"Must Keep At It Until The Job Is Done"

In today’s speech in Jackson Hole, Fed Chair Powell announced that the Fed would maintain its hawkish stance, raising rates as necessary until inflation is tamed. In doing so, Powell predicted that there will “very likely be some softening of labor market conditions.”

So now, to the list of raging semantic debates that have defined the macro environment for the past year or so (e.g., labor shortage v. bid-ask spread between employees and employers, transitory (as in duration of, most specifically in regard to inflation), Great Resignation v. Great Reshuffle, etc.), we can add ‘softening of labor market conditions.’

For now, we’ll leave aside the insanity of being recklessly impatient to let an already aggressive dose of medicine kick in before taking more, especially when an overdose of said medicine can prove fatal. Instead, we’ll focus on the two components of Powell’s prediction as it relates to the job market – ‘softening’ and ‘conditions.’

Starting with the latter, labor market conditions could mean any combination of the following (and because it’s plural, I am assuming it will be a combination): a decline in job listings (declining labor demand), a decline in monthly net job gains (declining, but still-positive nonfarm payrolls), monthly net job losses (negative nonfarm payrolls), and/or slowing or negative wage growth.

As to the former, what Powell means by ‘softening’ is highly relevant, particularly given the Fed’s clear dissatisfaction with what they’ve seen to date and their growing impatience to see more dramatic results from their prescription (likely both more immediate and more severe).

Does softening mean one month of whatever basket of conditions they’re looking at or do they need to see sustained trend lines for some number of consecutive months? And as those months progress (it’s safe to assume the Fed will need to see evidence for multiple months before it’s satisfied), is a gradual or even anxiety-inducing decline sufficient or do we need to be hurled into the abyss when we slam into the recession the Fed seems so hell-bent on crashing us into?

What’s also critical is how the Fed is viewing the timing and sequencing around a ‘softening of labor market conditions’ relative to inflation being tamed – is it a necessary catalyst/pre-cursor, do they occur in tandem, or is a decimated job market the required proof that inflation has been thoroughly eradicated once and for all?

These will be the key focal points of the debate that is certain to ensue in the months ahead, and if today’s sharp market declines are any indication of what we can expect (and of course they are), we’re in for some Tyler Durden turbulence.

We’ll be posting our ‘official’ nonfarm payroll forecast next Thursday when we get all of our job data for August, but we can already say with confidence that a gradual decline in job openings paired with a slowing rate of monthly net job gains does not sufficiently capture the environment the Fed envisions in the phrase ‘softening of labor conditions.’

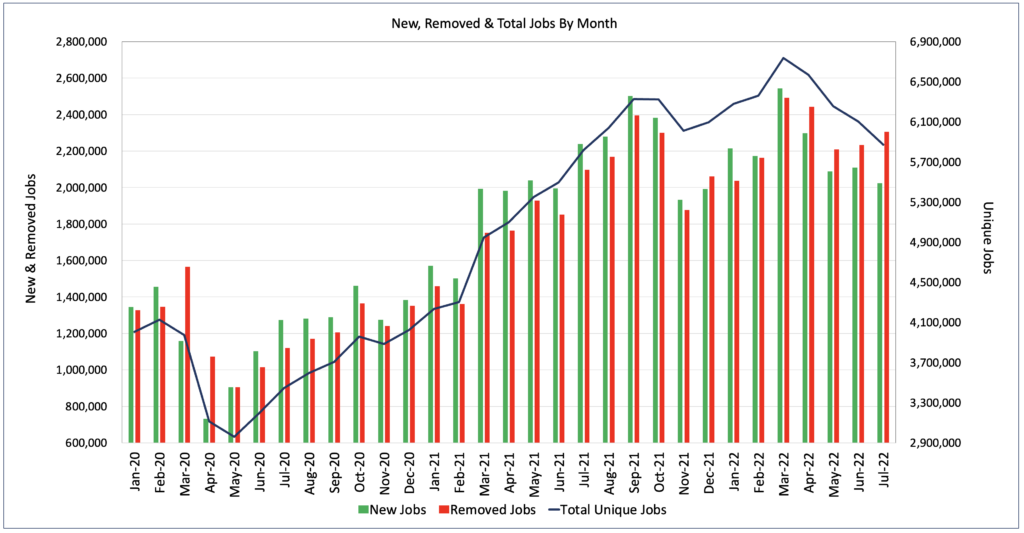

As we’ve noted for months, always well in advance of BLS JOLTS data, labor demand as measured by job openings on company websites is most definitely softening. From a peak of 6.74M in March, job listings across the U.S. have dropped 13% to 5.87M in July.

New job openings have dropped even more sharply, plummeting 20% in the same period.

Based on the LinkUp 10,000 which we track both monthly and daily (which means we are now-casting job market data)…

…labor demand is continuing to soften in August.

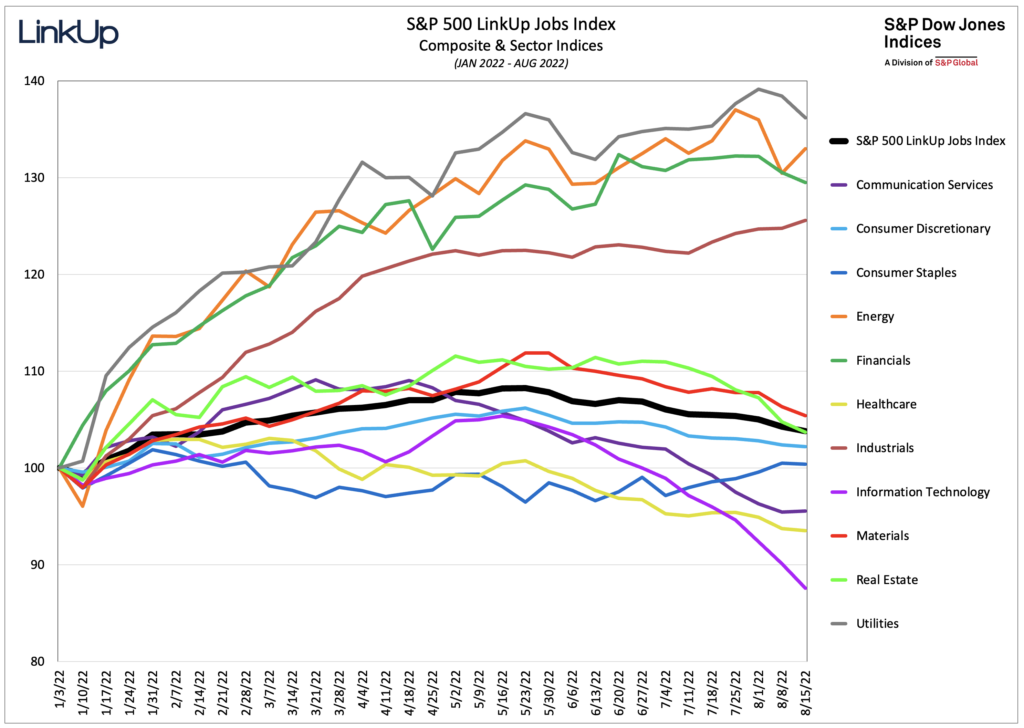

That trend is also evidenced by what we are seeing in the weekly S&P 500 LinkUp Jobs Index through mid-August.

As indicated in the chart above, labor demand in the S&P 500 has dropped 4% from May 23rd, and labor demand in the Information Technology sector has plummeted 17%.

Given that much of the data listed above extends well into August, we’re expecting those same trend lines to continue for August as a whole.

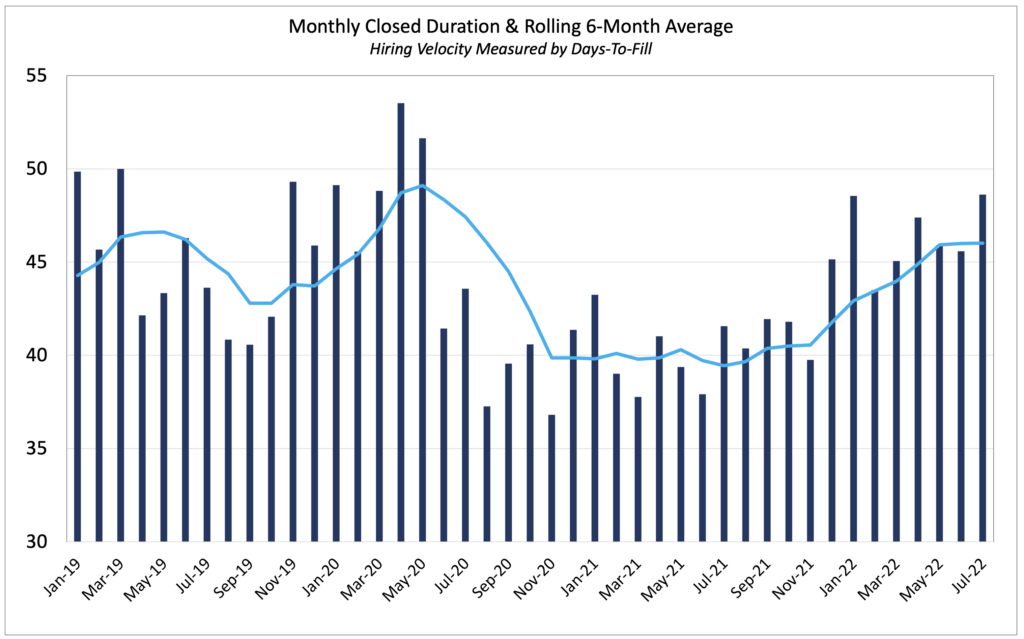

But given the fact that hiring velocity has slowed down significantly (meaning ‘days-to-fill’ has risen) since November…

…our forecast for August job growth will be based on our job listings data from July which showed a slight decrease of about 4%. As a result, we are estimating job gains slightly lower than last month’s blockbuster gain of 528,000 – likely in the neighborhood of 400,000 jobs.

As we said at the outset, we won’t be publishing our official forecast until next Thursday but it’s clear already what the terms of the debate will be for the foreseeable future and what the early indicators are pointing to at this point – continued decline in labor demand but better-than-consensus job growth.

Let the maelstrom persist.

Insights: Related insights and resources

-

Blog

03.01.2023

LinkUp Forecasting Strong Job Gains in February Even As Labor Demand Continues to Decline

Read full article -

Blog

01.03.2023

LinkUp Forecasting Net Gain of 160,000 Jobs in December and No Recession in 2023

Read full article -

Blog

09.26.2022

It's Now Just Job Vacancies. The Rest Is Noise.

Read full article -

Blog

09.01.2022

Strong Job Gains in August Will Keep the Fed-Inflation Debate Cauldron Raging

Read full article -

Blog

06.29.2021

Wage inflation: Overhyped or rising concern?

Read full article -

Blog

05.31.2018

The Phillips Curve Is Not Dead; Beware (or Cheer) The Paulsen Inflection Point

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.