LinkUp Forecasting Job Gains of Only 116,000 For December

As we move into the New Year, and an election year at that, I expect it will become increasingly difficult to maintain the discipline required to continue doing so.

I have no intention of completely abandoning (yet) my self-imposed rule of generally steering clear of politics post-November 2016, but as we move into the New Year, and an election year at that, I expect it will become increasingly difficult to maintain the discipline required to continue doing so. Suffice it to say, for now, that the recent military strike against Iran proves yet again (as if we needed any more evidence)Trump’s Second Law that all things in a Trump universe will trend toward increasing levels of chaos. That law, and the related Third Law in the Trump universe that tomorrow will likely be worse than today, will most certainly be the dominant themes of 2020 as the election approaches and the dumpster-fire that we live in these days burns, both literally and figuratively, hotter and hotter.

For the curious, Trump’s First Law is, of course, that the only body in the universe is Trump.

Over the past 3 years, amidst the growing levels of insanity, absurdity, and chaos, the one aspect of the world that remained seemingly immune to the horror show, despite his best efforts, has been the U.S. economy and, more specifically, the U.S. labor market. But alas, based on LinkUp’s job market data, it appears as if that, too, might finally be succumbing to the immutable Laws of a Trumpian Universe.

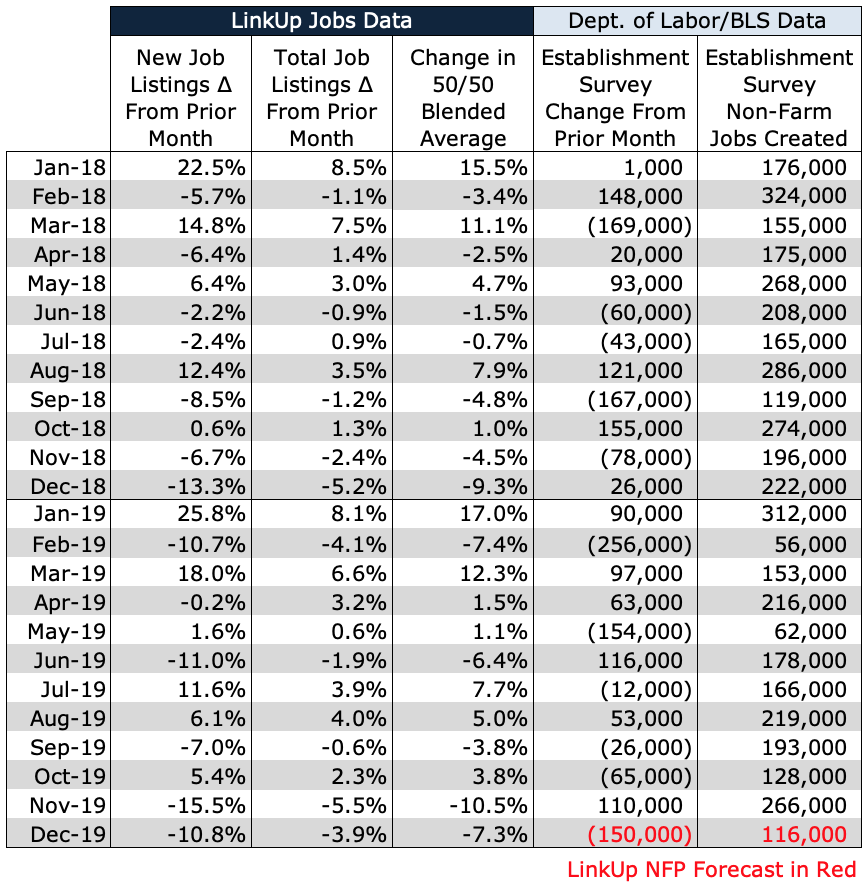

Of course, it will likely take time for a red-hot labor market to cool off and we were admittedly a bit premature with our dour forecast last month (due entirely to our inexcusable dismissal of our own duration analytic), but the job openings data from corporate websites over the past two months paints a grim picture of declining labor demand across the entire U.S. economy.

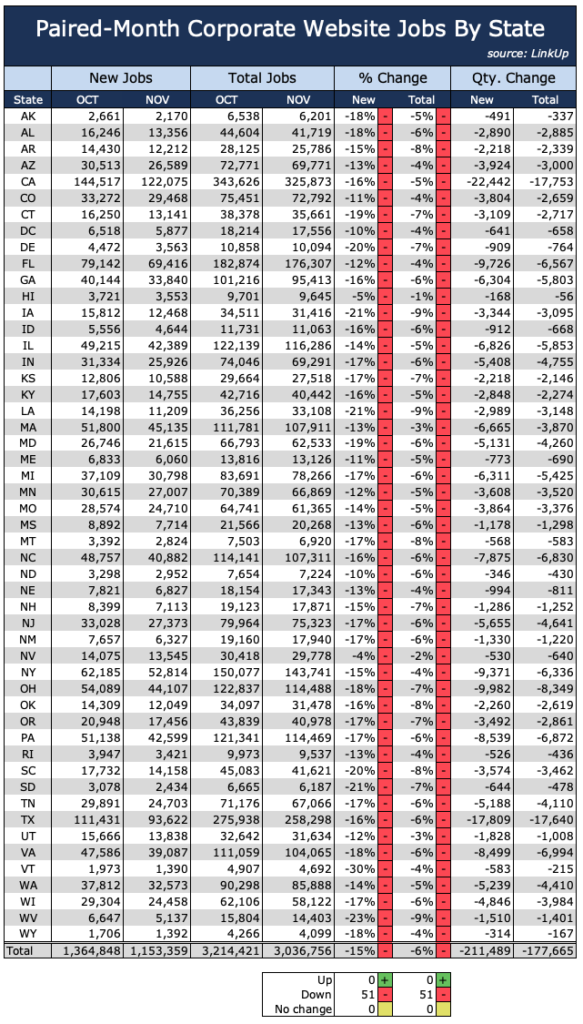

In November, our paired-month jobs data indicated that new job listings on company websites dropped 15% and total job openings fell 6%.

In our forecasting methodology, we use job listings activity to forecast job growth in later periods because the best indicator of a future job being added to the economy is when an employer posts a job opening on their corporate career portal on their company website. Because we are constantly adding new companies to our job search engine and our jobs index, we use a very specific, normalized sub-set of our data in our non-farm payroll (NFP) forecasting methodology – our ‘paired-month’ data.

This paired-month data measures the job listing activity for every employer in our dataset that was hiring in both of the most recent 2 months – employers across the entire U.S. economy in terms of geography and industry, foreign and domestic, as well as size and type (public, private, non-profit, government, etc.). We then measure the job posting activity from one month to the next to calculate the percentage increase in new jobs those companies posted as well as the change in total number of job listings.

Also of note, the most critical aspect of our entire job market dataset is that we only index jobs directly from company websites and we update our job search engine every day – we do not aggregate jobs from job boards or other 3rd party sources. As a result, the job listings are always current and we completely eliminate duplicate listings and job board pollution (scams, fraud, money-mule jobs, lead-gen, phishing jobs, resume hoarding, etc.).

Not only were November’s declines dramatic, they were also pervasive throughout the country.

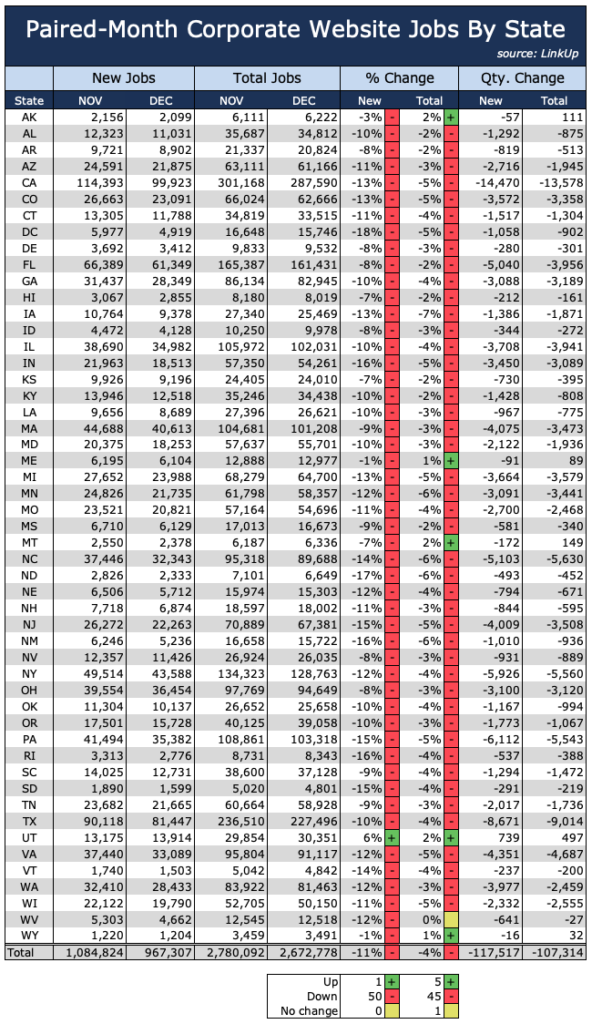

November’s declines continued into December with new and total job listings dropping 11% and 4% respectively, with declines spread, once again, throughout the entire country.

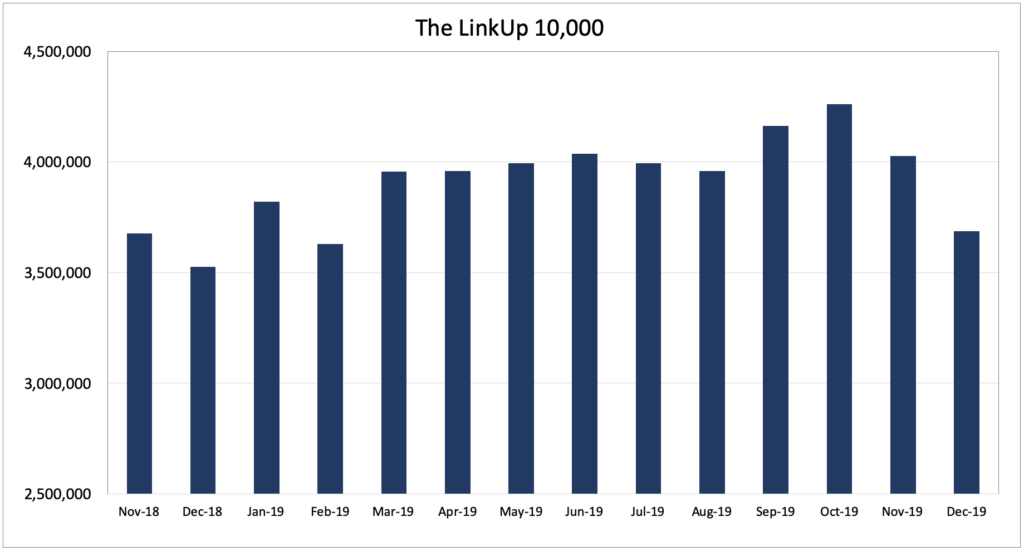

The paired-month declines mirror November and December declines in the LinkUp 10,000, another normalized macro analytic we use to calculate labor demand across the country. With the LinkUp 10,000, we sum the total number of U.S. job openings for the 10,000 employers in our dataset that have the most job openings inside the U.S. in a given month. Those employers can be U.S. or foreign companies including employers of any type (public, private, non-profit, government, etc.) in any industry and can change from month to month, but we always cap the analytic at 10,000 employers to normalize the data and account for the continuous addition of new companies to our overall dataset.

The LinkUp 10,000 declined 5.5.% in November and 8.4% in December.

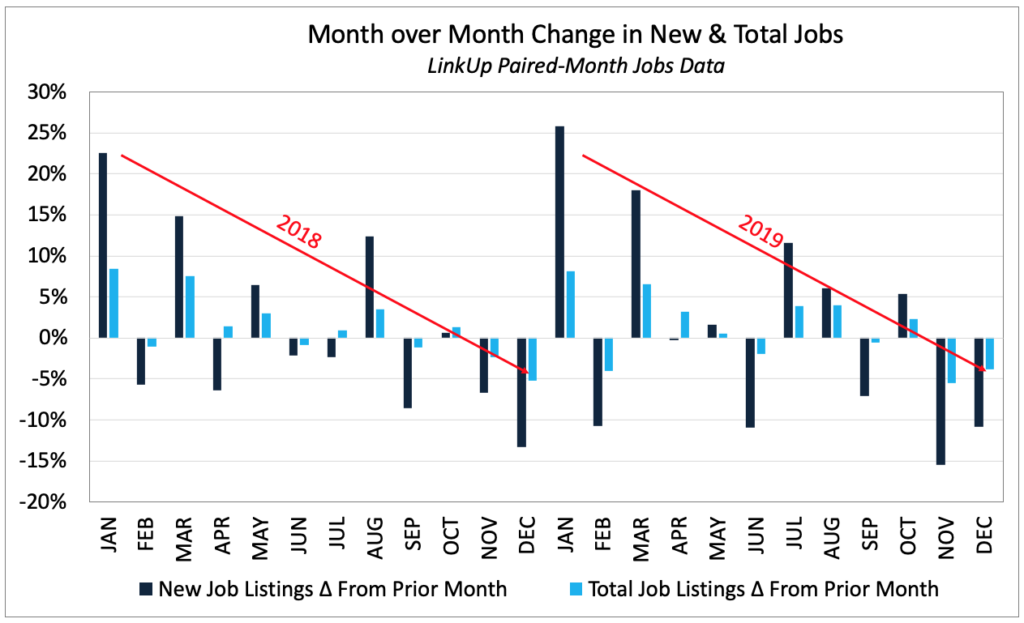

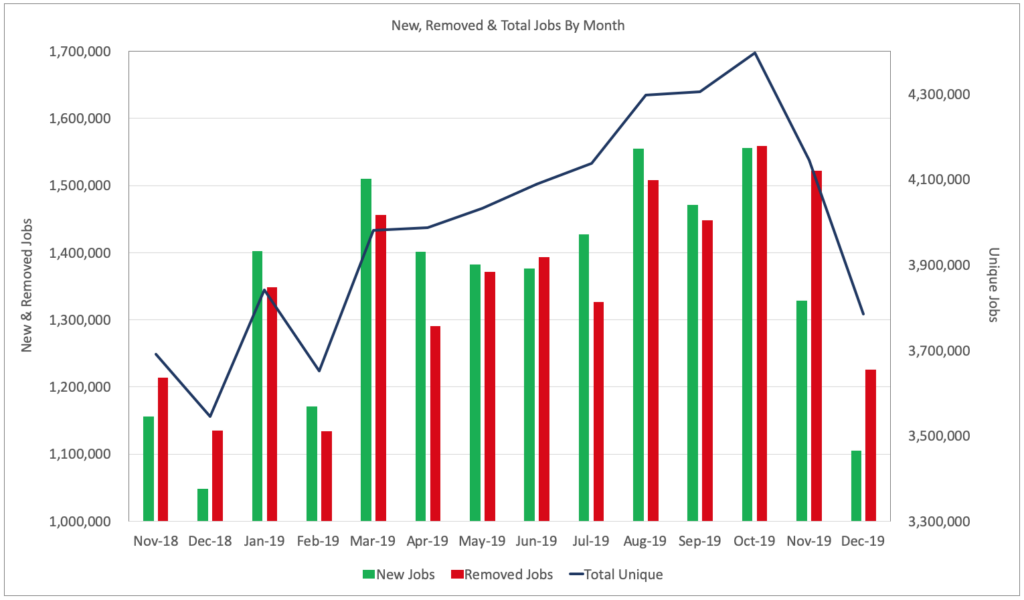

To be sure, seasonality plays a consistent factor in hiring during the year, with labor demand typically ebbing in November and December as the chart below clearly indicates.

But while the pattern of month-over-month changes in job listings activity was nearly identical in 2019 compared to the prior year, overall labor demand grew less in 2019 than the year before.

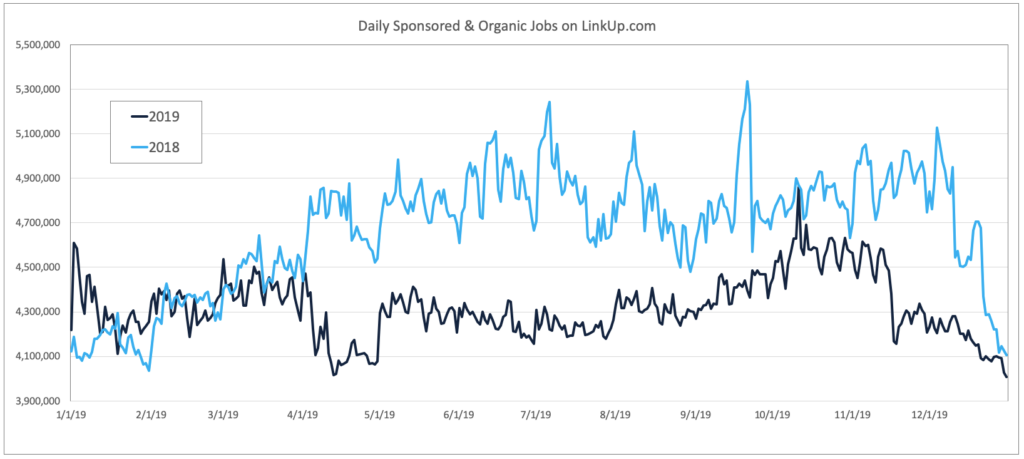

The general drop-off in labor demand is far more stark when we look at the total number of both organic and sponsored job listings each month on LinkUp.com. While we do not include sponsored job listings in our job market data solutions, the total volume of unpaid (organic) and paid (sponsored) job listings can provide another indicator of overall labor demand.

As the chart below indicates, total job openings (paid and unpaid) on LInkUp.com were significantly lower in 2019 than in 2018. Keep in mind, as well, that the data below is not normalized – we are adding new companies to our search engine every month and we have been rapidly growing and expanding our paid search recruitment advertising business along with our job market data business, so the declines this past year from the prior year would be even greater if we accounted for the significant growth of our data and advertising businesses.

Looking at just our organic jobs without any normalization, total job openings dropped precipitously in December, declining 9% from November and 14% from the high-water mark in October. New job listings dropped 17% and removed jobs dropped 20%. While seasonality is a factor in the data, there is little doubt that overall labor demand has tapered off significantly in the past few months.

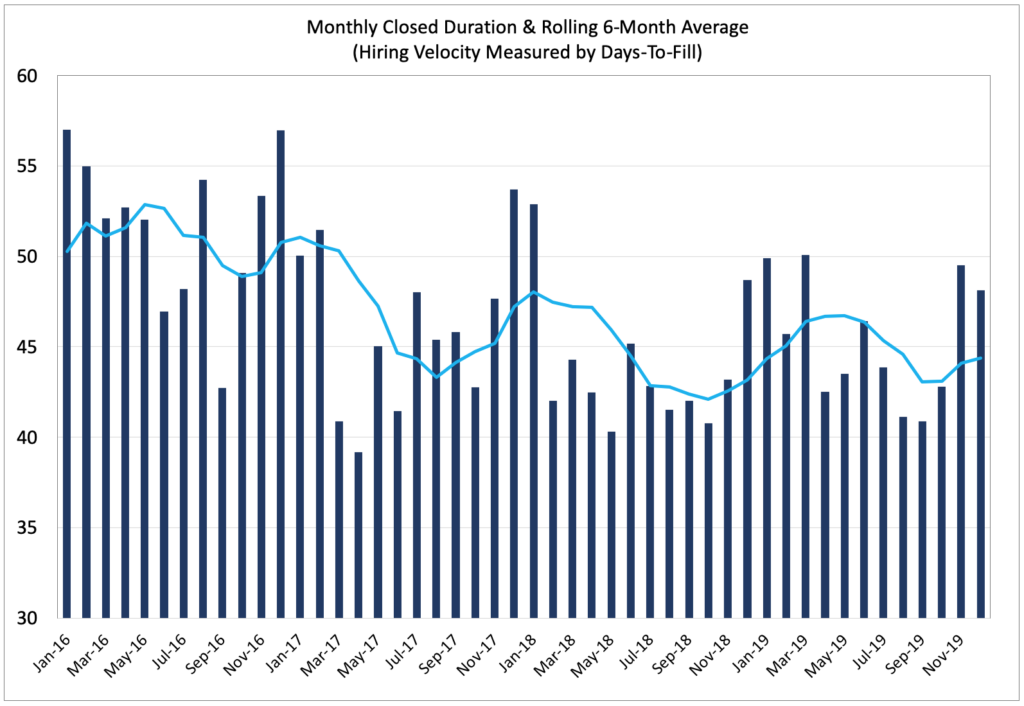

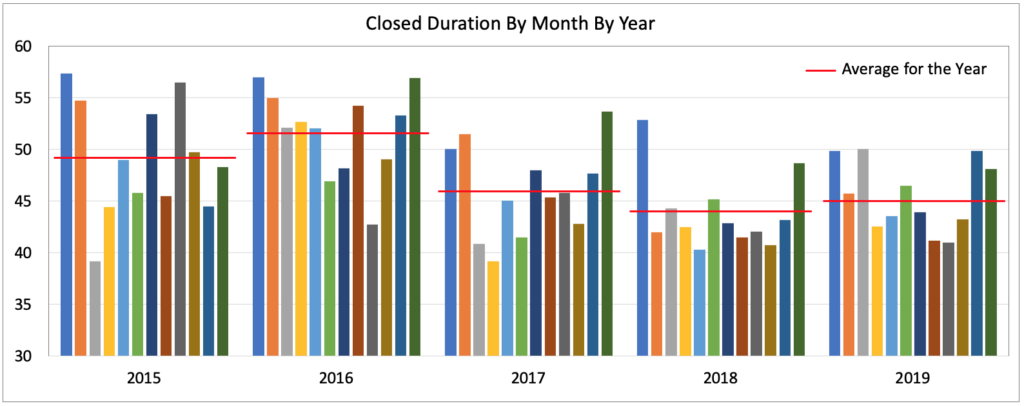

Duration fell slightly in December, dropping from 50 days in November to 48 days last month. Our Closed Duration metric, which tracks the average number of days that job listings were on company websites before they were removed sometime in December, serves as a strong indicator of hiring velocity.

Looking at duration by month over the past 5 years, one can see the acceleration in hiring velocity as average duration fell from 52 days in 2016 to 44 days in 2018 as unemployment fell steadily. Average hiring velocity rose slightly this past year and, consistent with seasonal trends, duration has peaked again in Q4.

So based on all our data, we are forecasting a gain of just 116,000 jobs in December, below the consensus estimate of roughly 160,000 jobs.

And lastly, based on LinkUp’s December job openings data, we expect it will be the case that January’s non-farm payrolls come in well below consensus estimates. If Friday’s BLS data for December is consistent with our forecast or even lower, it’s possible we might even see a negative number for January job gains.

To be certain, we’d urge a massive dose of caution in speculating about January at this point because our actual forecast for January, which we’ll publish in the first week of February, will be based, in part, on Fridays’ BLS data. Furthermore, we’d point to shockingly high job gains last January despite similarly gloomy declines in job openings in November and December of 2018 (although in 2018 those declines were less severe than in 2019).

So for the moment, we’ll stick to our below-consensus forecast for December and hold off for now in issuing our actual forecast for January’s non-farm payrolls. But we are definitely leaving the door open to the possibility of a really negative jobs report in January, one that would likely kick off some pretty serious shock waves.

And wouldn’t that be a perfectly Trumpian way to kick off 2020?

Insights: Related insights and resources

-

Blog

11.02.2018

Is President Trump really good for job growth?

Read full article -

Blog

09.28.2017

LinkUp Forecasting Net Gain of 260,000 Jobs For September

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.