LinkUp Forecasting Strong Job Gains of 225,000 in January

It’s hard to imagine how this week could get any more insane, but capping it off with what might be considered a blow-out jobs report Friday is likely to raise some eyebrows.

It’s hard to imagine how this week could get any more insane, but capping it off with what might be considered a blow-out jobs report Friday is likely to raise some eyebrows. Based on LinkUp’s job market data, we are expecting to see just that – a net gain of 225,000 jobs in January, well above consensus estimates of just 160,000 jobs.

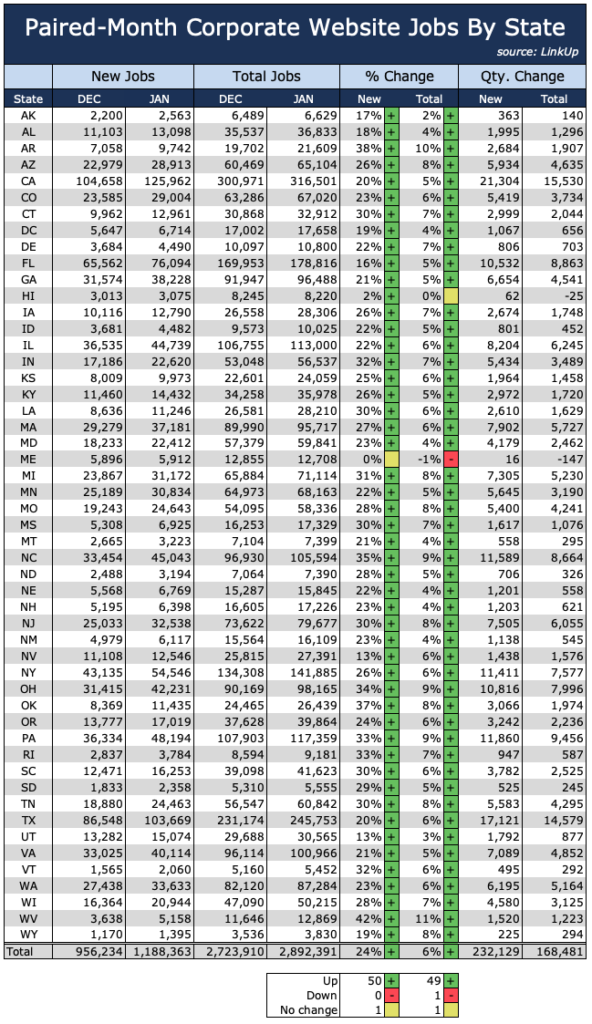

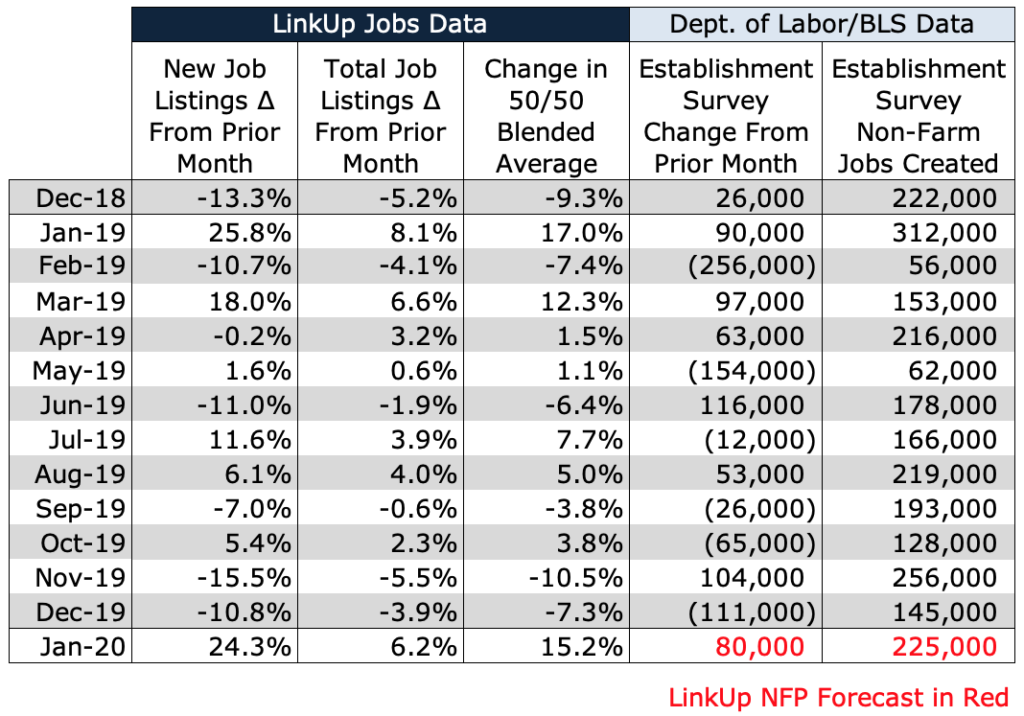

Using our paired month data, one of our derived analytics that we use in our non-farm payroll forecasting model, new and total job listings on corporate websites throughout the U.S. rose 24% and 6% respectively. And as the table below indicates, labor demand was strong throughout the country.

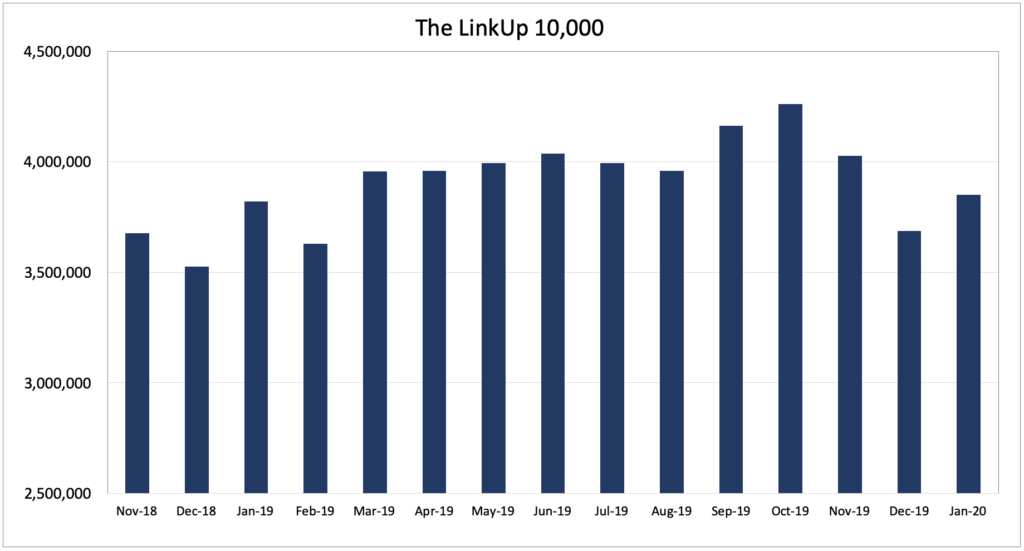

Looking at the LinkUp 10,000, another one of our derived analytics where we track job listings for the 10,000 employers in our dataset with the most job openings in any given month, total job openings rose 4.5% in January to 3.85 million.

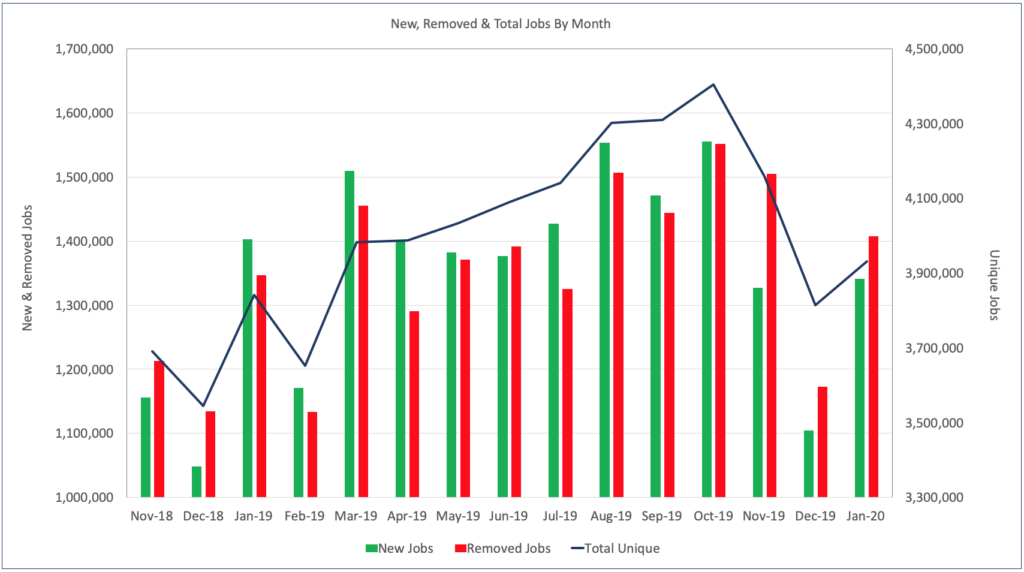

Looking at data that does not account for the continuous addition of new companies into our dataset, new job listings on corporate websites rose 21%, removed job listings rose 20%, and total unique job openings rose 3%.

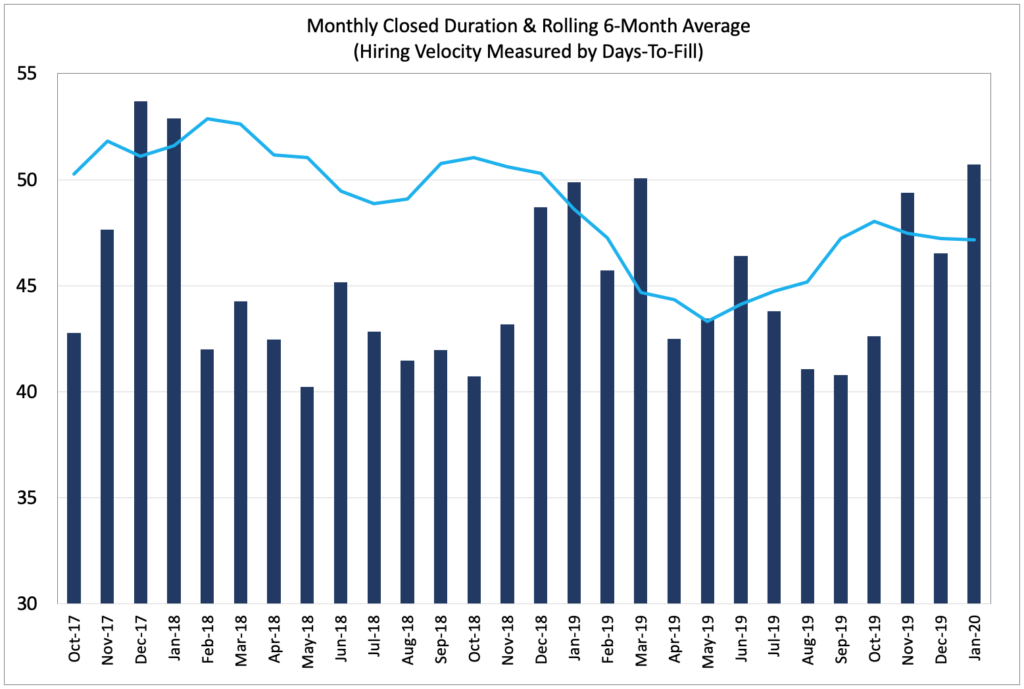

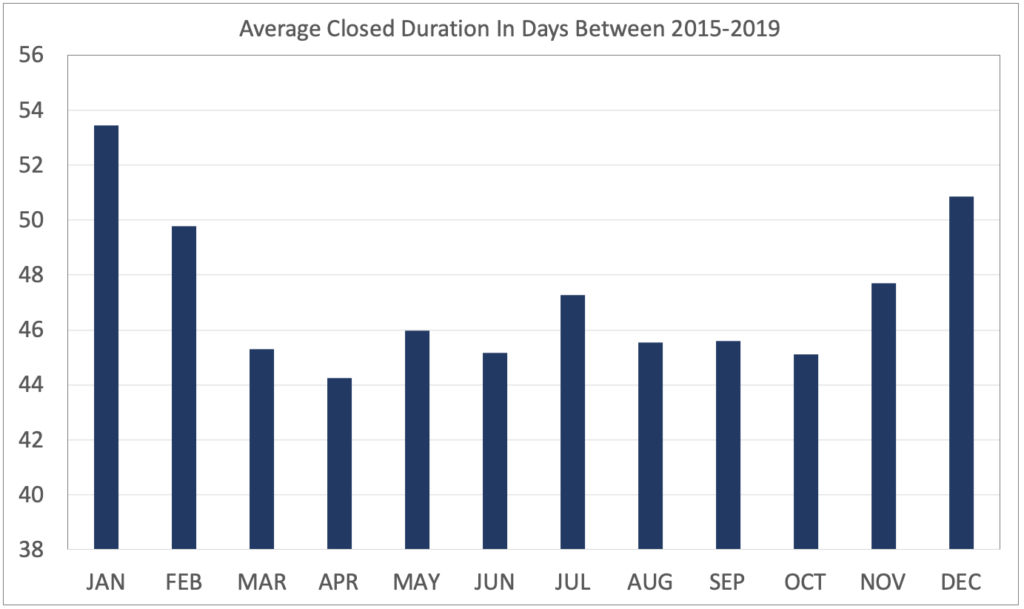

Closed Duration, which measures how many days job listings were open before they were removed (presumably because they were filled by a new hire) in a given month also rose from 47 days to 51 days in January. In this way, our Closed Duration analytic serves as a very strong indicator of hiring velocity across the U.S. economy.

It is important to note, however, that there is seasonality in our Closed Duration metric due to the fact that companies tend to ‘clean up’ their corporate career portals in December/January. This phenomena is sometimes referred to as the ‘Purge Effect’ as companies remove, often in bulk, jobs that were filled during the year but not removed, jobs that they couldn’t fill for any number of reasons, or jobs that they no longer intend to fill. Companies also sometimes refresh, update, or more significantly modify jobs that they intend to continue hiring for in the coming year.

The result is that there is an abnormally high level of activity on corporate career portals around the turn of the year and Closed Duration typically spikes, not necessarily because hiring velocity has slowed, but because employers are doing their annual cleaning of their corporate career portals.

The Closed Duration chart above shows the seasonality of hiring velocity during the year, nearly a perfectly inverted version of the seasonality seen in job growth by month where hiring spikes in the spring, tapers a bit in the summer (especially in July), picks up again in the fall, and then slows down post-Thanksgiving through the holidays.

The Closed Duration is highly relevant to January’s NFP forecast because normally we would look at the elevated Closed Duration in December and January and use December’s job listing activity on LinkUp to forecast January job gains in the BLS Employment Situation Report (there is typically a 30-60 day lag between when a company posts a job and when it gets filled with a new hire).

But because we typically see above-average activity on corporate career portals in December and January, it is more relevant to use the paired month ∆ between December and January’s new and total job listings in our paired month data to forecast January job gains. And while DEC18/JAN19 serve as a case where that methodology quirk proved effective, it is not always so clear or accurate, and our forecasting model is no better or worse for January that any other month of the year. It’s just a quirk in the methodology that reflects the way employers and HR departments typically manage their job openings on their company websites.

So with the usual caveats about the challenges in accurately reading our NFP forecasting alethiometer, we expect to see a very strong jobs report on Friday with a net gain of 225,000 jobs.

Insights: Related insights and resources

-

Blog

03.02.2020

LinkUp Forecasting Job Gains of Only 125,000 in February

Read full article -

Blog

02.17.2020

January 2020 Monthly Recap

Read full article -

Blog

01.07.2020

LinkUp Forecasting Job Gains of Only 116,000 For December

Read full article -

Blog

12.05.2019

Labor Market "Canary In the Coal Mine" May Have Died In November; LinkUp Forecasting Weak Job Growth of Just 80,000 Jobs

Read full article -

Blog

08.01.2019

LinkUp Forecasting Disappointing Job Gains for July

Read full article -

Blog

05.02.2019

LinkUp Forecasting Net Gain of 235,000 Jobs In April

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.