March 2024 Jobs Recap: Labor demand ticks up steadily with all eyes on Fed

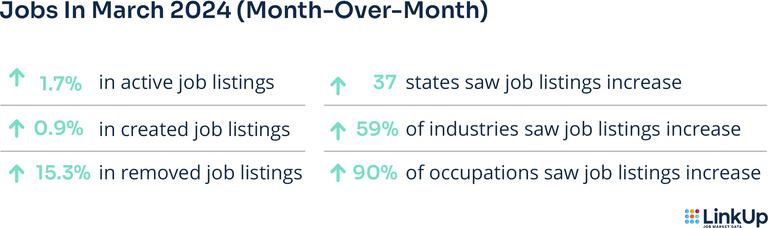

U.S. Labor demand rose in March, with increases across all metrics – active, created and removed listings; along with increases from the majority of states, industries and occupations.

Key Takeaways:

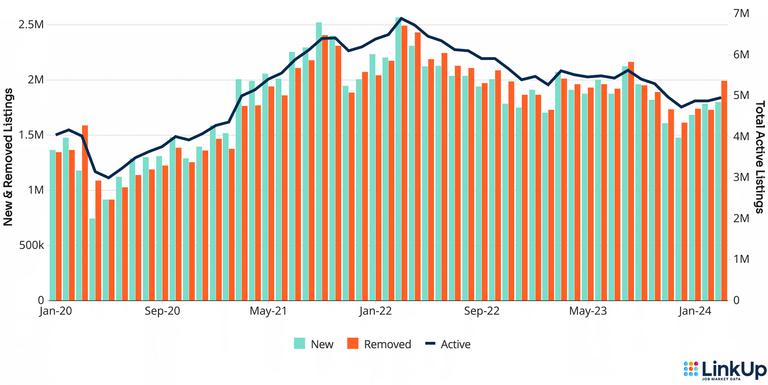

Active listings saw a bump in March, with a 1.7% increase in active listings compared to March. What we’re looking at is a strong job market operating in near-perfect balance, and shouldering on—down a little last month, up a little this month—with the steady growth of a healthy economy. LinkUp is forecasting 290,000 NFP jobs for March—about 45% higher than consensus estimates of 200K.

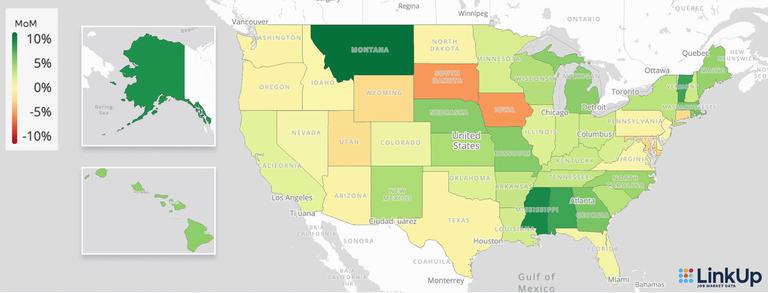

Listings are up in 37 states, and down only slightly in states including Iowa (-4.7%), South Dakota (-4.7%), Maryland (-2.5%), and Wyoming (-2.0%).

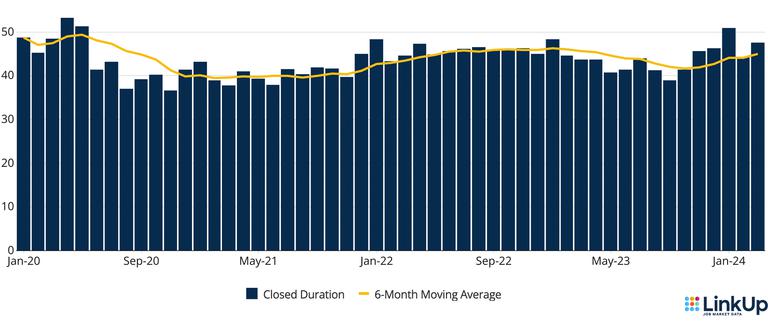

Hiring velocity slowed with the average time to hire up from ~44 to ~47 days, indicating a slight decrease of liquidity in the job market, which is a good sign for the long term settling of labor demand.

90% of occupations experienced increased demand, demonstrating an economy firing on almost all cylinders.

The first month of 2024 was undeniably a hot one for labor demand—the BLS reported a net gain of 353,000 jobs, blowing every estimate out of the water. By quarter’s end we’re seeing a job market with continued strength (job gains) and just a little less heat (modest wage inflation). It’s a job market operating at an atypical level of balance, driving growth without getting over its skis. In other words, it’s a best case scenario for the job market and economy at large.

But perhaps not for investors and analysts hungry for rate cuts—Powell reiterated today that the Fed will take its time before reducing rates, as inflation subsides and the economy grows at a steady clip. Validating our top-of-year predictions, pundits are pushing back their timeline for the blessed event deeper into the summer. If our forecast of 290K jobs for March bears out (it did last month), expect major hair-pulling and doomsaying from the Street.

But at LinkUp, we remain optimistic about a full-employment environment holding labor demand at a healthy vector of growth, while inflation—slowly—eases. Everything points to this: the kids are all right and job openings remain the acutest barometer of where the U.S. economy is moving—onwards and upwards.

LinkUp job data offers advanced insight on fluctuations in the job market, allowing you to stay ahead of official economic reports. Keep reading for a complete analysis of job market data in March.

U.S. Job Listings by Month | January 2020 - March 2024

CLOSED DURATION

The entire U.S. economy tracks hiring velocity by measuring closed duration, or the average number of days that companies post job listings on their websites before removing them. As the average number of days a job listing remains live increases, hiring velocity slows.

Job listings removed in March remained open for an average of 47.5 days—7.2% longer than the 44.3-day average of listings removed in February. This decrease in hiring velocity follows a brief increase in labor demand. However, it hasn’t reached the slowest velocity observed in January (average of 50.9 days).

Closed Duration of U.S. Jobs | January 2020 - March 2024

JOBS DATA BY STATE

Nearly three quarters of U.S. states experienced an increase in job listings during the month of March. The five states experiencing the largest increases were:

Montana (+9.6%)

Mississippi (+8.6%)

Alaska (+8.2%)

Vermont (+7.3%)

Alabama (+7.2%)

The four states with the largest drop in demand were:

Iowa (-4.7%)

South Dakota (-4.7%)

Maryland (-2.5%)

Wyoming (-2.0%)

Percent Change in Active Job Listings by State (Month-Over-Month) | March 2024

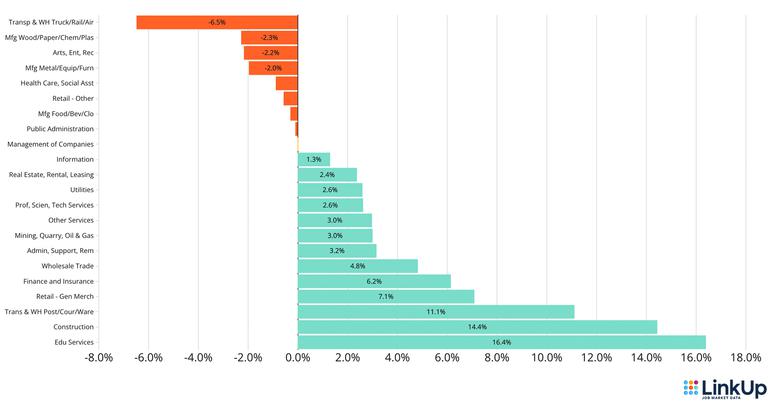

JOBS DATA BY INDUSTRY (NAICS)

Last month labor demand rose across 59% of U.S. industries, reflecting recent shifts in economic activity and employment trends. The four industries with the most growth were:

Educational Services (+16.4%)

Construction (+14.4%)

Transportation & Warehousing Postal/Couriers/Warehousing (+11.1%)

Retail - General Merchandise (+7.1%)

The four industries with the largest decline were:

Transportation & Warehousing Truck/Rail/Air (-6.5%)

Manufacturing Wood/Paper/Chemicals/Plastic (-2.3%)

Arts, Entertainment & Recreation (-2.2%)

Manufacturing Metal/Equipment/Furniture (-2.0%)

Job Listings by Industry (NAICS) | March 2024

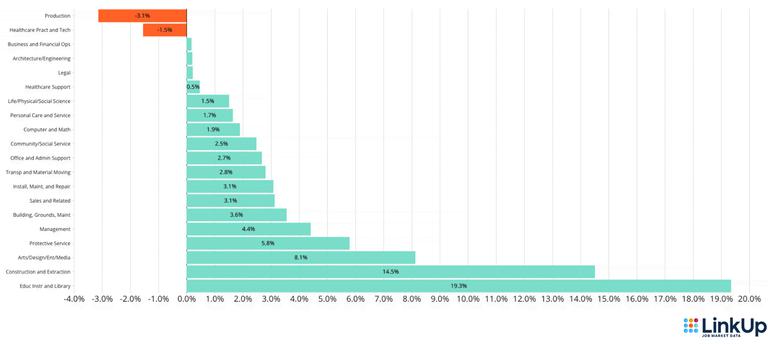

JOBS DATA BY OCCUPATION (O*NET)

Similar to industries, 90% of U.S. occupations saw an increase in labor demand. *The rise in Educational Instruction and Library job openings is because of LinkUp’s recent indexing of more public schools, not a government hiring boom.

The growing occupations were:

Educational Instruction and Library (+19.3%)*

Construction & Extraction (+14.5%)

Arts/Design/Entertainment/Media (+8.1%)

Protective Service (+5.8%)

Conversely, the only two occupations with a decline in demand were:

Production (-3.1%)

Healthcare Practitioners & Technicians (-1.5%)

Job Listings by Occupation (O*NET) | March 2024

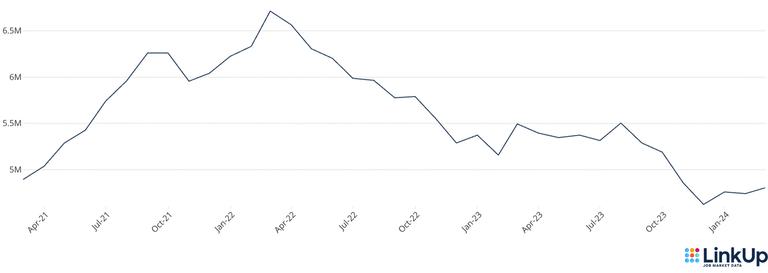

LINKUP 10,000

The LinkUp 10,000 is a daily and monthly analysis that shows the number of job openings from 10,000 global employers with the most U.S. job openings in LinkUp’s dataset.

From February 2024 to March 2024, the LinkUp 10,000 rose 1.4%. Compared to this time last year, the LinkUp 10,000 has declined 12.6%.

Monthly LinkUp 10,000 | January 2021 - March 2024

If you’d like more granular economic data or would like to look deeper into specific industries, occupations or companies, trial our job data or request a sample.

COMPANIES ADDED

Every month we index new companies to our database. During March, LinkUp started indexing 976 new additional employer websites.

Contact us if you are interested in obtaining the complete list of recently added companies.

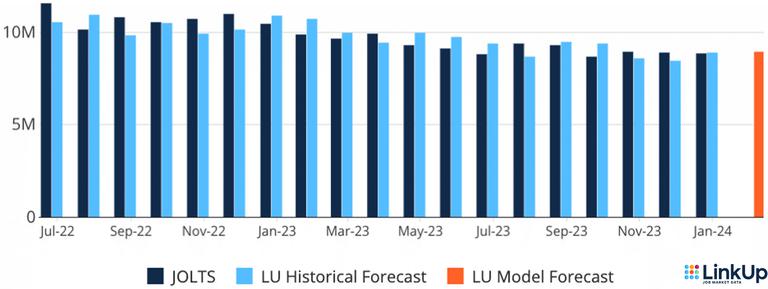

LINKUP MONTHLY FORECASTS

Stay tuned for our monthly forecast of the BLS JOLTS report which drops next Wednesday, ahead of the release of JOLTS data from the Bureau of Labor Statistics (BLS). The data includes estimates of the number and rate of job openings, hires, and separations for total jobs from private employers, by industry and by establishment size class.

Also, each month we publish a nonfarm payroll report forecast ahead of the BLS release, which is based on our RAW LinkUp job listing data. The NFP report is based on total U.S. job vacancies and provides insight into anticipated growth or decline in job listings.

DATA DISCLAIMERS

LinkUp’s monthly data recaps incorporate revisions to previously-reported monthly data with the purpose of reporting the most accurate and up-to-date data points. For more information on what circumstances may impact data revisions, visit our Data Support Center.

Insights: Related insights and resources

-

Blog

04.01.2024

LinkUp Forecasting Net Gain of 290,000 Jobs In March as Job Market Continues To Show Extraordinary Resilience

Read full article -

Blog

03.25.2024

Both the Job Market and the Economy Are In Near-Perfect Balance; The Fed Will Sit Tight Until Forced To Do Otherwise

Read full article -

Blog

03.14.2024

Dollar Tree to Prune 1,000 Stores After Year of Hiring Decline

Read full article -

Blog

03.13.2024

LinkUp Forecast: February JOLTS report by the BLS

Read full article -

Blog

03.11.2024

Netflix Beefs Up Hiring for Live Entertainment Push

Read full article -

Blog

03.07.2024

Crypto Jobs Flat Despite BitCoin Rally

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.