LinkUp Forecasting Not-So-Ugly Job Growth In January

...But Nowhere Near Enough to Move The Needle Closer To Equilibrium Anywhere.

Over the past 6 months or so, our view regarding the job market has been that, rather than being afflicted by a labor shortage, the economy has suffered from an enormous bid-ask spread between employers and employees.

Beyond the given of a safer workplace, workers across the country have held steadfast in demanding more and equal pay, better benefits, remote (or at least hybrid) work, affordable child-care, saner work-life balance, more meaningful careers, and broadly speaking, more dignity and respect.

To summarize the U.S. job market in 2021, workers have rightly been demanding a higher quality of life.

After decades of having the playing field increasingly tilted against them, workers across the country have essentially gone on strike right at the moment things began opening up (albeit unevenly) in the sort-of-post-vaccination world. Given the enormous leverage of the American workforce at precisely this moment, the timing could not have been more perfect had the revolt been premeditated and organized. And the resolve among workers could not be stronger or more determined – at a speed and scale never seen before, workers everywhere have been quitting their jobs both preemptively and with hair-trigger speed after their ‘demands’ were not met by their employer. In retrospect, this hasn’t actually looked like much of a stand-off as workers have pretty much just stood up and walked away from the negotiating table.

But in any event, in our September Non-Farm-Payroll post, we made the observation that, by definition, the illiquidity in the job market would end only when the two sides made the necessary concessions to bridge the divide. In that same post, we correctly predicted that employers would end up capitulating to a far greater extent than employees. But what we did not expect was how fast and how furious employers would cave.

Our thinking was clearly anchored to the Jobless Recovery of ’12-’14 when employers begrudgingly raised wages in fits and starts over a period of years and only after trying every other ‘trick’ in the book to avoid paying living wages, all the while complaining loudly and incessantly every step of the way.

And it worked, too. Businesses didn’t have to raise wages much at all back then and they never really had to work too hard to fill positions – small signing bonuses, even smaller referral bonuses, ping-pong tables, better snacks, a gym in the office, and a new chair were often more than enough to get people back to work.

But this time around, businesses couldn’t afford to run that same playbook over such a protracted period of time.

What we did not fully take into account last fall was the fact that while demand across the economy was decimated by The Great Recession, it’s essentially remained insatiable throughout the pandemic. And as a result of ferocious consumer demand, employers have been hyper-aggressive in not only raising wages but making concessions anywhere and everywhere to fill open positions to avoid losing revenue and market share.

Which brings us to inflation – seemingly the only topic anyone cares about these days. On that topic, we maintain our view that the elevated rate of inflation presently coursing through the system is predominantly the result of businesses struggling to get people back to work to deal with a massive supply shock that has ravaged the economy. Ultimately, the pandemic will get normalized, businesses will figure out what they need to do to fill (or automate) open positions, the supply chain crisis will ease, and inflation will subside from the highs we’re seeing today.

As far as predicting the timetable for that glide path, I’d point to Austin Goolsbee who noted earlier this week on Bloomberg, “The virus is the boss of this thing,” and until Covid runs its course, no one should have any confidence whatsoever in forecasting timelines. Transitory or permanent? Yes. Inflation will persist until the above-mentioned pandemic normalization occurs, after which broader inflation will ease.

What we do expect following that normalization is a permanently elevated cost of labor. A large contributor to the Great Resignation was essentially two generations of stagnant wages in this country and employers and the economy as a whole are now confronting the consequences of that neglect. And on top of that, underlying demographics have not gone away and that force will resume its white-walker-like march on the economy soon enough.

From our perspective, then, the more critical question about long-term inflation is how fast and in what manner businesses solve their labor challenges and therefore, what a truly post-pandemic economy looks like. And it is those two questions that we’ll be concentrating on within these monthly NFP forecast posts as the year unfolds and we hopefully move closer to that post-pandemic world.

Our immediate attention, then, is focused on Friday’s jobs report for January and unfortunately, as Goolsbee noted, Omicron is still ruling the economy and the job market continues to bear the brunt of its devastation. Although labor demand rose slightly in January and despite the fact that we’re forecasting a better-than-expected jobs report for the month, labor demand across the country has essentially come to a grinding halt since September.

As a result, we do not expect Friday’s jobs report to show job gains anywhere near the level required to move the needle in any meaningful way towards equilibrium in the job market, let alone the broader economy from a supply-demand imbalance standpoint.

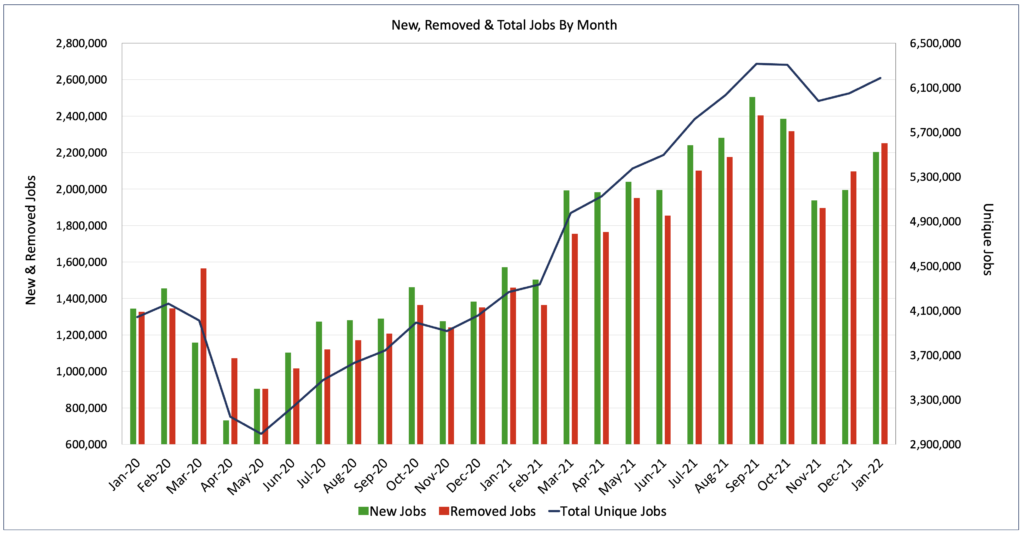

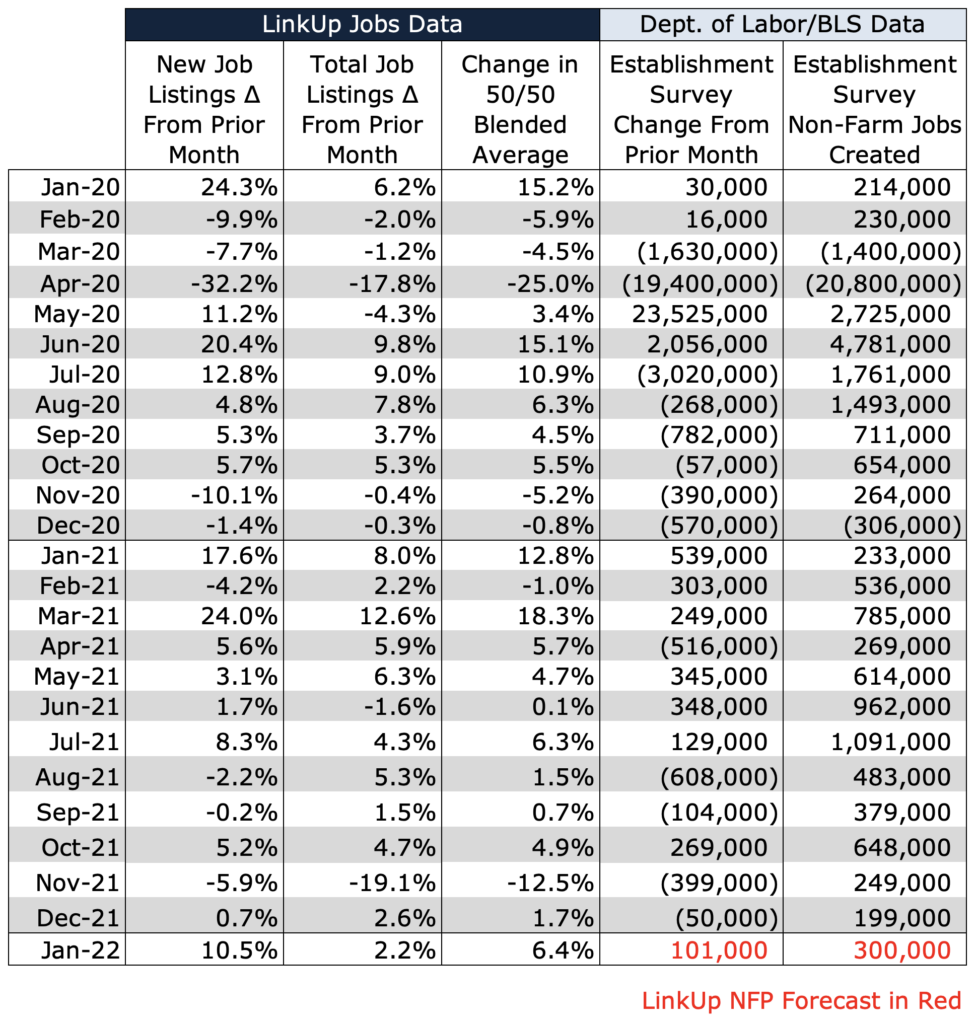

Looking at LinkUp job data for January, total U.S. job openings on company websites globally rose 2.2% while new job openings rose a healthy 10.5%.

As background, our non-farm payroll forecasts are based on LinkUp’s job market data – a global database of job openings indexed every day directly from company websites around the world. As a result of our unique dataset, our high-frequency data is accurate, powerful, and insightful. And because a job opening posted on a company’s website signals the intent to make a hire, our data is predictive and highly correlated to job growth in future periods.

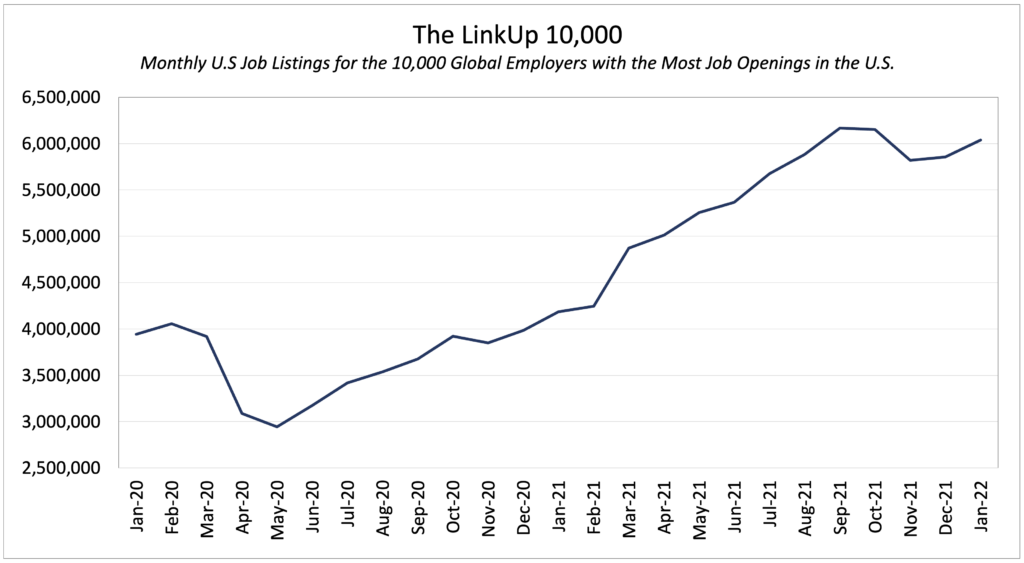

As we noted previously, of particular note in each of the charts below is the impact of Omicron on labor demand. Undoubtedly there is some seasonality in the decline in job openings in Q4, but Omicron is a far larger contributor and it goes without saying that the impact on job growth and the economy has been and will be severe.

The LinkUp 10,000, which tracks total job openings from the 10,000 global employers that have the most job openings in the U.S., rose 3.1% in January but remains below its peak in September.

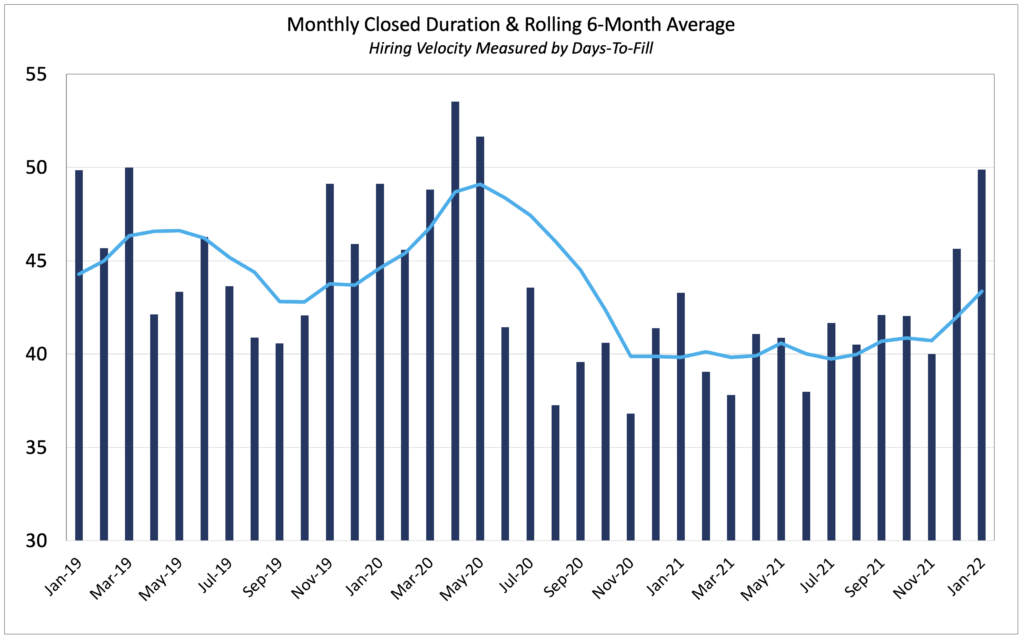

Job Duration, the average number of days that job openings are posted on company websites before they are removed – presumably because the job was filled – essentially measures hiring velocity across the economy. And in January, Duration rose to 50 days as labor demand plateaued, hiring stagnated, and people remained reluctant to return to the workforce.

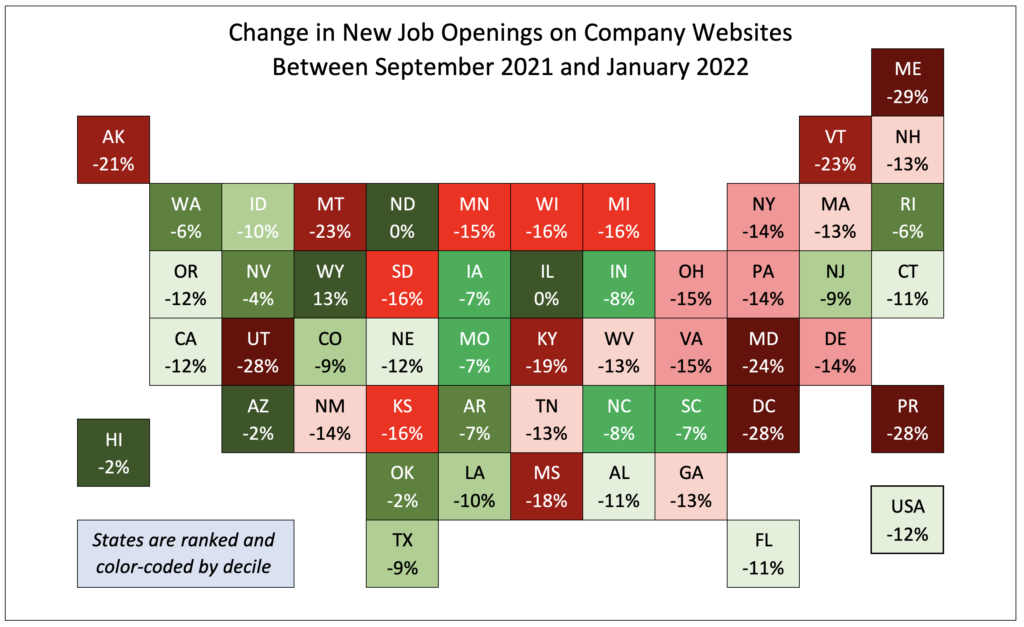

Since September, new job openings across the country have dropped 12% with larger declines seen in the upper midwest and northeast.

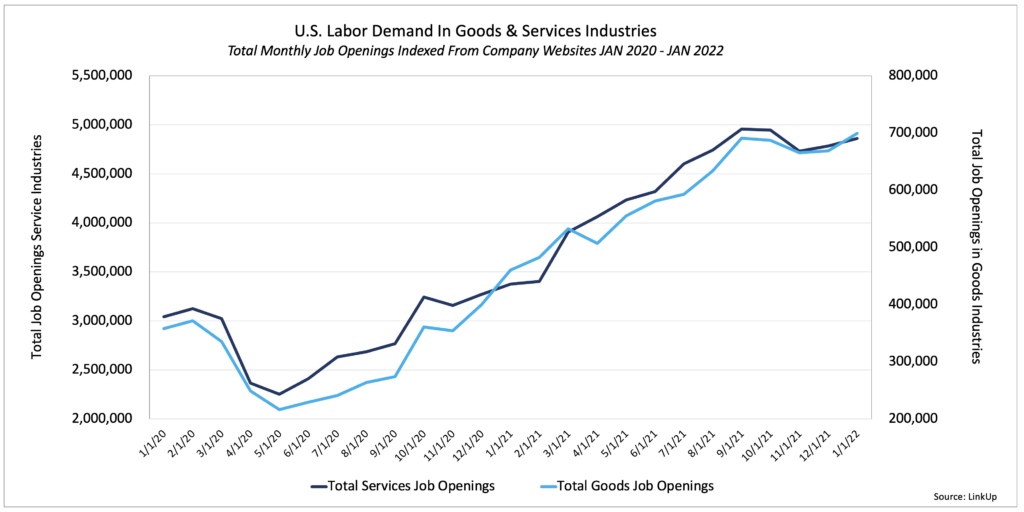

Labor demand in both goods and services related industries has shown a similar plateau since September, with goods-producing industries rising slightly faster than services industries in January.

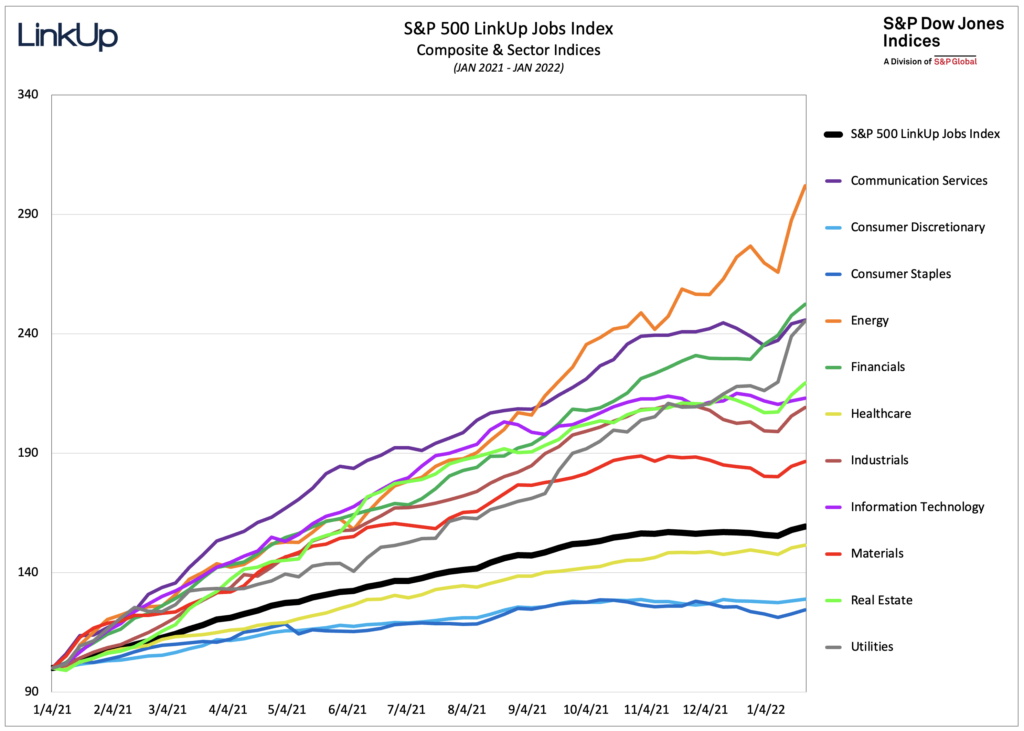

The S&P 500 LinkUp Jobs Index has also remained flat since October with only 3 sectors, Financials, Energy, and Utilities, showing any material gains.

Far more encouraging is the fact that this week, the S&P 500 LinkUp Jobs Index rose 95 basis points with every sector rising between 50-500 bps. Energy led the pack again with a jump of just over 5%.

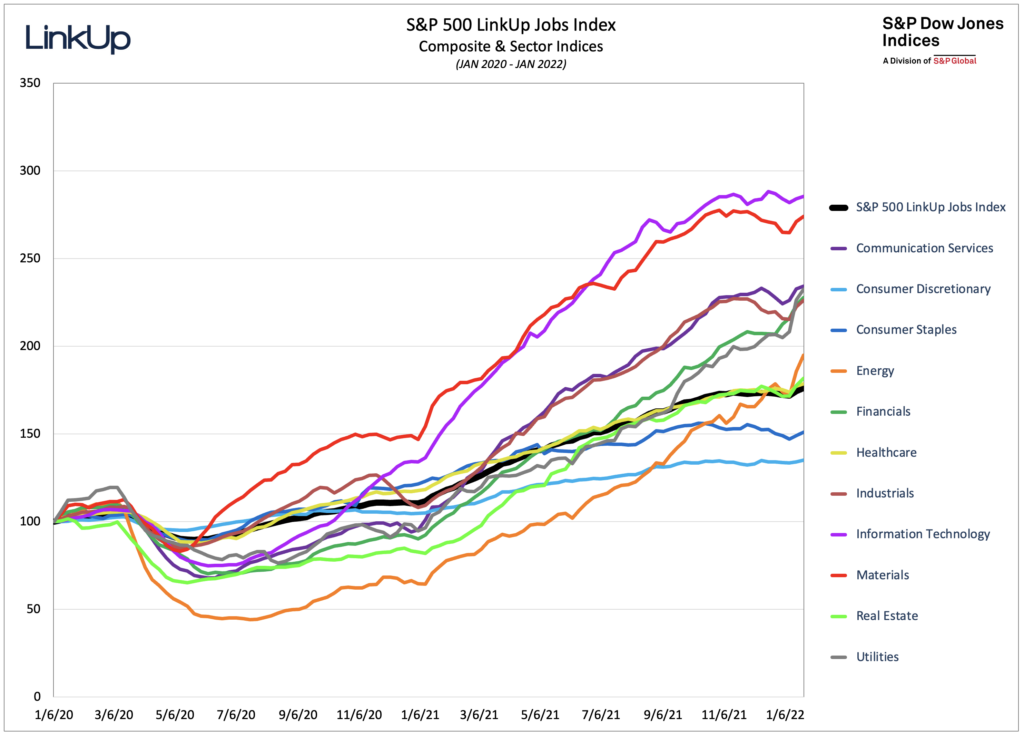

Since January of 2020, labor demand in every sector of the S&P has risen above pre-covid levels, with Information technology and Materials far outpacing all other sectors.

So based on our data, we are forecasting a net gain of just 300,000 jobs in January, slightly above consensus estimates of 160,000 jobs.

But as the country knows all too well, predicting the behavior of a crazy, tyrannical despot is a tough racket, and Omicron’s impact on January’s jobs report gives us serious pause. The White House has been aggressively signaling a horrible number all week, but we remain hopeful it won’t be as ugly as they are indicating. We’ll see.

Insights: Related insights and resources

-

Blog

09.26.2022

It's Now Just Job Vacancies. The Rest Is Noise.

Read full article -

Blog

08.04.2022

Heads I Win, Tails You Lose; Reflections on the Still-Cooling But Strong Job Market

Read full article -

Blog

06.01.2022

LinkUp Forecasting Disappointing Jobs Numbers For May and Continued Weakness in June

Read full article -

Blog

10.07.2021

LinkUp Forecasting Net Gain of 625,000 Jobs In September But Large Bid-Ask Spread In Job Market Will Persist

Read full article -

Blog

09.01.2021

Get a Shot and Wear a Mask to Save Lives and Help the Job Market. Jabs and Jobs!

Read full article -

Blog

07.01.2021

June 2021 Non-farm Payroll Forecast: The Growing Bid/Ask Spread Between Employers and Employees

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.