LinkUp Forecasting Net Gain of 290,000 Jobs In March as Job Market Continues To Show Extraordinary Resilience

Persistently elevated wages have reset the natural rate of growth across key macro metrics and the adjustment for the Fed & the markets will cause extreme gnashing of teeth.

Last week’s post (Both the Job Market and the Economy Are In Near-Perfect Equilibrium; The Fed Will Sit Tight Until Forced To Do Otherwise) provided much of our commentary on the present state of the U.S. economy in general and the job market in particular, so for now we’ll jump straight to the data and our non-farm payrolls forecast for March.

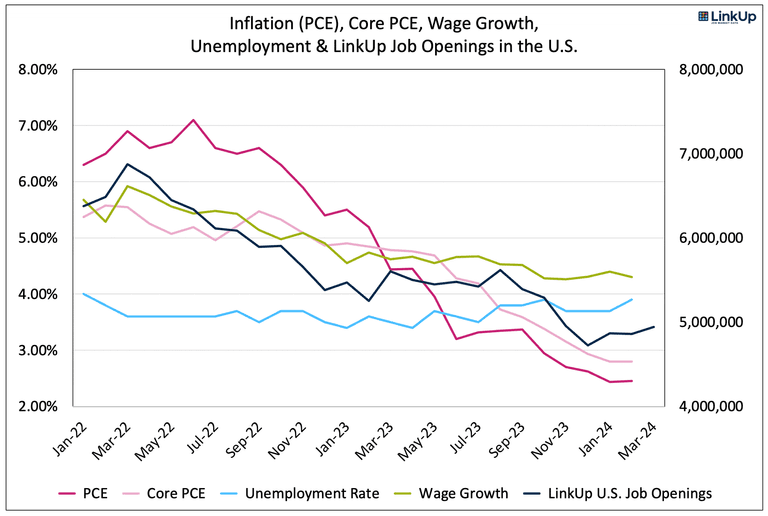

With last week’s inflation report, the soft landing that’s been underway for roughly a year maintained its exceedingly comfortable, pillowy character. Given that the numbers came in right in line with expectations, comments from Powell and others at the Fed over the past few days continued to confirm that they are, most assuredly, in no hurry to cut rates anytime soon.

And based on LinkUp’s job data for March, combined with our longer-term perspective that wages will remain elevated and wage inflation, particularly in the service sector, will persist, we firmly maintain our conviction that inflation has essentially reached its reasonably achievable nadir and that the Fed and the markets will only slowly, with much gnashing of teeth, come to grips with the series of new natural rates around the economy (3% inflation, 4% wage growth, 5% job openings growth).

It’s those adjusted natural rates of growth that we’ll focus on in greater detail in the coming weeks, particularly wages, but turning to our March data, it’s clear that the U.S. job market continues to show signs of extraordinary balance and resilience.

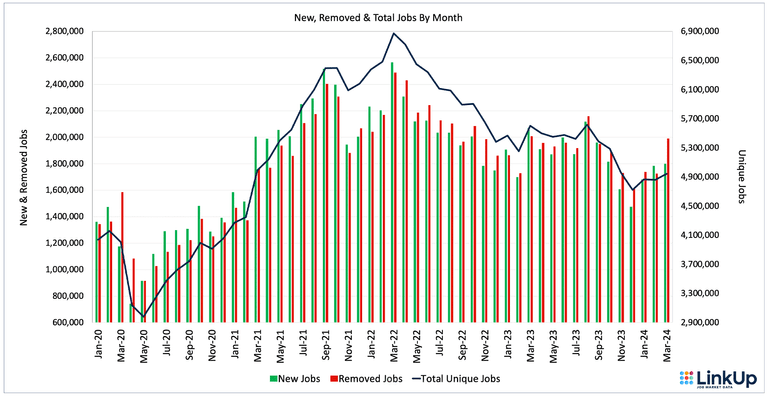

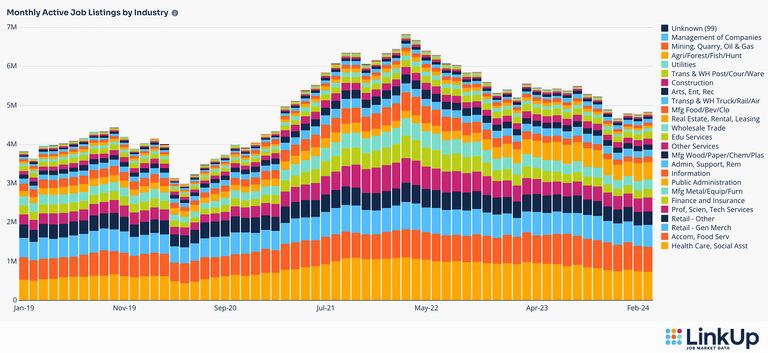

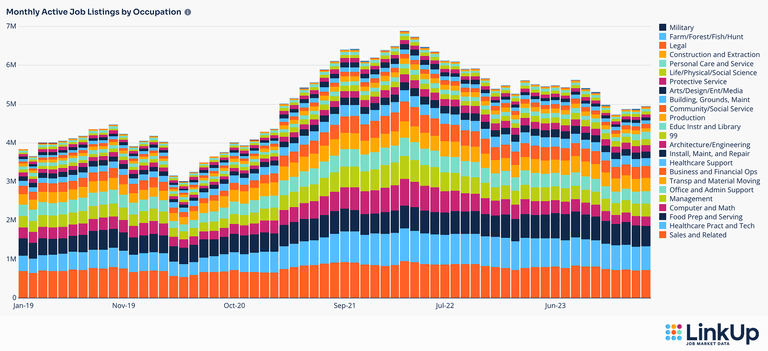

In March, total U.S. jobs indexed directly from company websites around the world rose 2% to 4.9M jobs, while new and removed jobs rose 1% and 15% respectively.

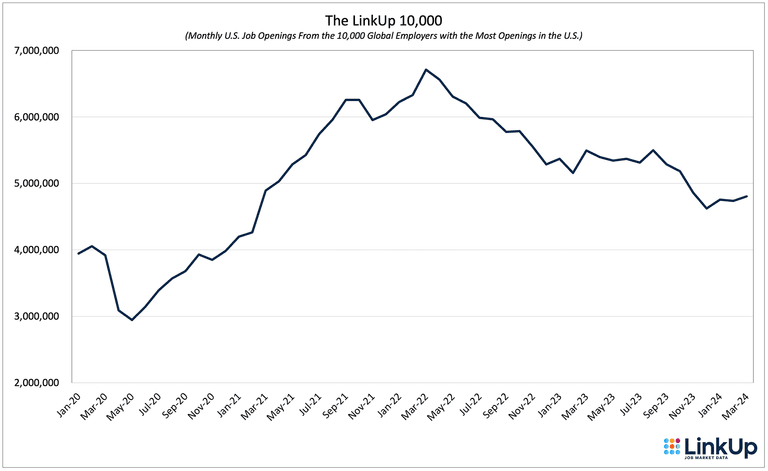

Similarly, the LinkUp 10,000 - a metric that tracks total U.S. job openings from the 10,000 global employers with the most openings in the U.S., rose 1%.

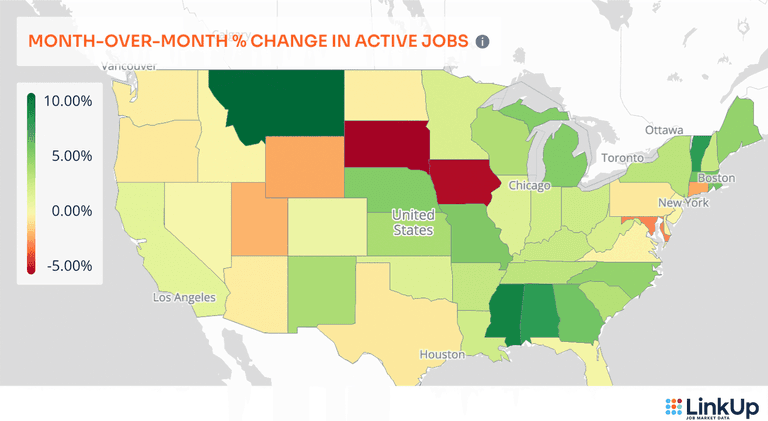

Job openings by state rose across most of the country with the largest increases in Montana (10%), Mississippi (8%) and Alaska (8%) and the largest declines in South Dakota (-5%) and Iowa (-5%).

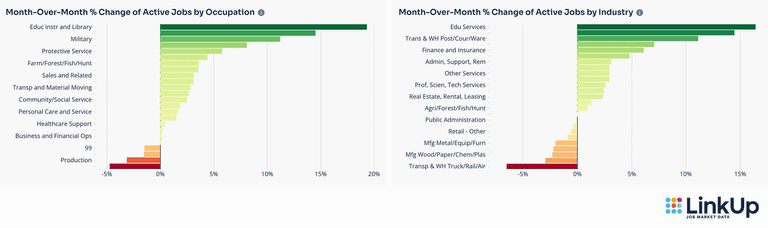

Far more occupations and industries saw openings increase, with the largest gains in Education and Construction.

Other Industries showing gains include Transportation-Warehouse (11%), Retail-General Merchandise (7%), and Finance (6%).

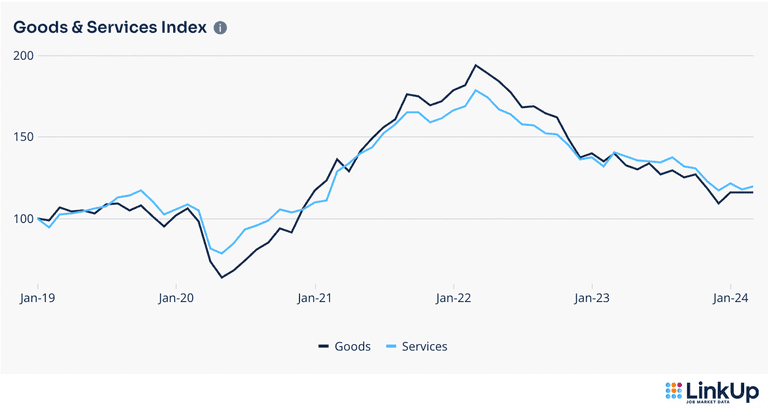

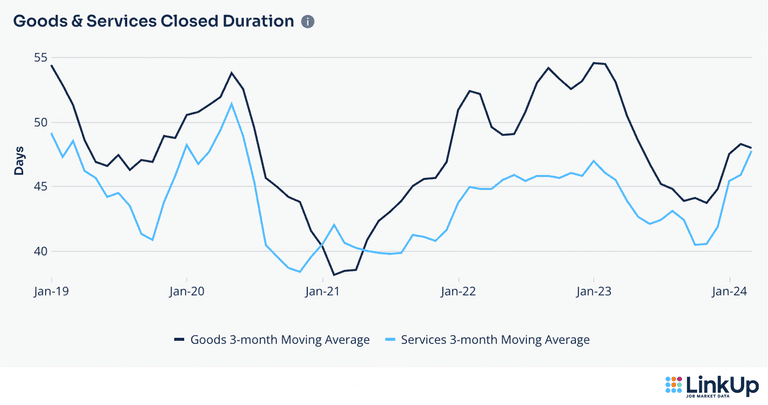

For the month, labor demand in manufacturing was flat while labor demand in services rose slightly.

Following Education and Construction, the largest gains by occupation were seen in the Military (11%), Arts/Design/Media/Entertainment (8%), and Protective Services (6%).

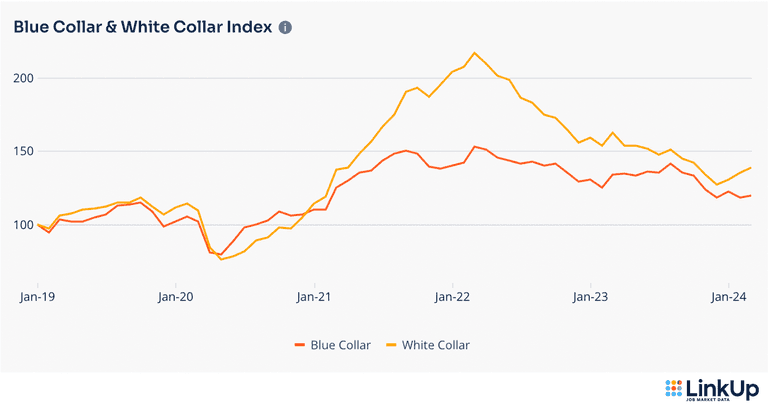

Labor demand for blue and white collar jobs rose 1% and 3% respectively.

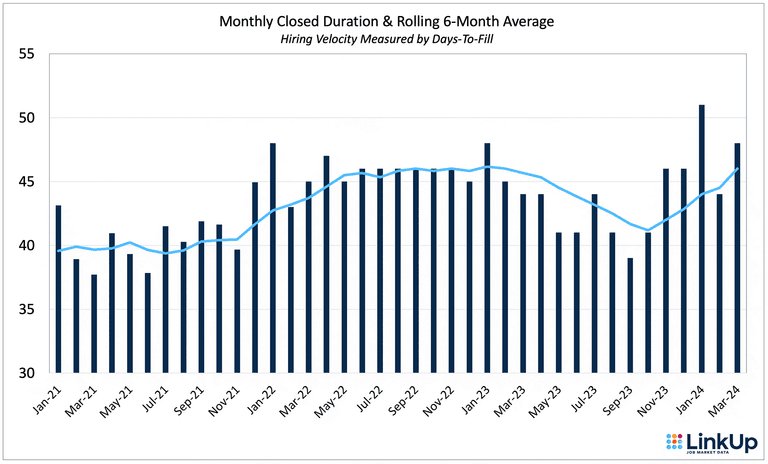

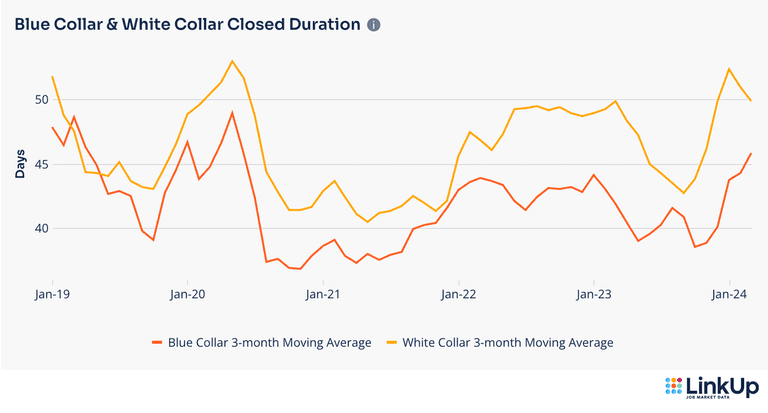

In March, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, rose from 44 days in February to 48 days in March. Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

The rolling 90-day average for Closed Duration dropped slightly for manufacturing but rose sharply for services.

The rolling 90-day average for Closed Duration for white-collar jobs dropped by a day but rose by 2 days for blue-collar jobs.

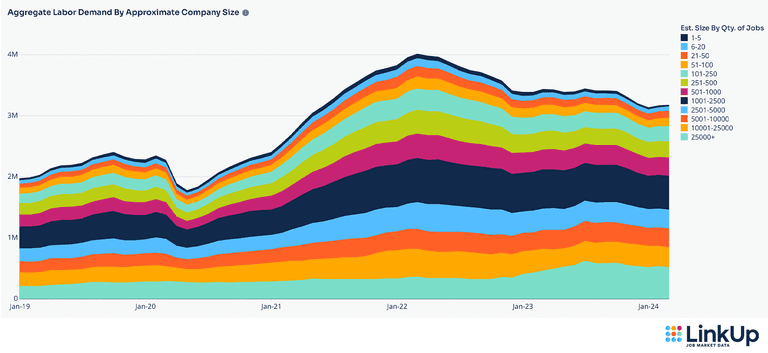

Labor demand was mixed across companies of all sizes, with demand edging up the most for companies that had between 51-100 job openings.

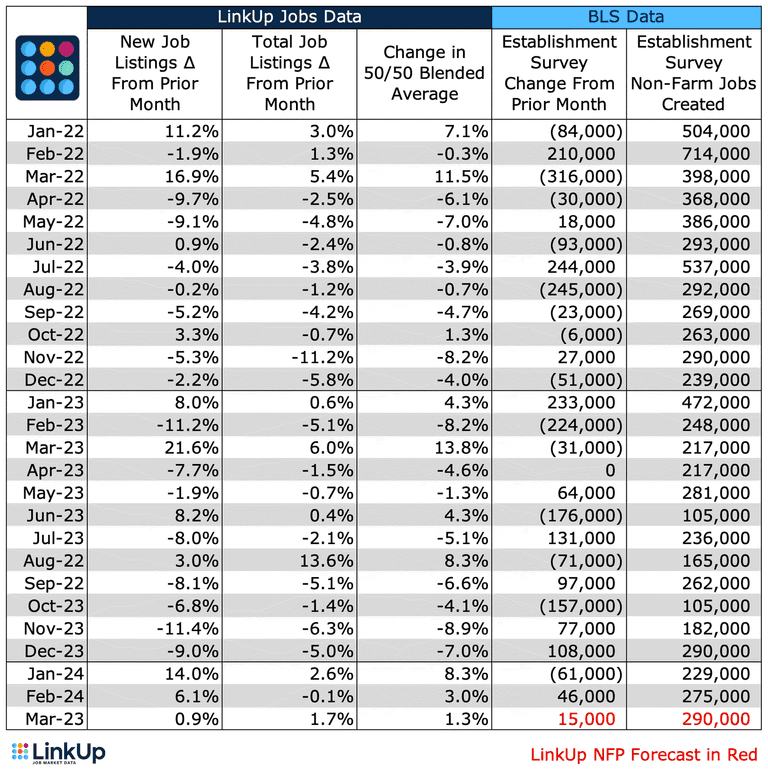

Based on our data from February and March, we are forecasting a net gain of 290,000 jobs in March, well above the consensus estimates of 200,000 jobs.

As noted above, we expect that Friday’s jobs report will not only set off yet another wave of adjusting around the timing and number of rate cuts expected this year, but the fevered pitch is unlikely to ebb for quite some time - not until the Fed and the markets come to the realization that we’re in a fundamentally different place than we were 4 years ago.

Insights: Related insights and resources

-

Blog

02.28.2024

Walgreens vs. Amazon: A Dow Jones Story

Read full article -

Blog

02.27.2024

The Minneapolis Fed Should Start Paying Closer Attention To Goldman Sachs Research

Read full article -

Blog

02.21.2024

Follow the Job Data, Not the Headlines

Read full article -

Blog

12.13.2023

LinkUp's November 2023 JOLTS Forecast

Read full article -

Blog

12.07.2023

What’s in a Job Listing? The LinkUp Difference

Read full article -

Blog

12.07.2023

November 2023 Jobs Recap: Job Growth Falls from Plateau to Decline

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.