LinkUp Forecasting Net Gain of 140,000 Jobs in November

A few times a year, the calendar is such that the first Friday of the month, the day that the Bureau of Labor Statistics typically releases its Employment Situation report, falls on the 1st or 2nd of the month.

A few times a year, the calendar is such that the first Friday of the month, the day that the Bureau of Labor Statistics typically releases its Employment Situation report, falls on the 1st or 2nd of the month. Because we don’t pull our monthly data for our Non-Farm Payroll forecast model until about 5AM on the 1st of each month, we have to scramble in those instances to calculate our NFP forecast, submit it to Bloomberg, and publish our commentary as early as possible before the jobs report gets released.

December is just such a month, and with a tight schedule before the jobs report tomorrow, I’ll forego any commentary and simply publish our data. (Admittedly, this also serves as a convenient excuse to put off to another day having to write anything about the nightmare election).

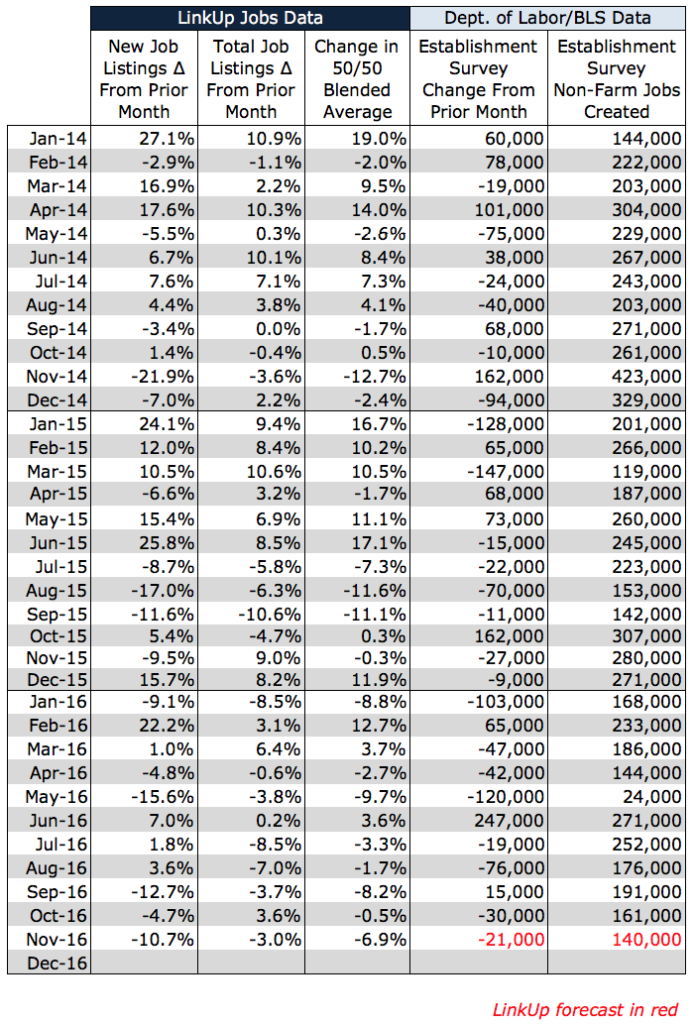

Based on new and total job openings in LinkUp’s job search engine in October, we are forecasting a net gain of 140,000 jobs in November, slightly below October’s job gains and below consensus forecast.

As background, LinkUp’s job search engine only indexes jobs directly from company websites. Today, our search engine includes roughly 3.5 million openings sourced from approximately 30,000 company websites in the U.S. and around the world. Because we update the search engine every day, the jobs are always current, and there are no duplicates because we only source jobs from as single source – the employer’s website itself. And perhaps most importantly, LinkUp’s labor market data eliminates job board pollution (job scams, fraudulent posting, phishing posts, identity theft, money-mule scams, resume gathering, etc.) because we do not aggregate jobs from other job sites the way that other aggregators and jobs data companies do.

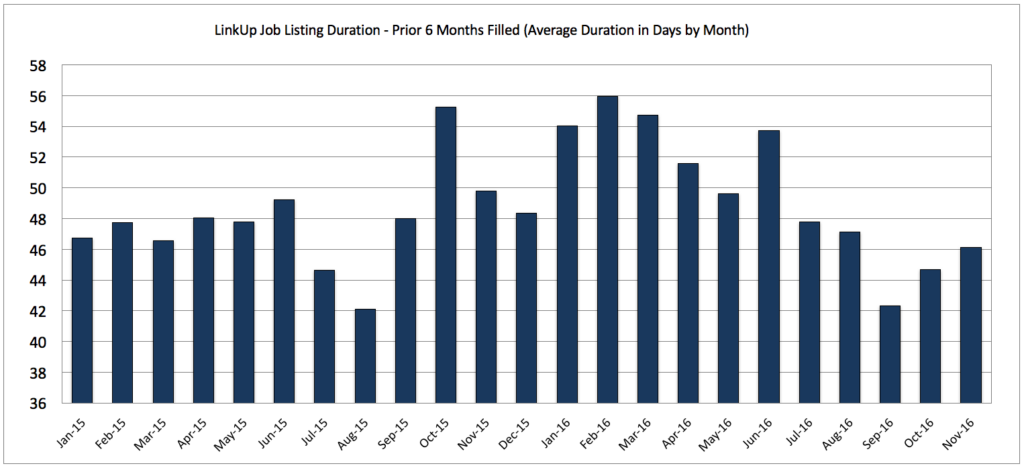

Job duration rose from just over 44 days to 46 days in November, pointing to slowing hiring velocity in the labor market due to slowing labor demand and/or growing difficulty in filling openings due to a Full Employment environment which we’ve been in since at least Q2.

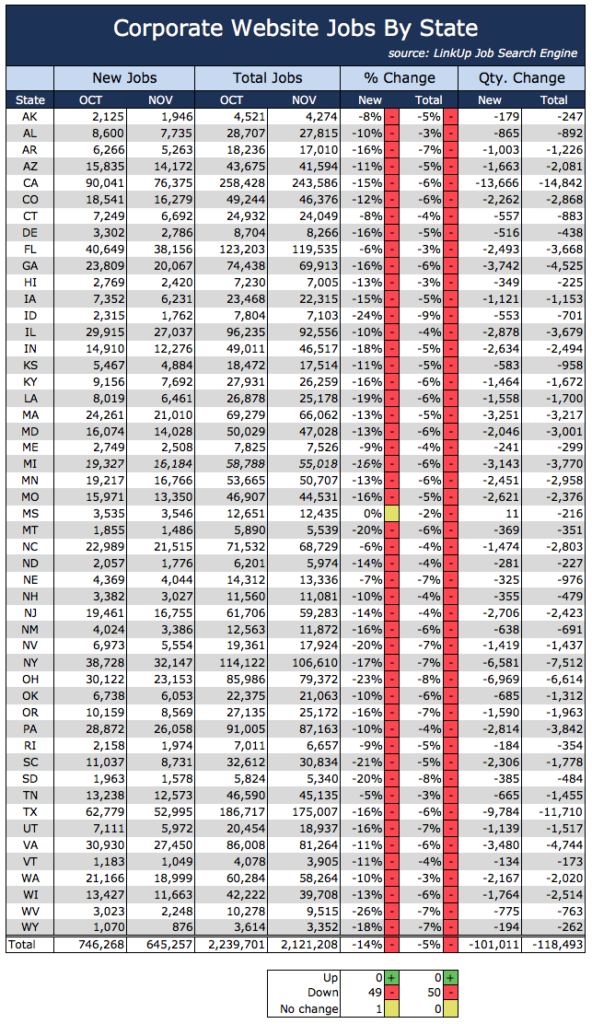

To be clear, the labor demand remains strong and wages will undoubtedly continue to climb, but not surprisingly given the Full Employment environment, the pace of hiring has been slowing down. And it looks like that trend will continue given LinkUp’s data from November, a month in which new job listings dropped 14% from October and total job openings declined 5%. Those declines were spread throughout the entire country, as indicated in the table below.

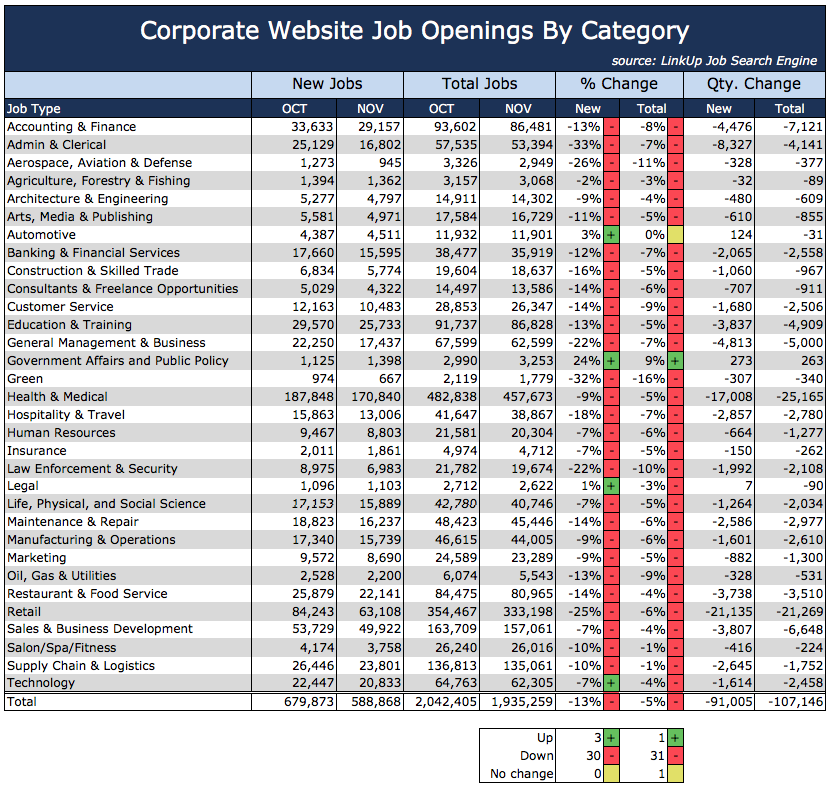

The Jobs by Category picture for November is equally as grim.

So tomorrow, look for a decent but below-consensus jobs report of 140,000 jobs gained in November which should be more than sufficient to allow the Fed to raise rates later this month.

Insights: Related insights and resources

-

Blog

11.02.2022

LinkUp Data Points To Net Gain of 315,000 Jobs In October, Well Above Consensus Estimates

Read full article -

Blog

11.02.2019

LinkUp's Job Market Data Provides Accurate, Predictive Insights Into U.S. Labor Market

Read full article -

Blog

11.01.2019

LinkUp Forecasting A Better Than Expected Jobs Report For October

Read full article -

Blog

07.02.2019

Streak of Monthly U.S. Job Gains Will End In June

Read full article -

Blog

10.29.2018

Accelerating Hiring Velocity Means We Cannot Publish Our October NFP Forecast Until 10AM On Thursday, November 1st

Read full article -

Blog

05.30.2017

LinkUp Forecasting NFP of 160,000 Jobs For May

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.