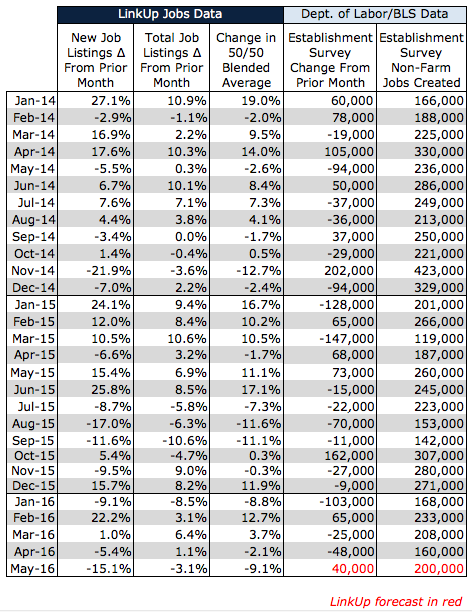

Leaving aside for a moment what we expect the Fed to do in June/July, we are forecasting net job growth of 200,000 jobs in May, taking into account the Verizon strike which will likely reduce job gains by roughly 36,000 jobs.

Our forecast is based on the 3.7% increase in March in new and total job listings in our search engine (which includes ~3.2 million job openings indexed daily directly from 50,000 company websites). Because there is an average lag of between 30-60 days from the time a company posts a job opening and when they fill the position with a new hire, we have to look back to March’s growth in job listings for signs of job growth in May.

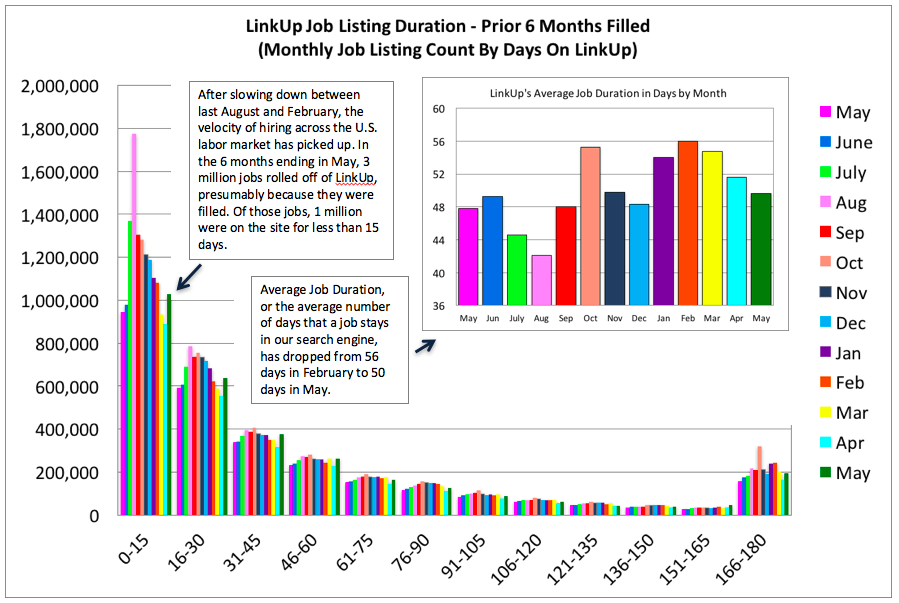

But what makes our forecast a bit tricky is that the average number of days that jobs stay on LinkUp (what we call Job Duration) has fallen from 56 days in February to 50 days in May. While the decline in Job Duration points to an uptick in the velocity of hiring (of particularly note are the 1 million jobs that rolled off the site in the past 6 months that were on the site for less than 15 days), it could be the case that we should be looking at April’s LinkUp job market data instead of March’s data.

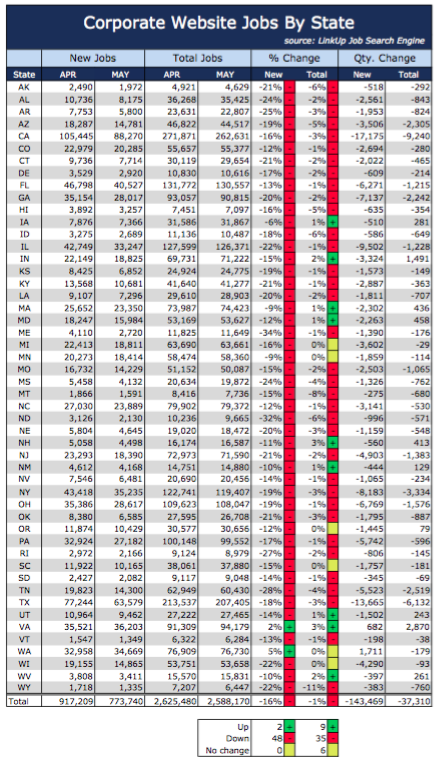

The other sobering fact is that job listings on LinkUp have declined for two consecutive months. In April, new job listings fell 5% while in May, new job listings declined an alarming 15%. Looking at LinkUp RAW Data for May, there are clear signs that the labor market is definitely softening as new job listings declined in 48 states and total job listings fell in 35 states.

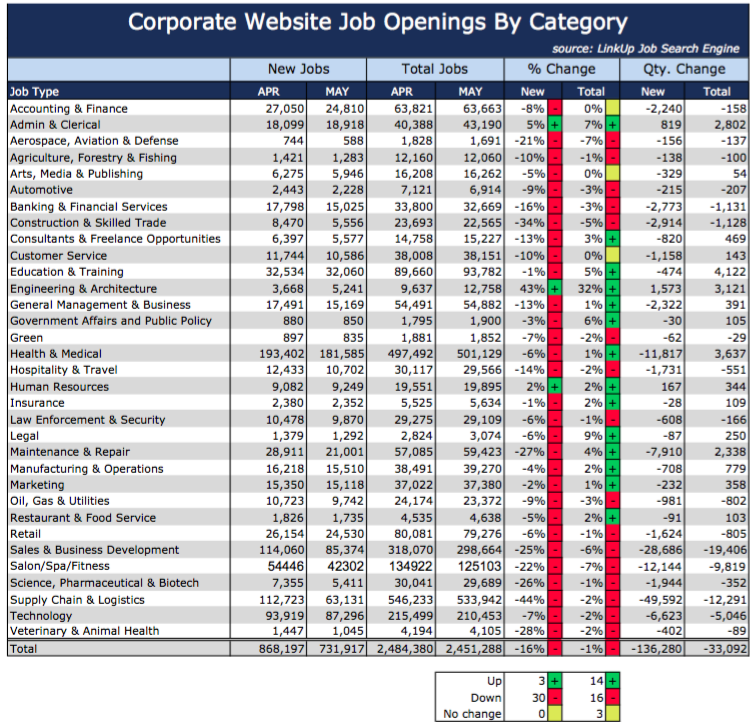

May’s job listings by category report shows a similarly bleak picture, with new job listings declining in 30 of 33 categories and total jobs falling in 16 of 33 categories.

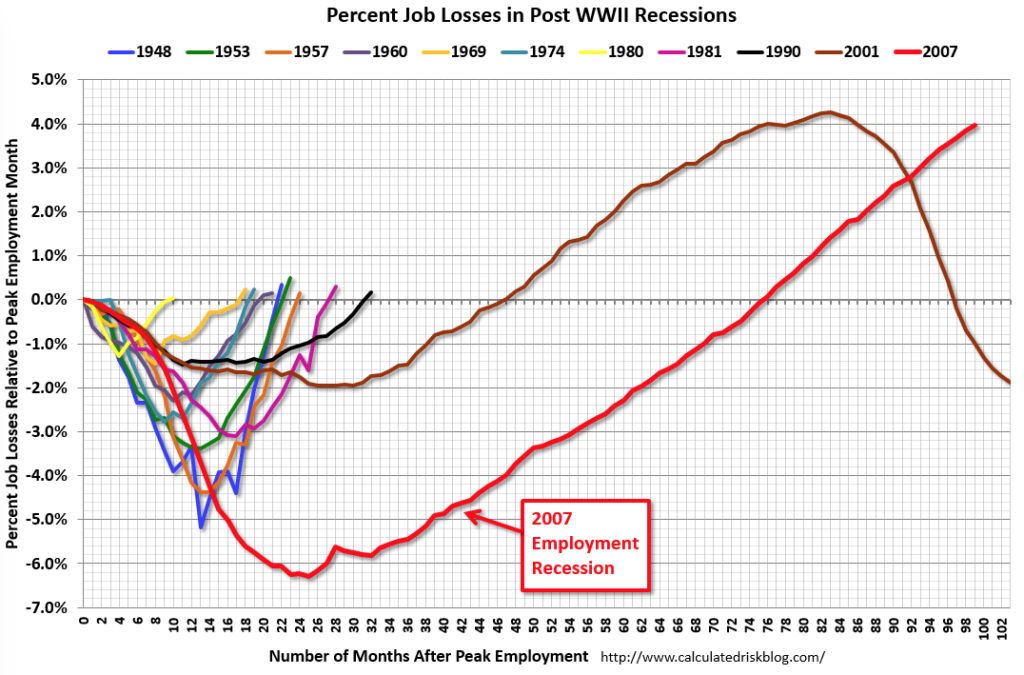

So despite a bullish forecast last month that articulated our conviction that we are most definitely in a full employment environment, circumstances that will inevitably trigger a June rate hike, we are a bit more measured these days. Despite what we expect to be a better-than-estimate jobs number on Friday of 200,000 jobs gained in May, there is little doubt that the labor market is cooling off. Given the phenomenal job growth over the past 5 years and the incredible recovery from the depths of the Great recession, this cooling off shouldn’t be too surprising.

So despite being a bit more measured than we were a month ago, we’ll maintain our position that due to overwhelming evidence for a full employment environment, combined with a strong report Friday that should include solid job growth and continued wage gains, the Fed will raise rates in June.

Insights: Related insights and resources

-

Blog

07.28.2022

Q2 2022 Economic Indicator Report: Labor market slowdown

Read full article -

Blog

07.07.2022

Job Openings Dropped 3% in June; LinkUp Forecasting Net Gain of Just 265,000 Jobs

Read full article -

Blog

06.01.2022

LinkUp Forecasting Disappointing Jobs Numbers For May and Continued Weakness in June

Read full article -

Blog

05.30.2017

LinkUp Forecasting NFP of 160,000 Jobs For May

Read full article -

Blog

11.03.2015

The Glass Is Half Empty; October NFP To Disappoint (Again)

Read full article -

Blog

09.02.2015

Amidst An Abundance Of Uncertainty, The U.S. Labor Market Is Flashing Some Serious Warning Signs

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.