LinkUp Forecasting Net Gain of 260,000 Jobs In December

As we ring in the year New Year amid climate chaos and a seemingly never-ending pandemic, to name just two of the leading sources of our collective trauma these days (not to mention the fact that we’re now in an election year), it’s incredibly difficult to steer clear of the black hole we appear to be racing towards at lightning speed.

Things just keep getting more and more warped – and not just reality itself but also the twisted disconnect between reality and whatever alternate universe so many people apparently inhabit.

And to the list of the three hyperobjects cited above, phenomena that defy comprehension, I’d add a fourth – human susceptibility to delusion. For the moment, however, I’ll set that one aside (at least for the time-being; we’ll see how the year progresses) and dial that fourth phenomena down a notch to ‘Human Fallibility’. And while capitalism stands as another oft-cited hyperobject, I’ll focus here on a subset of capitalism (or at least economics), and comment yet again on a few of the perplexing disconnects between perception and reality afflicting some broadly-held views these days regarding the economy, inflation, and the labor market.

I’ll start with the most confounding disconnect (and perhaps the most alarming given the implications for the election later this year) between the job market and consumer confidence. As Bloomberg’s Joe Weisenthal recently highlighted, the widening gap between people’s perception of the job market and the economy has reached truly absurd levels. In fact, the public’s positive view of the labor market has never been higher while consumer confidence reached a 9-month low in November.

Post-Thanksgiving data notwithstanding (we’ll return to that in a minute), unemployment is near pre-covid levels, labor demand is through the roof, jobless claims keep surprising to the downside and are now the lowest since 1969, quits are at all-time highs, wages are rising, workers are finally gaining some leverage over employers, unemployment is falling, and even labor force participation is slowly starting to inch up.

Widening the lens to the broader economy, supply-chain bottlenecks are starting to get resolved, GDP growth is solid, corporate profits are at record levels, and the Purchasing Managers Index continues to signal expansion. Early signs point to robust holiday sales and forecasts for continued strength and robust hiring in the year ahead remain positive.

As is always the case, Krugman does a brilliant job perfectly articulating not only the strength of the recovery in 2021 but also the disconnect between that recovery and people’s perception of the broader economy outside their own household.

So despite a portugal-sized omicron wave, the only thing that might abort a sustained economic expansion is a misguided rate hike by the Fed which brings me to the second irrational disconnect in today’s economy – inflation. And it is inflation, alongside long-haul covid distress, that is likely inducing the dismal state of consumer confidence these days.

Regarding inflation, of course it’s risen this year – just as everyone expected when the economy went from zero to 100 mph in a nanosecond coming out of a mass quarantine. And given the cruelty and insanity of the anti-vax movement, volatility and inflation are likely to stay elevated for the foreseeable future. The question is to what degree and, ultimately, whether or not the panic-stricken terror a modest dollop of inflation has induced is justified.

On that note, one would be forgiven for perusing mainstream media headlines these days and mistakenly thinking they were reading the National Enquirer:

• Not terrified of The 70’s? YOU WEREN’T THERE!

• Could Raises Lead to a Wage-Price Spiral?!

• Lock yourself indoors! STAGFLATION IS COMING!!

As Krugman notes again and again, inflation is a potent, emotional topic that can be interpreted recklessly and applied errantly, and in today’s hyper-polarized, hyper-politicized, perpetually enraged, social-media frenzied, click-bate seeking, viewership-obsessed maelstrom, it is clearly being weaponized ruthlessly.

As we’ve noted for months, our view is that inflation will ebb from its high-water mark as supply-chains get sorted out and as the pandemic either recedes or gets ‘normalized’ into every-day life. At the same time, we also believe that inflation, driven mainly by continued but modest and long-overdue wage inflation, will remain slightly elevated above the lows we’ve seen for decades due to demographics and the new, post-pandemic, post-Great-Resignation reality.

The third disconnect we’ll touch on is the topic we’ve commented on most over the past 6 months – the fact that there actually is no labor shortage. What there is, rather, is a massive bid-ask spread between employers and employees that is narrowing quite rapidly as employers raise wages, embrace remote work, relax return-to-the-office mandates, strengthen benefits, improve corporate culture, and begin to appreciate, in a broader sense, that employees are not only critical but that they are actual people and need to be treated as such. Calling the present situation a labor shortage is akin to walking onto a new car lot and, seeing no cars for $10,000 or less, declaring that there’s a debilitating car shortage.

Employers recognized this fact sooner than we first imagined back in the spring when we commented on the recovery from the pandemic relative to the recovery from the Great Recession, and they’ve capitulated to the demands of workers faster and far more aggressively than we initially expected. So rest assured, the pandemic will end, employers will keep raising wages if necessary and making other critical concessions (sometimes even shocking ones), schools will provide in-demand skills, workers will return to the job market, and whatever jobs cannot get filled will be automated or eliminated. And while there will be some disruption, plenty of dislocation, abundant churn, and excessive gnashing of teeth, the bid-ask spread will keep narrowing and the job market will reach equilibrium.

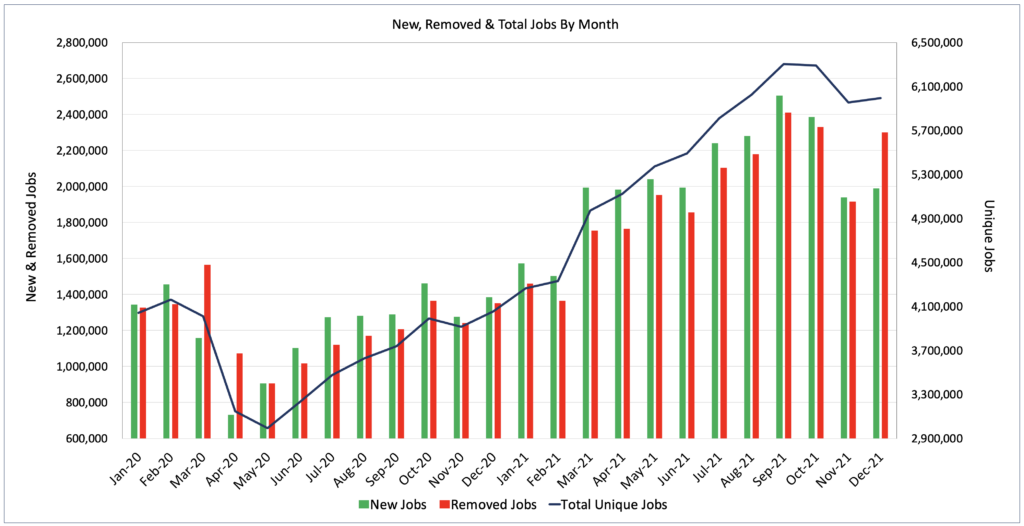

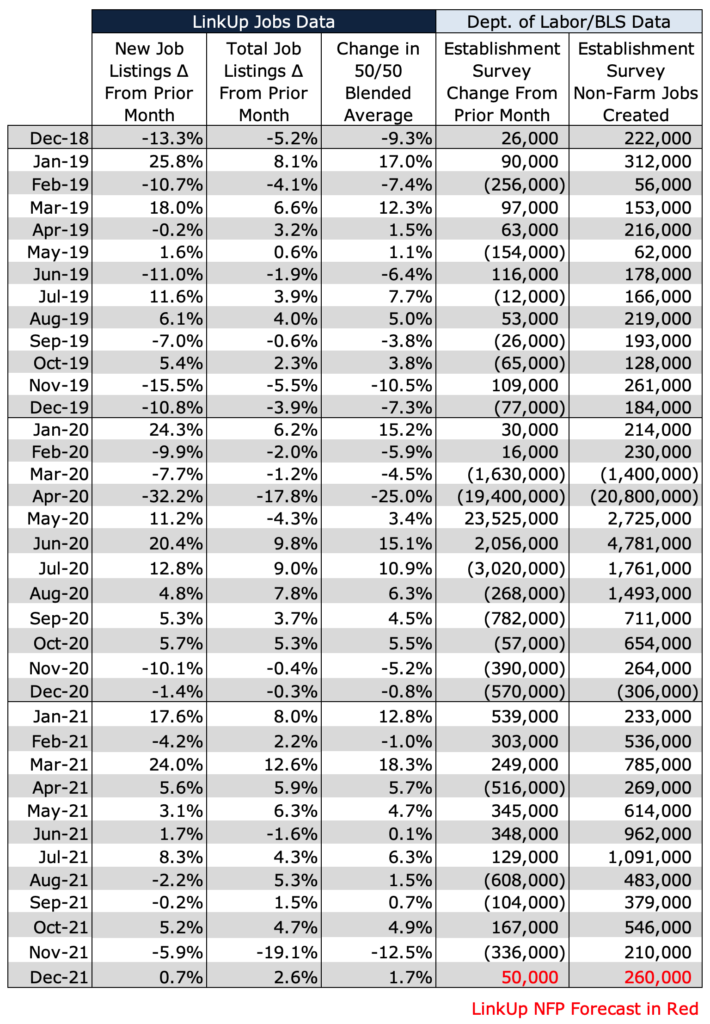

Unfortunately, based on LinkUp’s job market data for the month, we expect a disappointing jobs report for December. Total U.S. job openings on company websites globally rose just 0.7% in December while new job openings rose just 2.6% and remain 20% below their peak in September.

As background, our non-farm payroll forecasts are based on LinkUp’s job market data – a global database of job openings indexed every day directly from company websites around the world. As a result of our unique dataset, our high-frequency data is accurate, powerful, and insightful. And because a job opening posted on a company’s website signals the intent to make a hire, our data is predictive and highly correlated to job growth in future periods.

Also of note in the chart above, jobs removed from company websites in December rose 20% but a large percentage of that reflects the annual ‘purge effect’ when HR departments typically clean up their corporate career portals and remove jobs that they don’t intend to fill in the coming year.

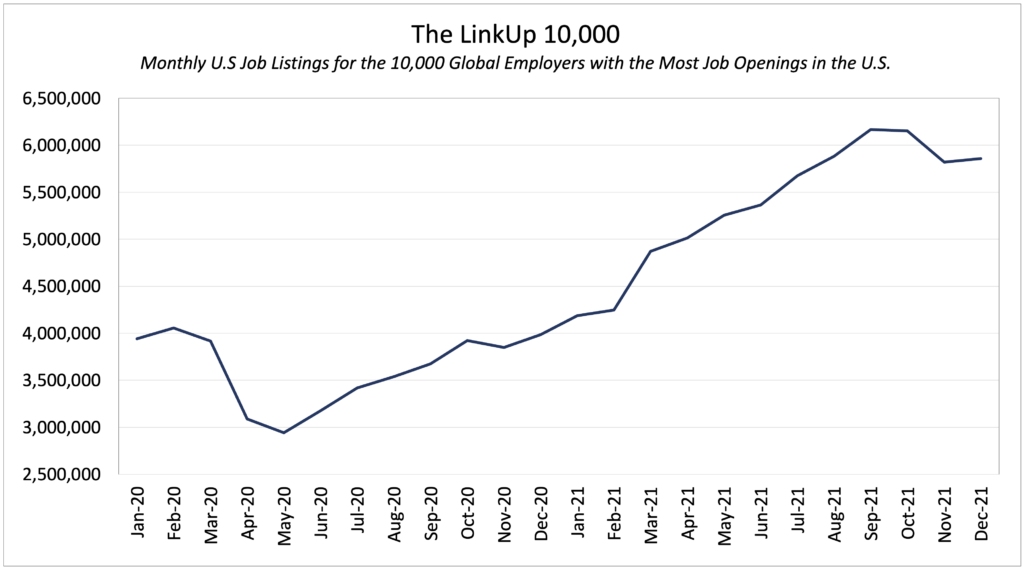

The LinkUp 10,000, which tracks total job openings from the 10,000 global employers that have the most job openings in the U.S., rose just 0.6% in December.

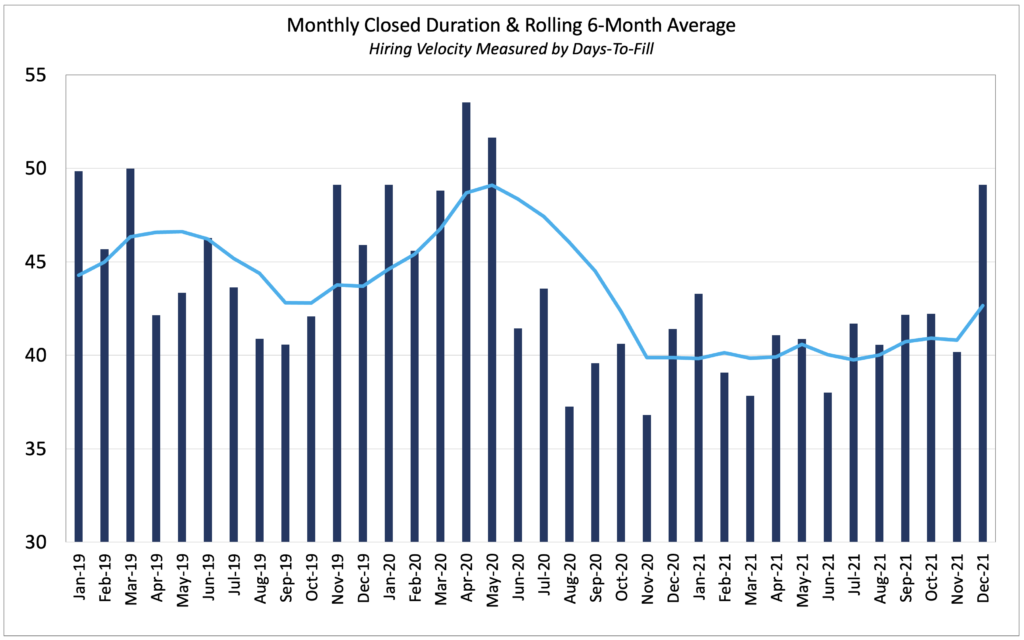

Job Duration, the average number of days that job openings are posted on company websites before they are removed – presumably because the job was filled – essentially measures hiring velocity across the economy. And in December, Duration shot up to to 49 days due to the previously mentioned ‘Purge Effect’ when employers remove old, outdated openings from their company websites that typically have been posted for a longer-than-average period of time.

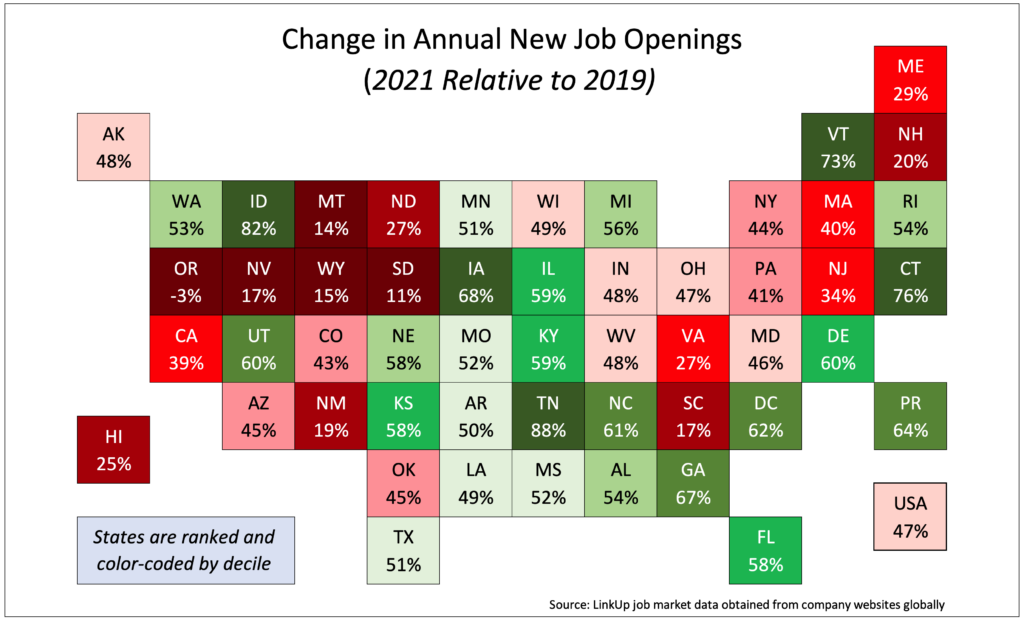

For the year, new job openings across the country rose a dramatic 47% relative to pre-pandemic 2019, with wide dispersion across the country.

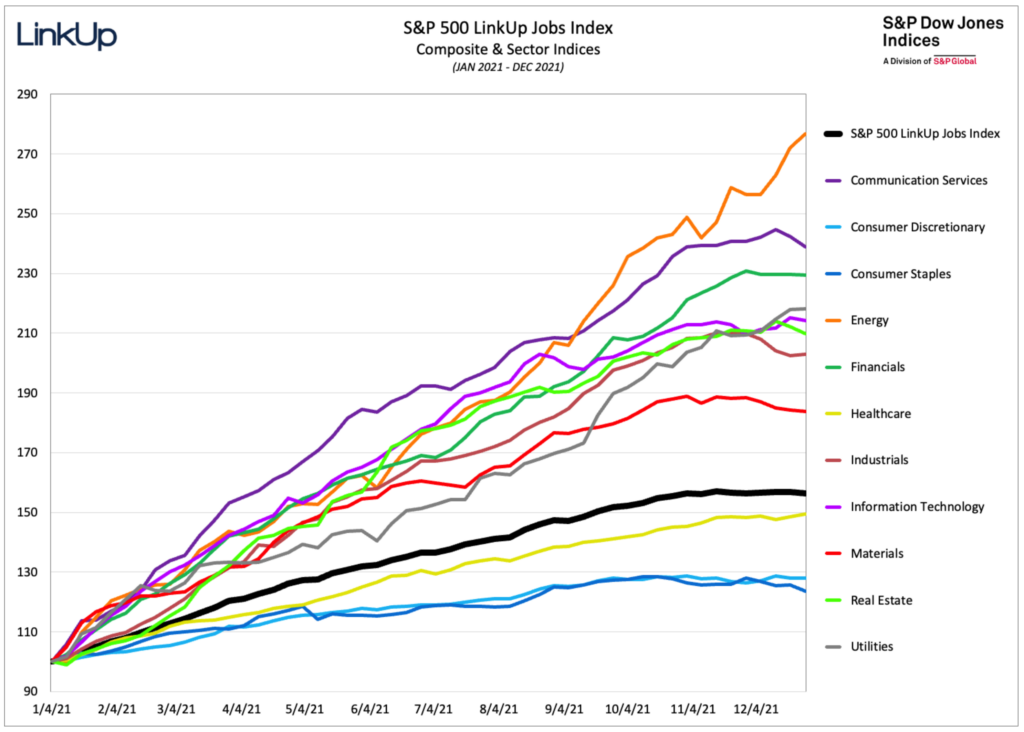

The S&P 500 LinkUp Jobs Index has remained essentially flat since October with only 2 sectors, Energy and Utilities, showing any material increase. Since the beginning of the year, job gains in the Energy sector are particularly noteworthy given the correlation to the record market gains in that sector in 2021.

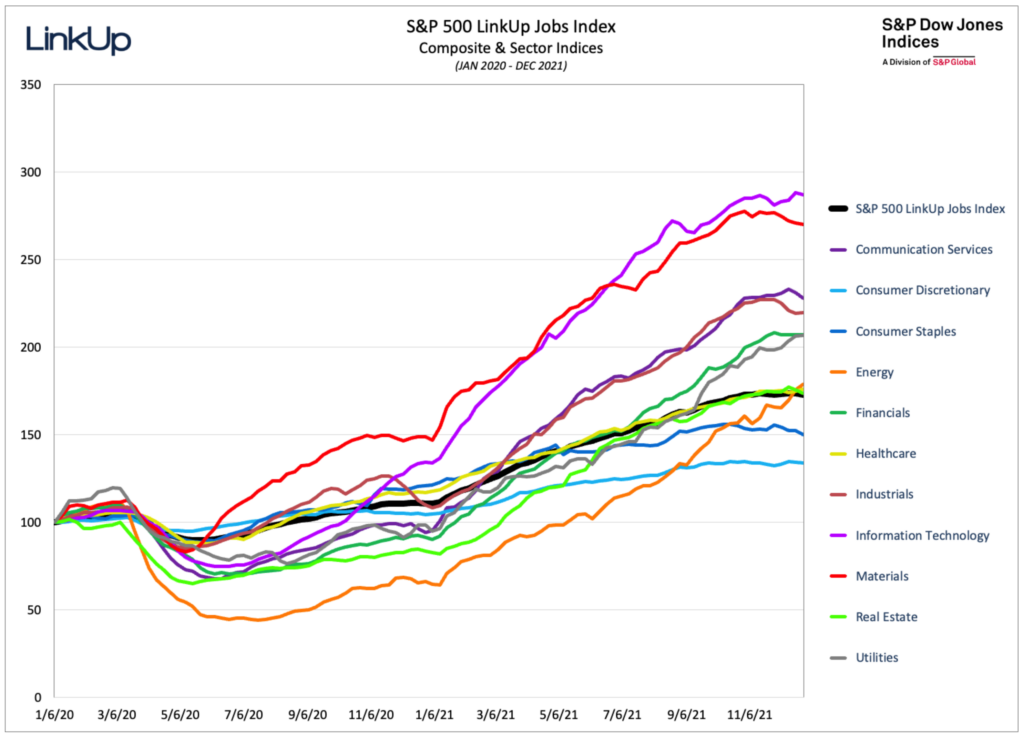

Since January of 2020, labor demand in every sector of the S&P has risen above pre-covid levels, with Information technology and Materials far outpacing all other sectors.

So based on December data, we are forecasting a disappointing net gain of just 260,000 jobs in December, well below the consensus estimate of 405,000.

And because tomorrow is the one-year anniversary of the attempted insurrection, we’d be remiss in failing to note that of all the warping of reality these days, by far the most horrific, unbelievable, and catastrophic is the Big Lie and the Republican Party’s march toward autocracy. As Thomas Friedman notes, the country is presently headed toward an ‘extinction-level’ event and we expect that in addition to all the 2022 discussion threads mentioned above (which are now relegated to the mundane and innocuous relative to the obliteration of American democracy), another will be the preponderance of serious and legitimate discussion of the coming civil war in America.

I warned you of the difficulty in steering clear of the black hole. Happy New Year.

Insights: Related insights and resources

-

Blog

08.30.2021

Labor Demand in Goods Producing Industries Outpacing Labor Demand in Service Industries

Read full article -

Blog

02.11.2021

Insights from our 2020 Jobs Report [COVID impact on labor demand]

Read full article -

Blog

10.07.2020

Shopping, Shipping, and Signals of Holiday Hiring

Read full article -

Blog

06.22.2020

Fiscal Fitness: Peloton jobs are up while gyms are down

Read full article -

Blog

06.05.2019

Cannabis Jobs, High On Success

Read full article -

Blog

07.29.2018

LinkUp Forecasting Mildly Disappointing July Job Gains; LinkUp 10,000 Hinting That Trade Policy Is Starting To Dampen Labor Demand

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.