The Soft Landing Happened. Game Over. America Won. And October NFP Will Be 210,000.

Between April and September, core inflation was 2.8% and unemployment averaged 3.6% - the same as when the Fed started hiking rates. That is a soft landing.

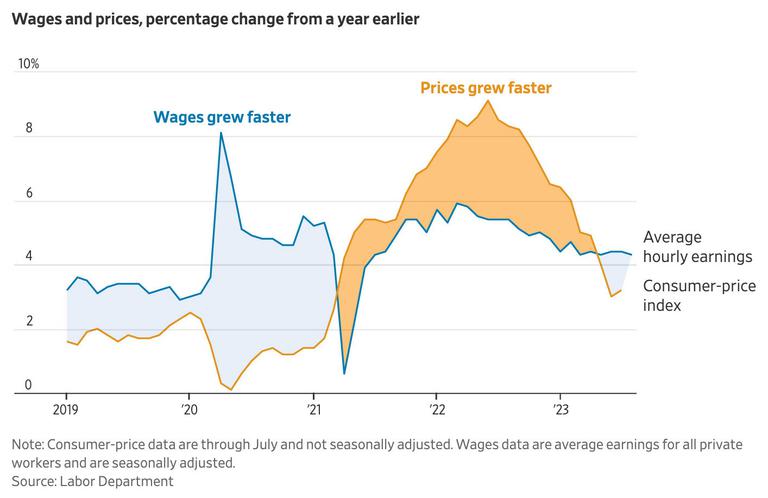

In our post a few days ago in which we declared that the soft landing had definitely occurred, we ended with a great chart from the Wall Street Journal that succinctly captures the most critical narrative driving the U.S. economy in the covid era. We’ll repost that chart again because it’s where we’ll pick things up as we get into our job market data for October and our non-farm payroll forecast for the month.

We’ve frequently articulated our take on the underlying dynamics of the Covid-era economy in general and the job market in particular in both long and short form, but to summarize here again in highly condensed fashion and with the chart above as a visual guide, we’ll pull a quote from our post in February of this year when we first declared that the soft landing was happening:

sufficient equilibrium between supply and demand in the job market has been achieved through a combination of falling demand (job openings) and increased supply (due to sufficiently elevated wages, decent monthly job gains, some layoffs here and there, non-wage employer concessions, receding health concerns, greater adoption of remote work, etc.), such that wage inflation is now tapering and broader core inflation is plummeting without ANY increase in unemployment.

All of those same dynamics have continued to play out even further over the subsequent 9 months and the evidence of the soft landing happening has become increasingly apparent since February to the point where it’s now essentially everyone’s highest probability outcome for the future - i.e., it’s the consensus view.

But that’s what led us to last’s week’s post - the soft landing is over. The plane has landed. It happened. It’s done. It’s yesterday’s news.

Core inflation for the period from April to September was 2.8% and average unemployment in that same period was 3.6% - the exact same as it was in March 2022 when the Fed began hiking rates.

Game over.

The Fed won. The U.S. economy won. American workers won. American consumers won. Corporate America won. And anyone that had their chip(s) on the soft-landing outcome, they (we) won, too.

The Fed’s decision this afternoon to not raise rates (for the second consecutive meeting) confirms that this particular contest in the covid era season is over. The Fed nailed it. America Won.

Of course, we’re not morons - we understand that time keeps rolling and the economy keeps moving forward. There’s always another game. But whatever happens next is precisely that - a new game.

And unfortunately, the next game has some new variables, a new playing field, some new players, and a different set of playing conditions.

Those new variables, players, and conditions include a second war that is, arguably, even more likely to escalate into a world war than the one in Europe, the election of the most extreme Speaker in the history of the nation, and a timeline that extends into a Presidential election year.

And of course, this new game will also be impacted by the continuation (and acceleration) of many of the same storylines from the last game - climate change, covid-decimated cities, a potential (or actual) government shutdown (maybe a protracted one), the resumption of student debt payments, the ongoing deployment of federal funds from the IRA and CHIPS Act, and the longer-term lag effect of a high interest-rate environment.

A complicated, formidable set of variables (mostly challenges) to be sure. This game definitely starts with some pretty dark storm clouds forming on the horizon that, at best, should give serious pause to people determining the odds around how this next game plays out.

Leaving those variable aside (for the time being), this next game is also going to largely center on the job market. In fact, the Fed Chair stated at today’s press conference that the labor market is likely, going forward, to be even more integral to understanding the economy than it has been in the past. That is saying something.

So on that note, we’ll jump to our job market data for October.

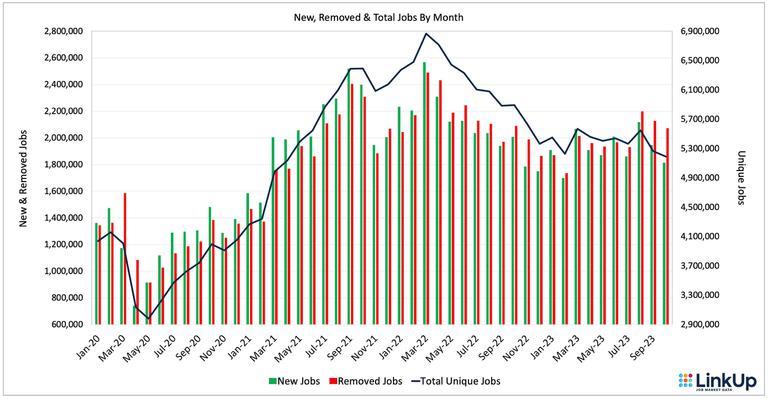

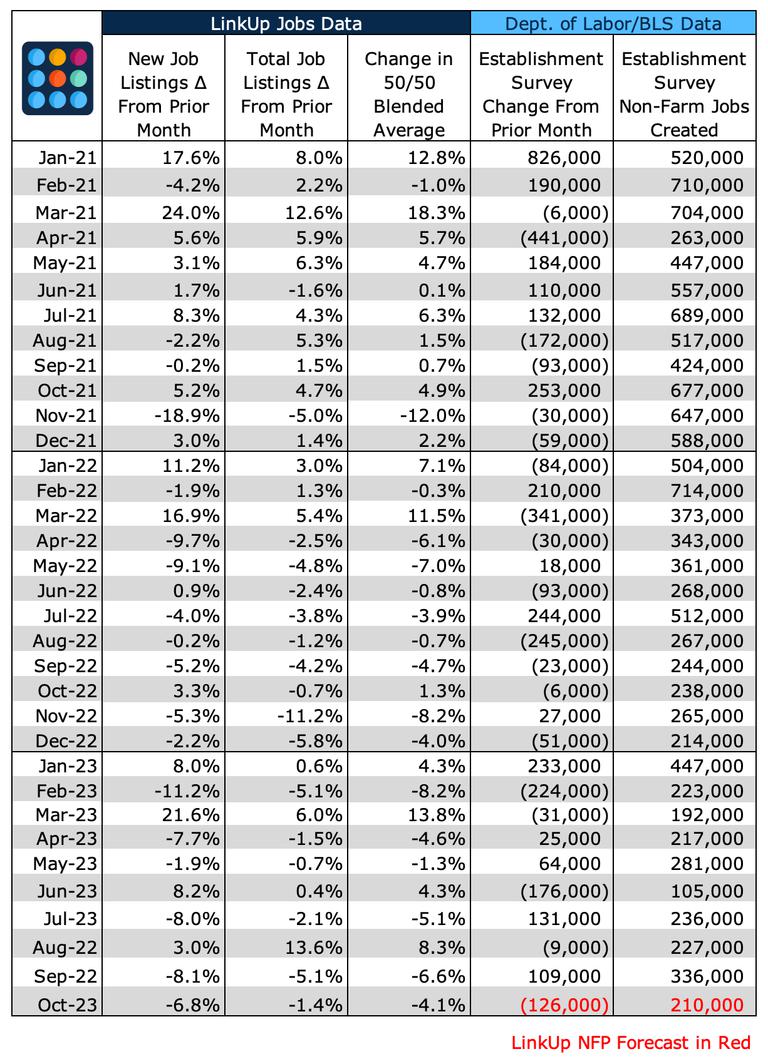

Job openings in the U.S. indexed directly from company websites globally fell 1% last month, and new and removed openings dropped 7% and 3% respectively.

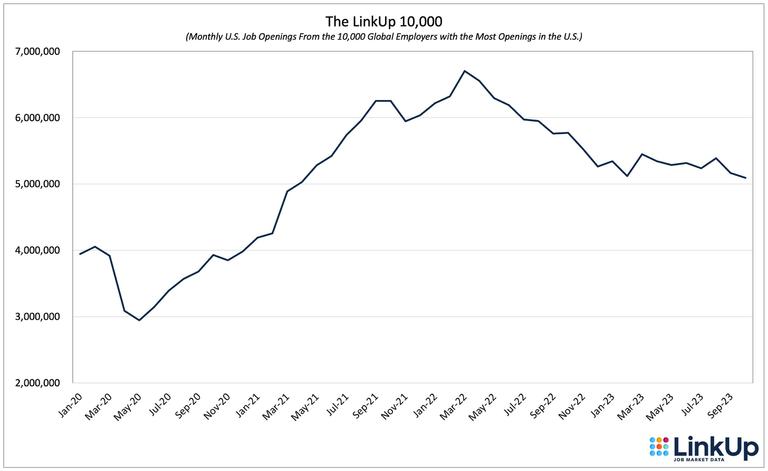

The LinkUp 10,000, which measures the total number of U.S. openings from the 10,000 global employers with the most job openings in the U.S., fell 1% in October.

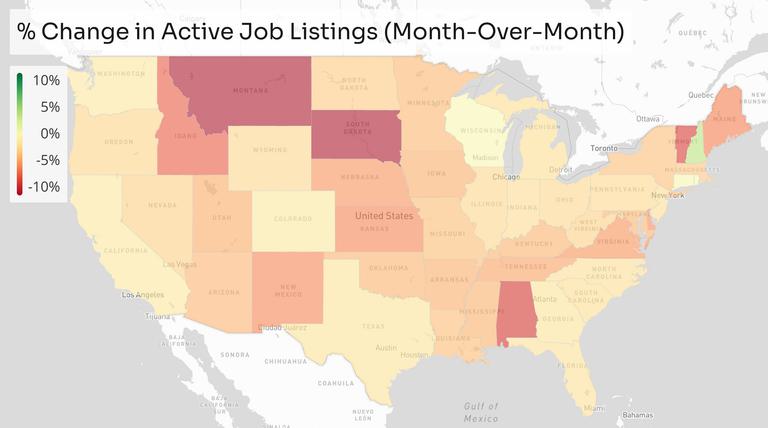

The decline in active job openings was widely distributed throughout the country with the steepest declines in Montana and South Dakota and the only increases in New Hampshire and Rhode Island.

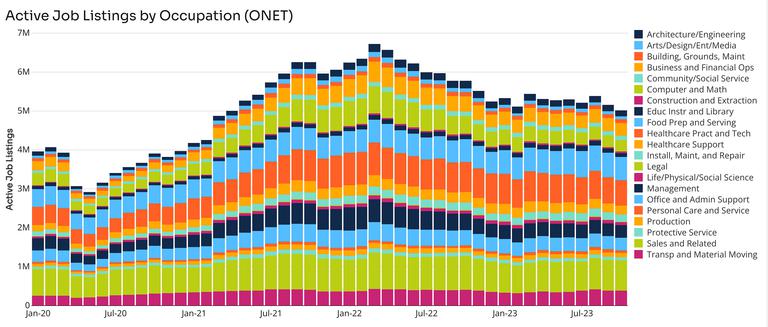

Job openings declined in nearly every single Occupation category except Construction (up 9%) and Installation, Maintenance & repair (up 2%). The largest declines were seen in Personal Care & Services, Life/Physical/Social Sciences, and Education.

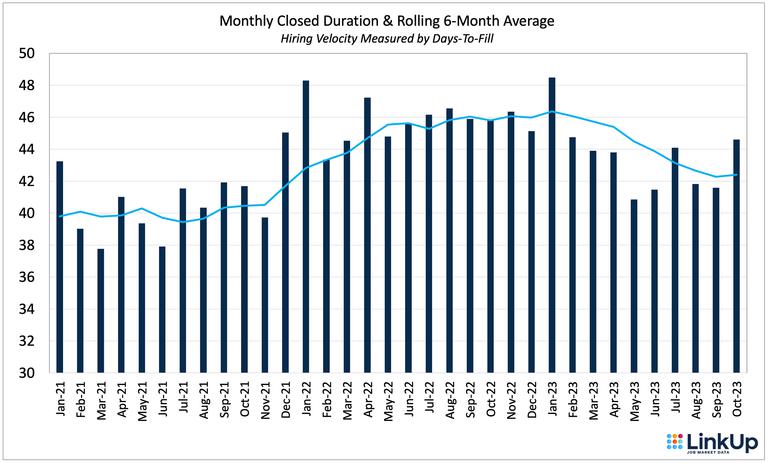

Job Duration, which essentially tracks hiring velocity by measuring the average number of days that openings are listed on company websites, rose to slightly above 44 days in October.

Based on our data, we are forecasting a net gain of just 210,000 jobs in the U.S. in October, above consensus estimates of 170,000.

And remember, if you hear anyone offer a prediction about whether the soft landing is or isn’t going to occur in the future ask them, as a follow-up question, if they also have any thoughts around who they think might win Super Bowl LVII.

Insights: Related insights and resources

-

Blog

11.01.2023

October 2023 Citi Report: LinkUp Job Data and the Future of Work

Read full article -

Blog

10.29.2023

With the Recent Economic Data, It's Clear the Soft Landing Has Occurred

Read full article -

Blog

10.11.2023

LinkUp's September 2023 JOLTS Forecast

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.