LinkUp Forecasting a Net Gain of 410,000 Jobs In February

There is no way to begin this month’s post other than noting that as the situation continues to unfold in Ukraine, with the near certainty that it will get worse in the days and weeks ahead, our thoughts and hearts go out to everyone impacted by Russian atrocities.

I am not sure the global back-drop could have gotten any more complicated or terrifying than it has in the past few weeks, and the Russian invasion of Ukraine has, most assuredly, further intensified and exacerbated a complex set of circumstances for the economy. With increased inflationary pressure and a massive injection of uncertainty (and potential chaos) into the capital markets, caution has most certainly become the order of the day.

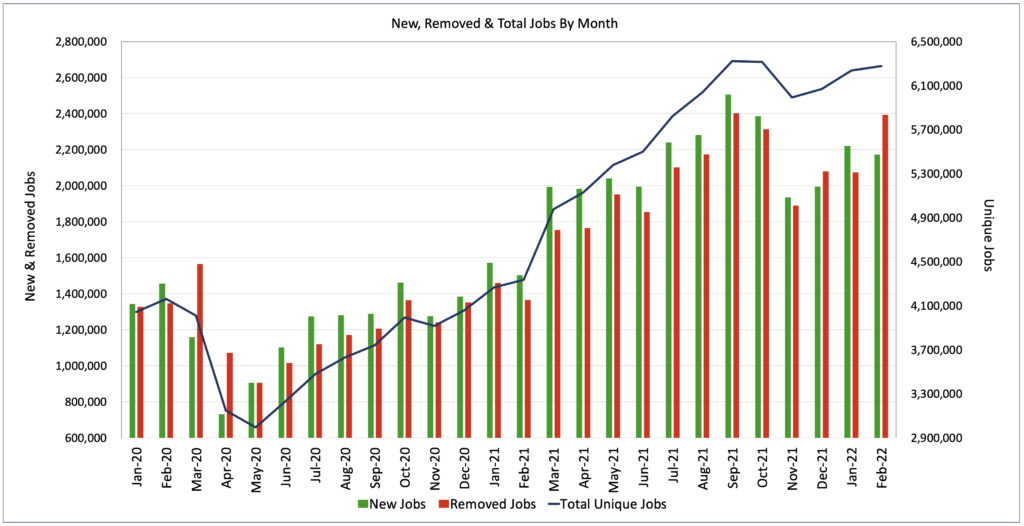

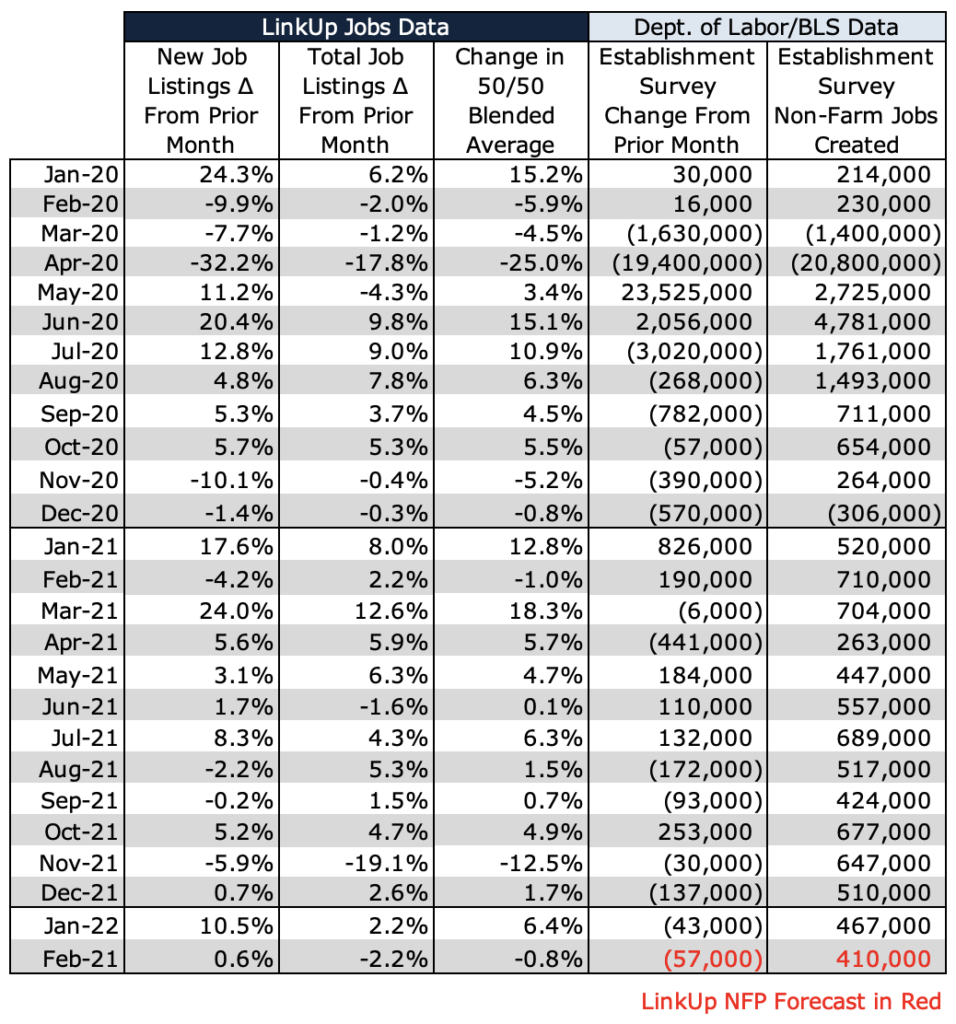

Debates around causation and correlation aside, LinkUp’s job market data for February definitely reflect a more muted outlook. Total U.S. job openings on company websites globally rose a scant 0.6% while new job openings actually declined -2.2%. Potentially a positive sign, jobs removed from company websites jumped 15.4%.

In drilling into Jobs Removed a bit further, companies remove openings from their website for one of two reasons – either they have filled the role with a hire and the position is no longer available or they do not intend to fill it. (There is a 3rd reason – if the company takes the job down and reposts it shortly thereafter to ‘game’ the system and boost SEO – but our technology can detect that and we account for it in our data).

Our hypothesis for January is that the sharp rise in Jobs Removed is a combination of these. Decent hiring resulted in jobs being filled, but the challenging circumstances facing businesses likely resulted in an above-average number of jobs being removed because companies are becoming more cautious about the year ahead.

As background, our non-farm payroll forecasts are based on LinkUp’s job market data – a global database of job openings indexed every day directly from company websites around the world. As a result of our unique dataset, our high-frequency data is accurate, powerful, and insightful. And because a job opening posted on a company’s website signals the intent to make a hire, our data is predictive and highly correlated to job growth in future periods.

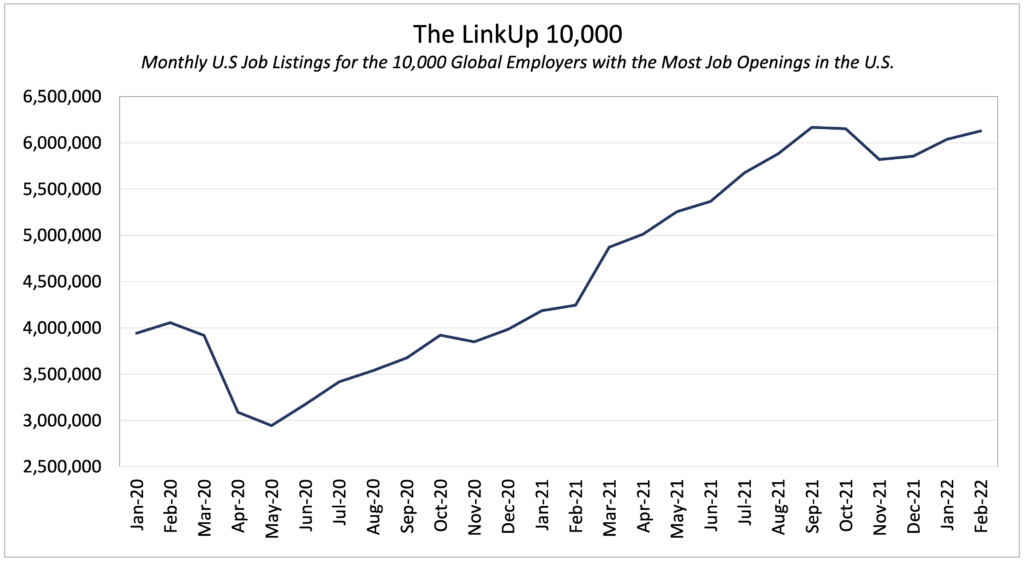

The LinkUp 10,000, which tracks total job openings from the 10,000 global employers that have the most job openings in the U.S., rose 1.5% in February – near its peak in September.

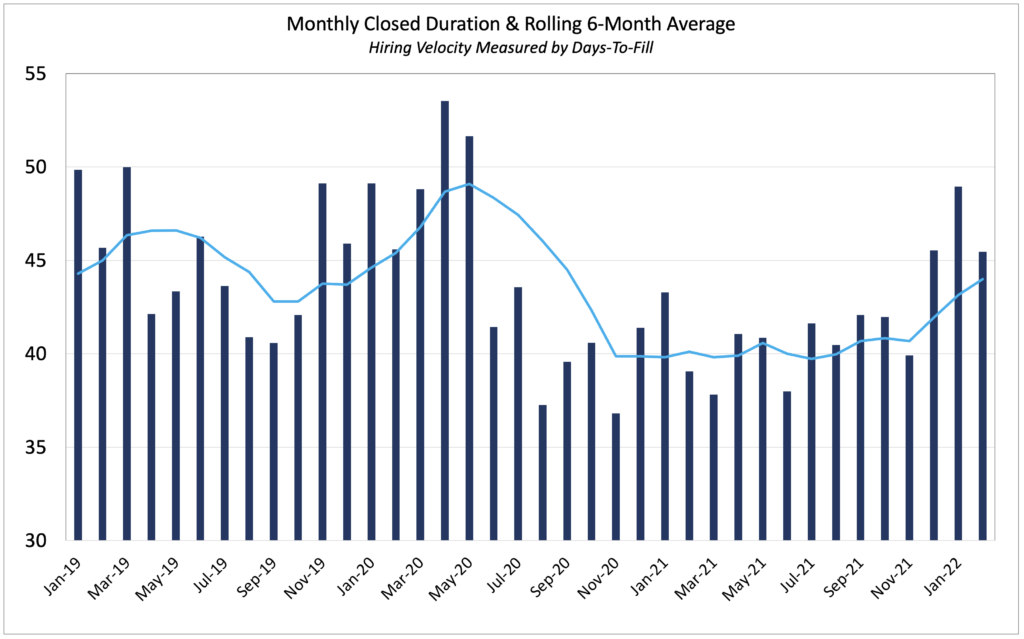

Job Duration, the average number of days that job openings are posted on company websites before they are removed – typically because the job was filled – essentially measures hiring velocity across the economy. As we previously noted, however, duration can also be impacted by companies removing jobs because they do not intend to fill them which we expect was the case, to some extent, in February. Duration declined to 45 days but the 90-day moving average rose to 44 days, indicating a decline in hiring velocity over the past 3 months.

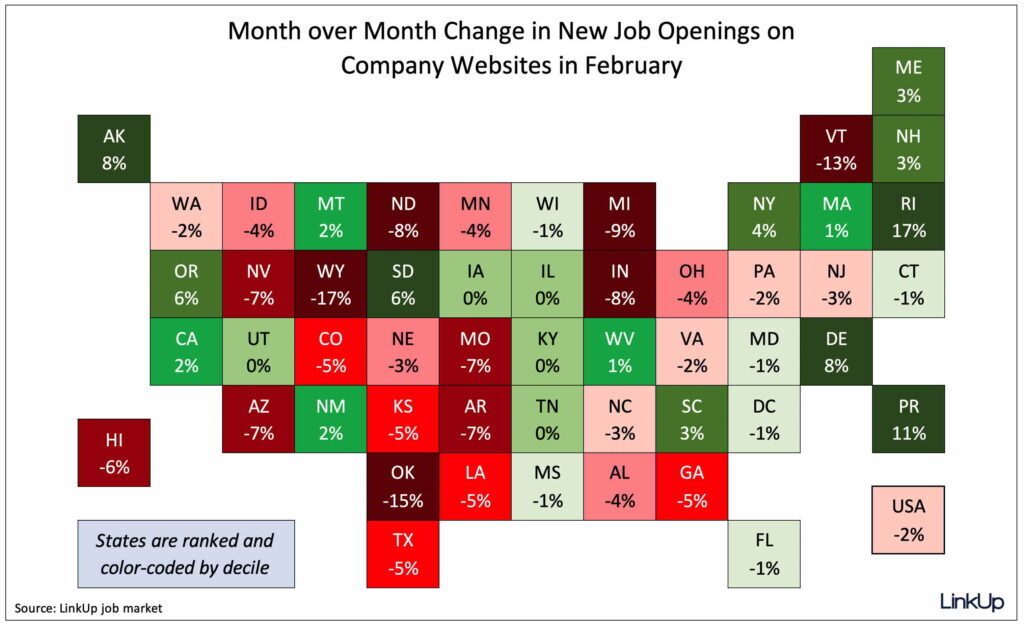

In February, new job openings across the country have dropped 2% with wide dispersion across the country.

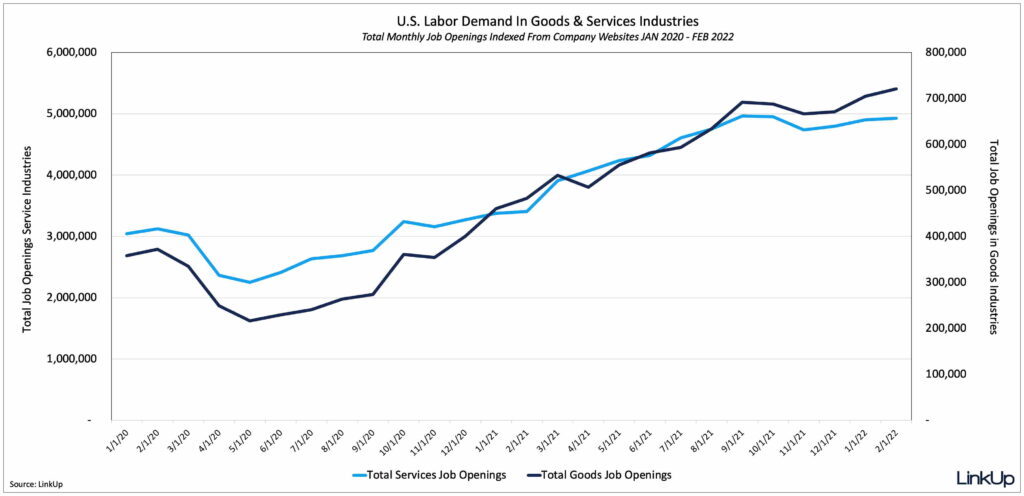

Labor demand in both goods and services related industries rose slightly in February, with goods-producing industries continuing to outpace labor demand in services industries.

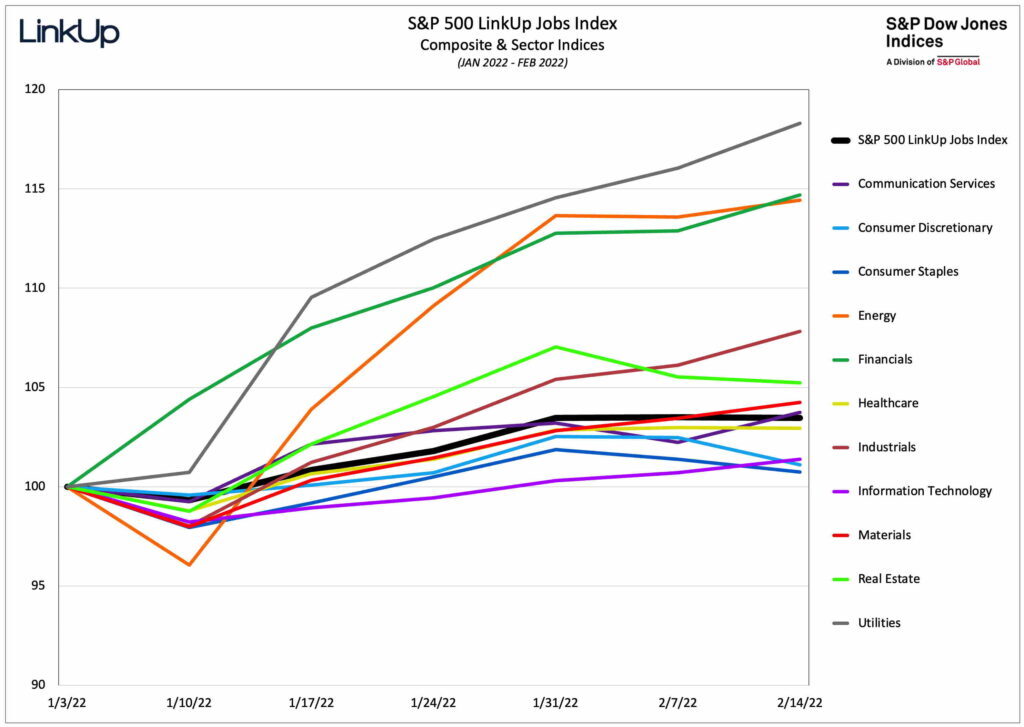

The S&P 500 LinkUp Jobs Index is up slightly in 2022, and Utilities, Financials, and Energy continued to outpace every other sector with gains of 18%, 14% and 14% respectively.

As has been the case since early 2020, Consumer Staples and Consumer Discretionary have continued to bring up the rear, but in a noteworthy shift in the pandemic era, labor demand in Information Technology has lagged considerably so far this year.

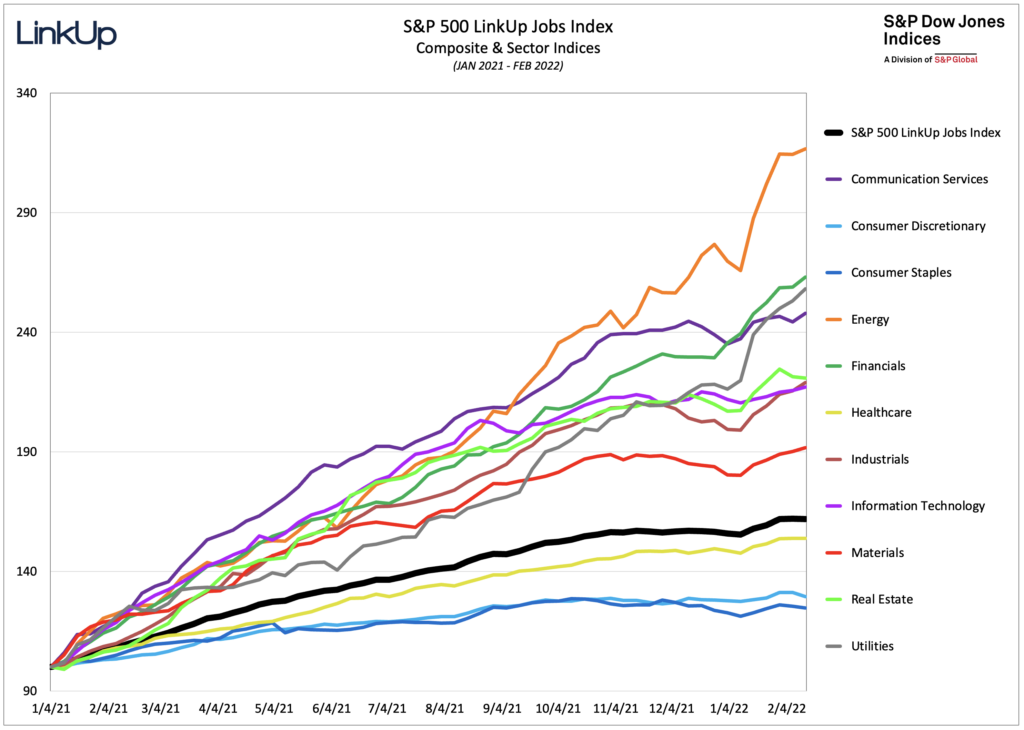

Looking at labor demand across S&P sectors since January of last year shows how significant demand has grown in the energy sector.

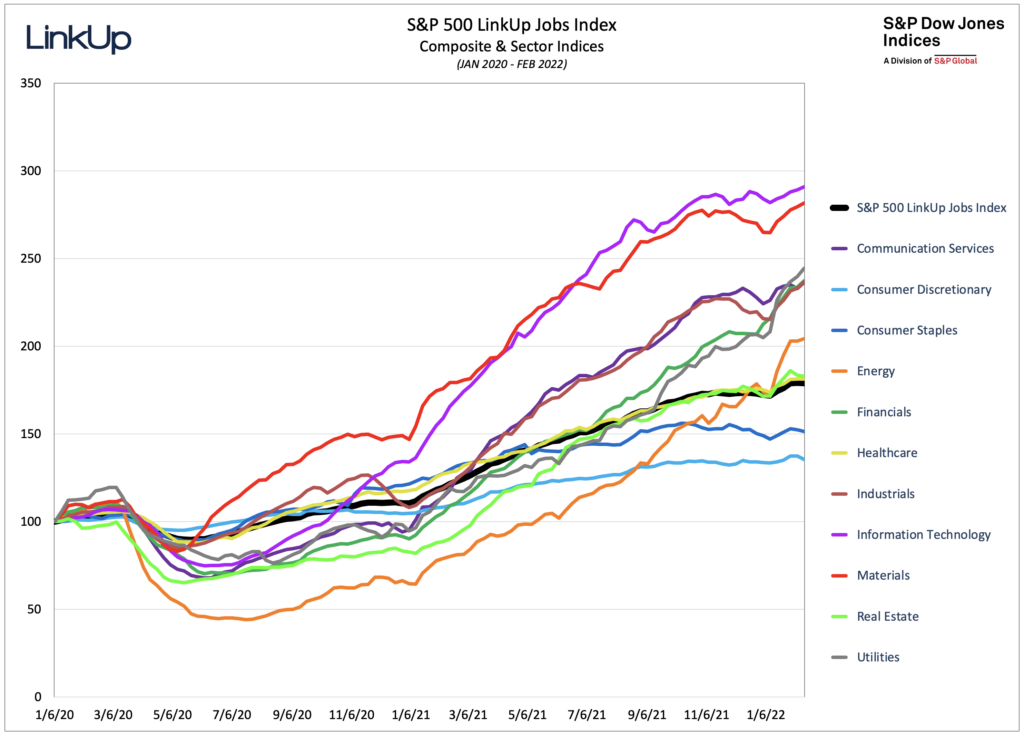

Since January of 2020, labor demand in every sector of the S&P has risen above pre-covid levels, with Information technology and Materials outpacing all other sectors but plateauing since last fall.

So based on our data, we are forecasting a net gain of 410,000 jobs in February, slightly below consensus estimates of 440,000 jobs.

Insights: Related insights and resources

-

Blog

08.04.2022

Heads I Win, Tails You Lose; Reflections on the Still-Cooling But Strong Job Market

Read full article -

Blog

08.05.2021

Bid/Ask Spread in Job Market Narrowing; July Non-Farm Payrolls Will Surprise to the Upside

Read full article -

Blog

07.01.2021

June 2021 Non-farm Payroll Forecast: The Growing Bid/Ask Spread Between Employers and Employees

Read full article -

Blog

09.28.2017

LinkUp Forecasting Net Gain of 260,000 Jobs For September

Read full article -

Blog

03.01.2017

LinkUp Predicts Disappointing Jobs Report For February But March Should Be Better

Read full article -

Blog

07.07.2016

The Full Employment, Healthy Tortoise U.S. Economy Should Add 50,000 Jobs In June

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.