September 2024 Jobs Recap: Job Market remains cautiously optimistic, even as openings dip.

The tension between fostering job creation and managing inflation remains at the forefront of economic policy.

Key Takeaways:

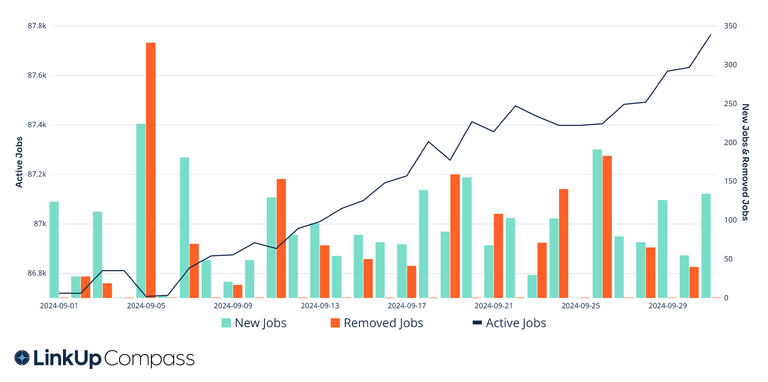

- Active Job Listings Decline: In September, LinkUp data shows a notable decrease in active job listings, with a drop of 52,000 from August. This decline follows a trend of cautious hiring, reflecting companies' concerns about ongoing inflation and market volatility. While the broader job market remains resilient, this reduction in job postings suggests that businesses are adopting a wait-and-see approach, particularly in industries sensitive to economic conditions.

Looking Ahead: The tension between fostering job creation and managing inflation remains at the forefront of economic policy. With businesses navigating higher costs and uncertainty about interest rate cuts, the job market is likely to continue facing mixed signals in the coming months.

From our data we see that there has been a significant increase in the number of “removed jobs” of around 103,000 from August to September. With inflation management still a top priority, there is hesitation about cutting interest rates too quickly, even though such a move could stimulate business growth.

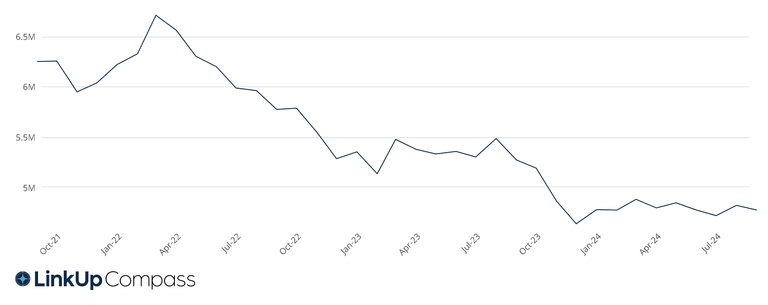

U.S. Job Listings by Month | January 2020 - September 2024

The graph illustrates monthly job listing trends in the U.S., comparing new and removed job postings alongside total active listings.

LinkUp 10,000

The LinkUp 10,000 is an analytic published daily and monthly that captures the total U.S. job openings from the 10,000 global employers in LinkUp’s jobs dataset with the most U.S. openings.

In September, the job market experienced a slight dip in momentum, with the monthly LinkUp 10,000 index falling by 1.0% compared to the previous month. The current monthly job listings stand at 4,783,299, down from 4,829,875 in August. This drop follows a similar trend of cautious hiring observed in the later half of the summer, suggesting that businesses may be holding back amid broader economic uncertainties. However, despite this monthly decrease, the overall index is still 9.4% lower than this time last year, reflecting a sustained shift in the labor market.

In summary, September saw a continued contraction in job postings, marking a challenging environment despite isolated growth sectors.

Monthly LinkUp 10,000 | January 2021 - September 2024

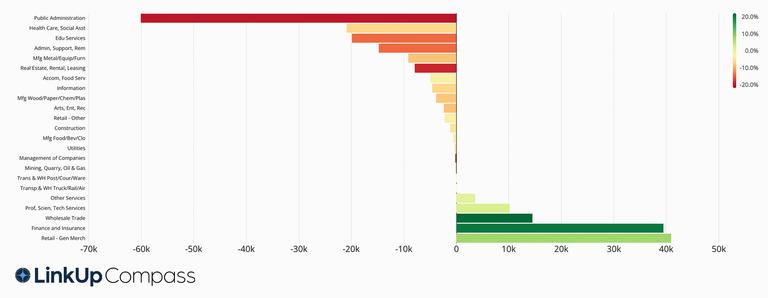

Jobs Data By Industry (NAICS)

We're seeing an increase in open jobs across 30% of industries this month, with the largest gains observed in:

Retail (+41k)

Finance and Insurance (+39.4k)

Wholesale Trade (+14.5k)

Industries that experienced the largest drops:

Public Administration (-60k)

Healthcare (-20.8k)

Education (-19.8k)

Job Listings by Industry (NAICS) | September 2024

This chart displays the change in job listings across various industries, categorized by NAICS codes.

Industry Spotlight:

Retail – General Merchandise

This sector experienced a notable 7% increase in job listings for September, likely driven by heightened consumer demand, strategic expansion efforts, and inflationary pressures shifting consumer behavior. As prices rise across the board, more shoppers are turning to budget-friendly options, like dollar stores, for essential goods. A prime example is Dollar General, which, despite facing weaker earnings, continues its aggressive real-estate expansion.

With over 20,000 locations in 48 states, Dollar General boosted hiring last year to enhance customer experience and added staff at self-checkout areas to mitigate retail theft. Similarly, Dollar Tree has opened more than 300 new stores this year and acquired 170 leases from the bankrupt 99 Cents Only Stores, reopening over 100 locations and planning an additional 50 by the end of 2024. Together, Dollar General and Dollar Tree are set to open over 1,300 new locations this fiscal year, outpacing other retailers and reflecting their confidence in growth through expansion.

Daily Job Listings: Rise in Number of Active jobs in September in the Dollar General

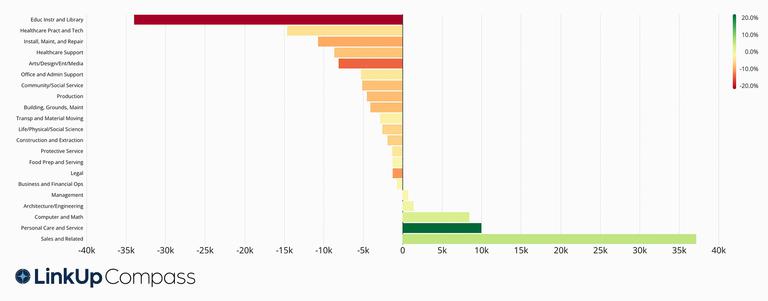

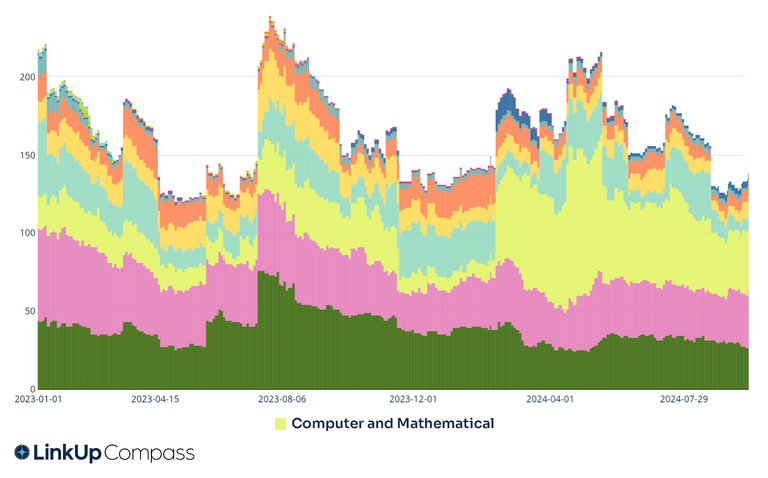

Jobs Data By Occupation (O*NET)

In step with the job postings across U.S. industries this month, 24% of occupational groups saw a rise in hiring.

Occupations with a rise in demand:

Sales and Related (+37.1k)

Personal Care (+9.9k)

Computer and Mathematical (+8.4k)

Occupations with a drop in demand:

Education Instruction and Library (-33.9k)

Healthcare Practitioners and technical (-14.6k)

Job Listings by Occupation (O*NET) | September 2024

This chart displays the change in job listings across various occupations, categorized by O*NET codes.

Occupation Spotlight:

Entertainment

The Art/Design/Entertainment/Media occupations saw a 9% drop in job listings, reflecting the industry's ongoing challenges. This decline could be attributed to shifts in consumer habits, reduced spending on non-essential goods, and growing automation in creative roles.

A notable example is Warner Music Group (WMG), which recently announced 750 layoffs as part of a restructuring effort. The company is aiming to streamline its recorded music business by cutting 13% of its workforce, with most of the layoffs affecting corporate and support roles. While traditional creative jobs are shrinking, there’s a noticeable rise in AI-related roles, as entertainment companies like WMG increasingly look to technology to reshape the future of media.

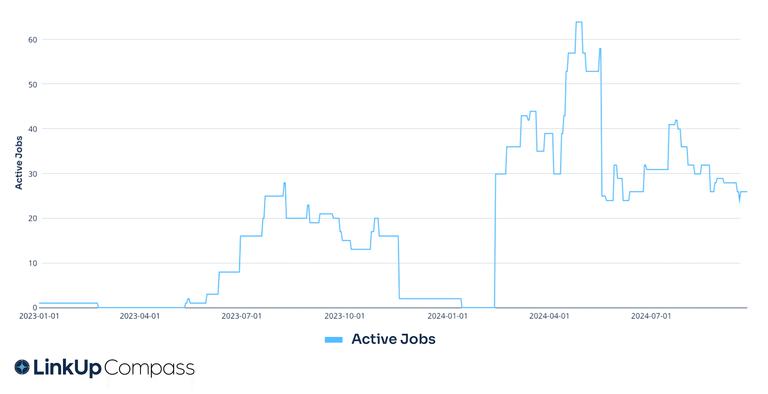

Warner Music Group Software Developer hires spike in Q2, Q3

WMG Active Jobs requiring Artificial Intelligence skill since 1/1/23

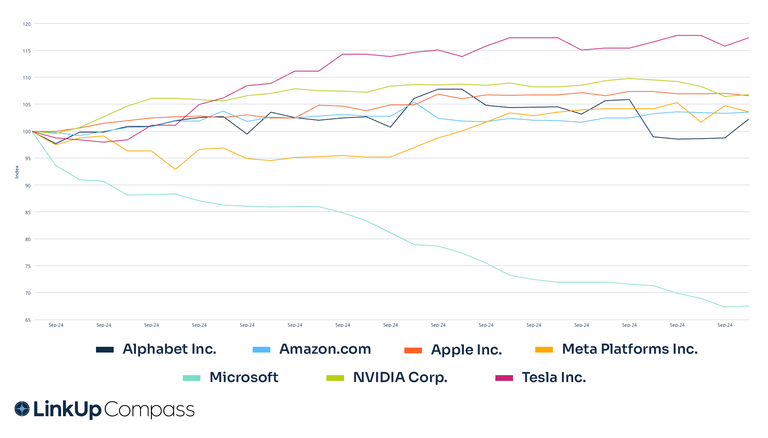

Computer and Mathematical

Computer and Mathematical job listings saw a modest 3.2% increase reflecting a cautious but steady uptick in hiring. Companies like Apple, NVIDIA, and Meta have all shown slight improvements in their job postings. However, one notable exception is Microsoft, which seems to be lagging in this department, showing either stagnant or reduced hiring trends. The overall trend suggests that, while the tech industry is slowly recovering from earlier slowdowns, it’s not all smooth sailing. Some companies are clearly ramping up their technical talent, while others, like Microsoft, may be taking a more conservative approach.

Computer and Mathematical roles Active Job Listings in Magnificent seven companies in September

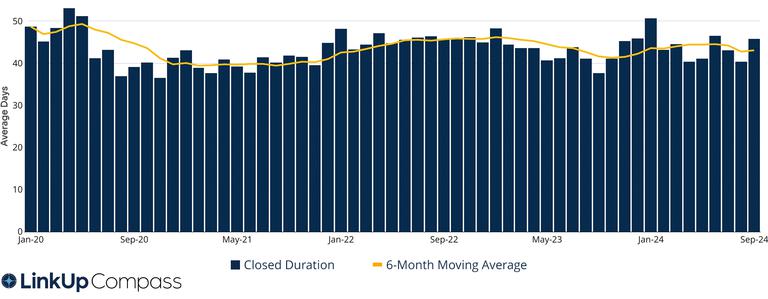

Closed Duration

Closed duration, or the average number of days job listings are posted on company websites before they are removed, tracks hiring velocity across the entire U.S. economy. As the average number of days a job listing remains live increases, hiring velocity slows.

The closed duration increased in September, rising by 5.5 days from August's figure to a total of 46 days.

Closed Duration of U.S. Jobs | January 2020 - September 2024

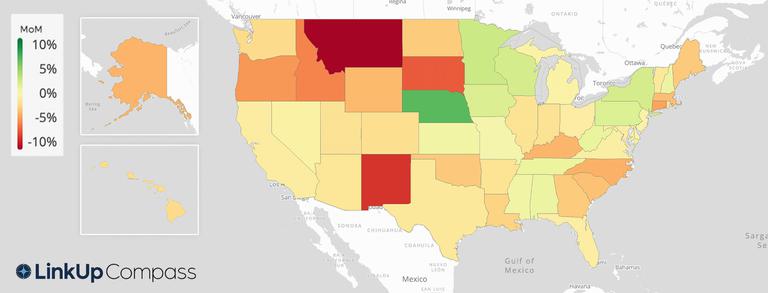

Jobs Data By State

During the month of September, 25% of the United States saw an increase in job listings. The states that saw the largest increases:

Nebraska (+6.2%)

Minnesota (+2.5%)

Wisconsin (+2.0%)

The states with largest drops in labor demand in September were:

Montana (-9.9%)

New Mexico (-7.9%)

South Dakota (-6.6%)

Percent Change in Active Job Listings by State (Month-Over-Month) | September 2024

Companies Added

Every month, LinkUp indexes new companies to our database. In September, LinkUp added 714 additional employer websites.

DATA DISCLAIMERS

LinkUp’s monthly data recaps incorporate revisions to previously-reported monthly data with the purpose of reporting the most accurate and up-to-date data points. For more information on what circumstances may impact data revisions, visit our Data Support Center.

Insights: Related insights and resources

-

Blog

09.11.2024

August 2024 Jobs Recap: Job growth gains momentum despite economic challenges.

Read full article -

Blog

10.04.2024

This Week in Jobs Data: Tesla, Nvidia, Domino’s, Star Entertainment Group

Read full article -

Blog

10.03.2024

LinkUp Forecasting a Net Gain of Just 70,000 Jobs in September

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.