LinkUp Forecasting Disappointing Jobs Numbers For May and Continued Weakness in June

It’s been a few months since we’ve provided commentary around the broader economy generally and inflation in particular, but these issues, combined with our permanent focus on the job market, continue to be justifiably obsessed about as everyone tries to figure out where the economy is headed and what the Fed will do.

To provide some pre-text, as we wrote back in February…

Over the past 6 months or so, our view regarding the job market has been that, rather than being afflicted by a labor shortage, the economy has suffered from an enormous bid-ask spread between employers and employees. Beyond the given of a safer workplace, workers across the country have held steadfast in demanding more and equal pay, better benefits, remote (or at least hybrid) work, affordable child-care, saner work-life balance, more meaningful careers, and broadly speaking, more dignity and respect.

To summarize the U.S. job market [since] 2021, workers have rightly been demanding a higher quality of life.

After decades of having the playing field increasingly tilted against them, workers across the country have essentially gone on strike right at the moment things began opening up (albeit unevenly) in the sort-of-post-vaccination world. Given the enormous leverage of the American workforce at precisely this moment, the timing could not have been more perfect had the revolt been premeditated and organized.

And the resolve among workers could not be stronger or more determined – at a speed and scale never seen before, workers everywhere have been quitting their jobs both preemptively and with hair-trigger speed after their ‘demands’ were not met by their employer. In retrospect, this hasn’t actually looked like much of a stand-off as workers have pretty much just stood up and walked away from the negotiating table.

Our perspective for the past 15 months has been that the country was not so much afflicted by a worker shortage as it was by an enormous bid-ask spread between employers and employees, and that equilibrium in the job market would only be achieved when employers recognized that they would have to capitulate far more than workers and eventually meet the demands of a striking American workforce.

And that is precisely what happened.

Companies have aggressively raised wages, stopped forcing people back to the office, adopted hybrid work environments, strengthened benefits, abandoned the traditional 9 to 5, 40-hour work week, relaxed certification and college degree requirements, recognized the need for improved work-life balance, and pretty much made any and every accommodation required to attract workers, fill job openings, and retain talent.

What is surprising in all of this is not the fact that all these concessions worked but how quickly and aggressively employers so thoroughly caved to the demands of the American workforce. Relative to how employers reacted to the Great Recession a decade or so ago, the past two years have been whiplash-inducing.

In fact, I’d go so far as to predict that a decade from now (if not sooner), this post-pandemic transformation of how America works will likely be regarded on a par with what happened during the industrialization of the U.S. economy.

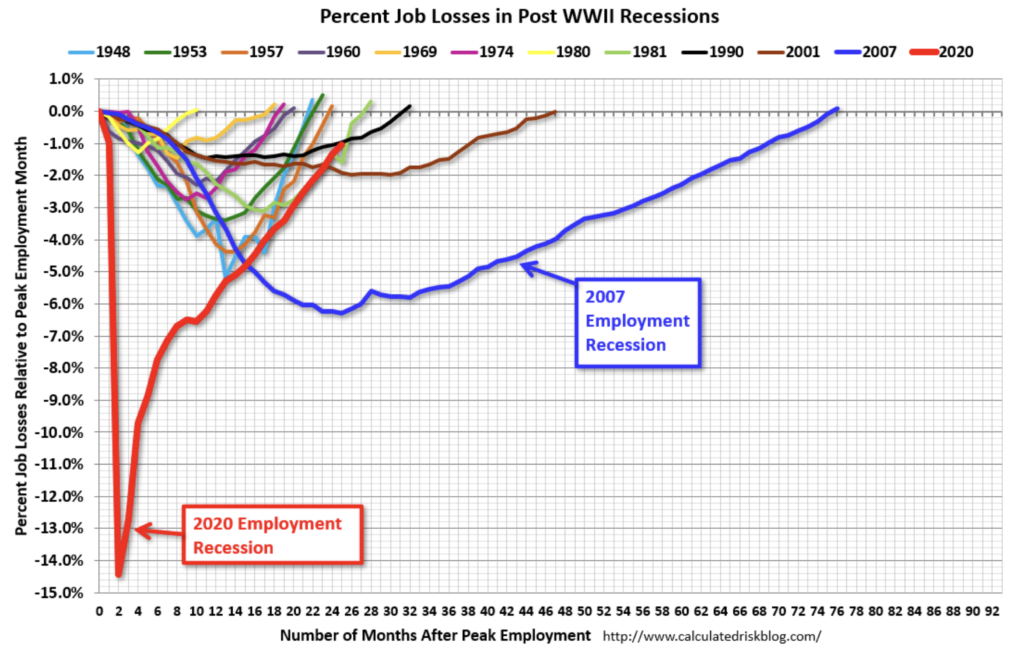

And that is perhaps one of the great lessons (or reminders) from this era – never underestimate corporate America’s ability to do whatever is necessary in the interest of self-preservation. By doing anything and everything required to hire workers, businesses added 9 million jobs over the past 16 months, averaging a net gain of 550,000 jobs per month during that stretch – a 190% increase over the average monthly net gains in the 16 months prior to the pandemic. Going back to May of 2020 to also include the critical assistance provided by the massive stimulus injected into the economy, the U.S. has recovered 21 million of the 22 million jobs lost in March and April of 2020.

The speed and scale of the 24-month recovery is beyond dumbfounding.

But of course, that highly effective public-private combination of federal stimulus and corporate crisis-management has led to the sharp (and temporary) spike in inflation, a situation exacerbated by supply-chain issues and the war in Europe.

And it’s inflation, the Fed response, and the speculation about both that has ignited the raging holy war that’s enflamed every discussion about the economy these days. And on top of that pile of highly combustible timber, the uncertainty around which way the economy is heading adds gasoline to the inferno.

Unfortunately, the mixed signals emanating from the labor market do little to clarify to the situation.

On the glass half full side of the ledger, labor demand and quits both remain at record-high levels, companies continue to find it nearly impossible to fill the roles necessary to meet insatiable demand for their goods and services, wages are still rising, and the labor force participation rate continues to climb as people continue returning to work.

On the glass half empty side, however, labor demand has tapered off, employers are beginning to announce slowdowns in hiring, and some are even announcing layoffs. Equally as distressing is the fact that despite rising wages, wages in most sectors have not outpaced rising inflation and workers as a whole have not increased their share of economic income.

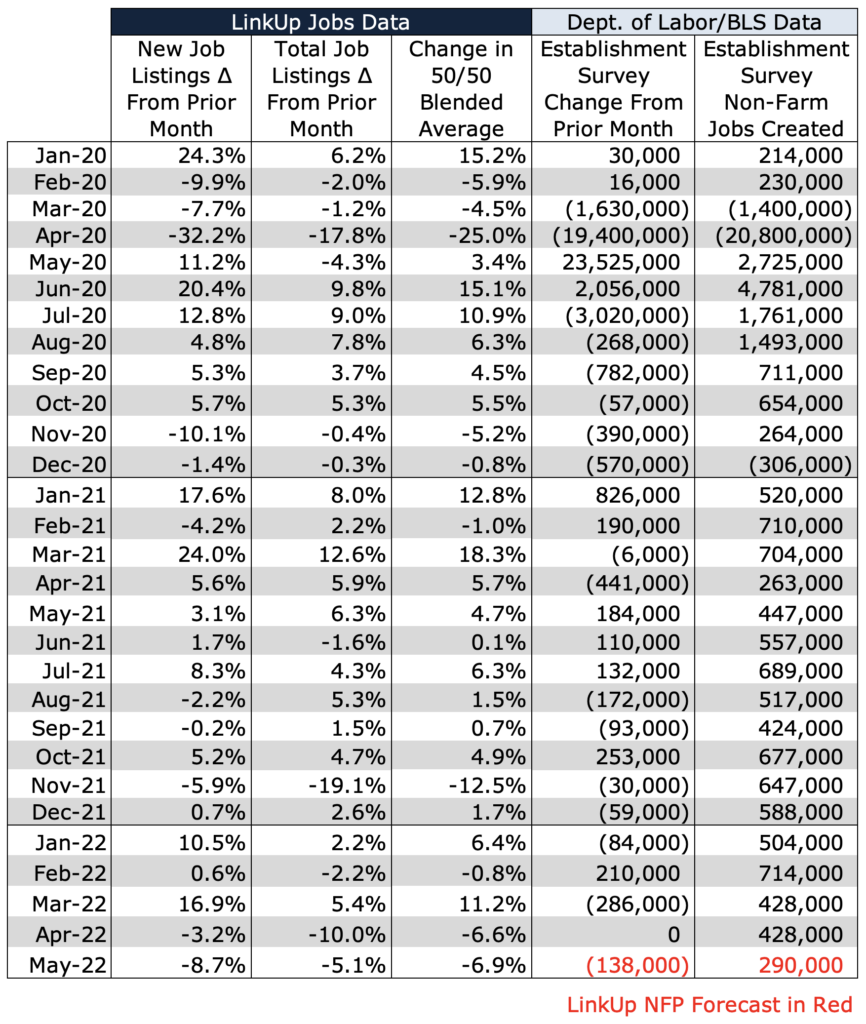

And while we’d love to say that our job market data is decisively tilting the scale in one direction or another, our alethiometer solidly confirms the highly mixed picture we’re seeing at the present moment. Having said that, based on LinkUp’s April and May data, we are forecasting a below-consensus payroll number for May and expect to see continued declines in June.

To start with Friday’s jobs report, we are forecasting a net gain of 290,000 jobs based on our job market data from April that we published last month.

As background, our non-farm payroll forecasts are based on LinkUp’s job market data – a global database of job openings indexed every day directly from company websites around the world. As a result of our unique dataset, our high-frequency data is accurate, powerful, and insightful. And because a job opening posted on a company’s website signals the intent to make a hire, our data is predictive and highly correlated to job growth in future periods.

In regard to what we expect to see in June’s jobs report that will be published July 8th, things are looking even a bit more grim.

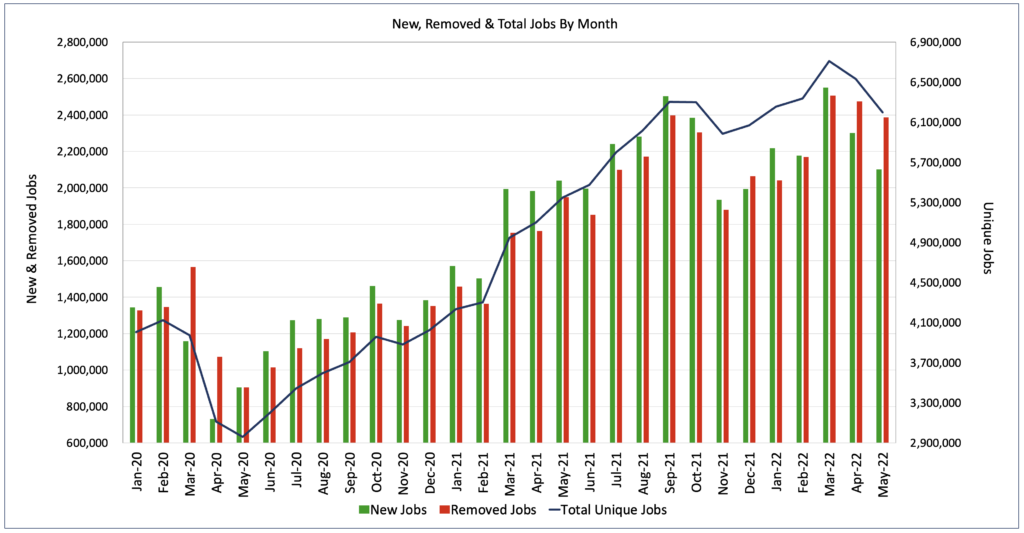

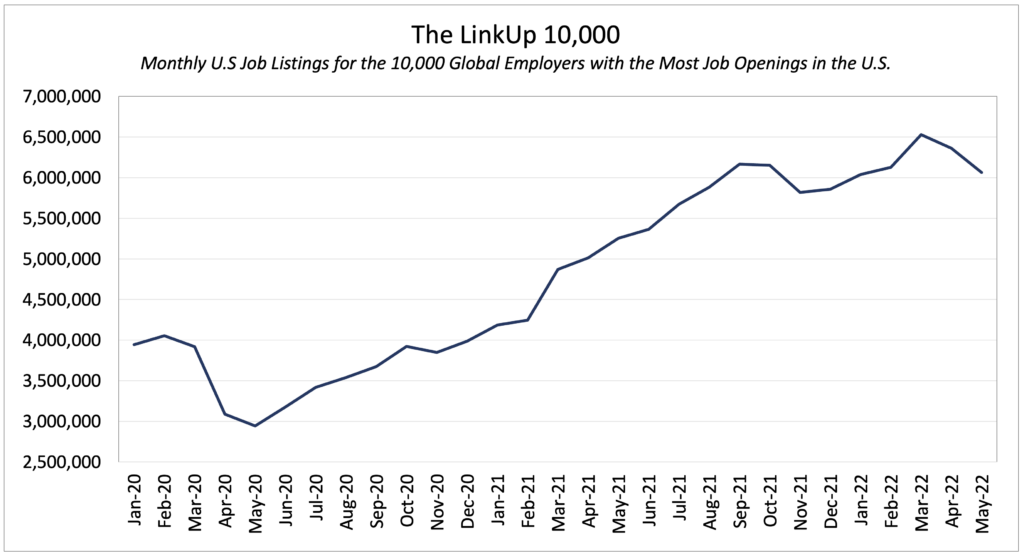

In May, total job openings dropped 5% and new and removed jobs fell 9% and 4% respectively. With the declines in May, labor demand has returned once again to a level seen last September.

The LinkUp 10,000, which tracks total job openings from the 10,000 global employers that have the most job openings in the U.S., also fell 5%.

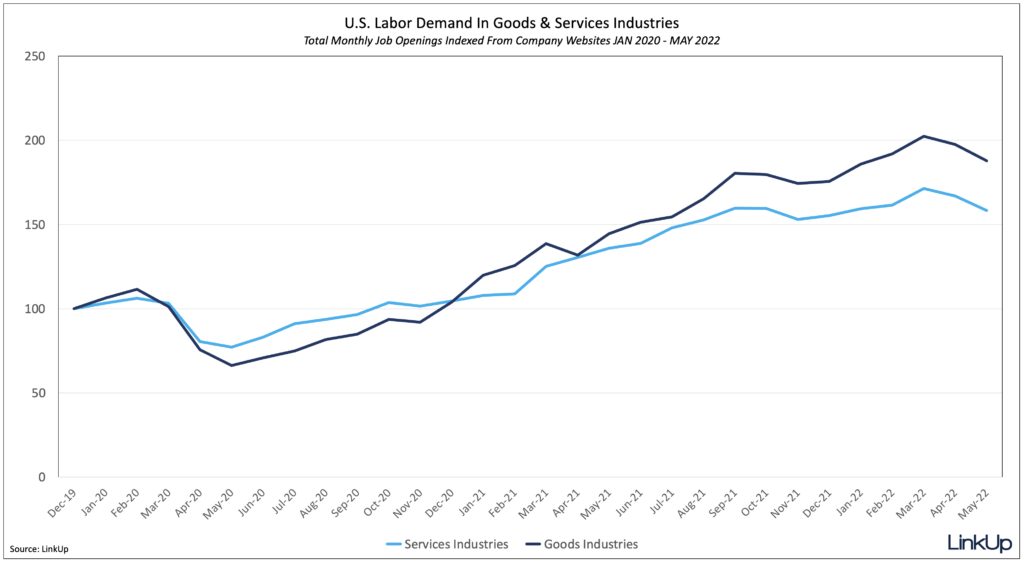

Nearly identical declines in labor demand were seen in goods and services industries alike.

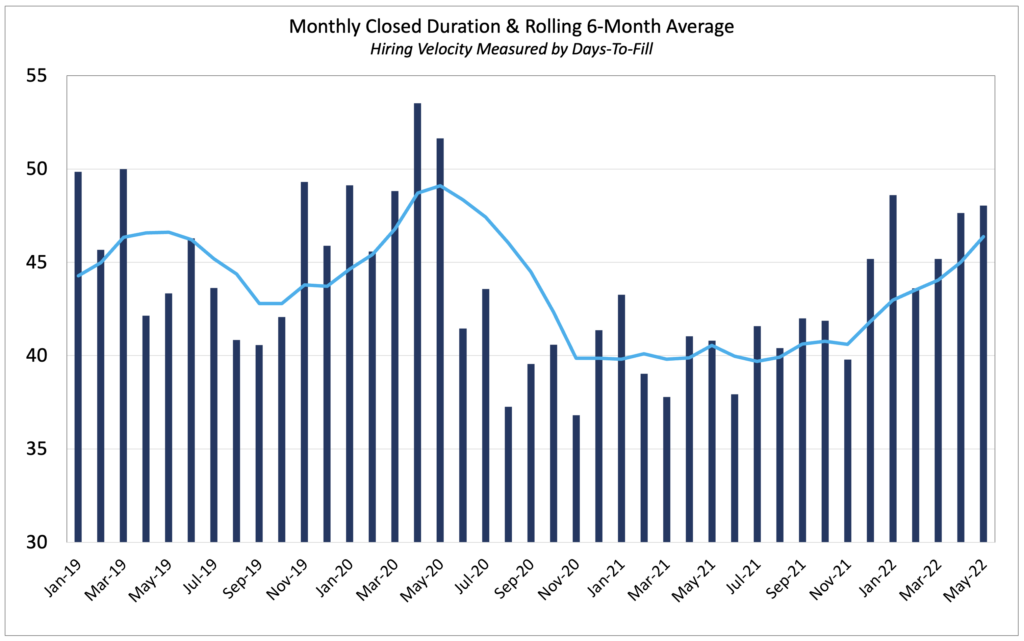

As it has for the past 6 months, hiring velocity slowed again in May as Job Duration rose to 48 days.

Job Duration, the average number of days that job openings are posted on company websites before they are removed – typically because the job was filled – tracks hiring velocity across the entire economy.

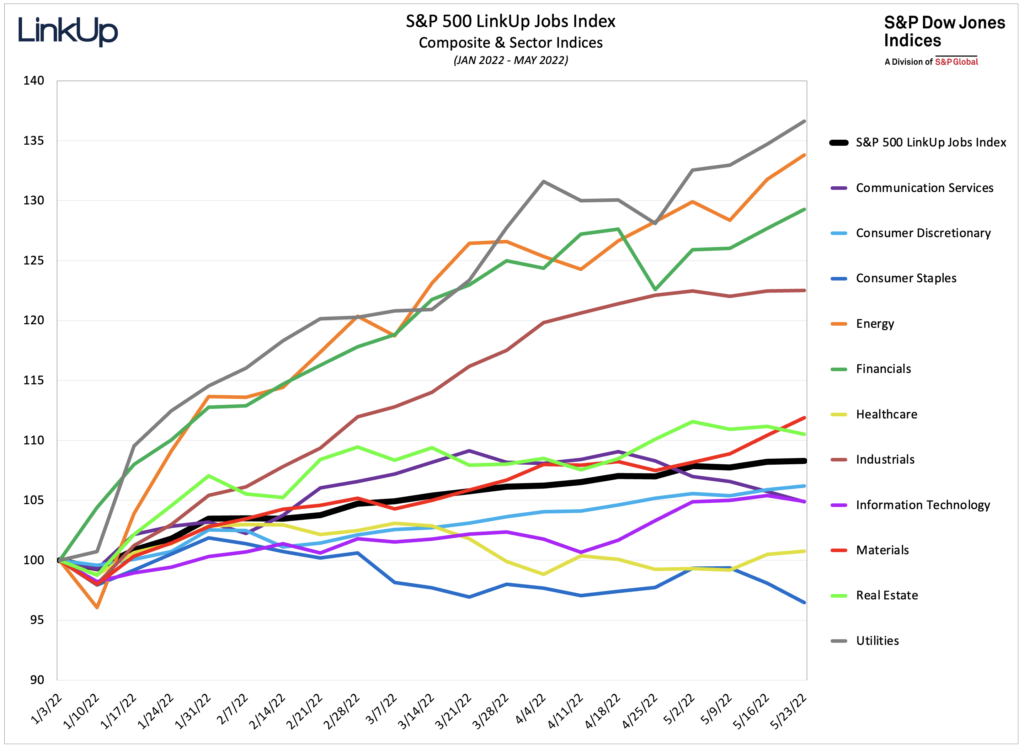

The S&P 500 LinkUp Jobs Index also presents a very mixed picture with only a handful of sectors showing solid job opening growth this year and most sectors showing modest to anemic job opening growth.

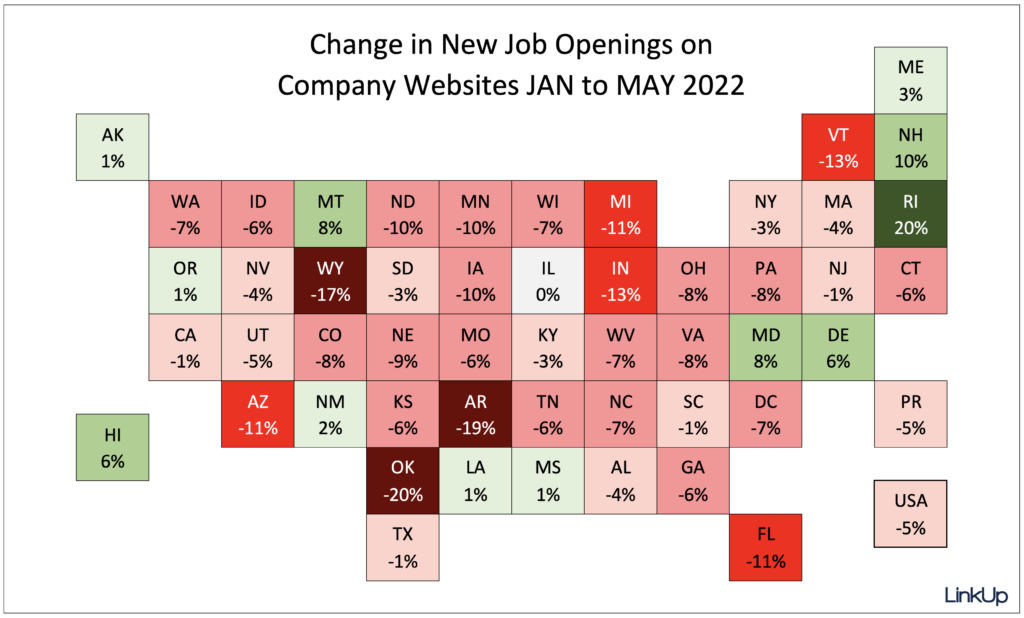

Since January, new job openings across the country have dropped 5% with only a dozen states showing any gains.

For Friday’s jobs report, as we mentioned previously, we are forecasting a net gain of 290,000 jobs in May, slightly below consensus estimates of 320,000 jobs. That forecast is based on our April data, and because our May data is similarly negative, we expect to see continued weakness in the job market in June. Perhaps the only upside to the grim outlook is that it might compel the Fed to slow, pause, or even abandon its tightening.

We can only hope.

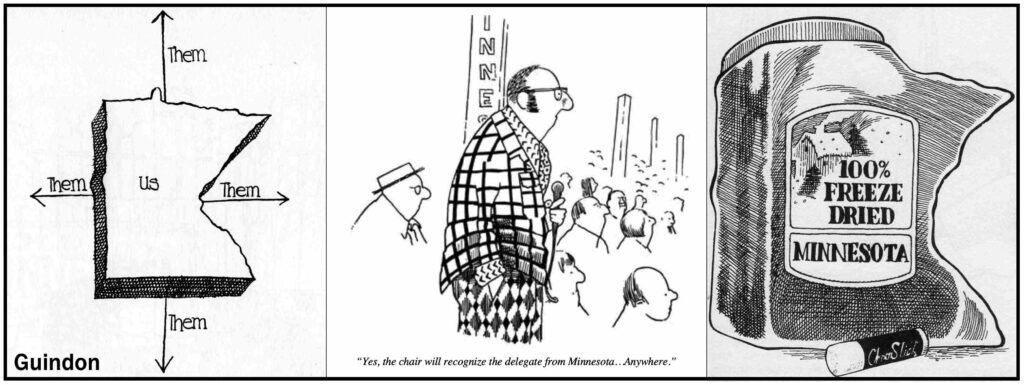

And lastly, albeit a few months delayed, Minnesota-native Dick Guindon died in late February at the age of 86. He was one of Minnesota’s all-time greats, and growing up, our refrigerator was covered with his cartoons from the Minneapolis Tribune. Plenty have perfectly captured Minnesota, but few have done it with so much good humor.

Insights: Related insights and resources

-

Blog

04.01.2022

LinkUp Forecasting Net Gain of 800,000 Jobs in March as Jobs Data Points to Accelerating Labor Demand in U.S.

Read full article -

Blog

09.02.2019

Despite Trump's Best Efforts, The U.S. Job Market Refuses To Cool Off

Read full article -

Blog

02.02.2017

LinkUp Forecasting Solid Job Gains In January and Continued Strength In February

Read full article -

Blog

10.05.2016

The Big Grind: LinkUp Forecasting Net Gain Of 125,000 Jobs in September

Read full article -

Blog

07.07.2016

The Full Employment, Healthy Tortoise U.S. Economy Should Add 50,000 Jobs In June

Read full article -

Blog

03.03.2016

LinkUp Forecasting Decent Job Gains In February

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.