LinkUp Forecasting Net Gain of 125,000 Jobs in January; First Increase In Job Openings Since March Points to Stronger Job Gains in February

Given the urgency to get our non-farm payroll forecast published as quickly as possible, we’ll provide additional analysis and commentary later this week and focus here primarily on our labor demand data for January and the forecast itself.

Having said that, however, we’ll start with the abridged version of the commentary which can be summarized quite succinctly: The soft landing that we and others on ‘Team Soft Landing’ have, for months and months, been forecasting would happen is now happening. In fact, it might be the case that the wheels have touched down and everyone can begin breathing a huge sigh of relief. The Fed’s 25bp hike earlier today serves not only as a nice proof point, but also a nice exclamation point to the collective elation that hopefully extends well beyond the markets.

So what’s happened to get us safely onto the tarmac? In addition to tapering wage inflation due to sufficient equilibrium in the labor market (which we’ll get to in a second), the pandemic is over, supply-chain issues have been resolved, and Fed tightening has clobbered the housing market, dampened consumer and business demand, and generally cooled off the economy (hopefully not too much).

Most significantly, sufficient equilibrium between supply and demand in the job market has been achieved through a combination of falling demand (job openings) and increased supply (due to sufficiently elevated wages, decent monthly job gains, some layoffs here and there, non-wage employer concessions, receding health concerns, greater adoption of remote work, etc.), such that wage inflation is now tapering and broader core inflation is plummeting without ANY increase in unemployment.

So Larry Summers and his fellow masochists on ‘Team Stagflation’ who have been relentlessly clamoring for excessive self-flagellation were dead wrong.

So that’s the brief synopsis of where we’re at, for the moment at least, because of course the story continues and touching down safely doesn’t guarantee that we get to de-plane safely and calmly through the gangway. It will be at least a few months before we have sufficient clarity around where things are at and along the way, debate will, unfortunately but most assuredly, continue to rage about what the ceaseless flow of data indicates, what’s likely to happen in the coming months, and what the Fed should do about it.

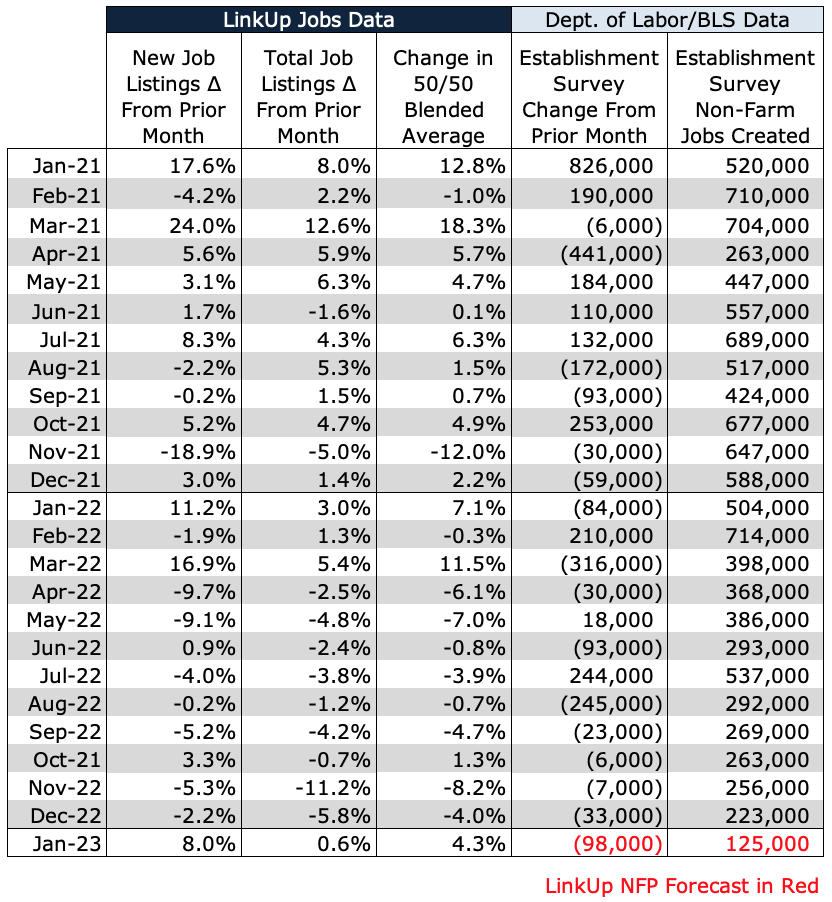

And while Friday’s jobs report for January is likely to confirm the Fed’s decision around the 25bp hike earlier today, our job data from January points to stronger gains in February which should keep the debates raging. But due to the lag between a job listing being posted and the opening eventually being filled with a new hire, our forecast for Friday’s jobs report of a net gain of 125,000 jobs in January is based on our job market data – millions of job openings that we index every day directly from employer websites around the world – from December.

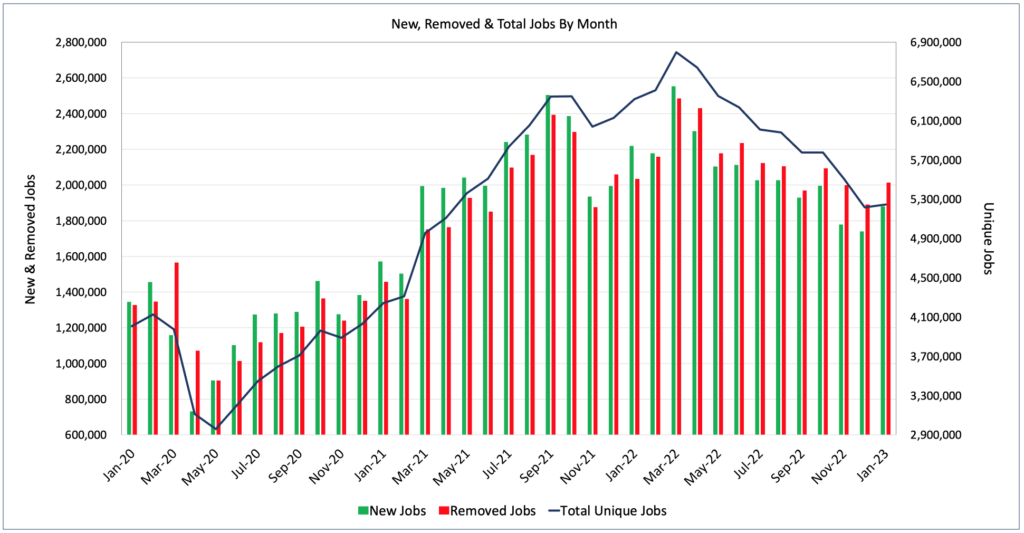

In January, total U.S. job openings indexed directly from company websites globally rose 0.6% in January, while new job openings jumped 8.0% and removed job openings rose 6.5%.

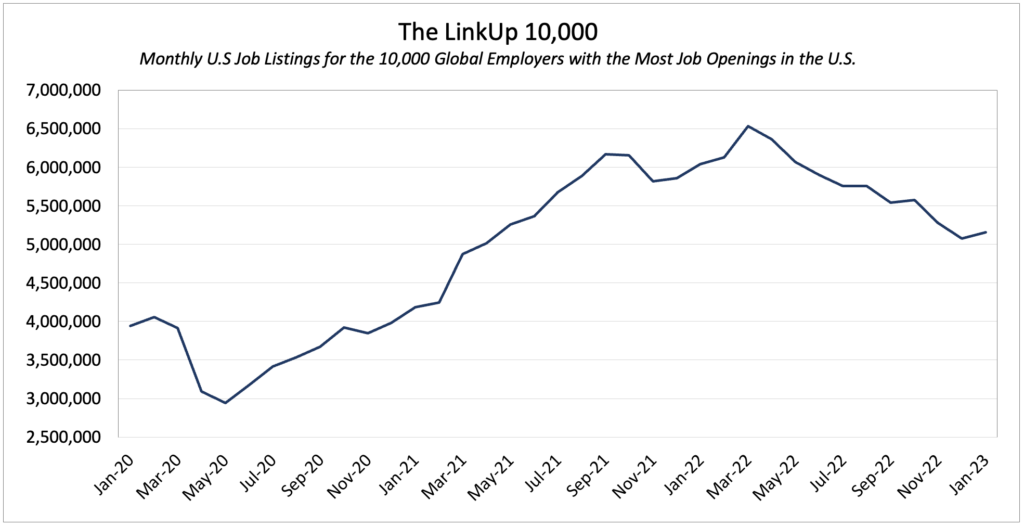

The LinkUp 10,000, which tracks U.S. job vacancies for the 10,000 global employers with the most openings in the U.S., rose 1.6% in January.

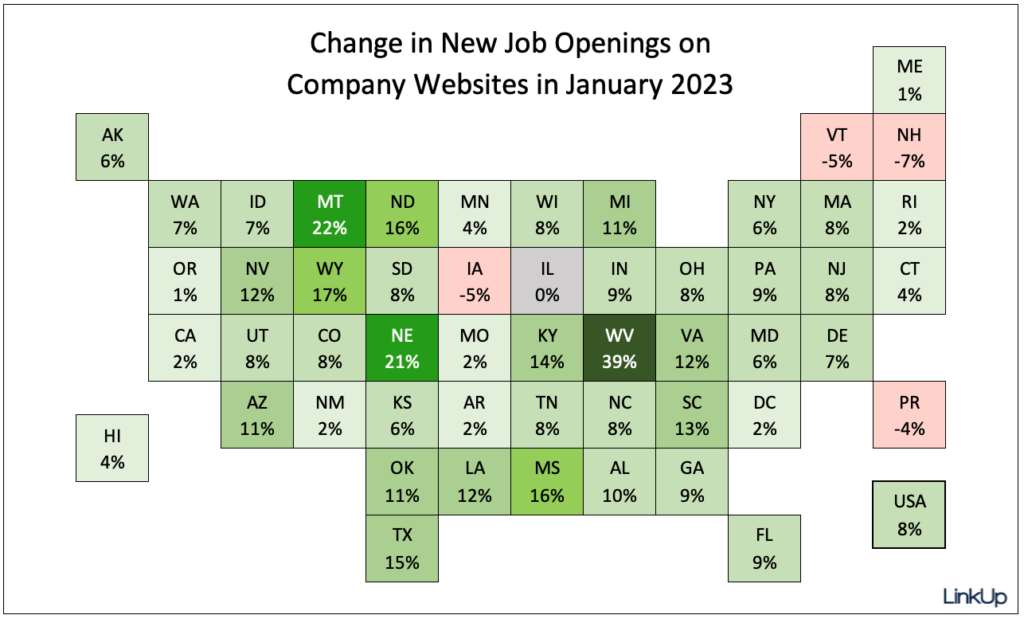

In January, new job openings rose in all but 5 states.

In January, labor demand in manufacturing rose but stayed flat in service industries.

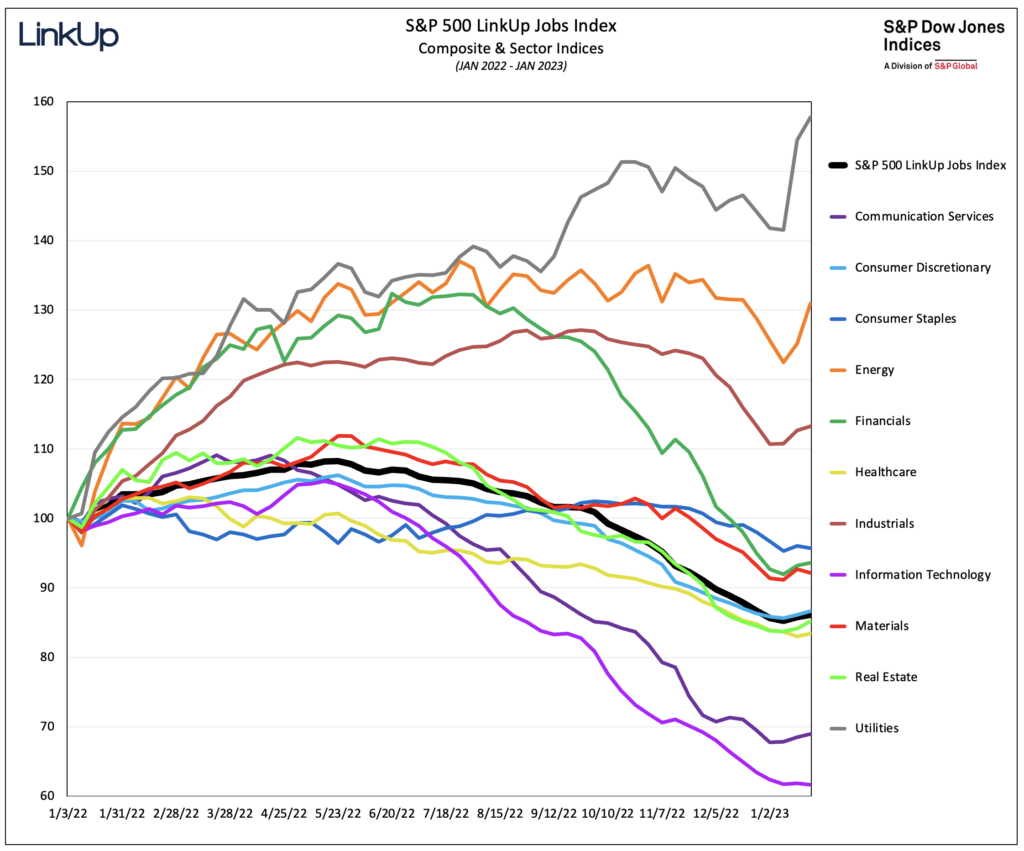

Through January 23rd, the S&P 500 LinkUp Jobs Index has risen 0.5%, with Utilities up 11.3% and Energy up 4.2%.

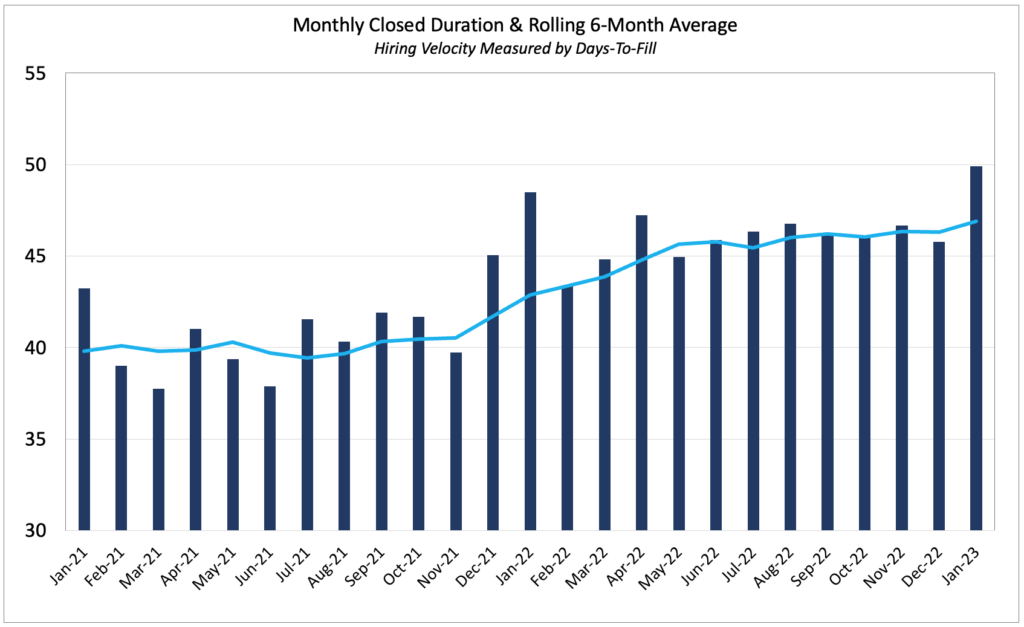

And lastly, hiring velocity continued to slow down, as LinkUp’s Closed Duration or ‘Time-To-Fill’ metric for January jumped to nearly 50 days, its highest level since May of 2020.

Based on our data from December, we are forecasting a net gain of 125,000 jobs in January, below the consensus estimate of 185,000 jobs.

Insights: Related insights and resources

-

Blog

11.28.2022

Larger Tectonic Forces Shaping Job Market Dynamics Will Soon Return to Center-Stage

Read full article -

Blog

11.02.2022

LinkUp Data Points To Net Gain of 315,000 Jobs In October, Well Above Consensus Estimates

Read full article -

Blog

10.03.2022

LinkUp Forecasting a Net Gain of 275,000 Jobs AND a Slight Rise in Unemployment; Expect Mayhem to Ensue

Read full article -

Blog

12.03.2020

LinkUp Forecasting Non-Farm Payroll Gain of 490,000 Jobs in November

Read full article -

Blog

04.05.2019

LinkUp Forecasting Net Gain of 155,000 Jobs in March

Read full article -

Blog

03.03.2016

LinkUp Forecasting Decent Job Gains In February

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.