LinkUp Forecasting a Net Gain of 275,000 Jobs In Next Week's Jobs Report for February

The U.S. job market will continue to surprise to the upside - good news for the economy but bad news for those expecting the Fed to begin cutting rates sooner than later.

We have too much data and too many charts to get to in conjunction with our non-farm payroll forecast for next week’s jobs report for February and earlier this week we posted a lengthy recap of the Covid-era job market and a detailed analysis of the soft landing that’s already occurred, so we’ll skip our customary commentary for now and jump straight into the data. Before next week’s jobs report, we’ll post some additional commentary on what we’re seeing the job market and how we think things should unfold in the near-term, particularly in relation to our predictions for the year that we made last month.

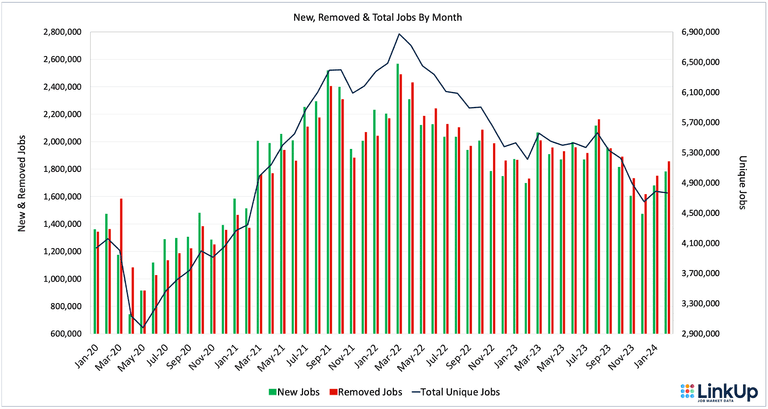

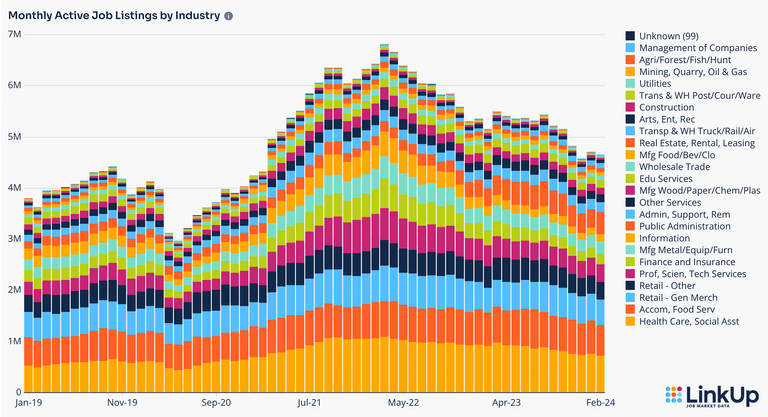

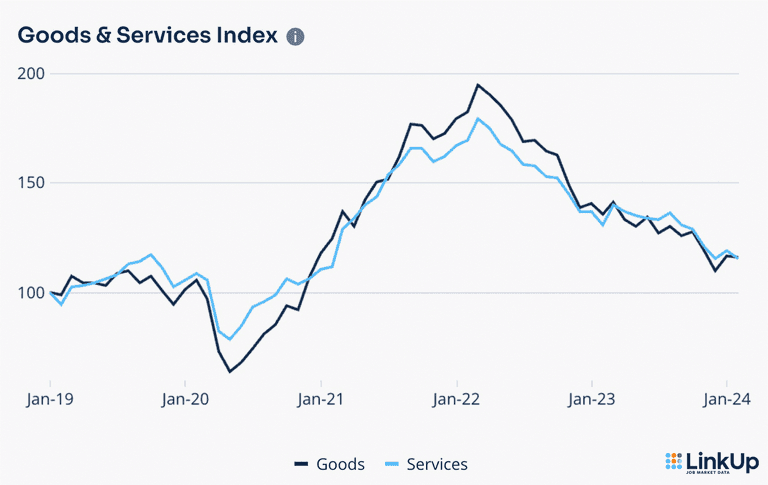

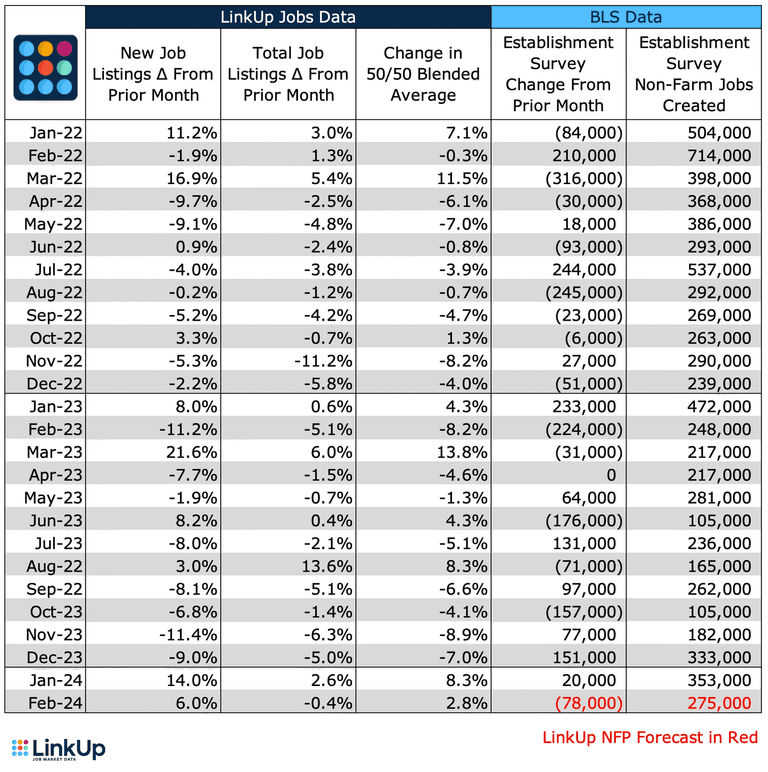

So, looking at our job market data for February, sourced entirely from millions and millions of job openings that we index every day directly from employer websites around the world, total U.S. jobs indexed directly from company websites were essentially flat in February, edging down just 0.4%. New and removed job openings each rose 6% from January.

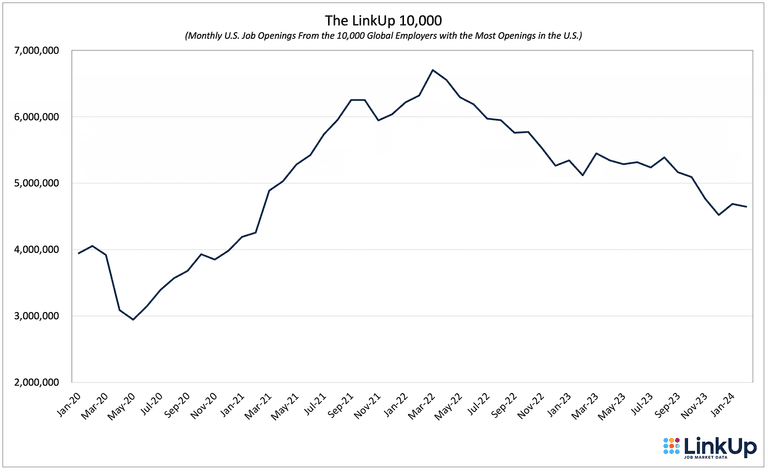

Similarly, the LinkUp 10,000 - a metric that tracks the total U.S. job openings from the 10,000 global employers with the most openings in the U.S., edged down 0.9% in February.

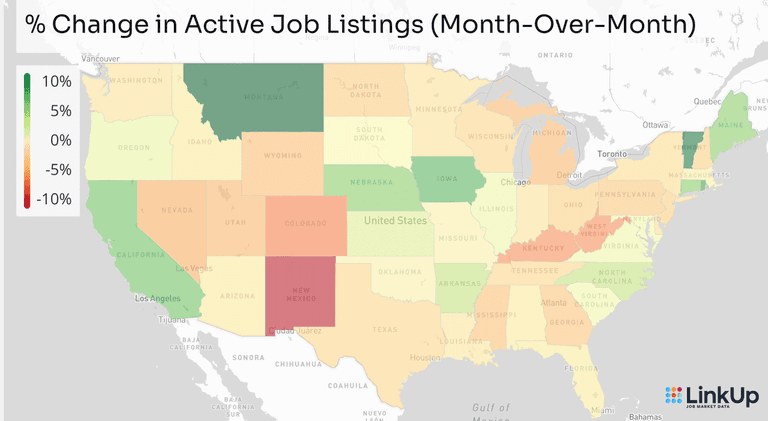

Job openings by state were largely flat to slightly down across most of the country with increases in just 11 states. The largest increases were in Montana (12%) and Vermont (9%) and the largest declines were seen in New Mexico (-9%) and Colorado (-6%).

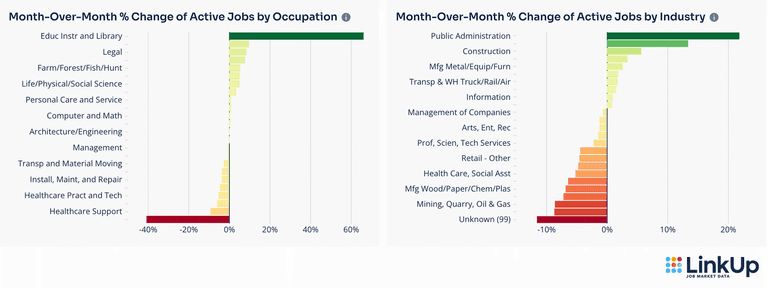

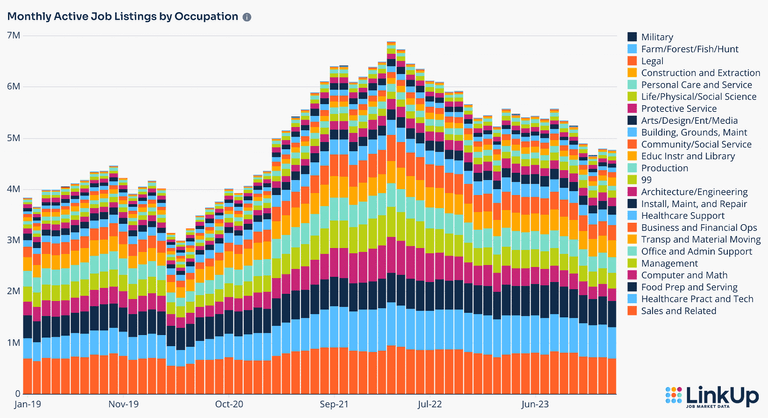

Increases and decreases in labor demand in February were evenly split when looking at the data across industries and across occupations.

Looking at specific industries, the largest increases were in Public Administration (22%), Education (13%), and Construction (6%).

For the month, labor demand in manufacturing was flat while labor demand in service sectors was slightly down.

By occupation, the largest gains were seen in Education and the largest declines were in the Military.

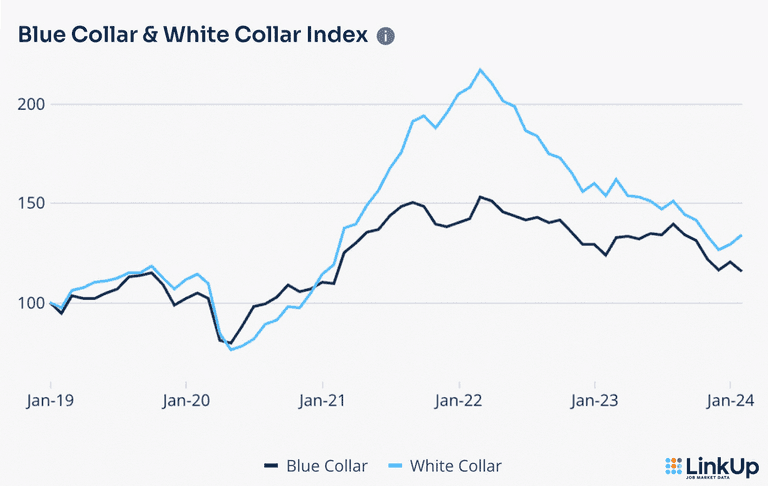

Labor demand for white collar jobs rose 6% and fell 3% for blue collar jobs.

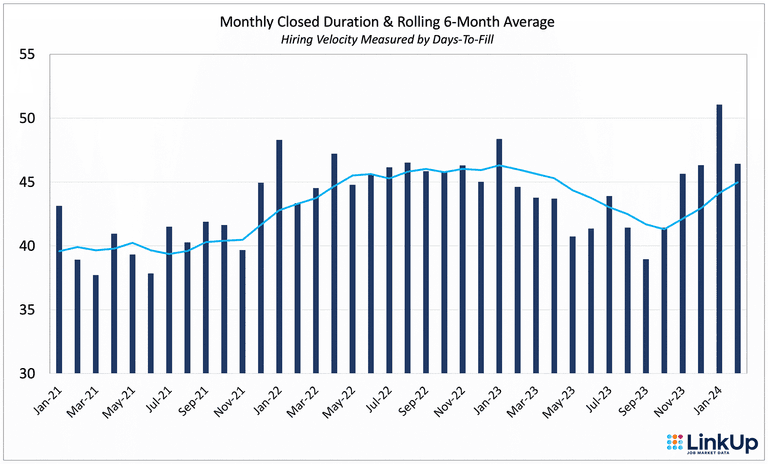

As we noted last month, Job Duration is always a bit wonky in January as employers clean up their corporate career portals at the beginning of the year, so for February and March, we’ll focus primarily on the rolling 90-day average for Hiring Velocity or ‘Time-to-Fill.’ In February, 90-day rolling average continued its climb up, hitting 45 days. Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is removed.

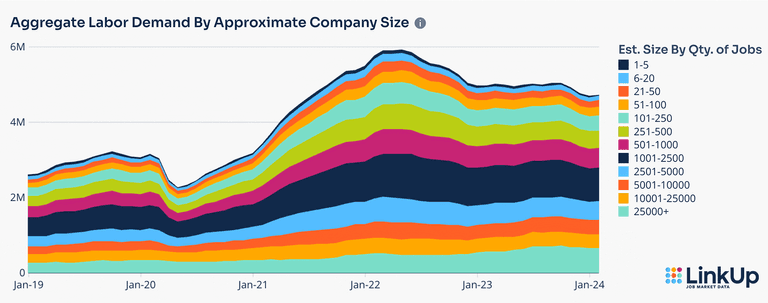

One of the newer charts available in our Macro Data solution measures aggregate labor demand by companies of various sizes as approximated by the number of openings on their corporate career portal.

Labor demand was pretty flat across companies of all sizes, with demand edging up the most for companies that had between 2,500-5,000 job openings.

Based on our data for January and February, we are forecasting a net gain of 275,000 jobs in February, well above the consensus estimates of 190,000 jobs.

Again, we’ll provide additional commentary on what we’re seeing in the job market and our outlook for the near-term future in the next few days, but we expect next Friday’s jobs report to provide, yet again, further evidence of the astounding strength and resilience of the U.S. job market. It may be bad news for those expecting to see rates come down sooner than later, but it’s certainly great news for workers, employers, and the U.S. economy as a whole.

Insights: Related insights and resources

-

Blog

02.28.2024

Walgreens vs. Amazon: A Dow Jones Story

Read full article -

Blog

02.27.2024

The Minneapolis Fed Should Start Paying Closer Attention To Goldman Sachs Research

Read full article -

Blog

02.21.2024

Follow the Job Data, Not the Headlines

Read full article -

Blog

12.13.2023

LinkUp's November 2023 JOLTS Forecast

Read full article -

Blog

12.07.2023

What’s in a Job Listing? The LinkUp Difference

Read full article -

Blog

12.07.2023

November 2023 Jobs Recap: Job Growth Falls from Plateau to Decline

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.