LinkUp Forecasting a Net Gain of Just 380,000 Jobs In November

For the past 6 months or so, we’ve held the view that while the U.S. is not plagued by a labor shortage, it is, rather, afflicted with a massive bid-ask spread between employees and employers that has essentially frozen the job market.

With 18 million Americans unemployed, underemployed, or not counted as unemployed because they haven’t looked for work in 4 weeks, not to mention another 4M+ people quitting their jobs every month, there are plenty of able Americans available for work. The common refrain from employers that “we can’t find workers” is laughable – they haven’t gone anywhere. Workers are everywhere – they just don’t want to work for the companies that claim they cannot find them.

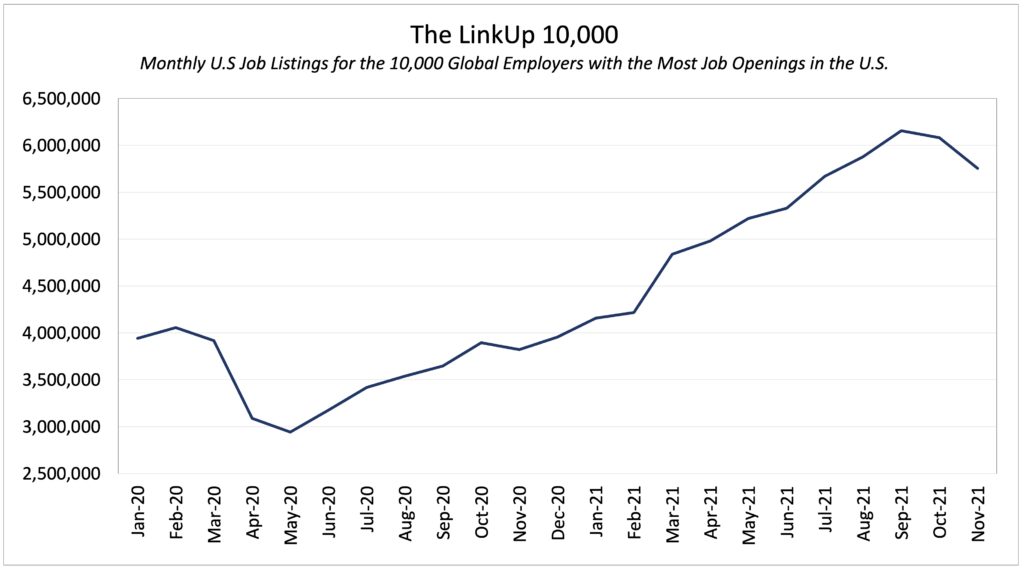

And a lot of workers are saying that to a lot of employers – since February, labor demand in the U.S. has risen 46% with global employers posting a record 6.3M U.S. job openings on their corporate websites in October. And workers, in the aggregate, are rejecting the current ‘Bid’ from employers for a lot of reasons – Covid, wages, benefits, child care, awful culture, dead-end careers, meaningless work, work-life balance, in-the-office mandates, miserable commutes, and better opportunities elsewhere.

After decades of a growing (and accelerating) imbalance between labor and capital and a persistent lack of dignity and respect shown to labor generally, U.S. workers have literally and figuratively gone on strike with a long list of legitimate demands. This collective ‘Ask’ from the American workforce is formidable and employers are just beginning to wake up to the reality that this job market is unlike anything any of us have ever seen in our lifetimes.

As we said last month, Covid unleashed a seismic event that had been building up for decades, and not only will the after-shocks persist for some time, the resulting landscape will be fundamentally altered. Precisely what that ‘new normal’ looks like is still taking shape as some form of equilibrium is achieved between employers and employees, and the only certainties are that the timeline for reaching that equilibrium is nowhere on the horizon as far as we can tell and the path to getting there will be fraught with acrimony, debate, and upheaval.

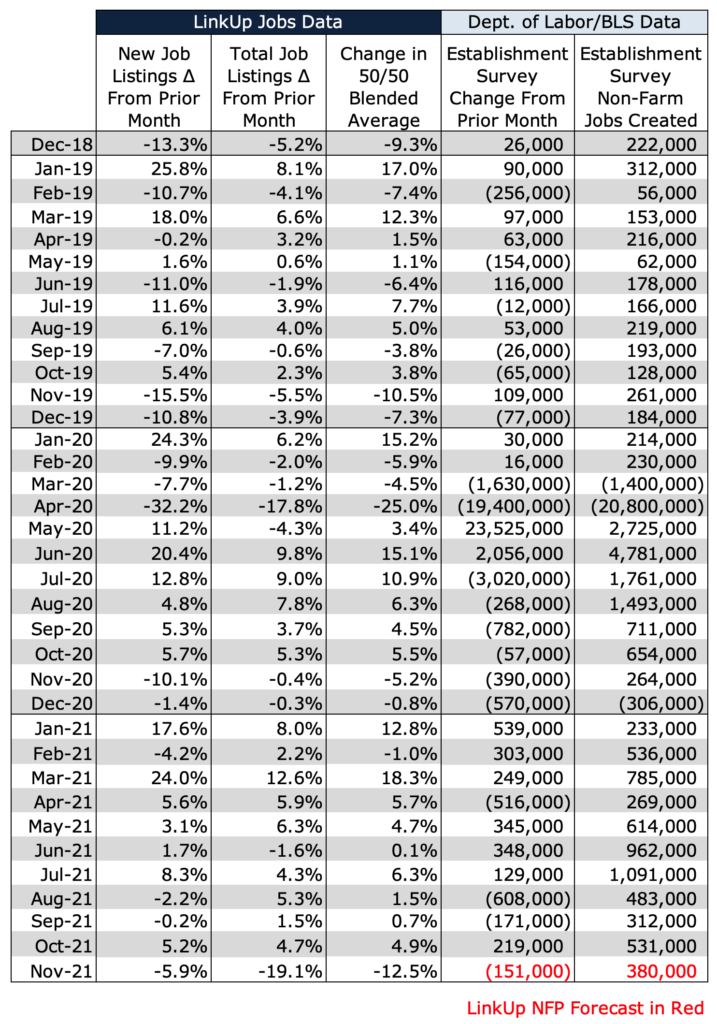

And unfortunately, tomorrow’s jobs report isn’t going to help matters. Based on LinkUp’s job data for November, we expect a disappointing net gain of just 380,000 jobs in November.

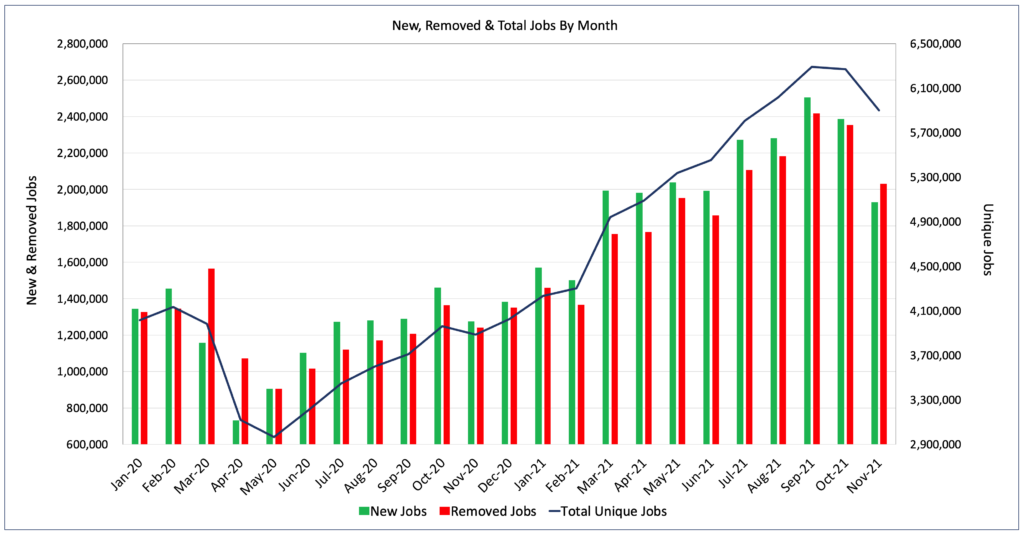

In November, total job openings in the U.S. dropped 6% to 5.9 million and new job openings plummeted 19% while removed jobs dropped 14%.

As an aside, our non-farm payroll forecasts are based on LinkUp’s job market data – a global database of job openings indexed every day directly from company websites around the world. As a result of our unique approach, our high-frequency data is accurate, powerful, and insightful. And because a job opening posted on a company’s website signals the intent to make a hire, our data is predictive and highly correlated to job growth in future periods.

Similarly, The LinkUp 10,000 fell 5% to 5.7 million. The LinkUp 10,000 tracks the total job openings from the 10,000 global employers that have the most job openings in the U.S.

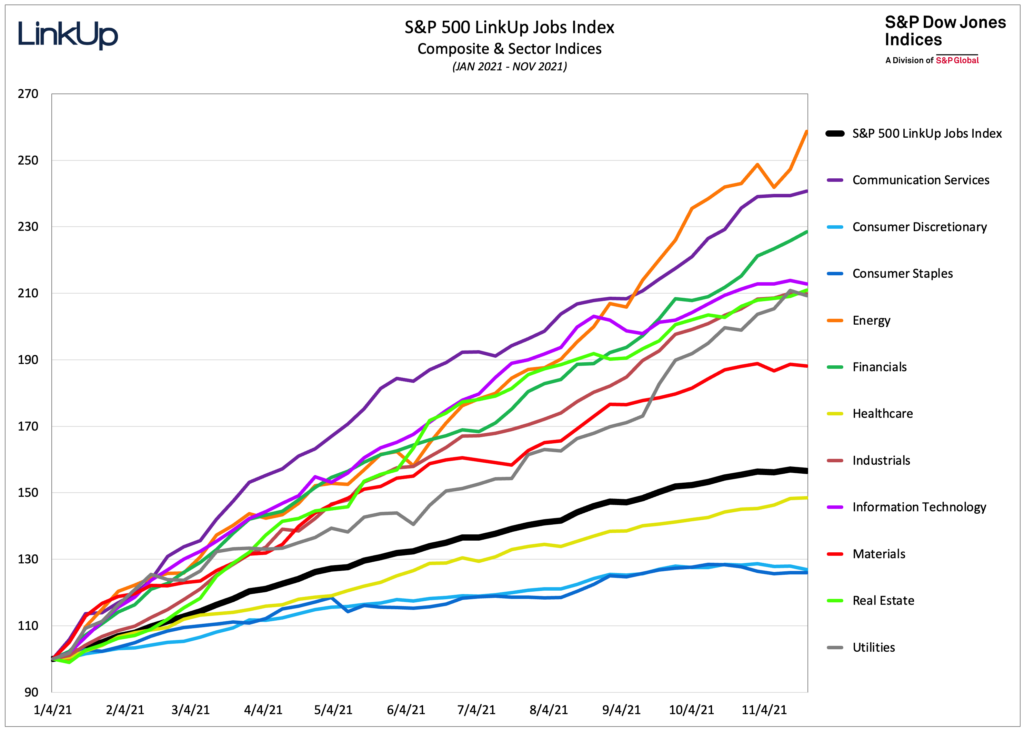

While the S&P 500 LinkUp Jobs Index did better than the rest of the labor market in November, it did stay flat with only 2 sectors, Energy and Financials, showing any material increase and all the others staying relatively flat or declining during the month.

Since January 2020, labor demand in Technology and Materials have far outpaced all other sectors, but even those two sectors were flat during the month.

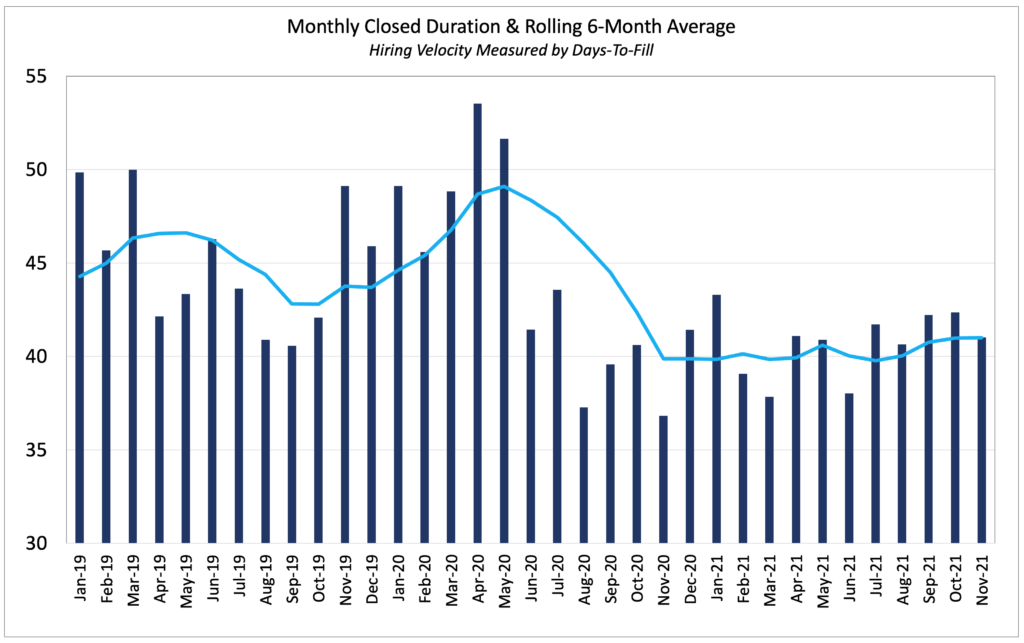

Job Duration, the average number of days that job openings are posted on company websites before they are removed – presumably because the job was filled – essentially measures hiring velocity across the economy. And in November, hiring velocity increased slightly to 41 days but the 90-day rolling average continues to hold steady at 42 days.

So based on our data, we are forecasting a net gain of 380,000 jobs in November, well below the 550,000 consensus estimate.

As we’ve said pretty consistently all year, while we’re always hopeful for a far better number that our data would indicate, we continue to anticipate that it will be a long and chaotic slog to achieve an equilibrium that will bridge the massive bid-ask spread that continues to wreak havoc in the labor market and the economy as a whole.

Insights: Related insights and resources

-

Blog

11.02.2021

There Is No Labor Shortage But There Is a Shortage of Dignity and Respect For Workers

Read full article -

Blog

10.07.2021

LinkUp Forecasting Net Gain of 625,000 Jobs In September But Large Bid-Ask Spread In Job Market Will Persist

Read full article -

Blog

07.01.2021

June 2021 Non-farm Payroll Forecast: The Growing Bid/Ask Spread Between Employers and Employees

Read full article -

Blog

09.29.2020

Stimulus revisited: Tracking the ongoing impact of unemployment benefits.

Read full article -

Blog

10.23.2018

As unemployment falls, time to fill jobs gets shorter

Read full article -

Blog

08.17.2017

We are all affected by the opioid epidemic

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.