Predicting employment fortunes (and layoffs) in private companies

Employment markets have changed a lot since Covid-19 entered the world. Millions of people lost their jobs on short notice. For big, public companies this is often major news.

Employment markets have changed a lot since Covid-19 entered the world. Millions of people lost their jobs on short notice. For big, public companies this is often major news. For private companies, the trauma is no less real but often gets discussed less. Many businesses disappeared as Covid appeared; some stumbled and have recovered slowly; and still, others have sprung back to strength, reaching new highs.

Often, layoff data is hard to come by, and even more so for privately-owned companies. Thanks to @roger_lee, we have a great up-to-date dataset at layoffs.fyi (“Layoffs”) which provides a window into layoff events in the wake of Covid. This website has been tracking tech startup layoffs, since the pandemic’s inception, from public reports. This gives us an excellent opportunity to use LinkUp’s job data to look for patterns in job postings that may indicate companies are contemplating laying employees off.

First, it is important to point out that this is not a comprehensive list of every layoff during this period, but rather those that have been identified or reported to the site. The list is also biased towards tech startups.

At the time of writing, there were 691 companies represented in the Layoffs dataset. Joining this data to the LinkUp job dataset, we had an overlap of 400 companies, and of those 400 we focused on 250 that had the most history before the announcement of layoffs.

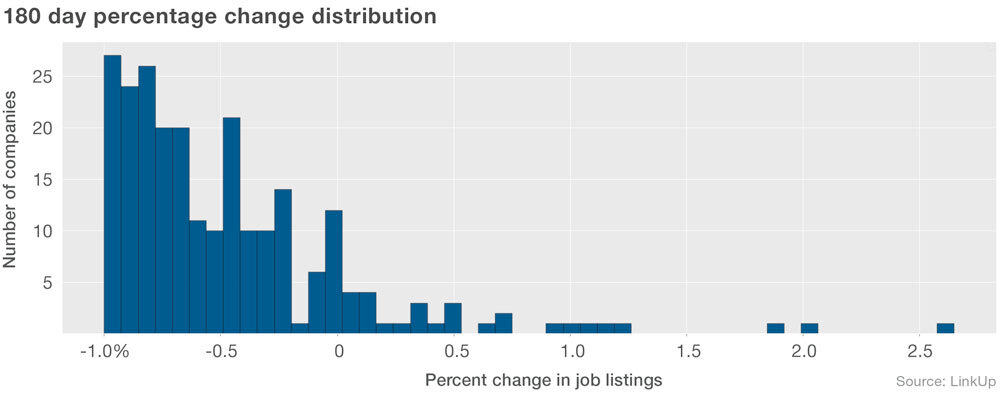

Looking at those companies, we found the average 30 day job listing percent change before layoffs, were down 28%. Compared to 90 day percent change, jobs were down 35%, and compared to 180 day percent change were down 46%. Below is the 180 day percentage change distribution for job postings compared to the layoff date.

After these layoff announcements, there have been varying outcomes, from hiring postings never returning, postings returning and continuing to grow, to postings that have grown and are now on the decline again.

The life of small companies is inherently volatile, even in the absence of a pandemic. A capital raise can be delayed or fail, a key customer can leave, or the departure of a senior executive can change the trajectory of the business. But the relative simplicity and nimbleness of a small company in comparison to a corporate behemoth also means that hiring plans can be adjusted in a fraction of the time that a large enterprise can adapt to changed conditions.

While many of the companies on the Layoffs site present interesting stories, we won’t be going over all 250, but rather will confine our inquiry to a few examples.

TripAction

First, let’s look at an example that responded quickly to Covid and then steadily increased its hiring. TripAction made headlines for having to lay off nearly 300 employees in March of 2020. Given the state of the world at the time, and their position in the travel business, this was predictable. This could have possibly been seen earlier by using LinkUp job market data. Before the layoff announcement, we can see a spike downwards for TripAction job postings. On the brighter side, we can see coming out the other side is demand looking strong as they have been on a hiring spree since the layoffs.

Third Love

Third Love job postings appear to be telling a different story. They had a steady decline in postings early in 2020 followed by a sharp drop preceding layoffs announced toward the end of March 2020 as the pandemic spread. Now looking at their job postings, it appears that they did recover and increase their hiring, but are now slowing hiring again, possibly a sign of decreased demand.

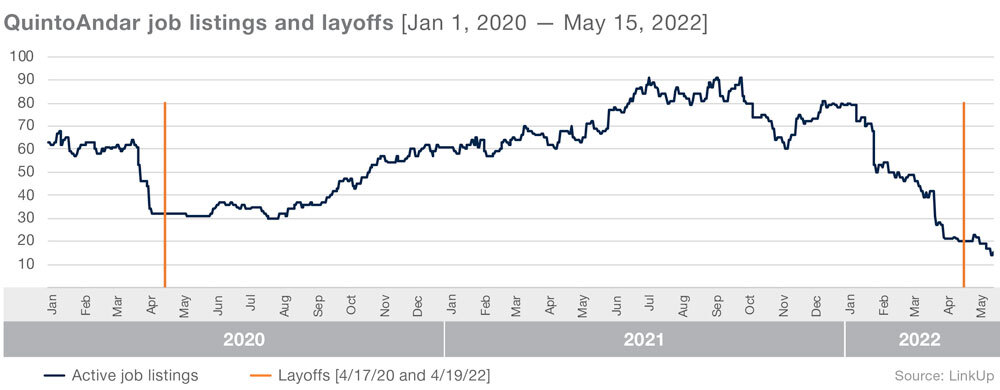

QuintoAndar

Lastly, another example is QuintoAndar, a Brazilian home rental company that has undergone two layoffs since the onset of Covid. LinkUp data foreshadows each event; active jobs posted dropped sharply before the announcement of each layoff. Unfortunately, jobs do not appear to be recovering.

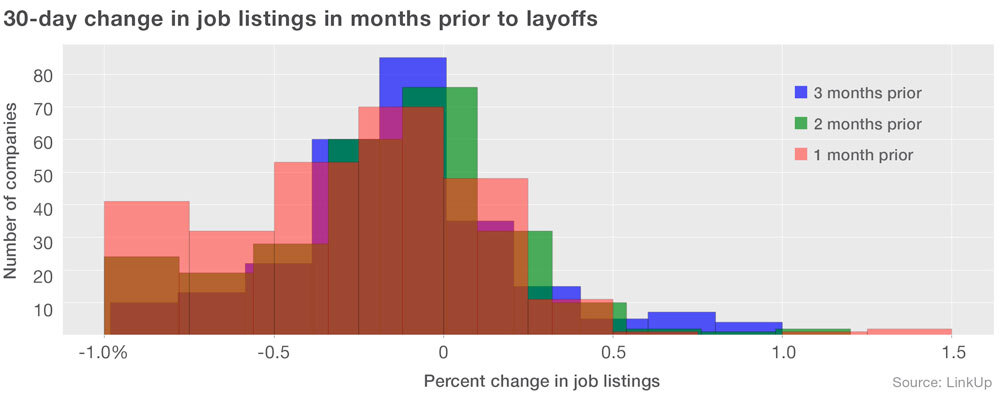

Taking a step back it is interesting to observe the way in which management progresses through its options of cutting costs. In each of the 3 cases laid out above, we see a slow decline in listings first, before the companies rapidly cut postings and announced layoffs. The entire cohort appears to follow a similar pattern. Below we take a look at the 30-day change in postings 1 month, 2 months, and 3 months prior to layoffs.

We can see as each month gets closer to the layoff announcement the rate of change in postings falls more and more, indicating greater urgency from management to control cost.

These examples help to illustrate the value of having LinkUp data as a resource to use as a filtering factor for finding private companies and a warning signal for those companies that rough times may be ahead.

Insights: Related insights and resources

-

Blog

12.08.2022

The Latest on Layoffs: Job Listings Data Provides Early Warning Signs

Read full article -

Blog

10.03.2022

LinkUp Forecasting a Net Gain of 275,000 Jobs AND a Slight Rise in Unemployment; Expect Mayhem to Ensue

Read full article -

Blog

05.17.2022

Hiring Freezes: Public vs. Private

Read full article -

Blog

02.04.2022

Data shows continued tight labor market in the U.S.

Read full article -

Blog

05.22.2019

Ford layoffs and the S&P 500 LinkUp Jobs Consumer Discretionary Index

Read full article -

Blog

11.27.2018

Silent signs GM layoffs were coming

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.