LinkUp's Job Market Data Provides Accurate, Predictive Insights Into U.S. Labor Market

In October, total unique job openings rose 1.8% to 4.35 million, while new job openings posted on company websites during the month rose 5.8% from September to 1.56 million.

Because Jobs Friday fell on November 1st, we didn’t have much time yesterday morning to thoroughly process our job market data for October before the Labor Department released its Employment Situation Report for the month. We did, however, have just enough time to make our non-farm payroll (NFP) forecast for the month.

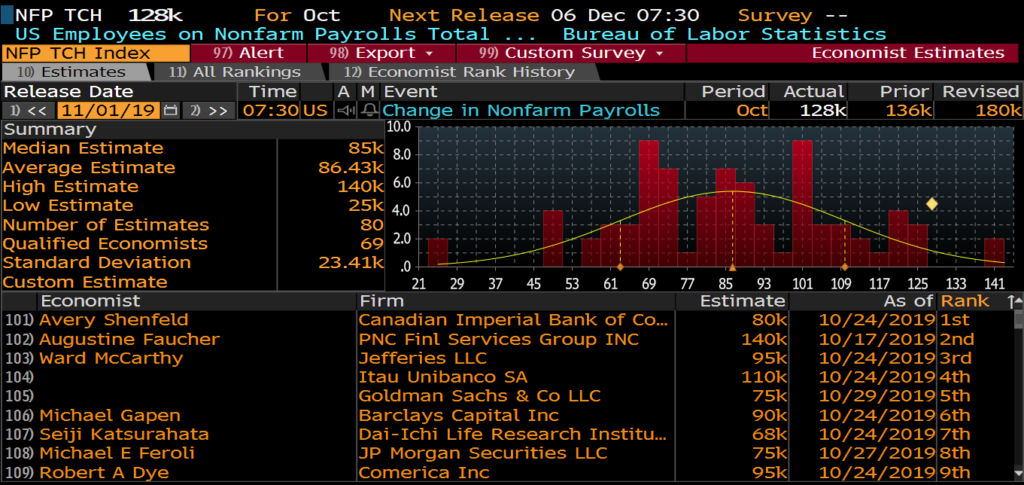

In sharp contrast to what almost everyone predicted would be a weak jobs report for the month, LinkUp’s job market data provided strong, accurate indications that job growth in October would be far more robust that what the pundits were anticipating. Based on the growth in new and total job listings posted by companies on their corporate website during the month, we forecasted a net gain of 160,000 jobs in October, well above consensus estimates.

In fact, our forecast was higher than that of every economist surveyed by Bloomberg, and we expect that, just like the upward revisions for prior months included in yesterday’s report, the Bureau of Labor Statistics will revise October’s data upward over the next two releases.

For background purposes, LinkUp is the global leader in delivering job market information to the capital markets, the HR Tech industry, corporations, job seekers, and employers throughout the economy. Our labor job market data and all of our analytics, indices, and labor demand signals, including our non-farm payroll forecasts, are based on an enormous dataset of job listings indexed every day directly from 60,000 company websites throughout the world. As a result, our dataset completely eliminates expired listings, duplicate jobs, and job board pollution and allows us to deliver the most accurate, predictive, and insightful job market information to our clients and users.

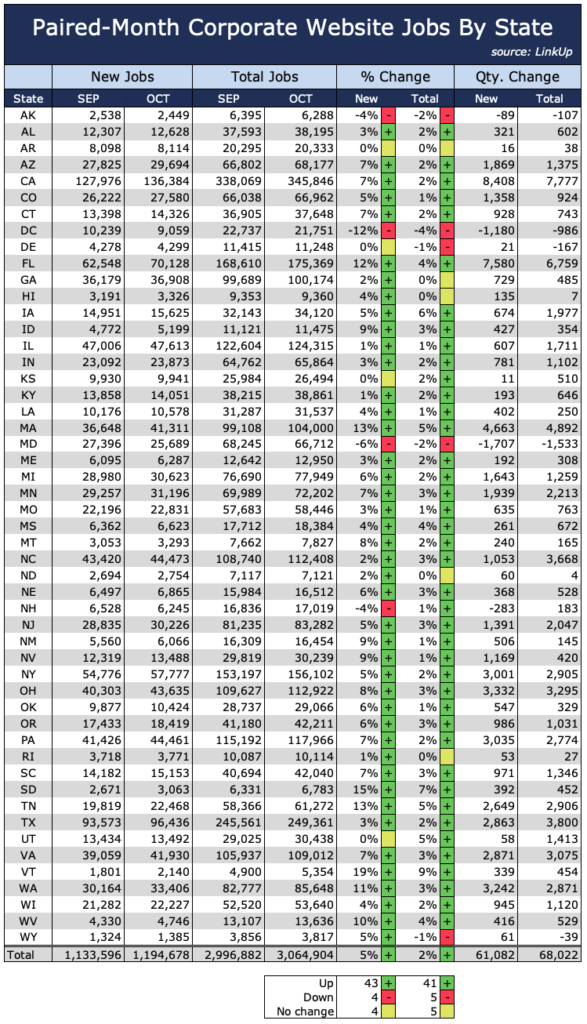

As we reported prior to yesterday’s employment report, looking at just our paired-month data (where we only track labor demand for employers around the world that were hiring in the U.S. in both September and October), new job listings on company websites in October rose 5% while total job openings rose 2%, with nearly every state across the country showing gains.

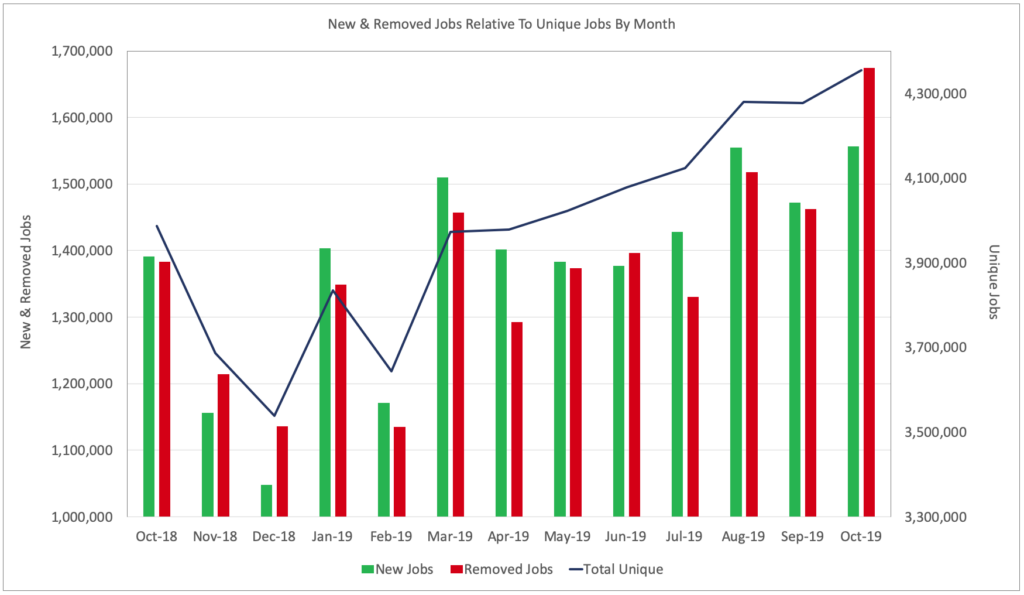

In addition to our paired-month data above, we also publish a wide range of additional macro analytics to provide insight into the U.S. labor market. In October, total unique job openings rose 1.8% to 4.35 million, while new job openings posted on company websites during the month rose 5.8% from September to 1.56 million.

Of particular note, the number of job listings that employers removed from their corporate website during the month spiked sharply last month, climbing 14.5% from the prior month to 1.67 million. For the most part, employers are very diligent about removing job openings from their corporate career portals on their company website when they have filled those jobs because they don’t want to continue receiving applications for positions that are no longer available. It’s also the case that in a relatively small number of cases, jobs are also removed because the company no longer intends to fill the position but that represents a tiny fraction of the data, particularly in an extremely tight labor market. So removed jobs are a very strong proxy for jobs filled, and the spike in October is a strong indicator of robust hiring during the month.

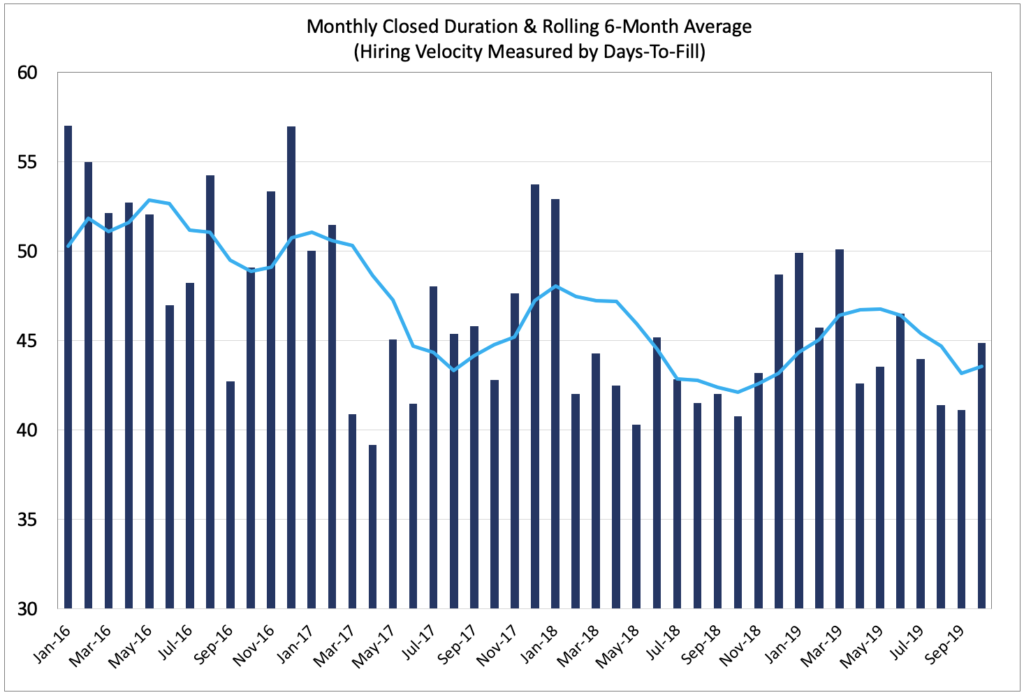

What is also interesting is that the job listings that were removed during the month had been, on average, open for a longer period of time than the jobs that were filled in the prior 3 months. Each month, we calculate the average number of days that closed jobs had been posted before they were filled and removed. In October, the average number of days that removed jobs had been posted (‘Closed Duration’) rose from 41 days to 45 days.

Normally, when we look at Closed Duration before the BLS releases its jobs report, we use the metric as an indicator of hiring velocity during the month. But looking at it after the fact allows for some different interpretations, particularly in light of the fact that in October, removed jobs spiked so sharply.

The first interpretation is that in October, employers filled a lot of positions that had been harder to fill and therefore had been posted for a longer-than-average period of time. This would be consistent with the narrative that as the strong labor market keeps pulling new job seekers into the mix that had not previously been looking for a job, companies are filling those hard-to-fill positions.

The second, less positive interpretation (and one I’d say is less of a factor) is that during the month, companies grew increasingly skittish about the economy and/or their own businesses and removed job openings that they no longer thought prudent to fill with new hires. While employers undoubtedly removed job listings for both reasons, the question is the extent to which each drove the spike in removed jobs. Of course, time will tell which interpretation or reason was more responsible, and the dichotomy serves as a perfect example of the challenges inherent in interpreting complex, multi-faceted data in an attempt to forecast U.S. job growth.

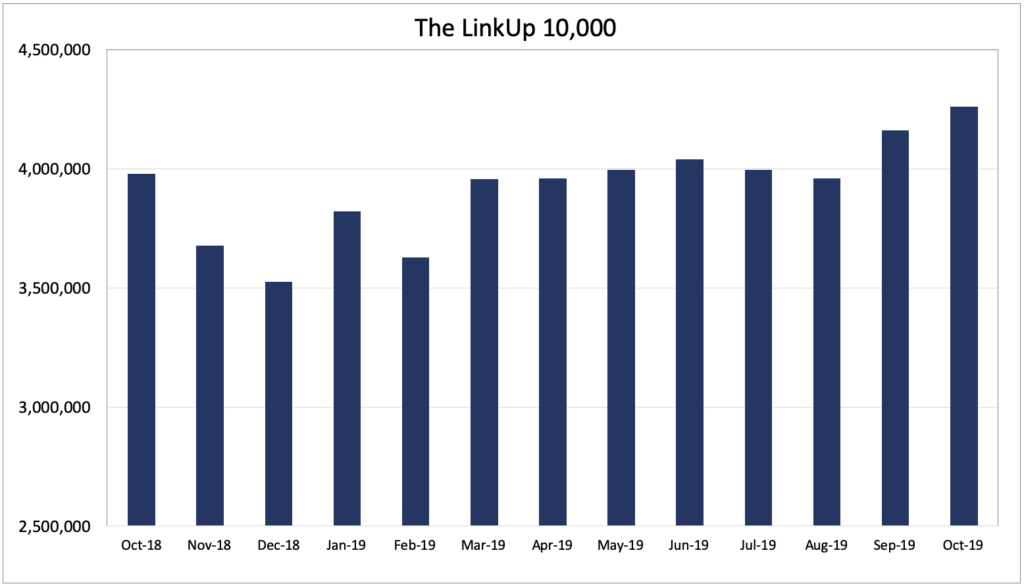

Another macro indicator we have constructed is the LinkUp 10,000. The LinkUp 10,000 is the aggregate number of U.S. job openings from the 10,000 employers (foreign or domestic) that have the most U.S. job openings in our index for a given month (it is also computed daily). In October, the LinkUp 10,000 rose 2.4% to 4.26 million.

Over the next week or two, as we continue to dig further into our job market data in preparation for Eagle Alpha’s alternative data conference in London later this month, we will publish additional insights and analysis here. In the meantime, anyone interested in leveraging LinkUp’s job market data for predictive signals at a macro, sector, geographic, or individual company level can contact us for a demo or a trial of our data.

Insights: Related insights and resources

-

Blog

12.01.2016

LinkUp Forecasting Net Gain of 140,000 Jobs in November

Read full article -

Blog

09.01.2016

LinkUp Forecasting Net Gain of 220,000 Jobs In August

Read full article -

Blog

08.07.2016

LinkUp Data Versus Conference Board's HWOL Data Series & Help Wanted Analytics/CEB Data

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.