LinkUp Forecasting Net Gain of 140,000 Jobs for October's NFP Jobs Report

As we indicated on Monday, we wanted to wait until the 1st of the month to issue our non-farm payroll forecast for tomorrow’s jobs report so that we could look at October’s job data from our job search engine.

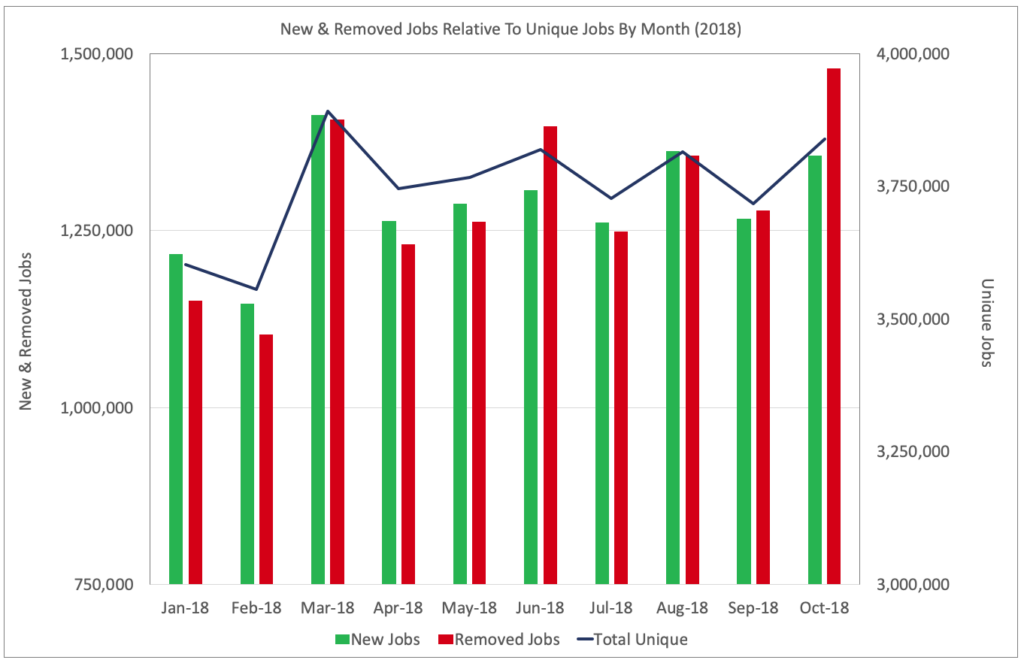

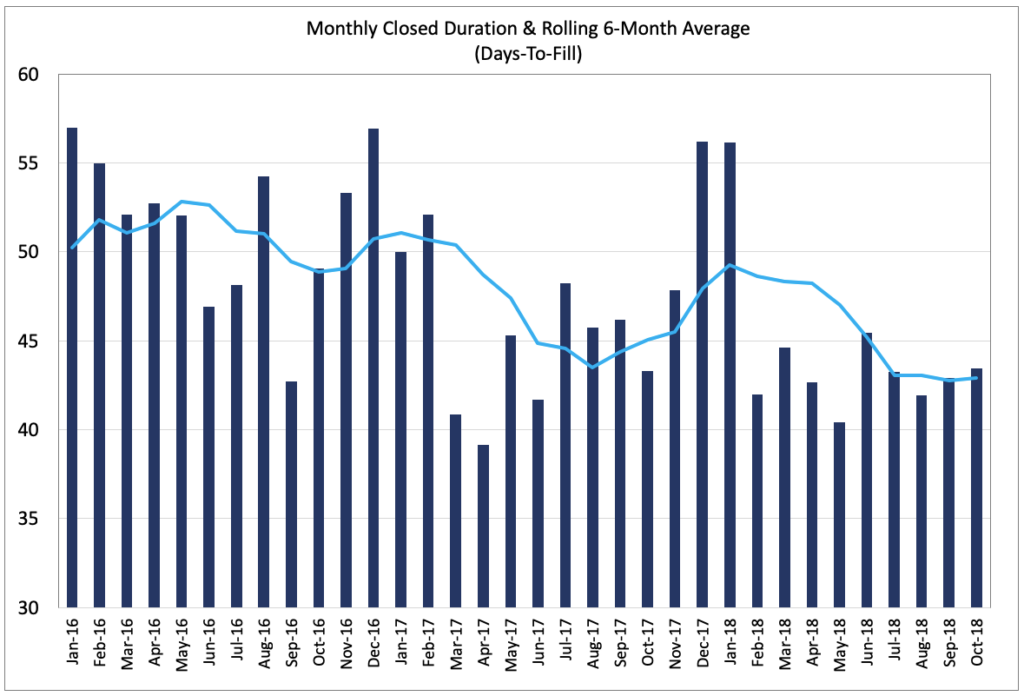

As we indicated on Monday, we wanted to wait until the 1st of the month to issue our non-farm payroll forecast for tomorrow’s jobs report so that we could look at October’s job data from our job search engine. Because job duration has been declining as hiring velocity has accelerated in the current full employment environment (as measured by the rolling 6 month average of our job duration analytic shown among the charts below), companies are increasingly posting and filling jobs as rapidly as possible. To some extent, that is likely contributing to the rise in both new jobs and removed jobs (which are a close proxy to filled jobs) that we saw in October the chart below.

As the chart above indicates, new jobs rose by 90,000 (7%) in October and removed jobs rose by 200,000 (16%), while total job openings rose 122,000 (3%).

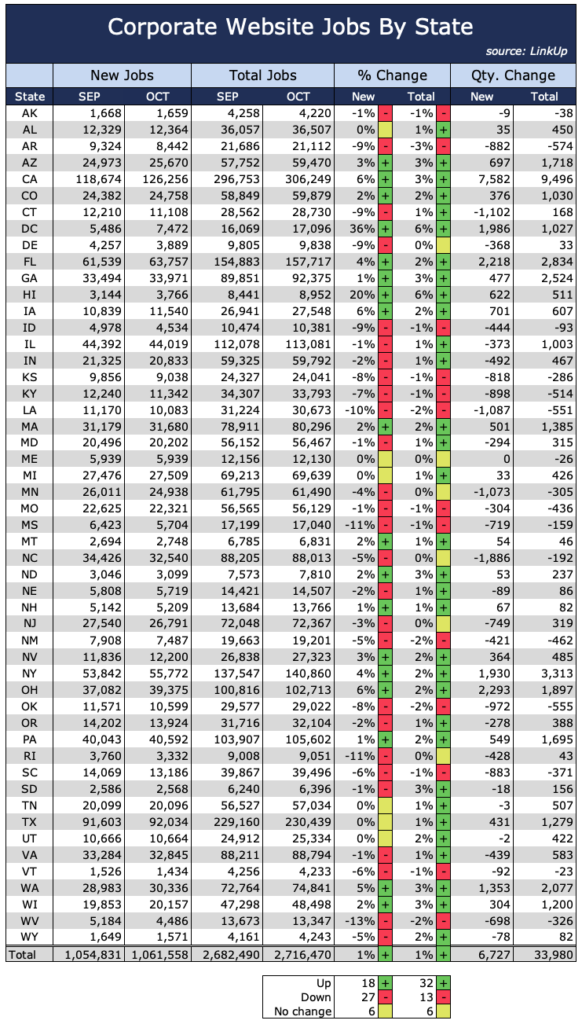

But if we normalize the data to account for the addition of new companies into the index (we continuously adding new companies, albeit further and further down into the long tail where the average new company has less than 50 new job openings), the data paints a far less rosy picture for October.

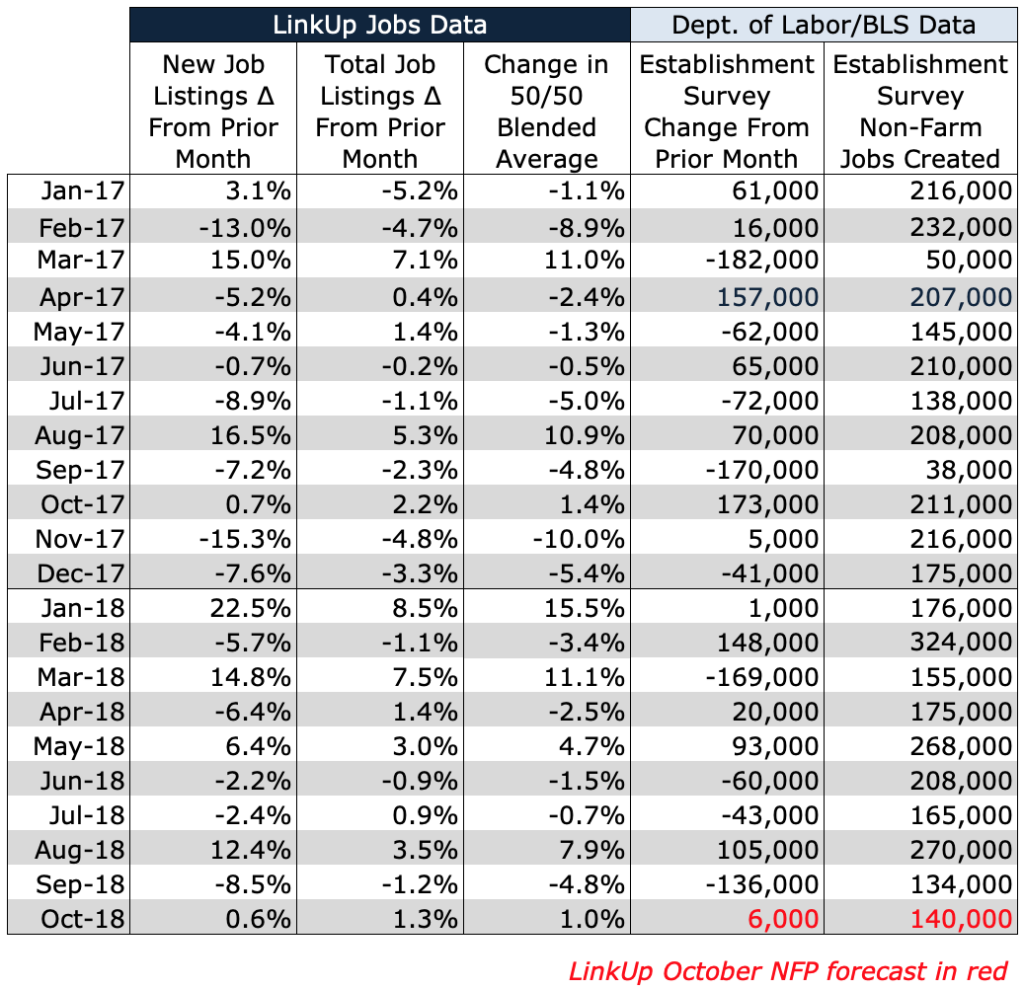

Looking at our paired month data, new and total job openings were essentially flat during the month with new job postings climbing by just .6% and total job postings climbing 1.3%.

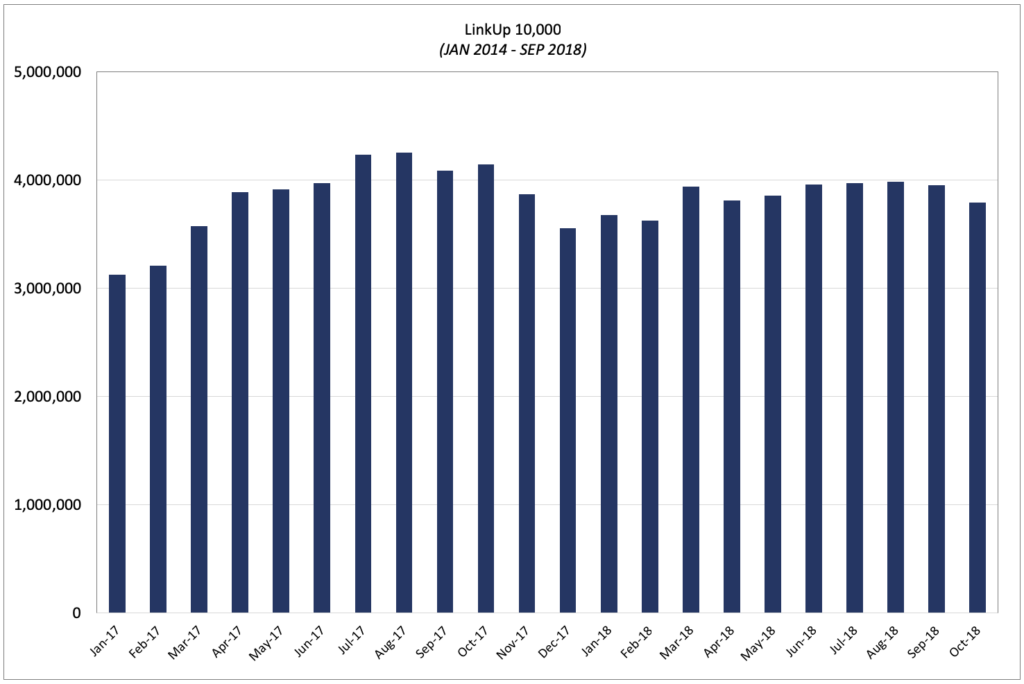

Looking at the LinkUp 10,000 (which tracks job openings from the largest 10,000 employers in the index in any given month), total job openings actually fell by 158,000 or 4%.

Also of note, job duration rose slightly in October from 42.9 days in September to 43.5 last month.

So putting all the data together, we are forecasting that tomorrow’s jobs report will come in below the consensus estimates of 190,000. Were we to rely solely on our September job openings data, our model would indicate a net gain of just 45,000 jobs in October. However, our October data is a little more mixed and generally less negative, indicating that job gains should come in somewhat higher than that. Lastly, it has been the case quite consistently for the past decade that if job openings in LinkUp’s search engine rise in October, job gains in October are going to be higher than September’s job gains. As a result of all of that, we are forecasting a net gain of 140,000 jobs in October.

And of course, we also remain steadfast in our conviction that wages will, one of these !?%&?&! months, break out and jump high enough to finally convince the skeptics that we are, without a shadow of a doubt, in a full employment environment.

Insights: Related insights and resources

-

Blog

10.29.2018

Accelerating Hiring Velocity Means We Cannot Publish Our October NFP Forecast Until 10AM On Thursday, November 1st

Read full article -

Blog

12.01.2016

LinkUp Forecasting Net Gain of 140,000 Jobs in November

Read full article -

Blog

12.02.2015

November NFP Should Be Decent But December Looks Grim

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.