LinkUp Forecasting Net Gain of 160,000 Jobs in December and No Recession in 2023

As the calendar turns to 2023, it’s been deeply engrossing and quite entertaining to read the commentary around what transpired in the US economy over the past year, what everyone thought was going to happen, and what people believe is in store for the coming year.

As the WSJ put it in a recent article entitled Wall Street and the Fed Flopped in Trying to Predict 2022, “Almost everyone on Wall Street and in Washington got 2022 wrong. The Federal Reserve expected 2021’s inflation surge to be transitory. It wasn’t. Core inflation climbed to a four-decade high this fall, nearly tripling the Fed’s full-year forecast. Top Wall Street analysts predicted markets would have a so-so year. They didn’t. With just a few trading days left in 2022, the S&P 500 is down 19% and on course for its biggest annual loss since the 2008 financial crisis. Bonds are headed for their worst year on record.”

To the list above, add the job market which almost everyone not only got wrong, but to an embarrassingly large degree. Through November, consensus estimates called for job gains of 3.2 million jobs while the US economy added a net gain of 4.3 million jobs – a miss of 26%.

While we may have erred a bit with our view that inflation would be more transitory than it was in 2022, our non-farm payroll forecasts (4.2 million in the aggregate) were spot on the mark with a negligible 2% tracking error.

One might advise us to resolve in the New Year to stay in our lane and stick strictly to the job market, but we wouldn’t make it a week. And in any event, core inflation continues to drop and if given some reasonable accommodation for the unexpected war in Europe and stubborn Omicron variants that persisted for much of the first half of the year, both of which kept inflation elevated as a result, the transitory camp seems to be guilty of little more than a foot fault while inflation hysteria continues to run amok.

As Claudia Sahm points out, arguably the most vocal inflation hysteric has been Larry Summers who’s been simultaneously bashing the American Rescue Plan for stoking the rise in prices. I’m not sure what planet Larry lives on, but the US economy is running laps around the rest of the world and the data about the health of the economy and what the American Rescue Plan has done for the country speaks for itself.

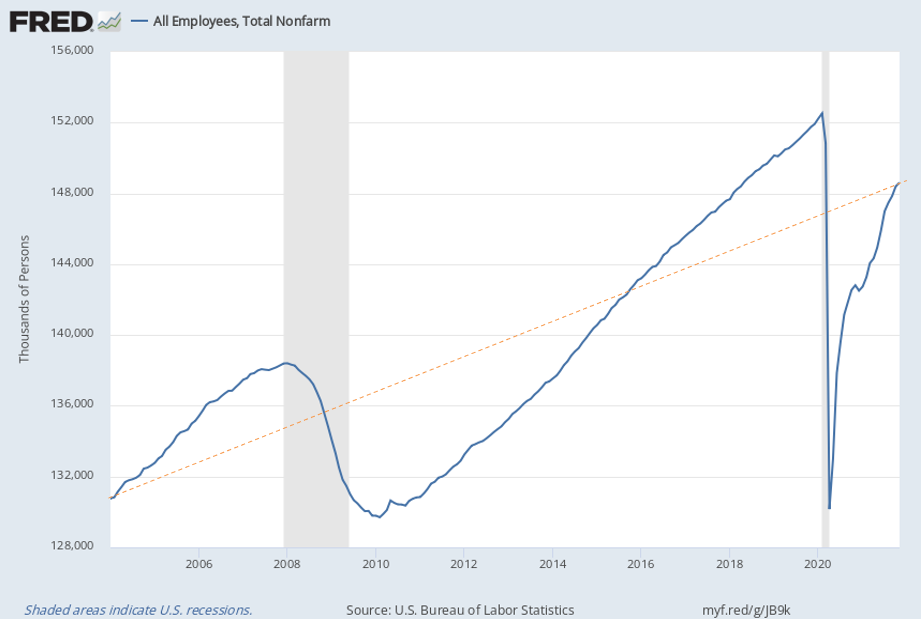

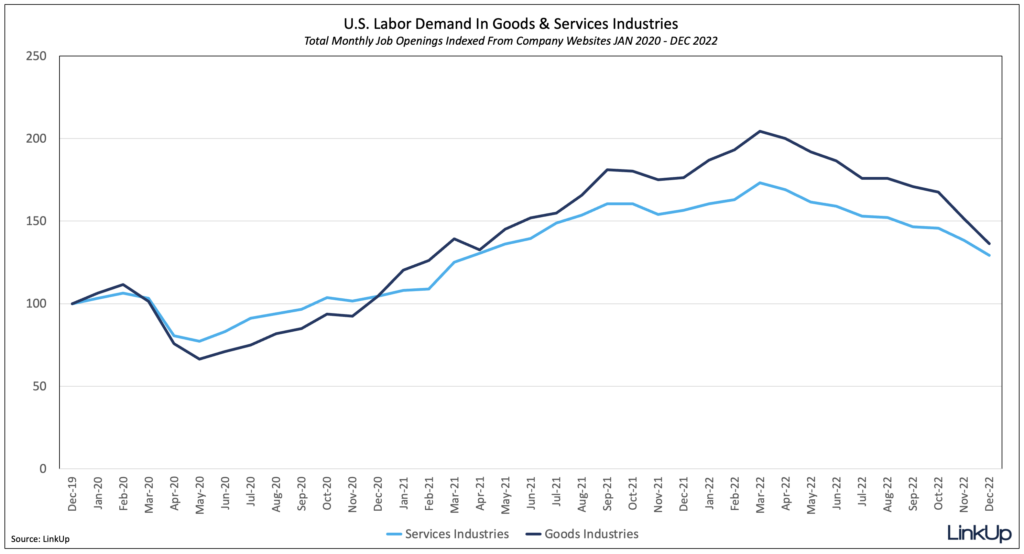

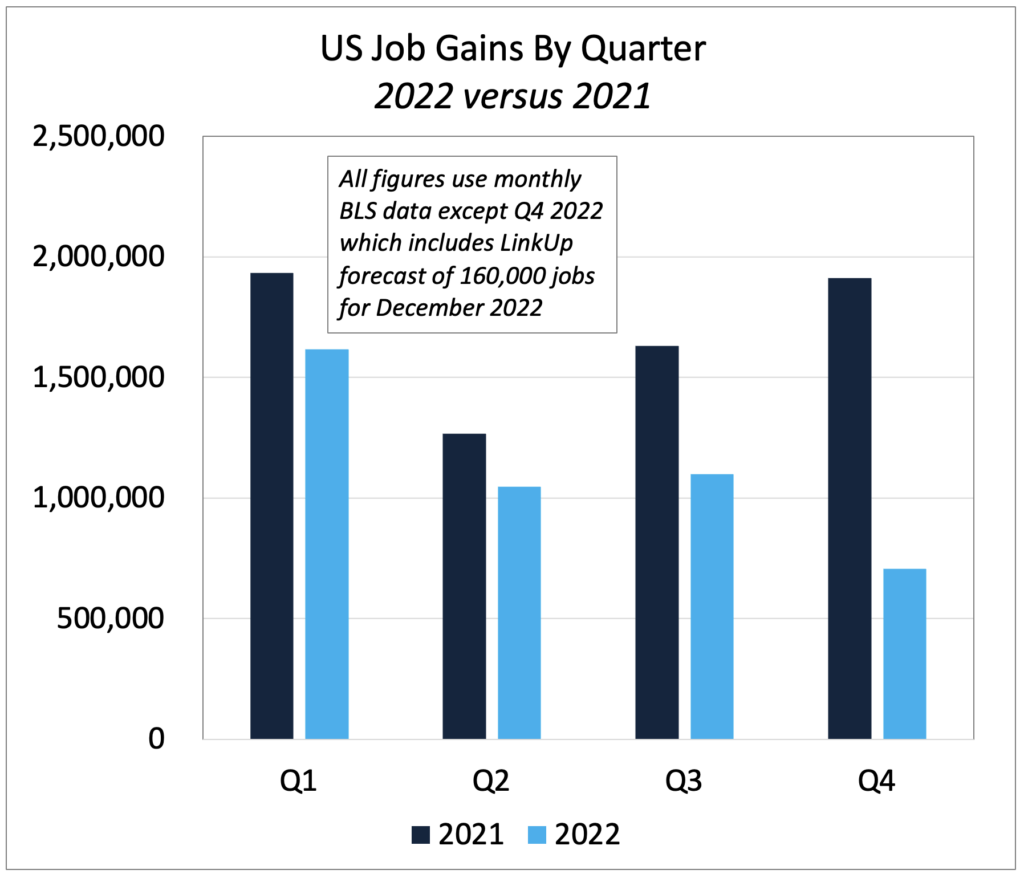

One chart, in particular, is worth highlighting:

Looking at the chart above, how could anyone be critical of anything that was done to create the kind of recovery we’ve experienced since 2020, even if a side effect was a small and short-lived bout of inflation? And that side-effect was, without question, a partial, very small, one at that – landing maybe not even in the top 3 of all the secondary contributors to inflation behind the primary driver – the crazy supply-demand imbalances during and following the pandemic.

The insane spike in demand for goods during the pandemic was matched in ferocity by the spike in demand for services afterwards which were, in turn, matched in magnitude by the drop in labor supply during the pandemic due to health and safety concerns and afterwards as a result of the Great Resignation.

While the goods-related supply-demand imbalance has subsided, the services-related imbalance persists, as noted in a recent Financial Times article, “Offsetting declining goods inflation are costs from dining out, haircuts, commuting and other activities tied to the services sector — a dynamic that Fed chair Jay Powell warned about at his final press conference of 2022. “Goods inflation has turned pretty quickly now after not turning at all for a year and a half,” he said.

The article goes on to note that, “How persistent services inflation turns out to be depends chiefly on the labor market.” In a recent NYT article entitled Trust the Models? In This Economy?, Jeanna Smialek echoed a similar sentiment, noting as well how unprecedented circumstances are these days, “Perhaps the most critical economic mystery is what will happen next in America’s labor market — and that is hard to game out.” Unless, of course, one has an ample supply of data to help solve the mystery.

Luckily for us, we do.

The key plot lines that have developed over the past 6 months continued in force in December; labor demand dropped further even while hiring remained strong, employers continued to raise wages (at a slowing rate) to bridge the persistently stubborn bid-ask spread between employers and job candidates, sporadic but high-profile layoffs further spooked the doomsayers but, as those workers rapidly found new jobs, actually paved more ground towards greater equilibrium in the job market, and small businesses reported that hiring is getting easier. And yet, in spite of the good news in the job market, debates about the likelihood of a recession reached fever pitch, even as inflation continued to subside.

In summary, all signs in the job market continue to point to a soft landing, just as we’ve been saying for months and months. Like a great Agatha Christie mystery, all the clues are right there in plain sight, staring us in the face. And unless this mystery turns into a slasher bloodbath with the Fed Chair turning into Michael Myers and hacking the economy to death well into 2023, the year ahead should bring about the optimal outcome we’ve all been hoping for.

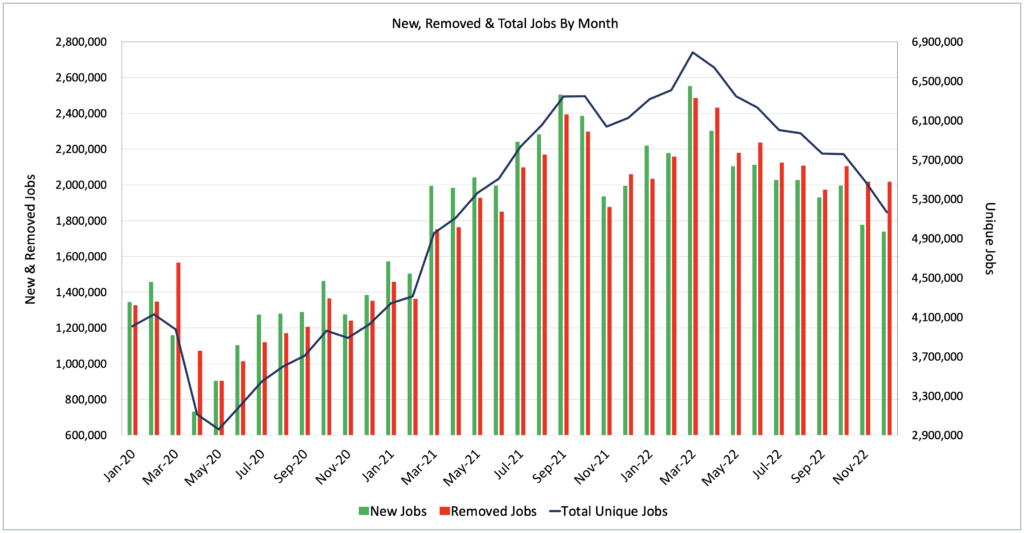

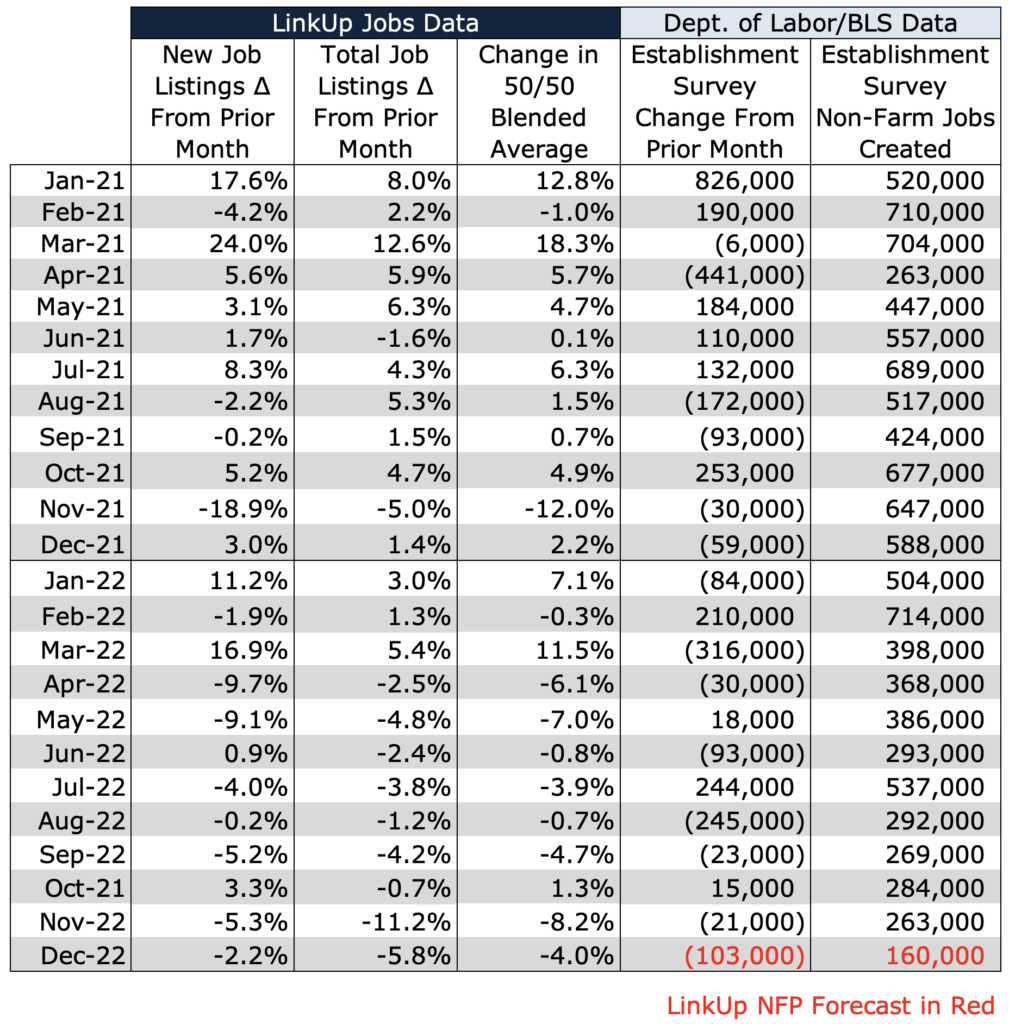

Turning to LinkUp job data, total US job openings indexed directly from company websites globally fell 5.8% in December, while new job openings dropped 2.2% and removed job openings stayed flat.

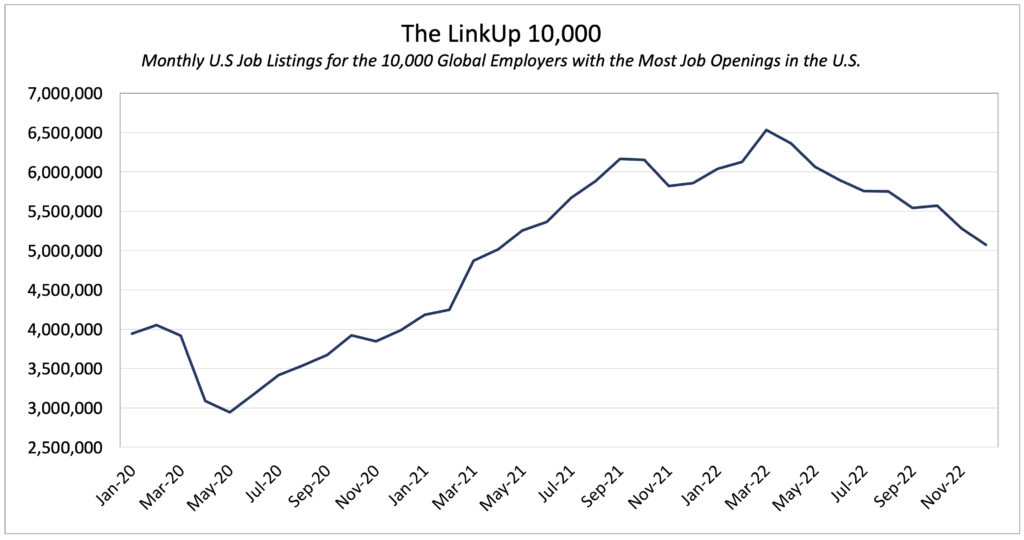

The LinkUp 10,000, which tracks US job vacancies for the 10,000 global employers with the most openings in the US, dropped a similar 3.8% in December.

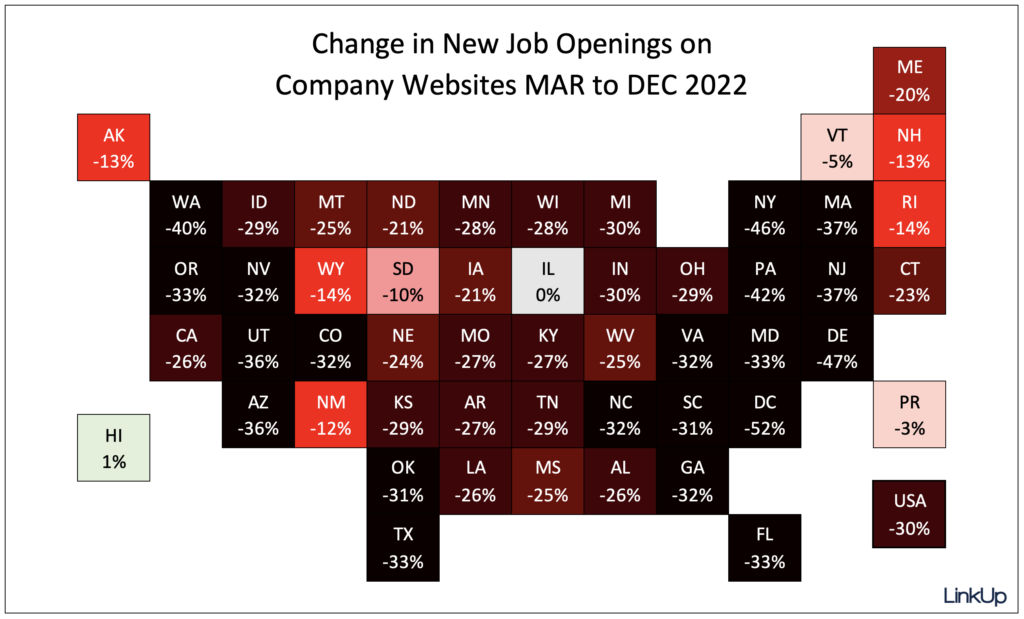

Since peaking in March, new job openings across the US had plummeted 30% with only two states (IL and HI) escaping the sea of red.

In December, labor demand in manufacturing and service-based industries converged further as job openings in goods producing industries dropped more steeply than in services industries.

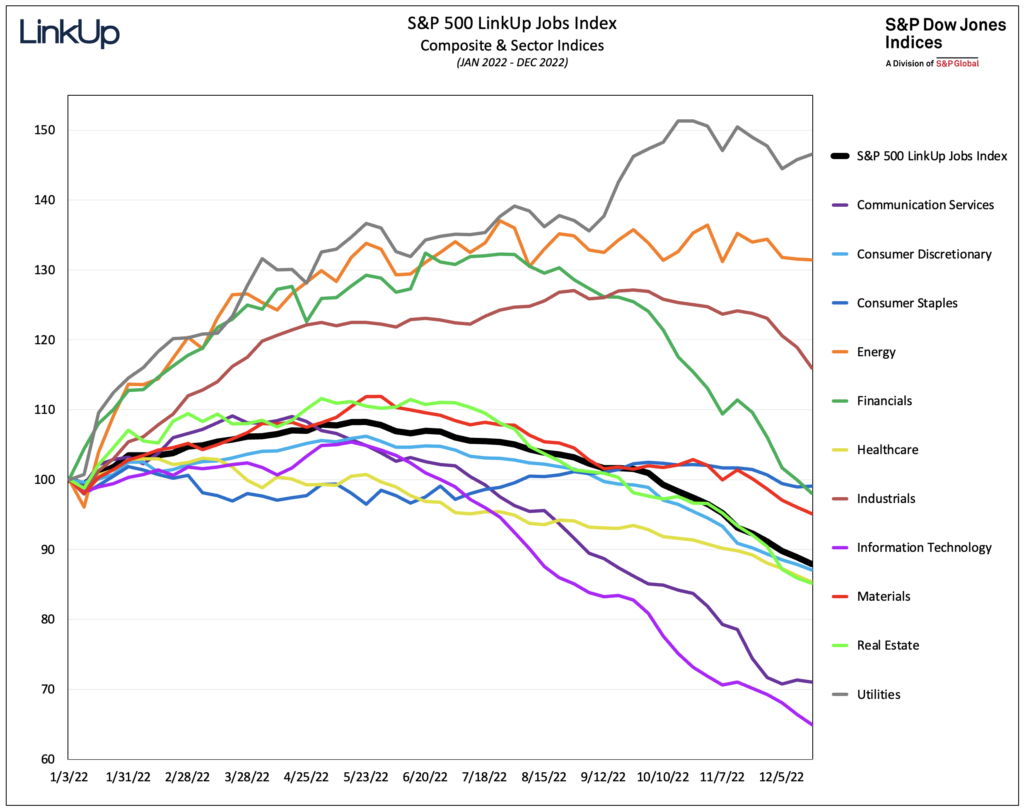

In December, the S&P 500 LinkUp Jobs Index was down 3.6% through the 19th, with declines in every single sector and the steepest declines in Financials and Information Technology.

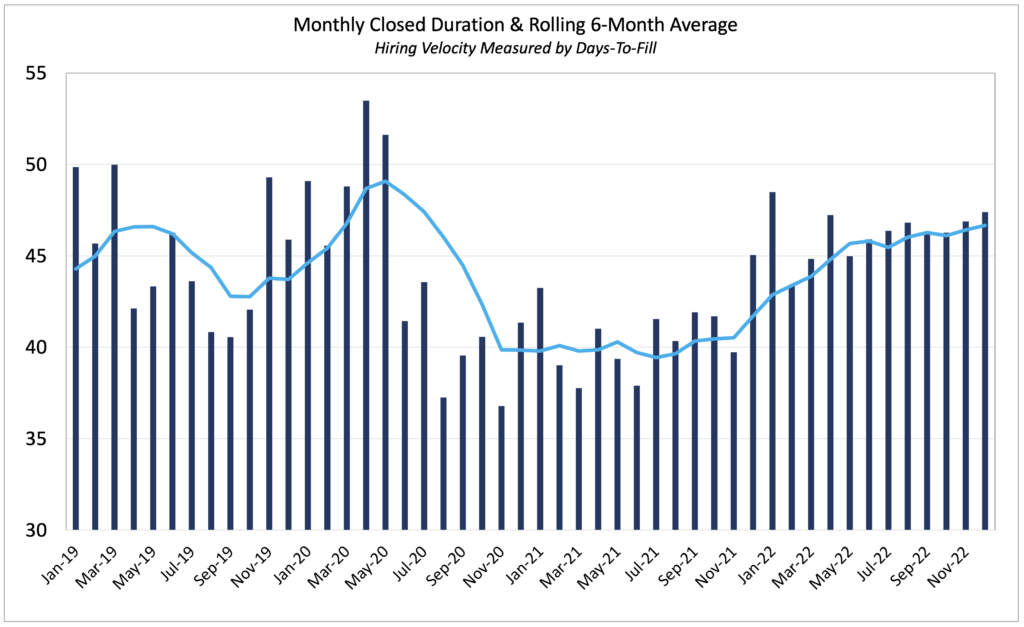

And lastly, hiring velocity continued to slow down, as LinkUp’s Closed Duration or ‘Time-To-Fill’ metric for December jumped above 47 days, its highest level since April.

Based on our data, we are forecasting a net gain of 160,000 jobs in December, 20% below the consensus estimate of 200,000 jobs.

While still a decent month of job gains, all things considered, such a number would nonetheless mark the lowest monthly job gains since December of 2020 when the US shed 166,000 jobs. Adding the December gain of 160,000 to November and October, and assuming no revisions in the next 60 days, the US economy would have added just over 700,000 jobs in Q4, the lowest number since the pandemic began.

Assuming, again, that our forecast is somewhere in the ballpark (and our track record so far this year gives us sufficient confidence to make such an assumption), there is no doubt whatsoever that the labor market is softening. As we’ve noted consistently for much of the past year, it was only a matter of time before a steady drop in job openings resulted in a steady decline in job growth. Job openings are declining, hiring is slowing down, and the rate of wage inflation is dropping. Given the rate hikes that have already occurred and their ongoing and long-lasting impact on the economy, all of these trends will continue well into 2023.

There is also little mystery as to what would likely happen going forward were one able to magically remove the Fed from the equation. Job growth would continue to fall until equilibrium between labor supply and demand is roughly achieved. All of the one-time, dramatic Covid shocks will fade in the rear-view mirror (accelerated retirements, mass relocation, dramatically elevated quit rates, etc.) while employers, employees, and the economy as a whole adjust rather quickly to the more permanent impacts from the pandemic – remote work, slightly more empowered employees, increased on-shoring, etc. As monthly job growth settles into a range between +/- 150,000 jobs per month, unemployment will rise slightly to somewhere around 4% and the rate of wage inflation would likely subside until it steadies somewhere between 3-4%.

What a world that would be.

But of course, we must now return to this planet, the one where the Fed sits firmly behind the wheel of the nation’s economic engine. As such, the true mystery is whether or not the Fed is going to drive this economy into a ditch or perhaps even smash it into a tree.

From our perspective, because we’re heavily anchored to the signals we’re seeing in our data and the job market as a whole and believe that the Fed is seeing the same evidence, we are inclined to lean towards a scenario that more closely resembles the rosy (hopefully not too delusional) scenario outlined above. Assuming the Fed exhibits a sufficient degree of patience and sound judgement, our forecast for 2023 is that the US avoids a recession. If forced to hedge our bet a bit, we’d argue that if there is a recession, it will be short and mild.

But as William Dudley stated on Bloomberg this morning, if there is a recession this year, it will have been Fed-induced, and unnecessarily so.

Insights: Related insights and resources

-

Blog

03.08.2023

Strong Job Gains in February, Despite Declining Labor Demand, Will Likely Add More Confusion to the Already-Confounding Macro Environment

Read full article -

Blog

03.05.2020

The Hot List: What LinkUp’s data tells us about top job markets

Read full article -

Blog

01.03.2019

The Wage Inflation Narrative Is About To Be Upstaged By A Nasty Jobs Report

Read full article -

Blog

04.27.2018

Like a Stray Dog Gone Defective

Read full article -

Blog

06.28.2017

Pace of Job Gains Showing More Hints of Running Out of Gas (Assuming Trump Doesn't Drive It Off A Cliff First)

Read full article -

Blog

11.03.2015

The Glass Is Half Empty; October NFP To Disappoint (Again)

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.