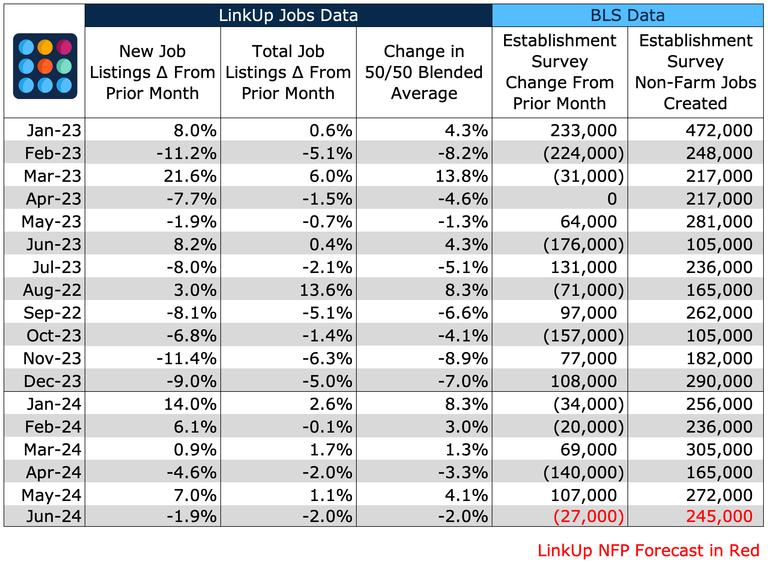

LinkUp Forecasting a Net Gain of 245,000 Jobs in June as Labor Demand Drops a Bit in June

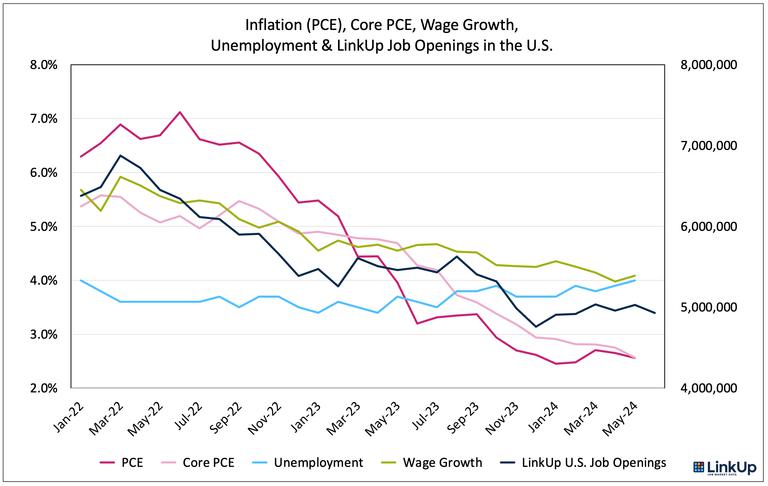

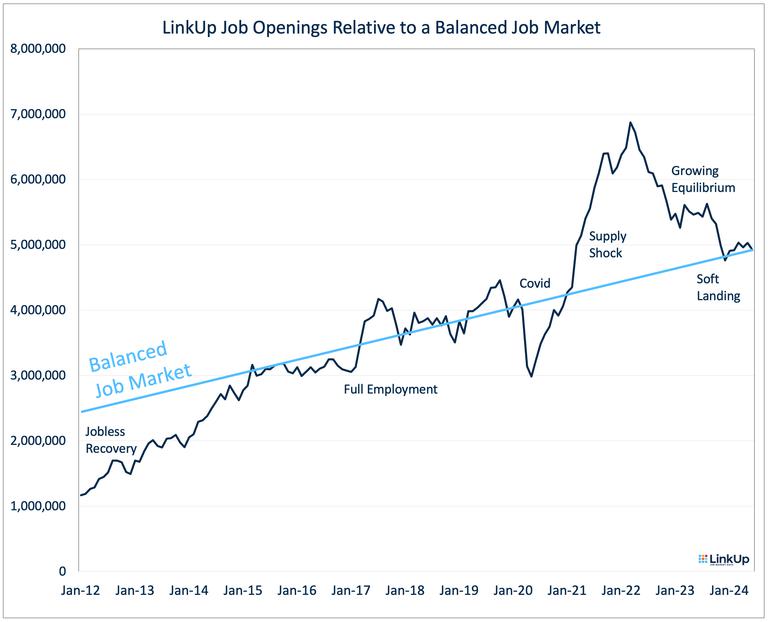

A balanced job market with near-perfect equilibrium between demand and supply continues to provide steady ballast to the U.S. economy through full employment and growth in real wages.

As we noted yesterday, with the 4th of July holiday this week, we published our broader commentary on the economy and the job market yesterday (A Balanced Job Market Continues to Chug Along, Powering the U.S. Economy). We’ve updated a few charts from yesterday’s post with June data, but the broader narrative of a solid but moderating job market remains very much intact.

With June’s data, the U.S. job market couldn’t possibly be more perfectly in balance.

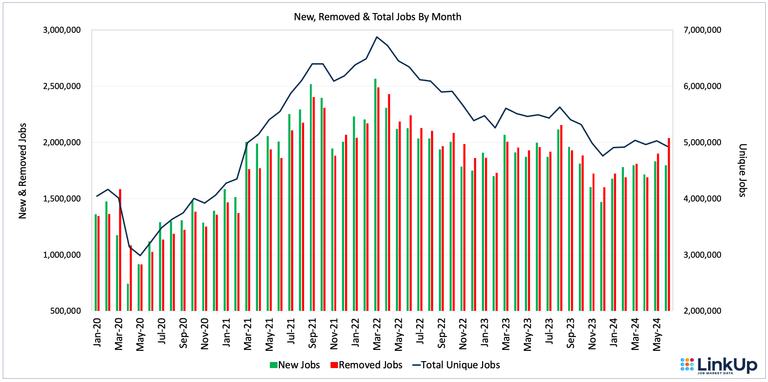

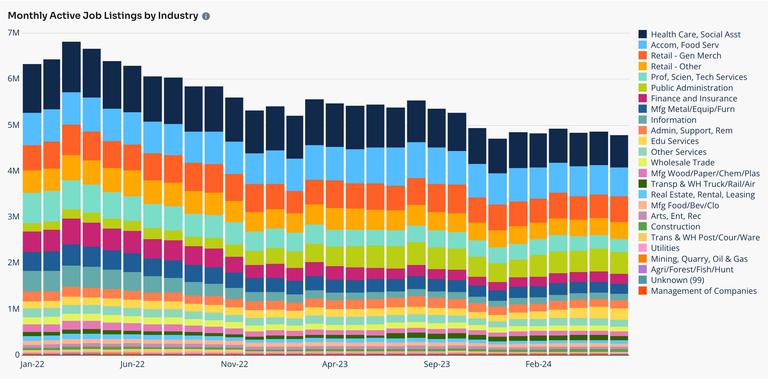

Drilling into the detail for June, total U.S. jobs indexed directly from company websites around the world fell 2% to 4.93M jobs, with new jobs also falling 2% and removed jobs rising 7%.

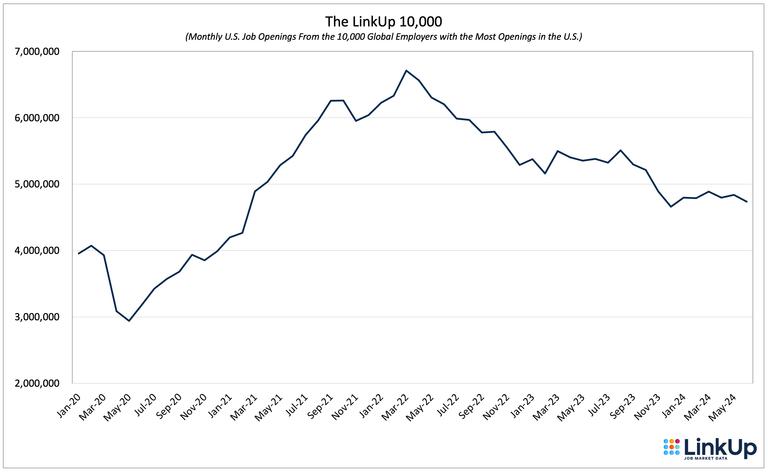

Similarly, the LinkUp 10,000 - a metric that tracks total U.S. job openings from the 10,000 global employers with the most openings in the U.S., dropped 2% during the month.

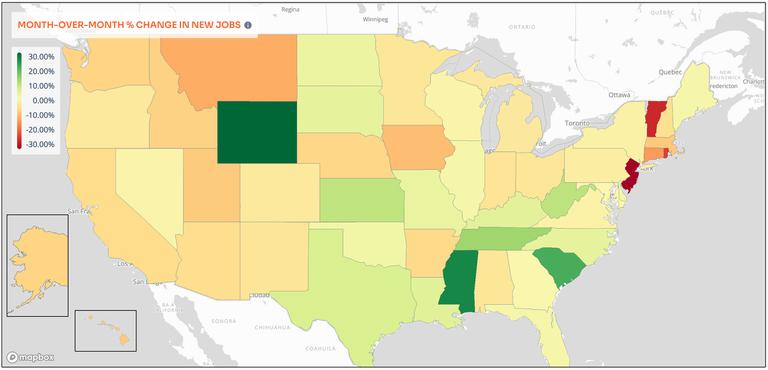

New job openings by state rose in 19 states with the largest increases in Wyoming, Mississippi, and South Carolina and the largest decreases in New Jersey, Vermont, and Rhode Island.

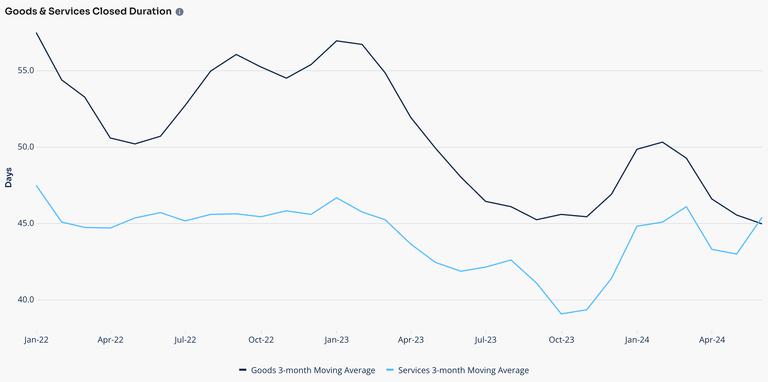

For the month, labor demand in manufacturing dropped a bit more than services.

Industries showing the largest increases in openings were Local Delivery, Retail, and Public Administration.

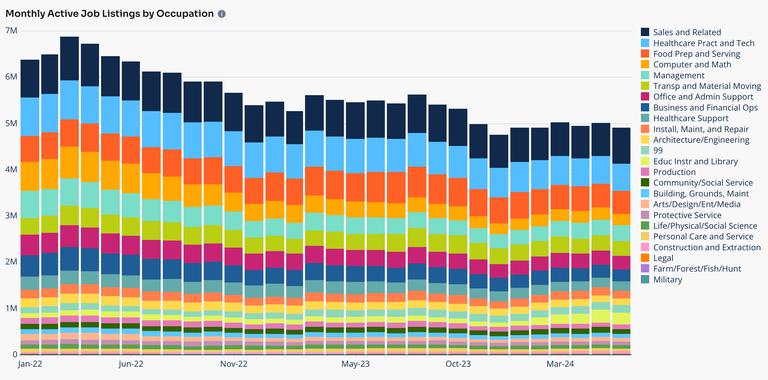

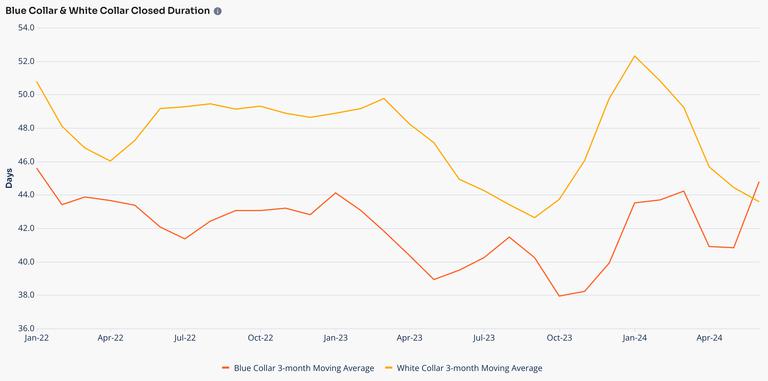

Labor demand for white collar jobs dropped a bit from its YTD high in May while demand for blue collar jobs remained essentially flat.

The largest gains by occupation were seen in Sales (9%) while the largest declines occurred in Arts/Design/Media/Entertainment (-13%), Life/Physical/Social Sciences (-9%), and Protective Services (-8%).

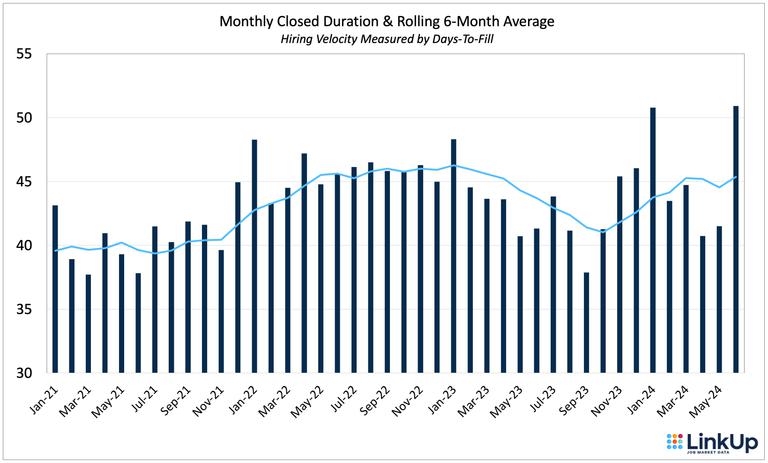

In June, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, jumped to 51 days as the labor market continues to cool down and employers increasingly slow their pace of hiring.

Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

The rolling 90-day average for Closed Duration dropped in manufacturing and rose in services.

Similarly, the rolling 90-day average for Closed Duration dropped for white-collar jobs and rose for blue-collar jobs.

So as noted above, based on our data, we are forecasting a net gain of 245,000 jobs in June, above consensus estimates of 195,000 jobs.

I hope everyone has a great 4th of July.

Insights: Related insights and resources

-

Blog

06.30.2024

A Balanced Job Market Continues to Chug Along, Powering the U.S. Economy

Read full article -

Blog

06.21.2024

SMCI Adds Scores of Jobs Quickly as AI Hardware Demand Soars

Read full article -

Blog

06.19.2024

Job Openings Plummeted Months Ahead of Fisker Bankruptcy

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.