LinkUp Data Points To Net Gain of 315,000 Jobs In October, Well Above Consensus Estimates

As we continue to absorb today’s Fed announcement and Chairman Powell’s subsequent press conference, we’ll hold off on publishing our job market commentary until after Friday’s jobs release and jump right into LinkUp’s job market data for October and our forecast for Friday’s non-farm payroll report.

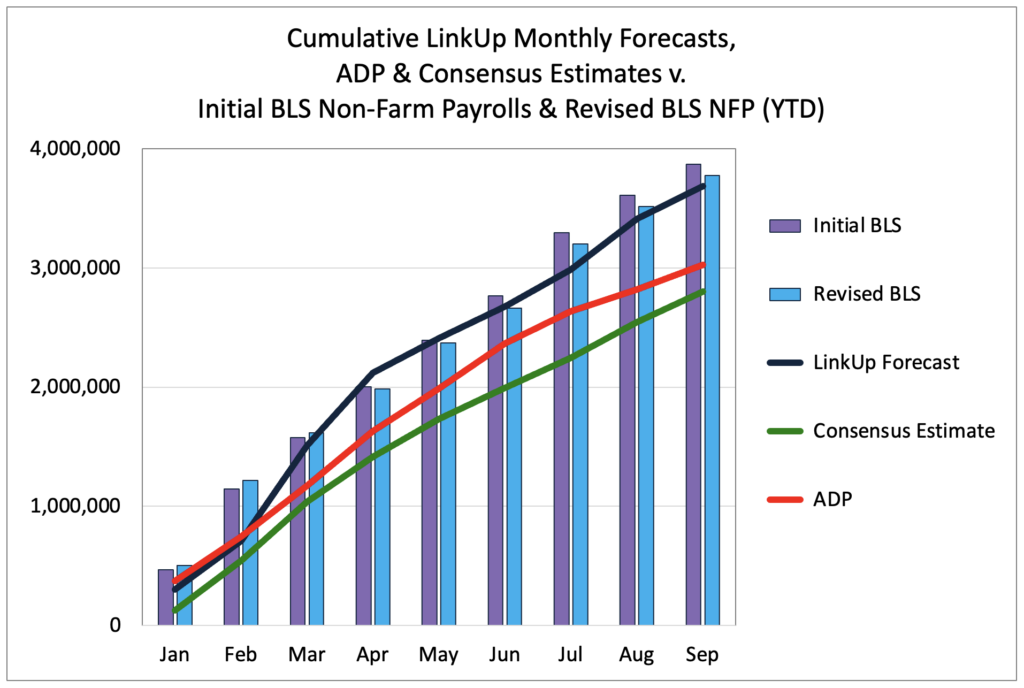

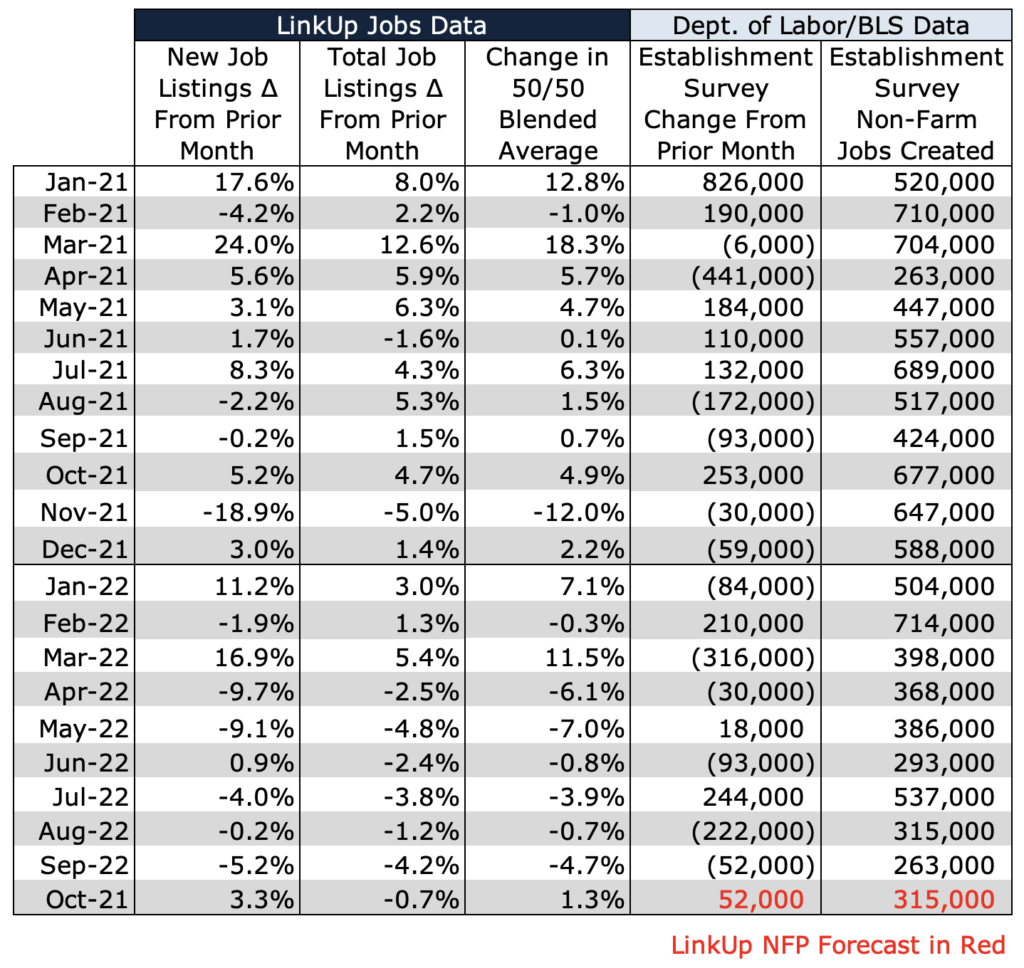

To start, because it’s the final quarter of the year (but mostly because we’ve had a great run this year with our forecasts), we thought it would be worth posting our YTD forecast track record (cumulative monthly) relative to actual job gains in the US and two relevant benchmarks.

YTD, we are off by just 2% from the Bureau of Labor Statistics’ reported job gains, vastly better than both consensus estimates and ADP which have missed their mark by 28% and 20% respectively.

Our forecast for October is well above consensus so we’ll see what happens Friday, but our job data for October points to another strong month of job gains.

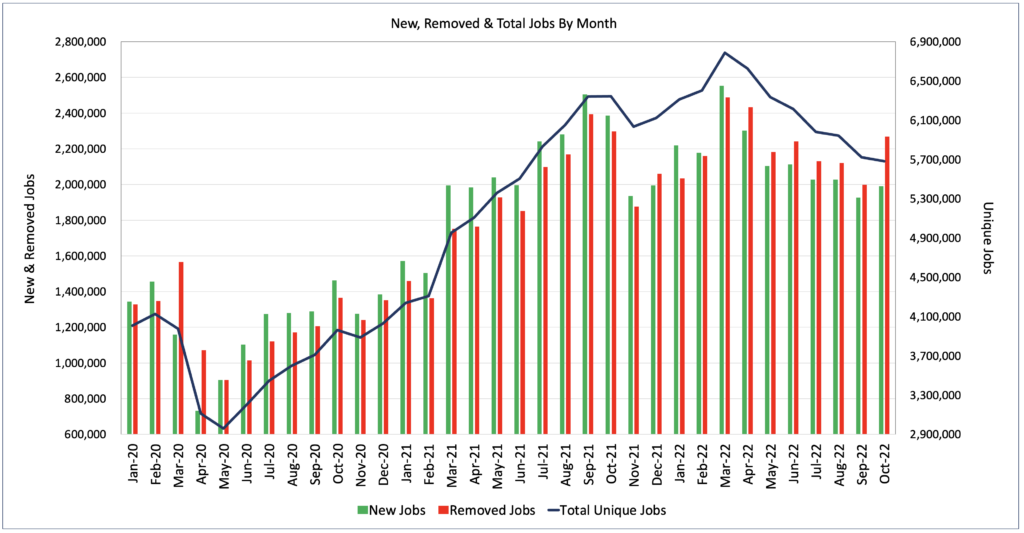

During the month, total job openings dropped a modest 0.7%, while new job openings rose 3.3% and jobs removed from company websites, both because they were filled with new hires and, to some extent, because companies are removing jobs they no longer intend to fill as the Fed continues to tighten, jumped sharply by 13.5%.

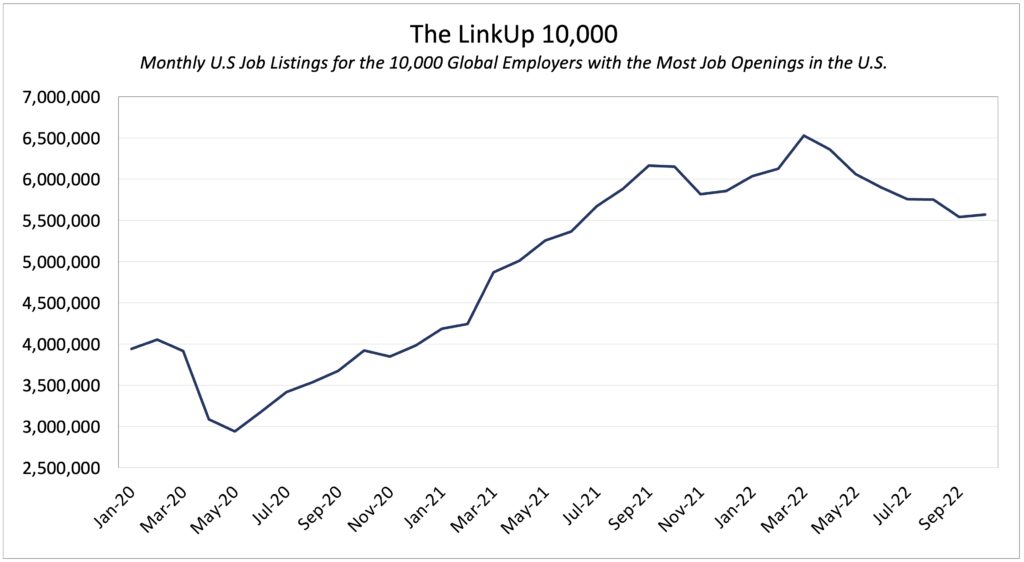

The LinkUp 10,000, which tracks US job vacancies for the 10,000 global employers with the most openings in the US, rose by 0.5% in October.

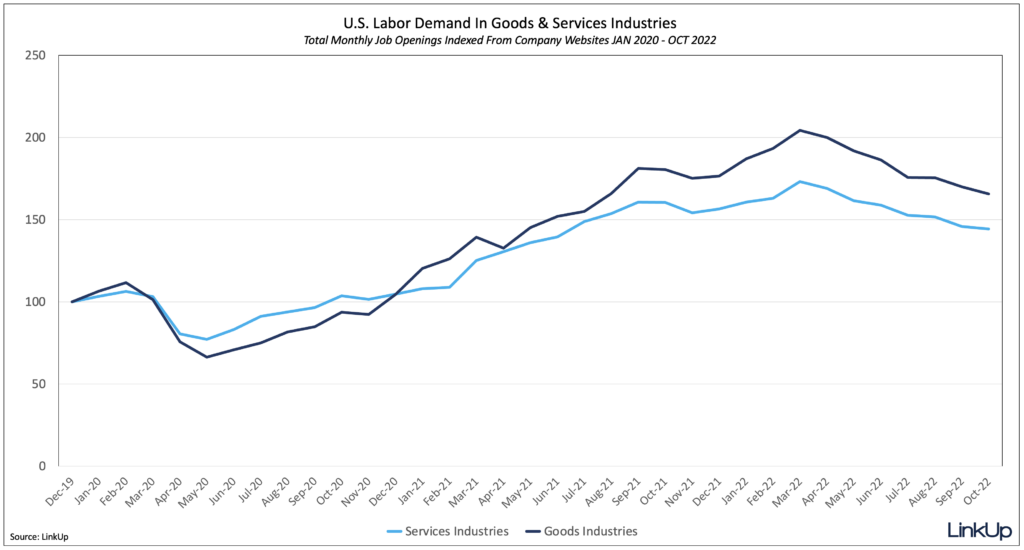

At an industry level, total job vacancies declined at similar rates for goods producing and services industries (the chart below is indexed to 100 beginning January 2019).

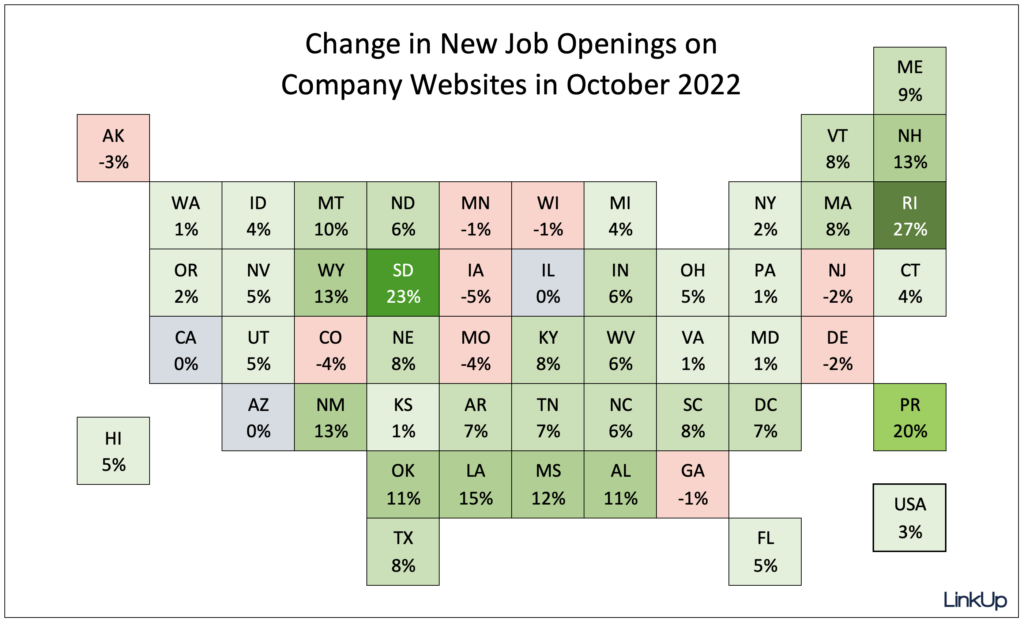

New job openings rose throughout most of the country in October, with only 9 states showing small declines.

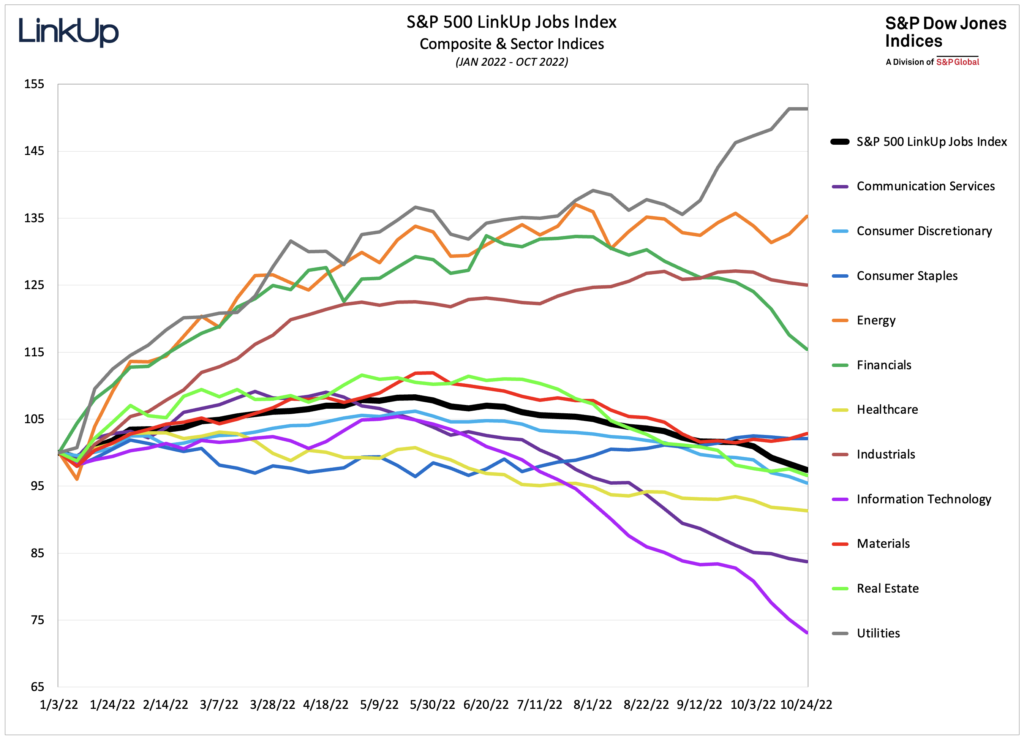

For the month, through the week of October 24th, the S&P 500 LinkUp jobs Index declined 4.1% as labor demand among the S&P 500 constituents fell in every sector except Materials and Utilities.

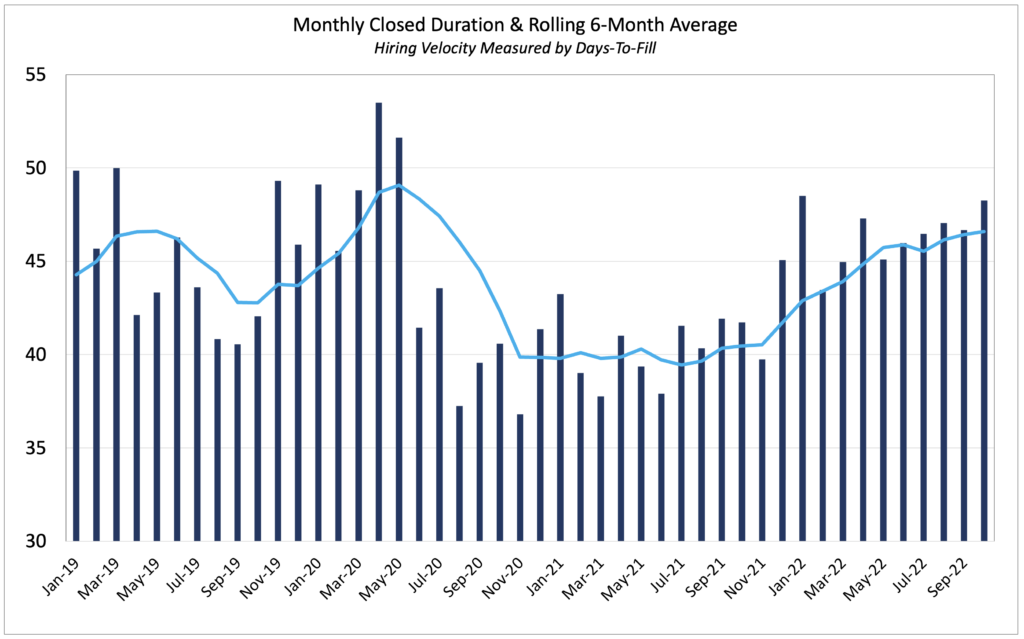

And lastly, LinkUp’s Closed Duration or ‘Time-To-Fill’ metric rose to 48 days and the rolling 90-day average rose to 47 days.

With the increase in new job vacancies, combined with the sharp rise in jobs removed (which indicates that employers filled a lot of positions), we are forecasting a net gain of 315,000 jobs in October, well above the consensus estimate of just 200,000 jobs.

Again, we’ll publish our commentary following Friday’s report and hopefully we’ll have improved on our already solid forecast record in 2022.

Insights: Related insights and resources

-

Blog

10.02.2019

U.S. Job Market Finally Cooling Off; September Job Gains Will Disappoint

Read full article -

Blog

07.02.2019

Streak of Monthly U.S. Job Gains Will End In June

Read full article -

Blog

08.30.2018

With Signs Pointing to Weakening Job Market, Job Gains Will Disappoint Again In August

Read full article -

Blog

10.26.2017

The New Abnormal Is Wreaking Havoc on Job Market Forecasts; LinkUp Predicting Net Gain of 120,000 Jobs In October

Read full article -

Blog

01.04.2017

Merry Christmas Donald: Despite Disappointing December Job Gains, You're Inheriting a Very Strong Job Market

Read full article -

Blog

03.30.2016

March NFP Of Just 100,000 Jobs Will Be Well Below Consensus Estimates

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.