LinkUp Forecasting Net Gain of 625,000 Jobs In September But Large Bid-Ask Spread In Job Market Will Persist

This past May, following a disappointing jobs report for April, we posted that the job market was not afflicted with a labor shortage but rather a wage shortage.

In subsequent months, we expanded our argument by laying out the case that the job market was suffering from a massive bid-ask spread between employers and employees. Health risks and economic devastation from COVID were obviously the primary contributors to illiquidity in the job market, but beyond those first-level factors, the pandemic incited what we called in June’s post a ‘stealth revolution.’ We articulated this ‘collective, nationwide strike’ as follows:

…coming out of lockdown after the stress and trauma of a pandemic, combined with the isolation and/or self-reflection of being quarantined for such an extended period of time, that there has been a massive, collective, nation-wide reassessment of priorities, passions, careers, work-life-balance, the kind of company people want to work for, and what people want to do with their lives.

The world is vastly different for everyone than it was 18 months ago and a meaningful chunk of the workforce is simply not willing to go back to the same job they had before the pandemic. At the very least, they’re not willing to go back to their old job at the same salary. It’s almost as if we’re watching a stealth revolution of sorts – a collective, nationwide strike against all the inequities and injustices that have built up over so many years.

We’ll see how fleeting or sustained this strike is but for certain it will end eventually, one way or another. Either rapidly or slowly over a torturous, drawn-out process, some sort of equilibrium will be reached. One side or the other (or both) will make the necessary concessions around wages and working conditions and the multitude of other factors that come into play when a job opening is filled with a new hire.

As we also made clear in that same post, there was not then and is not now a shortage of labor. Even after a gain of 2.25M jobs between June and August, there are still 18.6M Americans that are unemployed, underemployed, or not in the workforce but want a job.

At the same time, labor demand in the U.S., as measured by job openings, has reached record heights. But despite ample supply and abundant demand, the U.S. economy added a paltry gain of just 235,000 jobs in August. So the modest pace by which the bid-ask spread narrowed in June and July has effectively come to a screeching halt, leaving massive uncertainty around what lies ahead for the job market, unemployment, wages, inflation, Fed policy, and the economic recovery.

Based on our job market data, we’re forecasting better-than-expected job growth in September but we firmly maintain our view that the bid-ask spread between employees and employers remains a yawning chasm that will continue to wreak havoc for the country for as long as it persists.

There are a number of obstacles to resolving this stalemate but we’d generally summarize the situation as such: the nation’s workforce has effectively gone on strike and is demanding a wide range of hugely material concessions that all essentially boil down to improving quality of life.

We’ll start with the most obvious quality of life factor causing illiquidity in the job market which is, not surprisingly, life itself. In addition to the devastating effect on businesses and workers directly impacted by the pandemic, Covid has introduced a significant risk factor at work and people are simply unwilling to put their health at risk for a huge number of jobs in the economy that employers are struggling to fill.

Despite the alarming preponderance of people who have become completely unhinged about masks and vaccinations, most sane people want to stay healthy and live. And I’d like to believe, even in the face of a growing body of evidence to the contrary, that most people want to help keep their fellow citizens healthy and safe as well. How silly and naive of me, I know.

The second most significant quality of life factor is wages. Much has been said and written about wages here and elsewhere, but suffice it to say that we have 40+ years of ground to make up for stagnant wages, the present, epically horrifying levels of income inequality, and the inexcusable levels of working poor. Wages will and must go up for the U.S. to sustain both a functioning economy and a functioning society.

And the third quality of life category is a catch-all set of demands from workers that includes not only things like remote work, flex time, career development opportunities, and work-life balance, but also center around corporate culture, mission, values, life-purpose, fulfillment, respect, and dignity.

Again, much has been written about these factors here and elsewhere, but the short version is that workers have generally reprioritized and reoriented their lives and employers have taken a beating in the process. Even more importantly, workers are demanding a shift in the balance of power between capital and labor that will likely have a significant impact on the future of work in the U.S.

It will take time for this bid-ask spread to narrow and both sides will give in to some degree, but our view is that employers will end up ceding the most ground. As Bloomberg reported earlier this week (whiffing on an obvious and terrific headline about the current game of chicken between employers and workers…), when half of Raising Cane’s office personnel are being asked to work shifts as fry cooks, cashiers, and recruiters while the restaurant chain tries to hire 10,000 employees for its 530 locations in 50 days, it’s a good bet that employers everywhere are going to be rethinking every aspect of their business and making the changes required to operate in what will be a massively revamped U.S. economy that must be modernized for the 21st century.

Some companies will certainly resist, futilely trying to hold an outdated fort and letting the chips fall where they may (most likely obsolescence). And many will (and should) increase automation, robotics, and technology to increase efficiency, lower costs, and fix a flawed business model the rests largely on under-paying employees for jobs that most people don’t want. And without question, along the way, there will be constant wailing and gnashing of teeth, crazy amounts of dislocation and disruption, ample helpings of tension and friction, and lots and lots of fireworks.

Depressingly, Washington will be a useless bystander during the tumult thanks to Mitch McConnell and his two biggest allies in Manchin and Sinema. And what shame. Washington could and should be a hugely valuable third leg in the stool doing their part to strengthen the economy, the job market, and the nation as a whole by addressing policy issues such as healthcare, education, childcare, immigration, housing, social justice, and transportation, to name just a few.

So in the end, against a justifiably obstinate workforce, business will eventually, by and large, capitulate and the bid-ask spread will be sufficiently bridged to allow the economy to start moving into a post-COVID era. And as we indicated previously, based on our data over the past month, we expect a positive step forward with tomorrow’s jobs report for September (and not because the expanded unemployment benefits have expired as some would have us believe – a factor that has been proven to have had little to no impact on people’s reluctance to return to work).

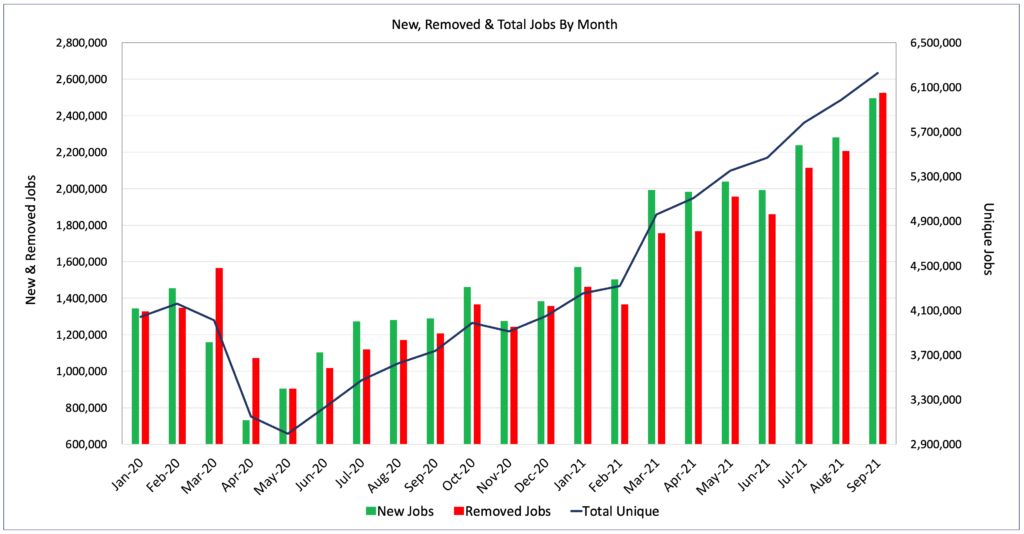

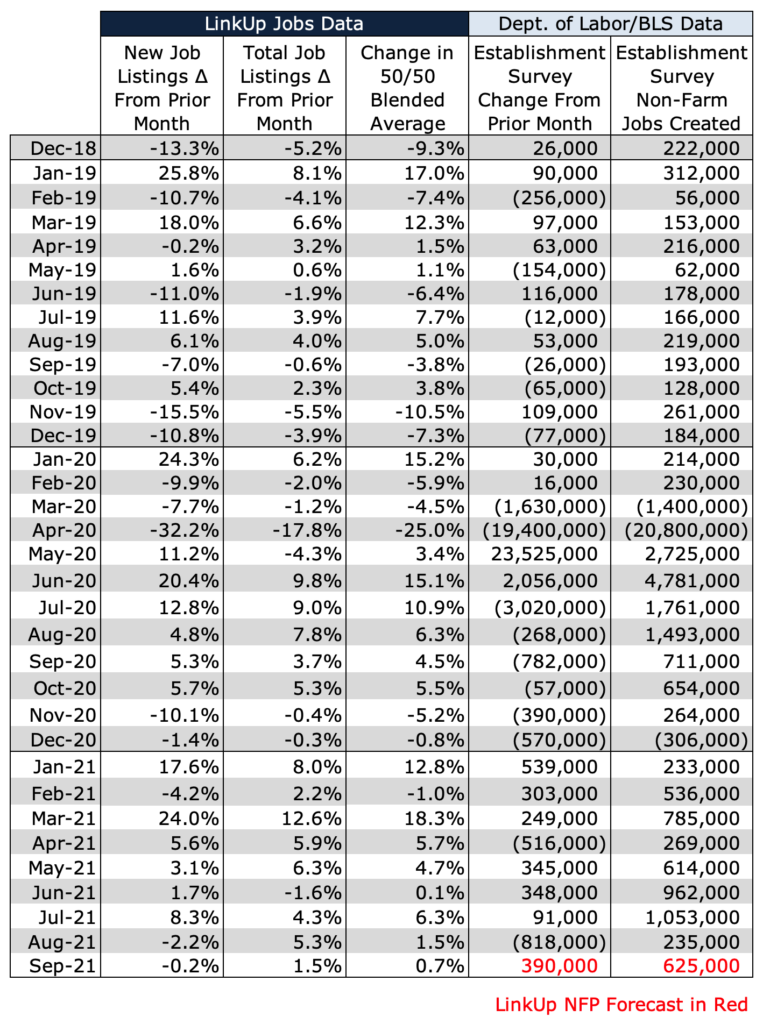

So looking at our data for September, total job openings in the U.S. rose 4% to 6.2 million and new and removed jobs rose 9% and 14% respectively. As we’ve noted over the past few months, jobs removed from a company’s corporate career portal a great proxy for that job having been filled, so it is equally as important a metric as new and total job openings.

As an aside, our non-farm payroll forecasts are based on LinkUp’s job market data – a global database of job openings indexed every day directly from company websites around the world. As a result of our unique approach, our high-frequency data is accurate, powerful, and insightful. And because a job opening posted on a company’s website signals the intent to make a hire, our data is predictive and highly correlated to job growth in future periods.

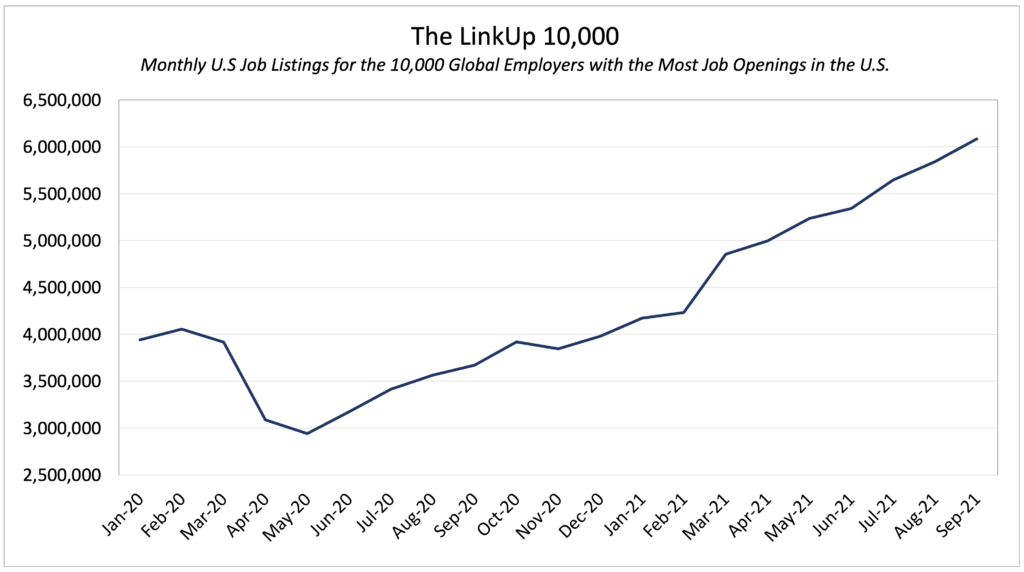

Similarly, The LinkUp 10,000 rose 4% to 6.1 million. The LinkUp 10,000 is an analytic we created to normalize our data and tracks the total job openings from the 10,000 global employers that have the most job openings in the U.S. Since January, The LinkUp 10,000 has risen 46% and since May of 2020, it’s up 107%.

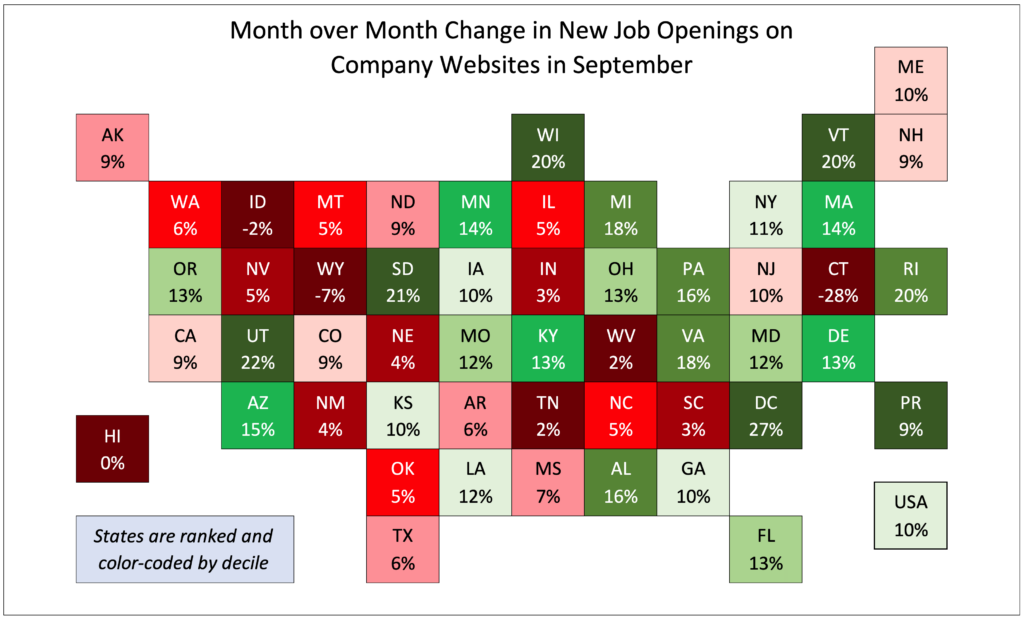

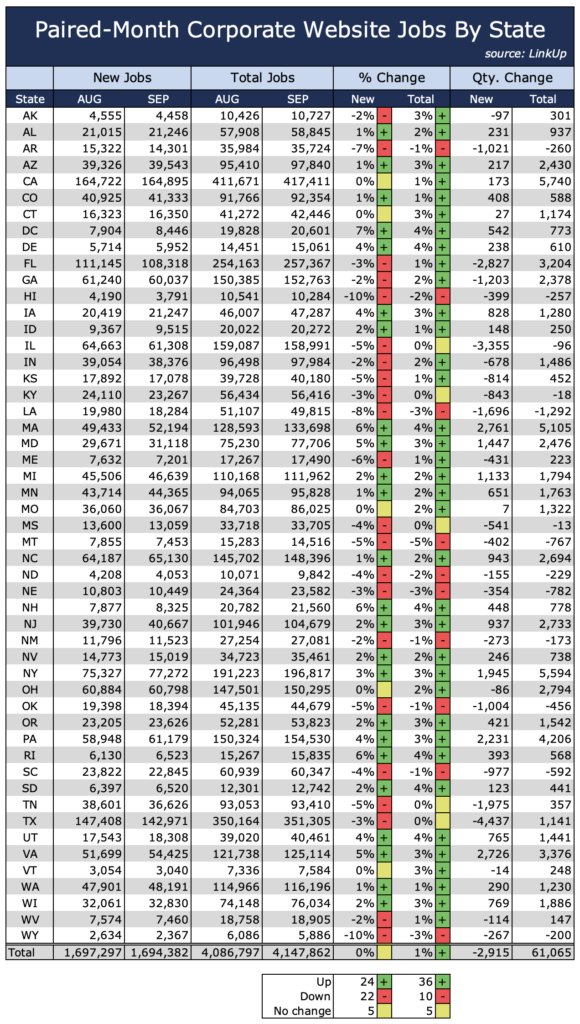

Looking at the month-over-month change in new job openings by state with states color-coded by decile rank, it’s evident that, generally speaking, there is still a correlation between rising labor demand and red/blue state delineations with blue states typically in the higher deciles.

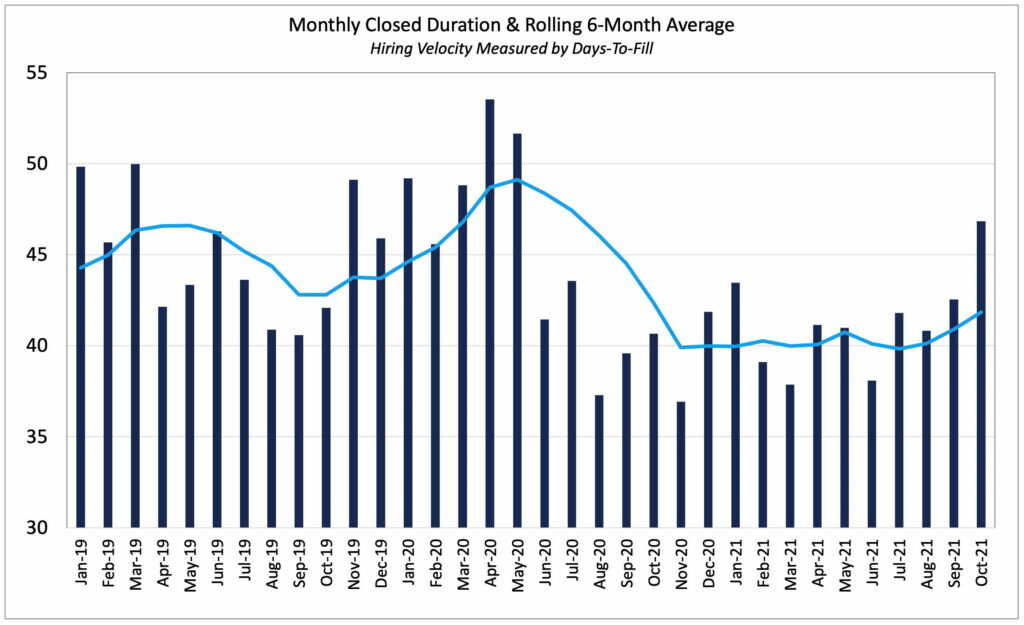

Job Duration, the average number of days that job openings are posted on company websites before they are removed – presumably because the job was filled, essentially measure of hiring velocity across the economy. And in September, hiring velocity jumped to 46 days as companies finally filled jobs that had been posted earlier in the summer.

Looking at our paired month data which tracks job openings for a common set of companies that were hiring in both August and September, new job openings were unchanged while total job openings rose 1%.

So based on our data, we are forecasting a net gain of 625,000 jobs in September, somewhat above the 490,000 consensus estimate.

So we definitely expect some positive news tomorrow, including possibly even an increase in the unemployment rate due to more people being classified as unemployed because they’ve once again started actively looking for work which would be a very encouraging sign.

But as we’ve consistently communicated, there’s no reason to draw too many conclusions or get too excited about a single month’s report. Beyond the volatility of subsequent revisions, this road to bridging the bid-ask spread in the job market will undoubtedly be a long, protracted slog that will likely run well into next year.

On that last point, it’d be great to be dead wrong – let’s hope we back to a healthy, liquid, strong job market and a better new normal much faster than we expect.

Insights: Related insights and resources

-

Blog

01.05.2022

LinkUp Forecasting Net Gain of 260,000 Jobs In December

Read full article -

Blog

12.10.2021

November 2021 Jobs Recap: a substantial slowdown with far fewer job listings

Read full article -

Blog

12.02.2021

LinkUp Forecasting a Net Gain of Just 380,000 Jobs In November

Read full article -

Blog

11.02.2021

There Is No Labor Shortage But There Is a Shortage of Dignity and Respect For Workers

Read full article -

Blog

08.05.2021

Bid/Ask Spread in Job Market Narrowing; July Non-Farm Payrolls Will Surprise to the Upside

Read full article -

Blog

07.01.2021

June 2021 Non-farm Payroll Forecast: The Growing Bid/Ask Spread Between Employers and Employees

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.