$7 Mayonnaise Might End Democracy

Despite a phenomenal economy, 80% of Americans rate the economy as fair to poor and 59% feel Trump could do a better job managing the economy.

As we noted in posts in late October and early November, the ongoing debate about the likelihood of achieving a soft landing are absurd. The plane has touched down. We all know how the landing went. Pontificating about it after the fact is like debating the outcome of Superbowl LVII.

As we wrote on November 1st:

Core inflation for the period from April to September was 2.8% and average unemployment in that same period was 3.6% - the exact same as it was in March 2022 when the Fed began hiking rates.

Game over.

The Fed won. The U.S. economy won. American workers won. American consumers won. Corporate America won. And anyone that had their chip(s) on the soft-landing outcome, they (we) won, too.

And as impressive as the data was a month ago, it’s gotten even better since. GDP in the 3rd quarter was revised up to a whopping 5.2%, core inflation in October dropped to 3%, and initial jobless claims in November were flat.

And yet, in spite of how incredible the U.S. economy has been, how miraculous the soft landing was (defying most - but not everyone’s - expectations), and the way people are behaving, based on recent polls one might think we’re living through a depression.

In a recent NYT/Siena College poll, 80% of respondents in 6 swings states said the economy was fair to poor and only 2% said it was excellent. For certain, the disconnect between how phenomenal the economy has been and people’s perception and/or articulation of how things are these days is the result of multiple factors including politics, post-covid shock syndrome, geopolitics, social media, cluelessness, and of course, more so than almost anything else, high prices. While inflation has plummeted, prices for nearly everything remain higher than they were pre-covid, and people are pissed.

As Leslie from Nevada (long-time listener, first-time caller) said in the NYT article about the survey:

Gas prices are obscene,” said Leslie Linn, 47, a restaurant manager in Carson City, Nev. “I’m looking at mayonnaise for $7. It’s like, how is that even a thing? So yeah, the economy is not great.

As the same article noted, the nationwide malaise, what Kyla Scanlon termed, way back in June, a Vibecession, has crept into politics and how people are indicating they might vote next November.

In the same NYT/Siena College poll, 59% of voters said Donald Trump would do a better job on the economy compared to 37% who said President Biden would. To that point, Frank Bruni sounded the millionth horrifying November ‘24 alarm bell in a NYT op-ed entitled, “It’s Not the Economy. It’s the Fascism.”

So with the future of democracy at stake, let’s circle back to the economy (or at least the job market) and how things might unfold between now and the election (or least between now and next week’s jobs report for November and what LinkUp’s November data might portend for December’s jobs numbers that will be released in January).

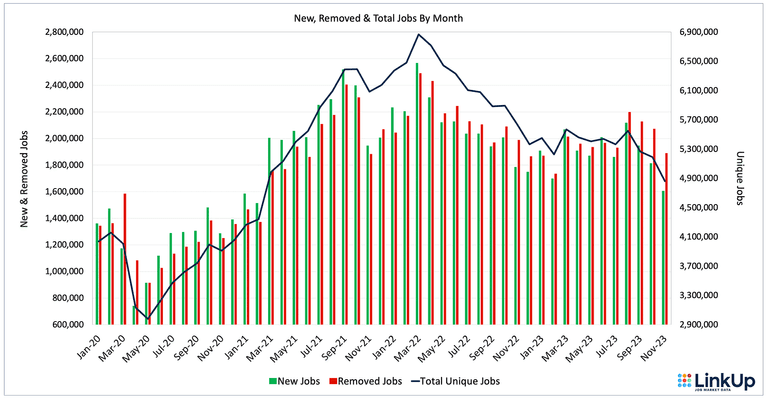

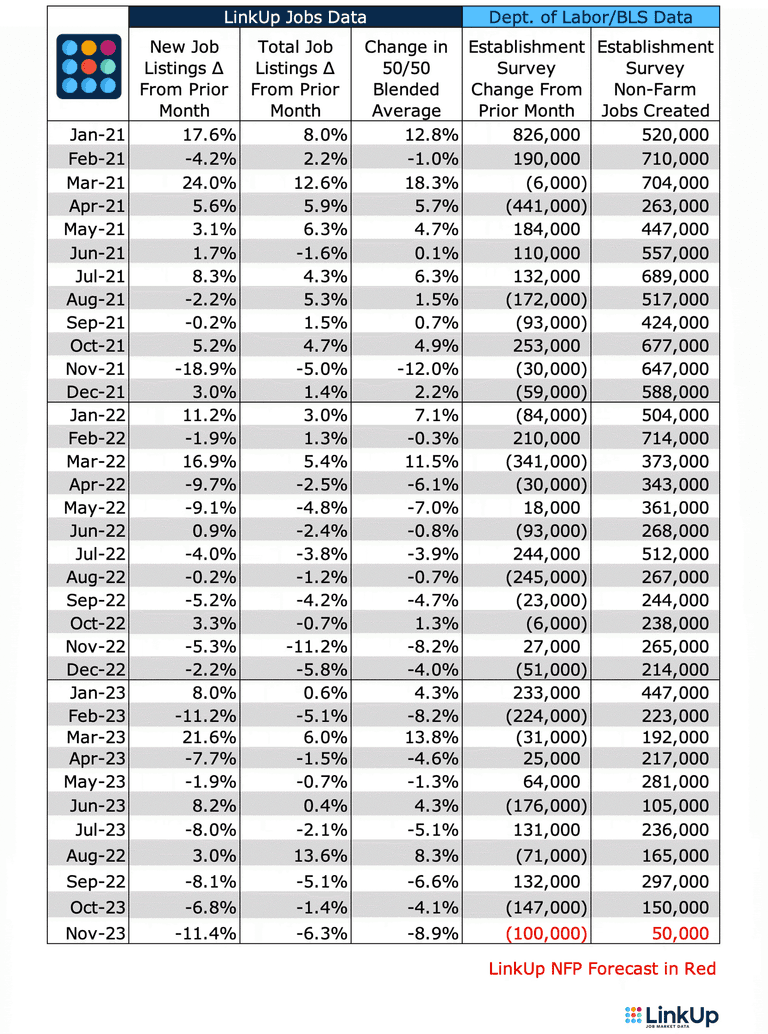

In November, the total number of unique U.S. job openings posted on company websites globally dropped from 5.2M in October to 4.7M in November, a decline of 6%. New job openings dropped from 1.8M to 1.6M (-11%) and job openings removed from company websites fell from 2.1M to 1.9M (-9%).

As background, LinkUp’s job market data is sourced entirely from corporate and employer websites around the world. Every day, we index millions and millions of job openings directly from individual employer website across 180 countries. Because we do NOT aggregate job data from job boards, recruitment advertising engines, or other 3rd party sources, our data is NEVER contaminated by job board pollution - fake jobs, duplicate jobs, expired listings, etc. As a result, LinkUp’s data is the most accurate, up-to-date, and timely job market data in the world.

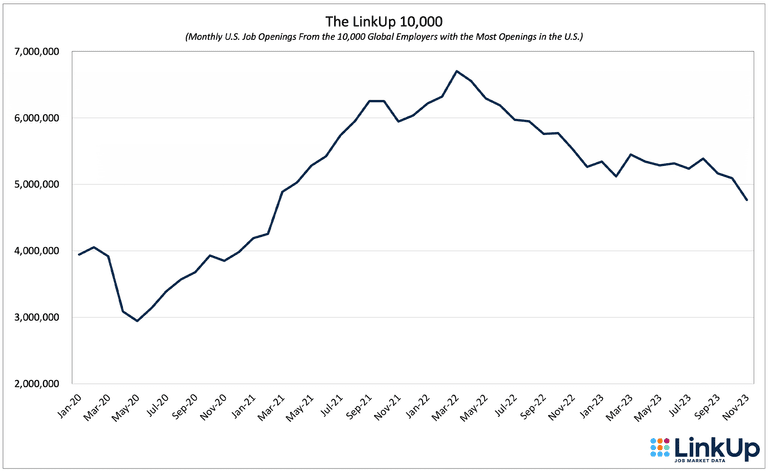

The LinkUp 10,000, which tracks total job openings from the 10,000 global employers that have the most job openings in the U.S., also fell 6% in November.

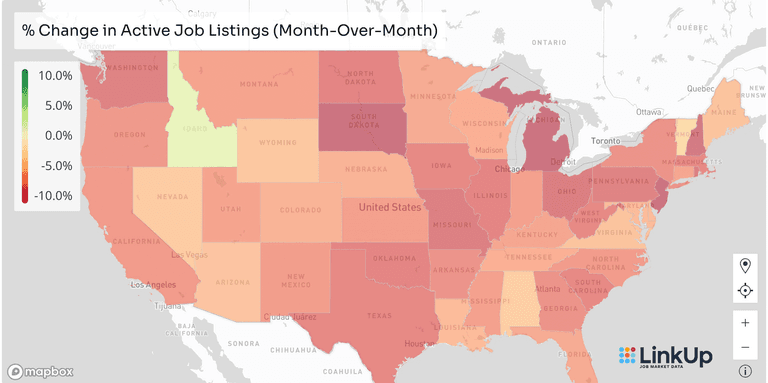

The decline in active job openings was widely distributed throughout the country with the steepest declines in South Dakota, Michigan, New Jersey, and New Hampshire and the only increase in Idaho.

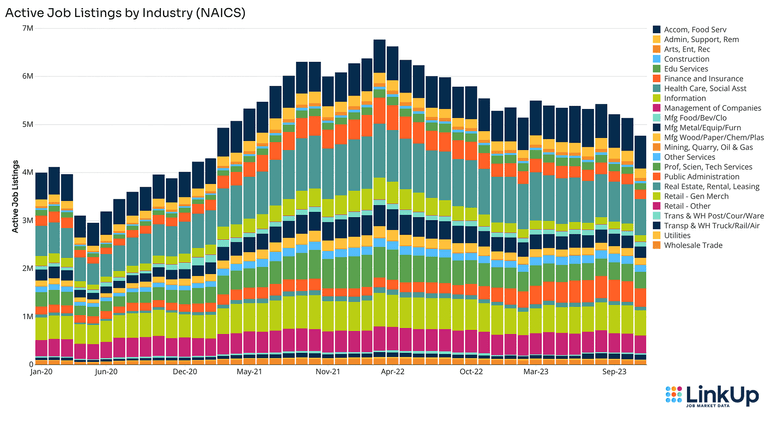

Openings fell in every industry but one with the largest declines in Transportation & Warehousing, Finance & Insurance, and Information and the only gain in Accommodation & Food Service.

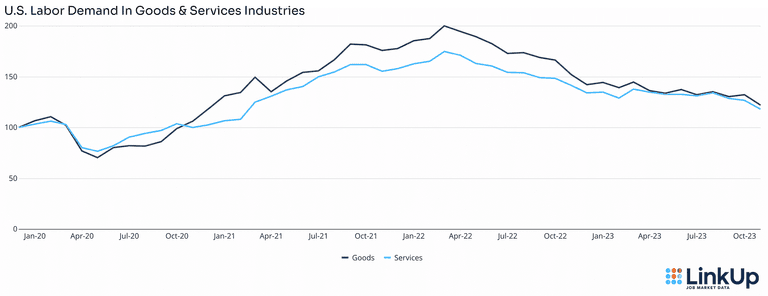

Nearly identical declines in labor demand were seen in goods and services industries alike.

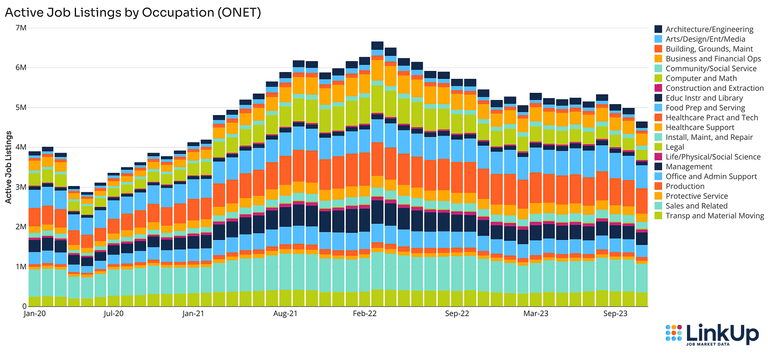

Job openings declined in every occupation category except Life/Physical/Social Science (+2%). The largest declines were seen in Personal Care & Services, Computer & Math, and Art/Design/Entertainment/Media.

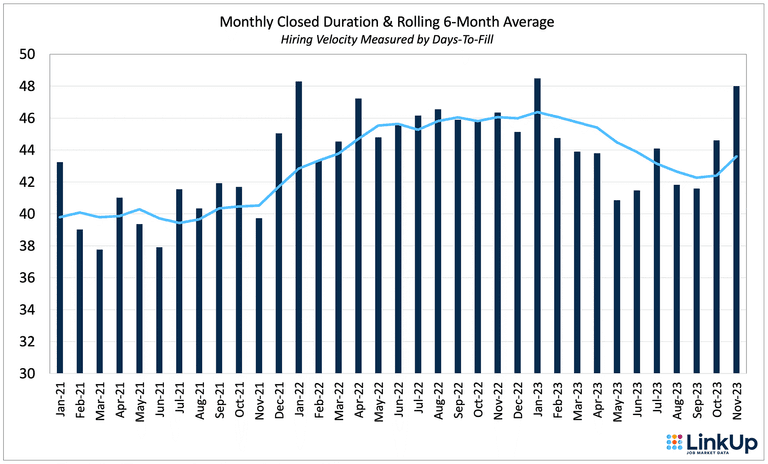

Hiring velocity slowed down significantly in November as Job Duration jumped to 48 days, bringing the rolling 90-day average duration up to nearly 44 days.

Job Duration, the average number of days that job openings are posted on company websites before they are removed – typically because the job was filled – tracks hiring velocity across the entire economy.

Because a job opening indexed from an employer’s corporate career portal on its company website is the best indicator of that employer’s intent to make a hire in the future, our forecasts are typically based on the previous month’s jobs data.

Accordingly, based on our data from October when new job openings dropped 7% and total jobs declined 1%, we are forecasting a net gain of just 50,000 jobs in the U.S. in November, well below consensus estimates of 170,000.

And while we have to wait until next week for the initial release for November before we can make our official forecast for December’s jobs report, there is little doubt that the net gain for December will drop markedly from whatever November’s numbers turn out to be.

If Powell is having a hard time brushing off rate-cut bets now, just wait until next week’s below-consensus jobs report for November, followed a month later by December’s report that might be the first negative jobs report in 35 months.

If expensive mayonnaise could end democracy as we know it, I cannot imagine what might happen if unemployment jumps above 5% in 2024.

Insights: Related insights and resources

-

Blog

11.24.2023

Black Friday 2023: Retail hiring down 10% signals caution

Read full article -

Blog

11.21.2023

Job Board Data Pollution: Expired Listings Slow Data Down (Part 3)

Read full article -

Blog

11.17.2023

Job Board Data Pollution: How Duplication Bloats the Labor Market (Part 2)

Read full article -

Blog

11.15.2023

Job Board Data Pollution: The Nefarious Underworld of Fake Jobs (Part 1)

Read full article -

Blog

11.09.2023

Job Board Data Pollution: An Introduction

Read full article -

Blog

11.08.2023

LinkUp's October 2023 JOLTS Forecast

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.