Under The Hood, December's Jobs Report Continues Some Worrisome Trends

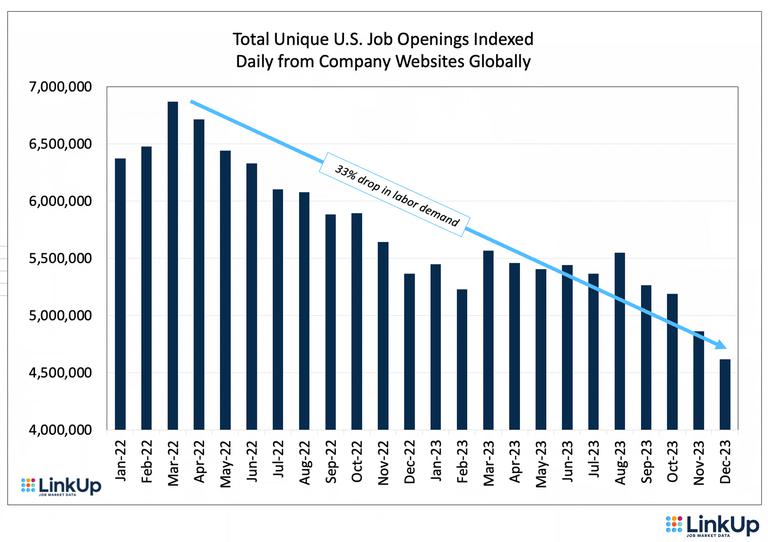

The job market is far less rosy than the headline numbers would indicate and LinkUp data for Q4 '23 points to more uncertainty in the job market and the economy as a whole than most are expecting.

Given the consistent strength of the job market since March of last year when the Fed began hiking rates, I suppose it shouldn’t be surprising that we ended 2023 with another surprise to the upside with December’s jobs report Friday. But it definitely stings a bit that we ended the year with our 4th consecutive forecasting miss, our worst streak since we started forecasting non-farm payrolls nearly 15 years ago.

Armed with job openings data that we index globally every day directly from company websites around the world (which, uniquely, eliminates job board pollution), our high-quality labor demand data is inherently forward looking and provides us with a pretty powerful alethiometer of sorts (for any Philip Pullman fans in the audience) that we’ve leveraged to accurately forecast job growth in future periods since 2010.

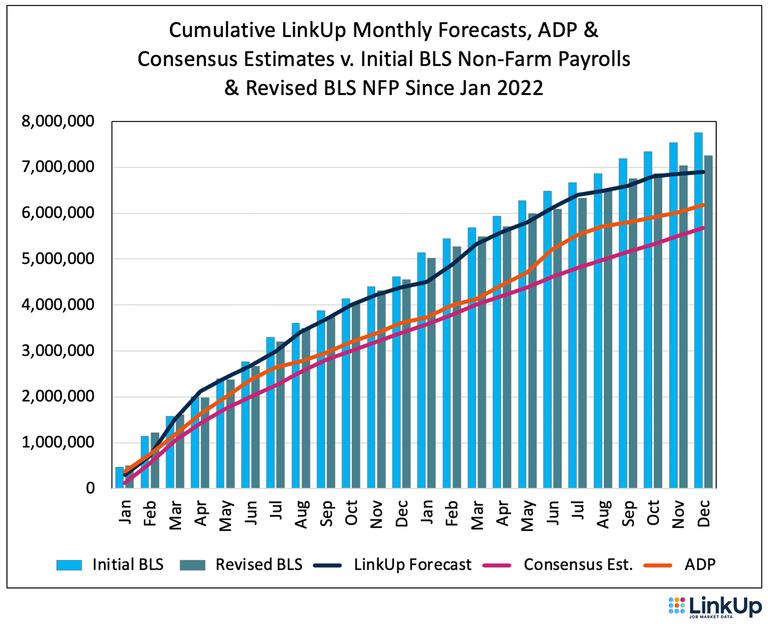

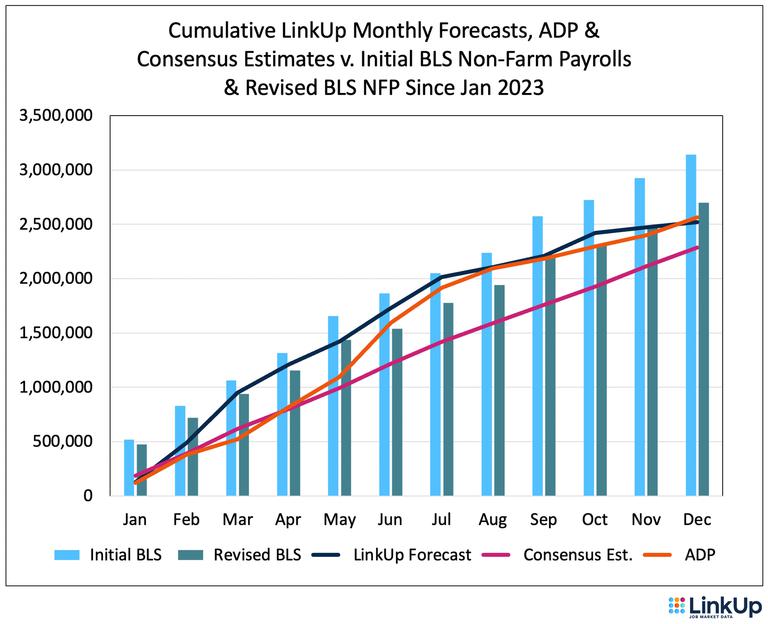

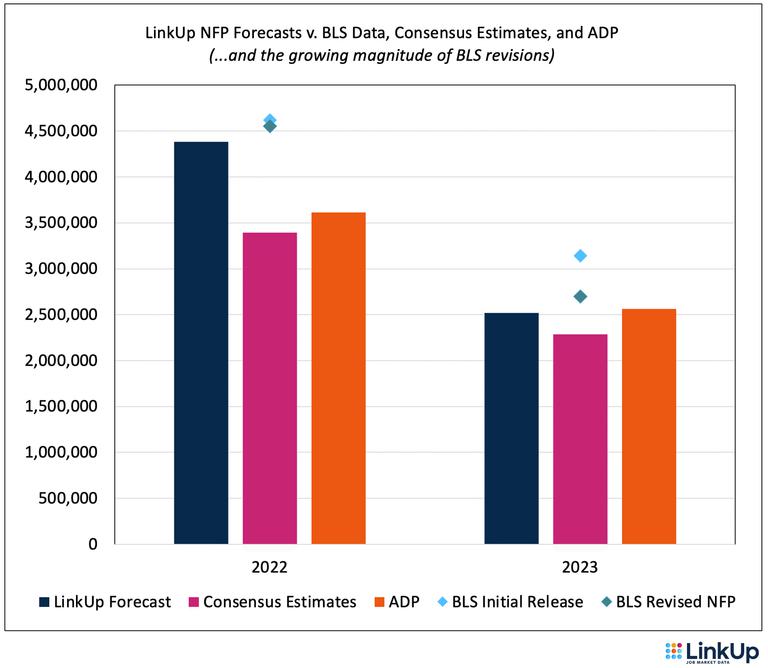

For the period from January 2022 through August 2023, our track-record in forecasting monthly job gains was off by a infinitesimal -0.11% from the Bureau of Labor Statistics (BLS) data but, as things stand now, our 24-month cumulative forecast is off by -4.8% (still better than ADP -17.4% and Consensus Estimates -21.7%, but not where we want it be).

And what stings more so than the recent slide is the fact that for the past two years, we’ve been among the most vocal (if not the most vocal) in accurately forecasting stronger job gains than anyone expected.

Looking at the chart above, specifically at our cumulative forecast through October, we had forecasted job gains 5% above where they actually came in (and way above what consensus estimates expected), and as of last month, our cumulative forecast for the year was off by just -0.4%. But Friday’s numbers knocked our tracking error for the year to an extremely frustrating -6.6%.

We’ll return in a minute back to what specifically in our job market data led us to our forecasts for November and December (and what leads us to believe that data for both months will be revised down in the next 30 and 60 days), but it’s worth first recapping December’s jobs report.

From a headline standpoint, December’s jobs report was clearly a strong one. Payrolls rose by 216,000 jobs, wage gains rose 0.4% MoM and 4.1% YoY, and unemployment held steady at 3.7%.

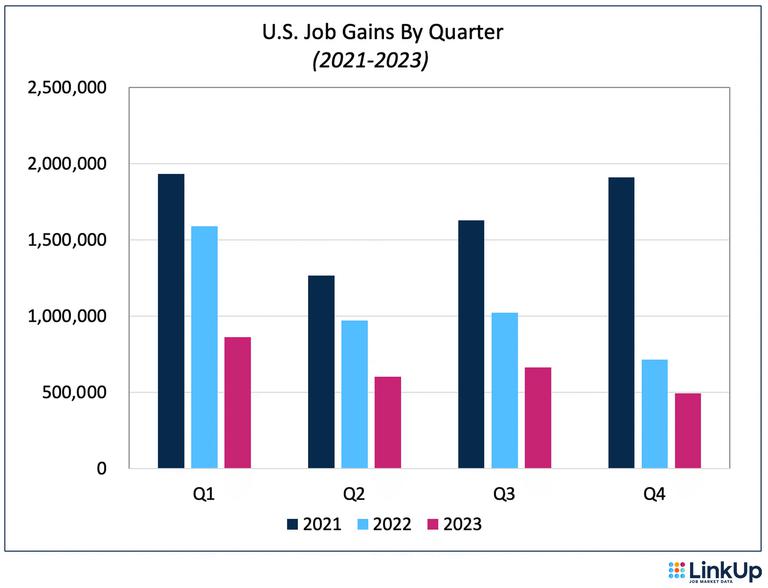

For the year (with revisions for November and December coming in 30 days and December revisions again in 60 days), the U.S. economy added 2.7M jobs in 2023, down 39% from 2022’s gain of 4.3M jobs.

But aside from the obvious fact that quarterly job gains year-over-year have dropped for 8 consecutive quarters (albeit precisely as the Fed intended with a perfectly executed soft-landing with unemployment holding steady at historic lows throughout their hiking regimen), December’s report provided further evidence that under the hood, there are indications that things in the job market aren’t so rosy.

Job gains were again powered by a narrow handful of sectors (Education/Health, Leisure/Hospitality, and Government), the Household Survey reported a drop in employment of 683,000 jobs, labor force participation dropped to 62.5% (the lowest level since February), and October and November’s job gains were revised down by a combined 71,000. With those revisions, job gains averaged just 165,000 in Q4.

And speaking of revisions, there is no doubt that the initial jobs reports issued by the BLS are becoming increasingly unreliable and are at a growing risk of becoming largely, if not entirely, irrelevant to anyone who wants to truly understand what is going on in the job market and, therefore, in the economy as a whole.

In 2022, BLS revisions issued subsequent to the initial release totaled -66,000, a downward revision for the year of just 1.4%. With revisions still to come in February and March, revisions so far for 2023 have totaled 443,000 jobs, down 14% from the initial data released.

As David Rosenberg tweeted (…not sure what tweets are now called post Xification - Xcrement, perhaps?), it might be time to stop trading off payroll data, certainly not the initial release data anyway.

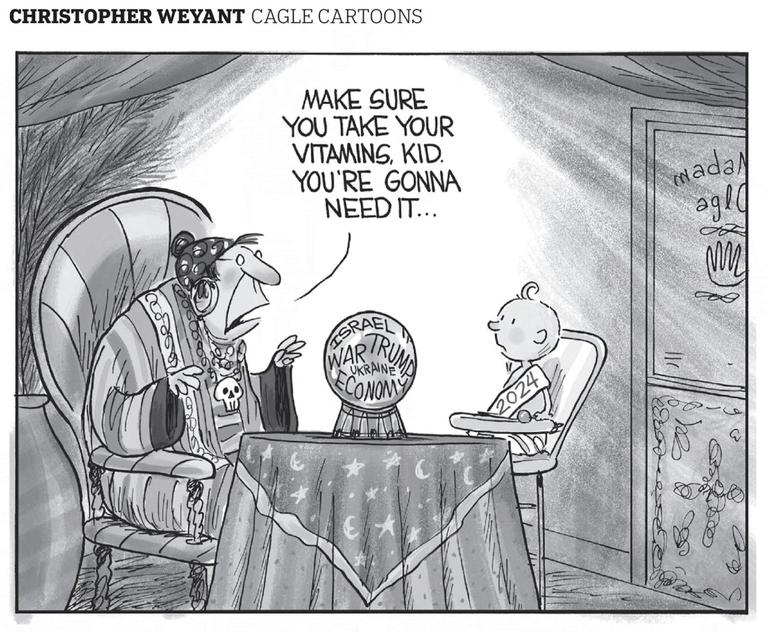

But in any event, while everybody knows that the job market is cooling off, our data is indicating that things are potentially heading toward a deeper freeze than anyone is expecting at the moment. That doesn’t necessarily mean that a recession is imminent, nor are we are we forecasting one, but it most definitely introduces more uncertainty into the year ahead than most are anticipating.

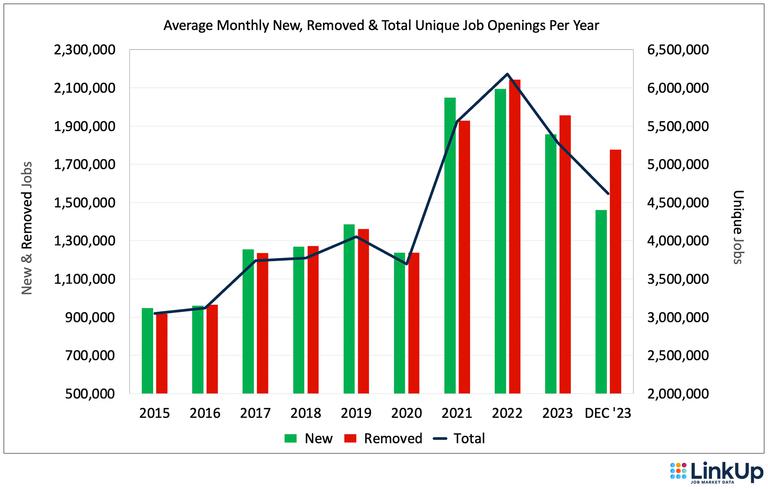

We’ll be issuing a longer-term forecast for 2024 when we publish our jobs forecast for January in a month or so, but for now, we’ll end with one last chart that provides a hypothetical baseline for 2024 calculated by annualizing our job market data from December (12 x each of new, removed, and total unique jobs in December 2023).

That hypothetical baseline would equate to 4.6M total job openings for the year, 1.8M new openings, and 1.9M removed jobs. Applying the same ratio for 2023 between new job openings on company websites and job growth for the year would translate to a net gain of 2.1M jobs in the U.S. in 2024, an average of 170,000 jobs per month, just slightly above the average monthly net gain of 165,000 seen in Q4 2023.

That’s a very simple, back-of-the-envelope calculation, and as previously noted we’ll be publishing our ‘official’ forecast in the next month, but the above is not an unreasonable baseline forecast nor would it be a bad outcome given the increasingly ominous storm clouds on the horizon. With the horrific risk factors we’re most assuredly going to be dealing with this year, in addition to the unknown unknowns, I’d lock that end result in as fast as possible if given the opportunity.

Insights: Related insights and resources

-

Blog

01.04.2024

December 2023 Jobs Recap: Continued Labor Cooling

Read full article -

Blog

01.03.2024

LinkUp Forecasting Net Gain of 50,000 Jobs in December

Read full article -

Blog

12.13.2023

LinkUp's November 2023 JOLTS Forecast

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.