Like a Stray Dog Gone Defective

What better way to describe this current End-of-Days-type era than as ‘a stray dog gone defective?’

A month or so ago, listening to Beck’s Paper Tiger, one particular line stuck in my head as a perfect description for the times we live in. What better way to describe this current End-of-Days-type era than as ‘a stray dog gone defective?’ With the White House and Republicans driving the train and Democrats feebly attempting to apply brakes that may have been severed in any event, the entire country has gone completely off the rails. And with every news cycle that sinks us further into the horror, it seems increasingly as if we might never be able to fix what is being obliterated beyond recognition.

As metaphors go, the entire song well describes the apocalyptic landscape that is emerging as everything is being ‘torn apart by idle hands.’ Ashes. Cinders. Ruins. Capsized boats. Deserts down below us and storms up above. The helter skelter morning (ravaged by the latest AM Twitter rant). The longer this goes, the clearer it becomes that ‘we’re just holding on to nothing to see how long nothing lasts.’

Pretty bleak to be sure but how could anyone possibly argue otherwise? Pages 4 and 5 of Thursday’s Minneapolis Star Tribune this week provide a perfect snapshot of how absurd things have gotten. On the 2-page spread (and yes, I still read a print daily newspaper…), the headlines of the 7 stories on the pages were as follows:

- Besieged VA pick might drop out

- Justices signal support of travel ban

- Macron rebuffs Trump before Congress

- HUD Secretary urges tripling rent for poorest using aid

- AG dodges recusal questions

- Mulvaney admits selling access to lobbyists while in Congress

- Cohen pleads the 5th in Daniels lawsuit

What a shit-show. Unless something or someone somehow manages to arrest the devastation, it might be the case that literally nothing will survive.

For the time being, it appears to be a minor miracle that Trump has somehow managed to avoid annihilating the glorious Obama economy he inherited and its record-setting streak of monthly job gains. Despite a weaker-than-expected jobs report for March (which some have argued might have been impacted by horrific weather), the job market continues to chug along, seemingly oblivious to Hurricane Trump.

90 straight months of positive job gains. Unemployment at 4.1% and falling. Black and Hispanic unemployment at record levels. Teen unemployment at the lowest level since 1969. Unemployment claims below 300,000 for 162 consecutive weeks – the longest streak ever. The employment population ratio is finally starting to rise. And believe it or not, even wage growth is finally starting to materialize in a meaningful fashion.

And before long, we might finally be able to put to rest the notion that the Phillips Curve has somehow become, in its own right, defective. I’ll admit that rising wage inflation in the official data is scant and that broader evidence of meaningful wage inflation remains anecdotal for the time being, but there is no doubt that the pace of anecdotal evidence is picking up dramatically and spreading further and deeper into the economy.

Two recent stories stand as perfect examples: With an unemployment rate of 3%, wages in Idaho rose 5.3% last year, well above the national average of 3.1%. And in Elkhart Indiana, the severe shortage of labor has had a dramatic impact on rising wages which has had a huge impact on the local economy. As the WSJ points out in "The Future of America’s Economy Looks a Lot Like Elkhart, Indiana”:

“The self-proclaimed RV capital of the world gives a glimpse of what the American economy looks like when operating at full tilt. High-school students around here skip college for factory jobs that offer great pay and benefits. For-hire signs sprout like roadside weeds. And workers are so flush that car dealers can’t keep new pickups on the lot. At the same time, the strains are showing. Employers can’t hang on to employees, and house prices are zooming. The worker shortage prompted a local Kentucky Fried Chicken restaurant to offer $150 signing bonuses. A McDonald’s failed to open for lunch last fall because managers couldn’t corral enough hands at $8 an hour to serve the lines waiting at the door.”

A few additional data points are worth noting:

- The producer price index rose 0.3% in March, well above the 0.1% economists expected

- WSJ 4/1/18 – “Wages are now rising somewhat faster than they did earlier in the U.S.’s current economic expansion”

- Morgan Stanley estimates that core inflation will reach 2.1% in March

- The Congressional Budget Office expects unemployment to fall to 3.5% by year-end, resulting in 4 rate hikes this year and another 4 next year and as Justin Lahart of the WSJ points out, the the CBO tends to be fairly conservative in its forecasts so “investors should be prepared for the Fed to be more aggressive.”

- In the last batch of Fed meeting minutes, Fed officials expressed growing confidence that inflation will reach the target rate of 2% in the coming year – “all participants agreed that the outlook for the economy beyond the current quarter had strengthened in recent months.”

To be perfectly clear, just because I think inflation will arrive sooner and more fiercely than most expect does NOT mean that I think the Fed should accelerate its pace of rate hikes or even raise rates at all in the immediate future. On that front, I tend to lean towards Krugman’s view that first, the markets do not see inflation and second, that the Fed should not raise rates until it “sees the whites of inflation’s eyes.” And even then, there’s a pretty solid case to be made that letting inflation run for a bit could have some beneficial effects on the economy and the country as a whole, particularly as it relates to wages, raising household incomes, closing the income inequality gap, boosting savings, and generally sustaining the current economic environment.

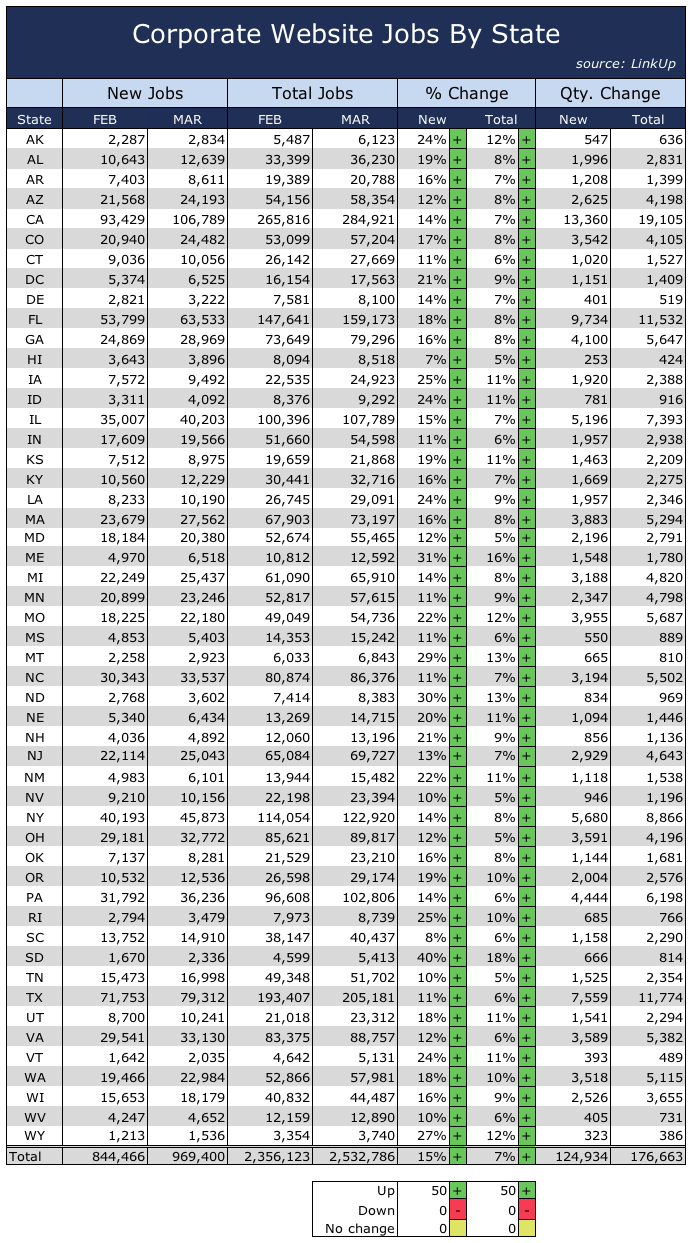

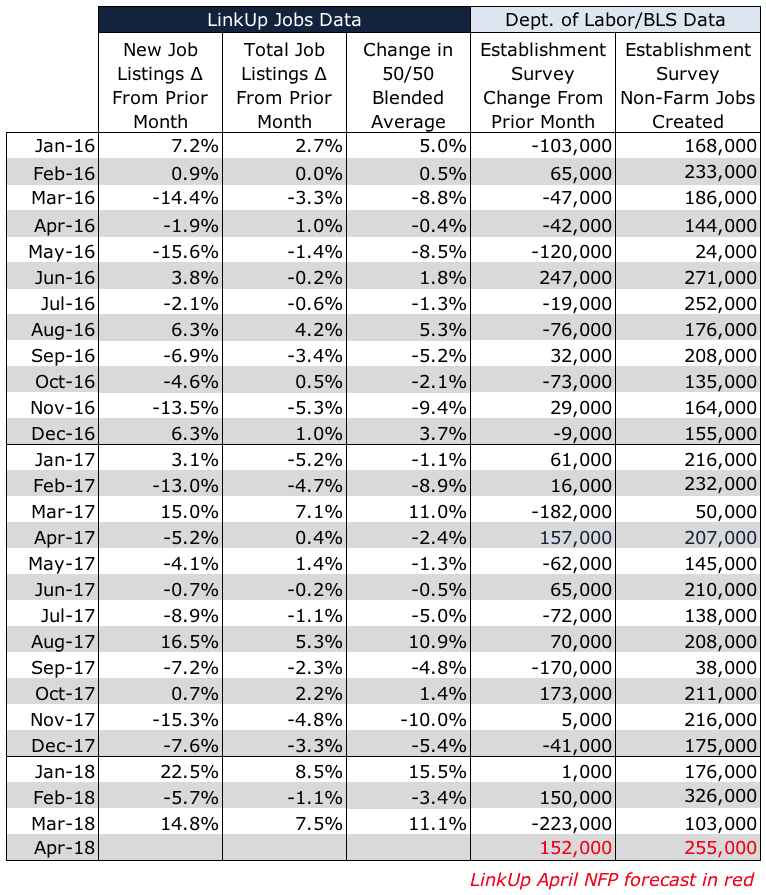

And in any event, regardless of one’s perspective on the specter of inflation and what the Fed should do in response, April’s jobs report will provide mountains of additional evidence to the case around sustained strength in the job market, further declines in unemployment, rising employment participation, and accelerating wage inflation. Our conviction around a strong April jobs report stems from the significant growth we saw in job listings in our job search engine in March. Last month, new job listings on company websites rose 15% and total job listings on company websites rose 7%. Equally as compelling, new and total job listings rose in all 50 states.

As background, our dataset of job listings only includes jobs indexed directly from company websites (~5 million jobs indexed daily from 50,000 corporate websites globally). As a result, the job listings are always current, there are no duplicate jobs or expired listings, and we have completely eliminated job board pollution (scams, fraud, lead-gen, phishing jobs, etc.).

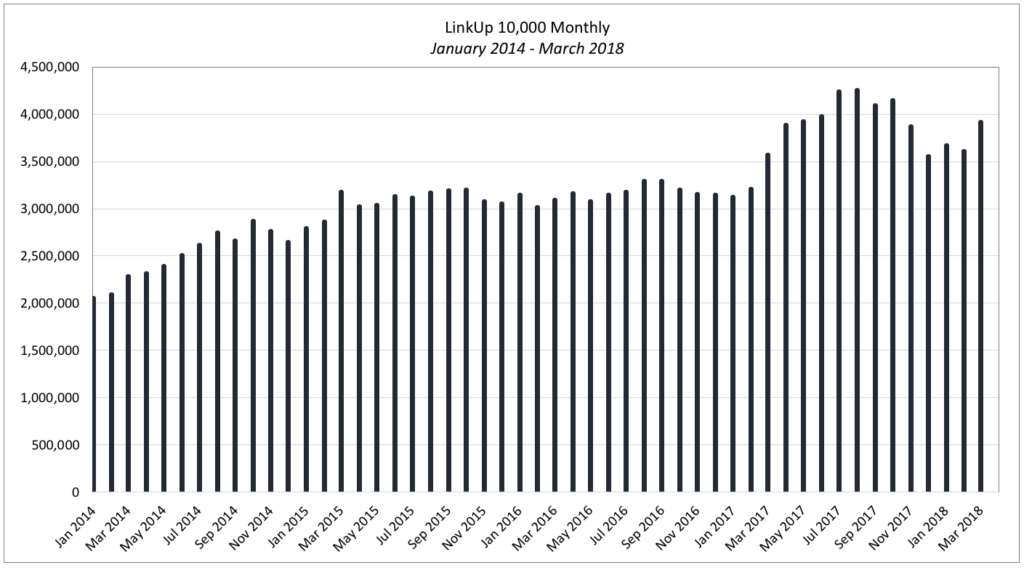

The gains we saw in March using our paired-month methodology closely mirror the 8.5% increase in the LinkUp 10,000 in March. The LinkUp 10,000 is an analytic, published both daily and monthly, that captures the sum total of U.S. job openings from the 10,000 global employers in LinkUp’s job search engine with the most U.S. job openings. Representing the entire U.S. economy, the LinkUp 10,000 is a macro indicator designed to measure real-time changes in U.S. labor demand. And because job openings are highly correlated to job growth in future periods, the predictive attributes of the LinkUp 10,000 deliver valuable insights into the future direction of the U.S. labor market.

So based on the increase in labor demand seen in March across the entire U.S. economy, we expect net job gains of 255,000 in April.

And lastly, because everything these days seems to be trending towards defective and nothing is ever clear or easy, we have to add the fact that there may be some hints of storm clouds gathering on the horizon. The growing likelihood of a recession is nothing new, of course, given the fact that we are now 9 years into the current recovery and nothing lasts forever. But again, while the storm may be way off in the distance, to the extent that it exists at all, the case for some caution is getting stronger and stronger every day. As the Wall Street Journal pointed out recently, there are plenty of reasons why things are starting to appear a bit shaky…

- Trade tensions are flaring up thanks to Trump

- The S&P 500 posted its first quarterly loss in 3 years in Q1

- The Global Dow is down 8% since its peak in January

- The vix is up sharply

- U.S. retail sales dropped 3 straight months before bouncing back in March

- The Atlanta Fed estimates that U.S. economic output grew only 1.9% in Q1

- Growth in the Eurozone is slowing down

- Germany’s industrial output dropped 1.6% in February

Goldman Sachs (courtesy of Calculated Risk) echoed a similar hint of caution in their recent note to clients, “In the end, we think the environment is becoming less pleasant but the baseline outlook for the economy and monetary policy hasn’t really changed much. Growth is a bit weaker, inflation is a bit higher, financial markets are definitely more volatile, and economic imbalances (especially in government finance) are starting to become more visible.”

Citigroup issued a note this week as well highlighting the fact that U.S. Treasuries are sending a potentially ominous warning through a flattening yield curve. As Business Insider writes, “Bonds tend to act rather oddly ahead of recessions as investors begin to expect lower future returns on investment. When that happens, the yield on long-term notes falls below its short-term counterpart. The phenomenon, known as a yield curve inversion, has invariably preceded an economic downturn.”

Economic growth did, in fact, slow down a bit in the first quarter. For the first 3 months of the year, the economy grew at an annualized rate of 2.3%, down from 2.9% in the 4th quarter of last year. That slowing growth may prove to be temporary, at least in the short-term (and it will likely be revised once or twice in the next few months in any event), but given the expected adrenaline shot everyone on the right was so fired up about (deceitfully and/or delusionally so, perhaps?), the slowdown could be a little more meaningful than it might otherwise be.

And then there’s Albert Edwards, the Societe Generale global strategist who says his bearish thesis for the economy may be unfolding sooner than he expected. As Business Insider writes, Edwards “has long warned about the threat of deflation, driven by countries like China devaluing their currencies to make exports more attractive. The end result would be a collapse comparable to the 2008 crash, he has said.”

And if anyone is interested in a potential canary in the coal mine, there’s also the fact that Wall Street bonuses averaged $184,220 last year according the New York State’s comptroller, the highest level since the Great Recession. In comparison, the median household income in the United States in 2016 was $59,039.

Of even greater concern is the fact that the infamous ‘Great-Recession-Denier‘ and Chief CNBC Ass-Clown Larry Kudlow is now in the White House as Director of the National Economic Council.

Maybe it’s time to start thinking about stocking the potato cellar.

And not to incite panic, but with the news this week that WeWork raised $702 million in debt despite $18 Billion in debt on its balance sheet, an insane burn rate, the comical invention of ‘Community-Adjusted EBITDA,’ and a Moody’s rating of ‘Deep Junk’ (my new favorite phrase that applies to many things these days), we may have identified our pets.com poster-child for the current bubble.

Talk about holding on to nothing. We’ll see how long nothing lasts.

Paper Tiger

Torn apart by idle hands

Through the helter skelter morning

Fix yourself while you still can

No more ashes to ashes

No more cinders from the sky

All the laws of creation

Tell a dead man how to die

And storms up above

Like a stray dog gone defective

Like a paper tiger in the sun

To make the past what it should be

Through the ruins and the weather

Capsized boats in the sea

And storms up above

Like a stray dog gone defective

Like a paper tiger in the sun

To see how long nothing lasts

And storms up above

Like a stray dog gone defective

Like a paper tiger in the sun

Insights: Related insights and resources

-

Blog

08.04.2022

Heads I Win, Tails You Lose; Reflections on the Still-Cooling But Strong Job Market

Read full article -

Blog

12.02.2021

LinkUp Forecasting a Net Gain of Just 380,000 Jobs In November

Read full article -

Blog

11.05.2021

For sale by (Z)owner: Zillow shuts down ibuying business, lays off workers

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.