September 2022 Jobs Recap: Job listings down 3.2% as hiring velocity slows

Job vacancies are all that matters – they are the single most potent metric that captures the balance between supply and demand in the labor market.

From U.S. Federal Reserve Chair Powell’s September 21, 2022 press conference:

RACHEL SIEGEL (Washington Post): Are [job] vacancies still at the top of your list in terms of understanding the labor market?

CHAIR POWELL: Yes

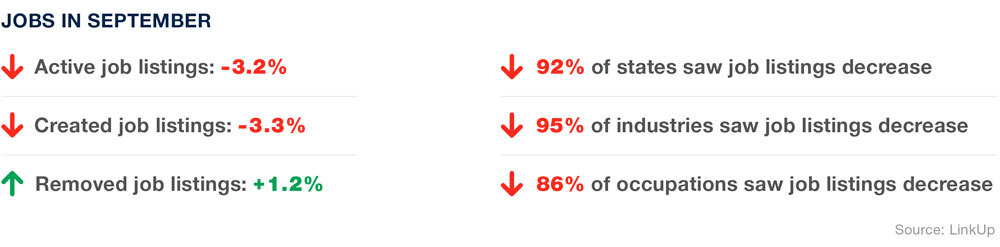

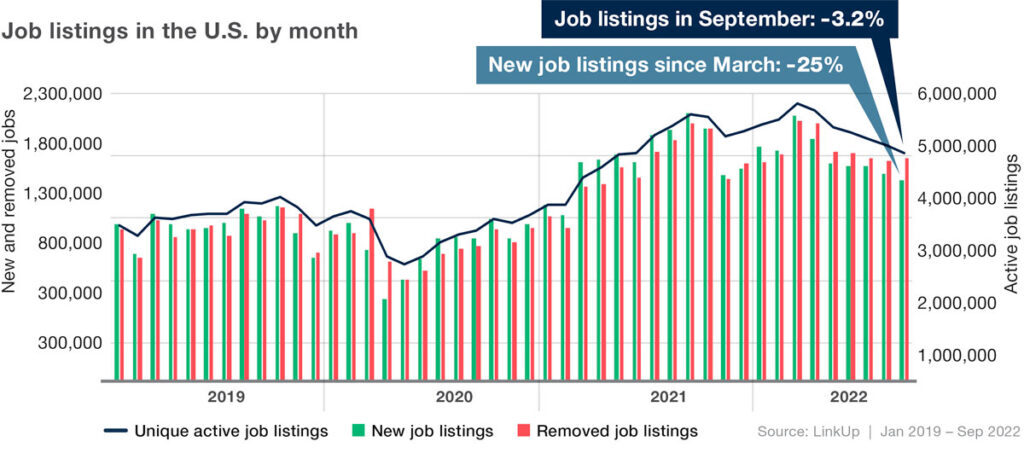

So job vacancies are all that matters – they are the single most potent metric that captures the balance between supply and demand in the labor market. LinkUp job listings provide a real-time view of the labor market, pre-dating BLS employment data by more than a month. Job listings continued to recede in September with active job listings down 3.2% month-over-month in the U.S. and across a majority of industries, locations, and occupations. As we’ve been saying, the labor market, while still very strong, continues cooling off.

Since the peak in March, U.S. total job openings indexed directly from company websites by LinkUp have dropped 16.5%. New job openings have dropped even more dramatically, falling almost 25% in the past 6 months.

As the country and the economy move further into a post-covid environment, supply chain issues are fading, the world is beginning to adapt to the war in Europe, and the economy is down-shifting to a less torrid pace.

As things start to normalize, and temporary contributors to inflation subside, the labor market remains strong, and wages continue to rise. Until the BLS released its August JOLTS data this week, there had been a growing fear that the Fed was going to have to keep hiking rates until unemployment rose considerably. Luckily, August’s JOLTS data has, just as we predicted, calmed things down and the narrative has abruptly shifted to the possibility of a less aggressive Fed and the growing possibility of a soft landing—a decline in job listings rather than an increase in unemployment.

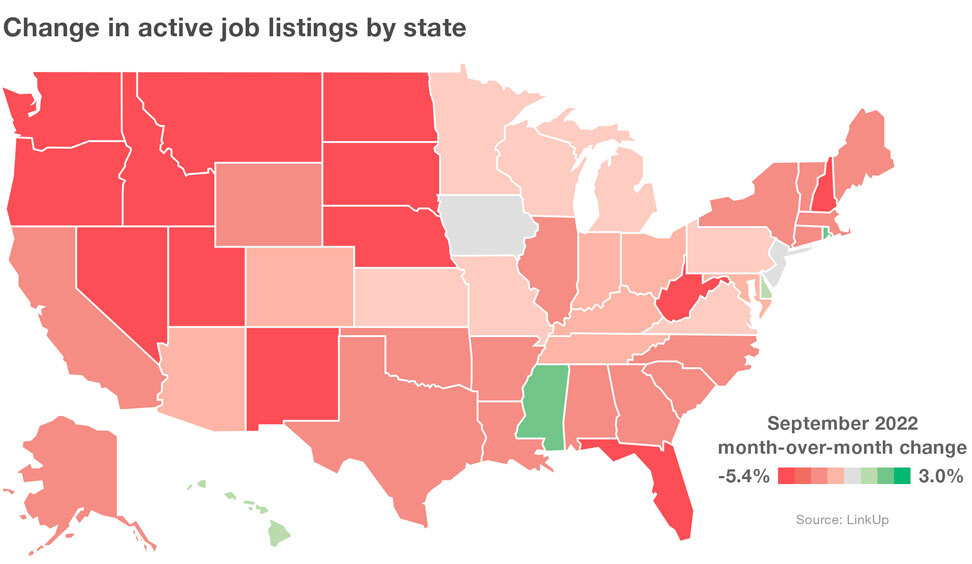

Change in new job openings by state

Active job openings dropped throughout the country in September, with only 4 states avoiding a decline: Rhode Island (+2.8%), Mississippi (+1.6%), Delaware: +( 0.3%),and Hawaii (+0.03%).

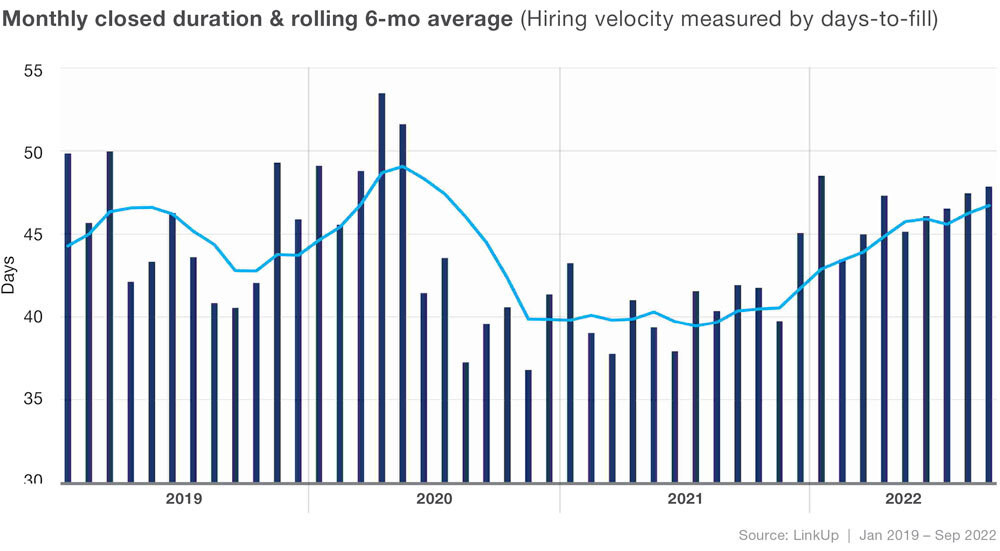

Hiring velocity slow down

As the time it takes to fill job openings keeps climbing, hiring velocity continues to slow down. The average closed duration for jobs in the U.S. rose to 48 days, and the rolling 90-day average rose to 47 days.

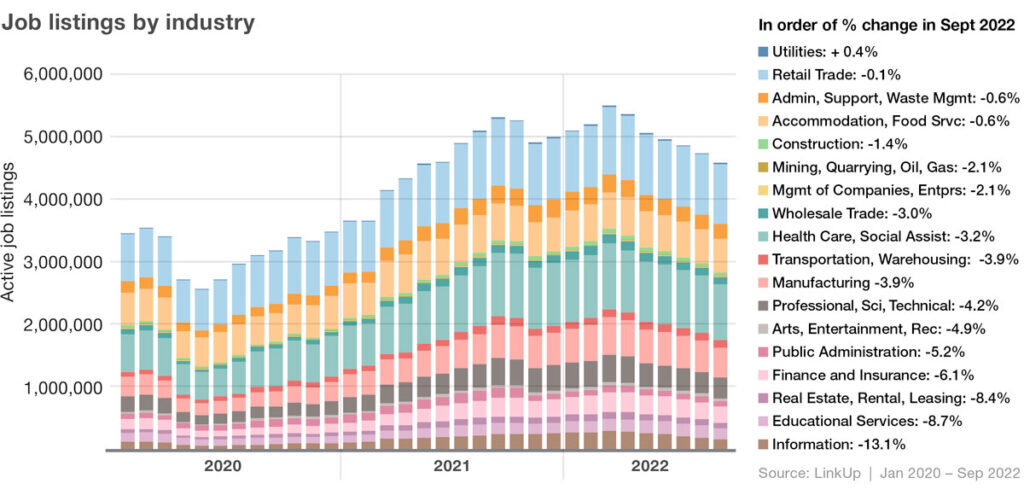

Job data by industry

Our September data shows 95% of industries decreased their job listings since August. Only the Utilities Industry showed subtle growth at 0.4%. Labor demand fell slightly in both goods-producing industries as well as service-based industries.

As reported last month, the Information Industry continues to tighten hiring, and is again the industry taking the largest cuts to their listings, down 13% for the second month in a row. This tech trend isn’t driven by just one company (although jobs at Dish were down big), or a single location (yet we feel you San Francisco). Standing out as one of the few big names actually adding jobs: Salesforce.

New: Get weekly and monthly job reports

The buzz and intense interest around job opening data is growing—from renewed interest in the Beveridge curve, and monitoring public and private sector jobs, to exploring the tie between remote work and the house-price surge. Instead of waiting for this monthly email, or data from other sources that is even more delayed, we are pleased to announce our new product LinkUp Compass.

LinkUp Compass offers a variety of dashboards automatically renders presentation-grade visualizations for every query—no spreadsheets or coding required. The reports allows you to grasp market trends quickly—from a high level all the way down to individual occupations, industries, and MSAs.

⤥ To receive the full-length LinkUp Jobs Recap emails with monthly job market insights like this in your inbox, subscribe here. To discuss your organization’s unique needs and LinkUp’s wide range of data solutions, please contact us.

Insights: Related insights and resources

-

Blog

12.15.2022

November 2022 Jobs Recap: November job listings show cooling labor demand

Read full article -

Blog

09.14.2022

August 2022 Jobs Recap: Jobs are down 3.5% in August, while duration increases

Read full article -

Blog

07.19.2022

June 2022 Jobs Recap: Jobs are down, even in tech

Read full article -

Blog

06.16.2022

May 2022 Jobs Recap: May job listings down 4.2%

Read full article -

Blog

06.12.2021

May 2021 Jobs Recap: Another month of steady growth

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.