The S&P 500 at 4,000, Kitten NFTs for $1M, and Job Gains of 800,000

Given the positive news of late and the broader trends around the pandemic, it’s tempting to start this post by noting that things seem to be slowly but surely starting to return to normal.

Given the positive news of late and the broader trends around the pandemic, it’s tempting to start this post by noting that things seem to be slowly but surely starting to return to normal. But of course, that’s an entirely absurd notion. I’m not sure normal is still a thing.

And in any event, the world is just about as bat-sh*t crazy as ever and the best that can be said is that maybe, just maybe, we’ve let up ever so slightly on the accelerator as we barrel down the highway toward the cliff of irreversible insanity. There’s a decent chance, in fact, that we drove off that cliff years ago and still have no idea.

But if not, there is reason to be hopeful that we might yet find the brakes and actually turn things around. To begin with, there is a functioning adult in the White House and a competent administration to boot, one actually focused on solving real problems. What a concept.

Additionally, with the passage of the Coronavirus Relief bill and the current pace of vaccinations, the highest priority problem might actually be solved sooner than we ever could have imagined 4 months ago, Republicans throughout the country notwithstanding.

Those developments alone have been enough to keep markets soaring, boost consumer confidence to a pandemic high, and stoke intense debate as to whether or not a forecast of 7% GDP growth in the 4th quarter is too low.

And despite the fact that 10+ million Americans are still unemployed and millions more underemployed, equally intense debate among alarmists has centered around how fast the country will reach full employment and how we can possibly ever combat double-digit, runaway inflation – and that was before the President identified a $2.3 trillion infrastructure and jobs bill as the administration’s next priority.

Responding to such hysteria, Julia Coronado, president of MacroPolicy Perspectives and former Fed economist, stated in a recent NYT article about the possibility of an overheated economy, “It is strange to me that for years economists pined for a better mix of monetary and fiscal policy and now we have it and there is a narrative among some that it has to end in disaster. I am more optimistic about the macro outlook than I have been in a long time and am far more focused on how quickly the labor market returns to health than any threat from inflation.”

The Fed Chair is very much of the same mind. As he stated last week in his testimony before Congress, “The recovery has progressed more quickly than generally expected and looks to be strengthening. But the recovery is far from complete, so, at the Fed, we will continue to provide the economy the support that it needs for as long as it takes.”

The WSJ elaborated further, stating that, “the Fed is in no hurry to change its easy-money policies until its forecasts materialize in the form of higher inflation and a strong labor market. In fact, most central bank officials don’t expect to raise rates until 2024 at the earliest when the labor market has returned to full employment and inflation is not only back to the central bank’s 2% target, but appears on course to run moderately above 2% for a while.”

The Phillips Curve and NAIRU are back!

And based on LinkUp’s March job data (we’re the global leader in delivering powerful, real-time, and predictive job market data sourced directly from company websites around the world), the ferocious debates around those two concepts are likely going to arrive sooner than expected.

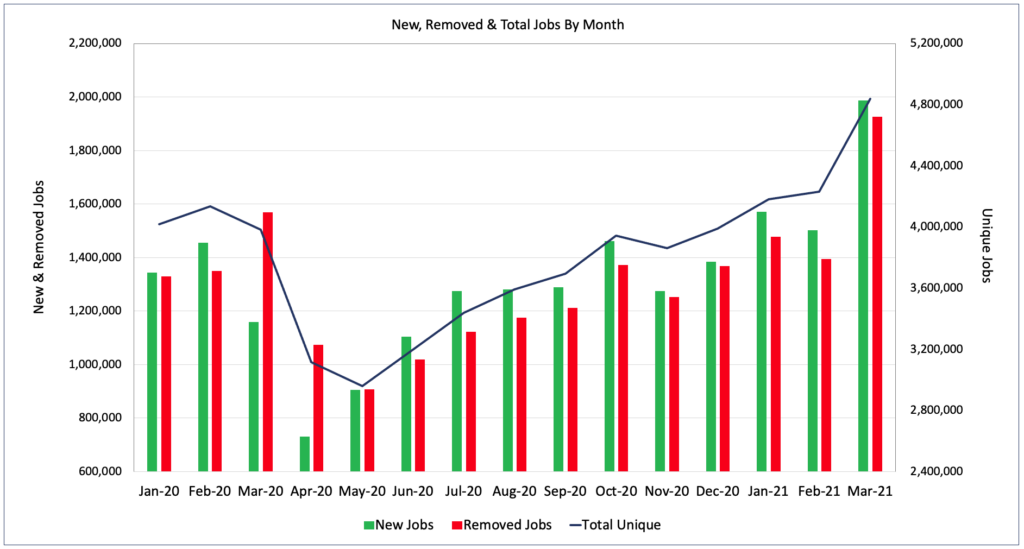

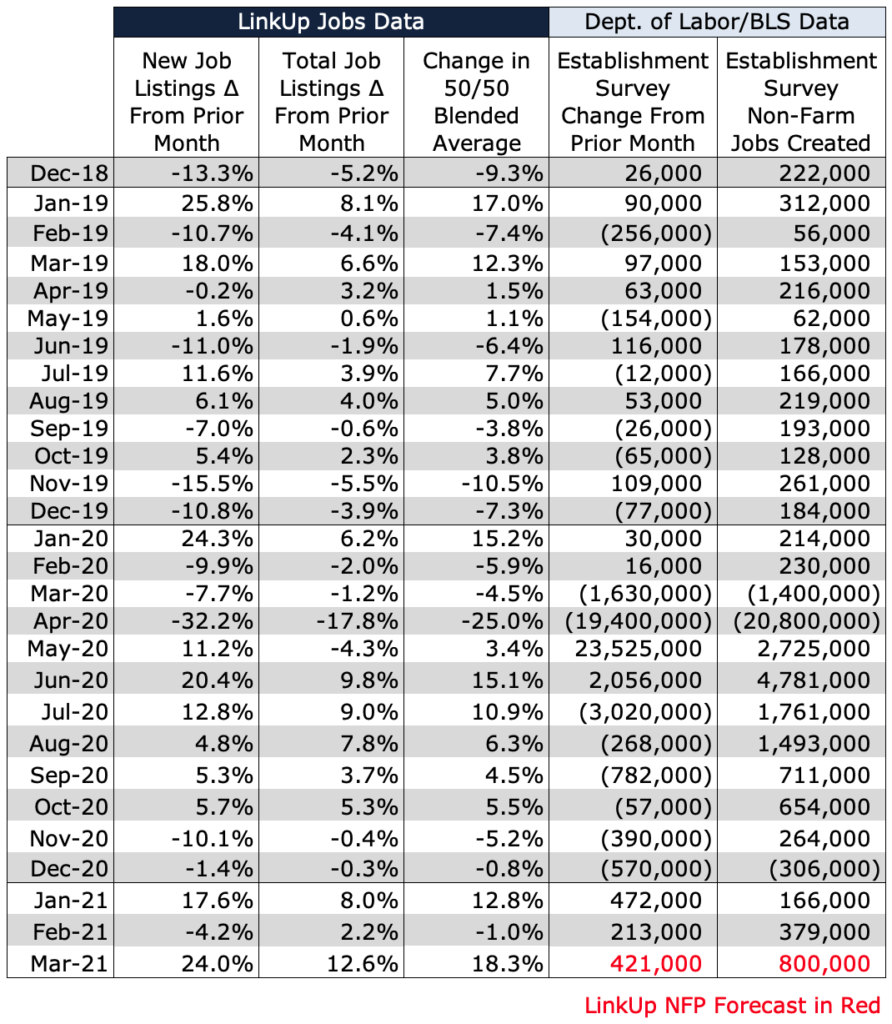

In March, job openings in the U.S. rose 14%, while new and removed job openings rose 32% and 38% respectively.

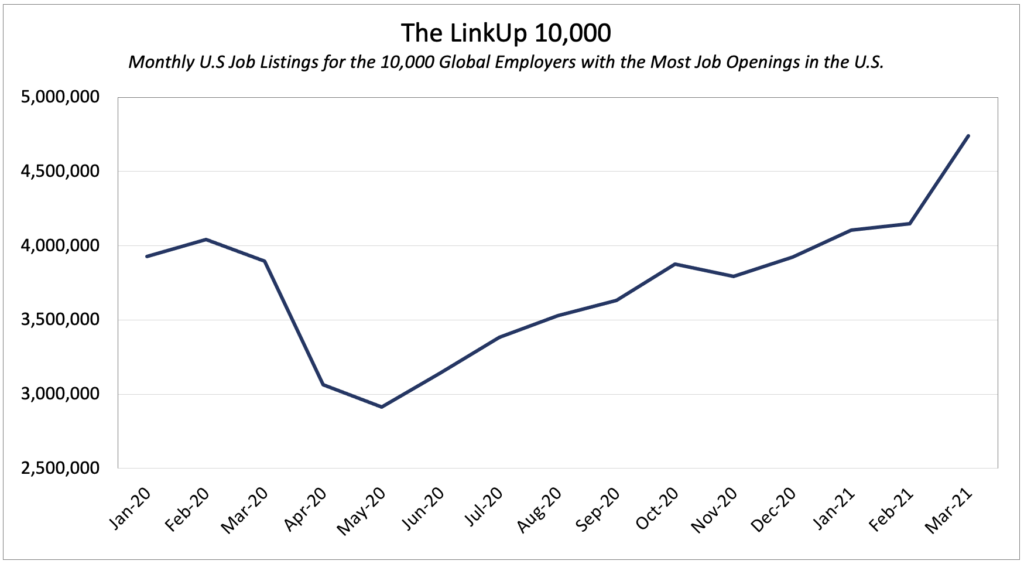

Similarly, the LinkUp 10,000 (total U.S. job openings for the 10,000 global employers with the most job openings in the U.S.) rose 14% in March and now stands 22% above March of 2020.

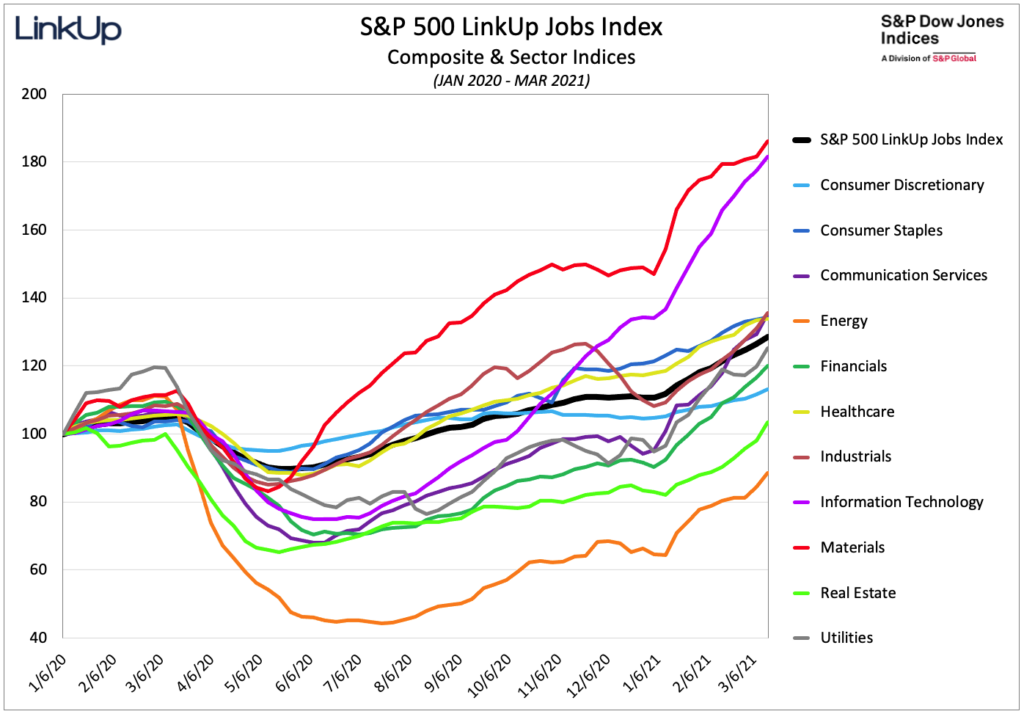

Since the first week of 2020, the S&P 500 LinkUp Jobs Index has risen nearly 30% with the Information Technology and Materials sectors leading the way and only Energy still below its January 2020 level.

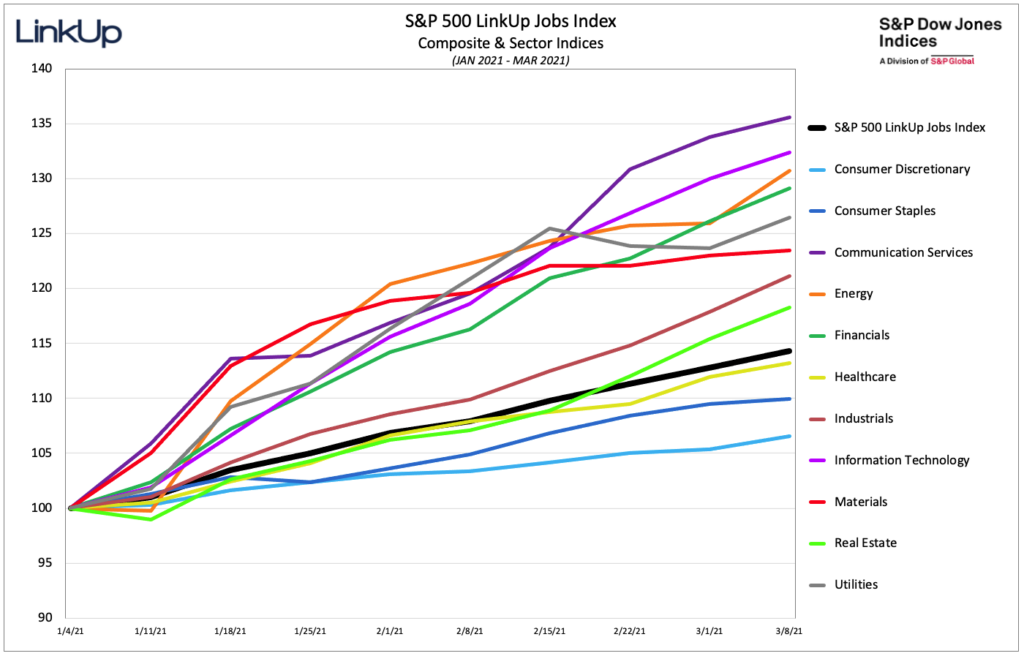

Since the first week of 2021, the S&P 500 LinkUp Jobs Index is up 16% with labor demand having risen in every sector and Information Technology and Communication Services leading the way.

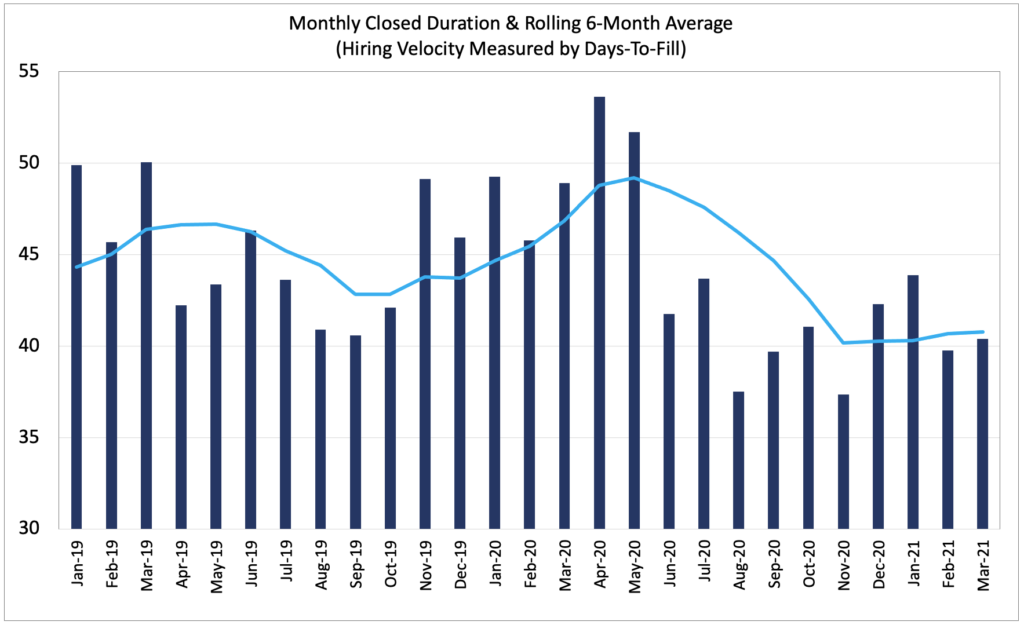

After accelerating in February, hiring velocity remained flat in March. We track hiring velocity by measuring the average number of days that companies keep their jobs posted on their corporate career portals before taking them off once a hire is made.

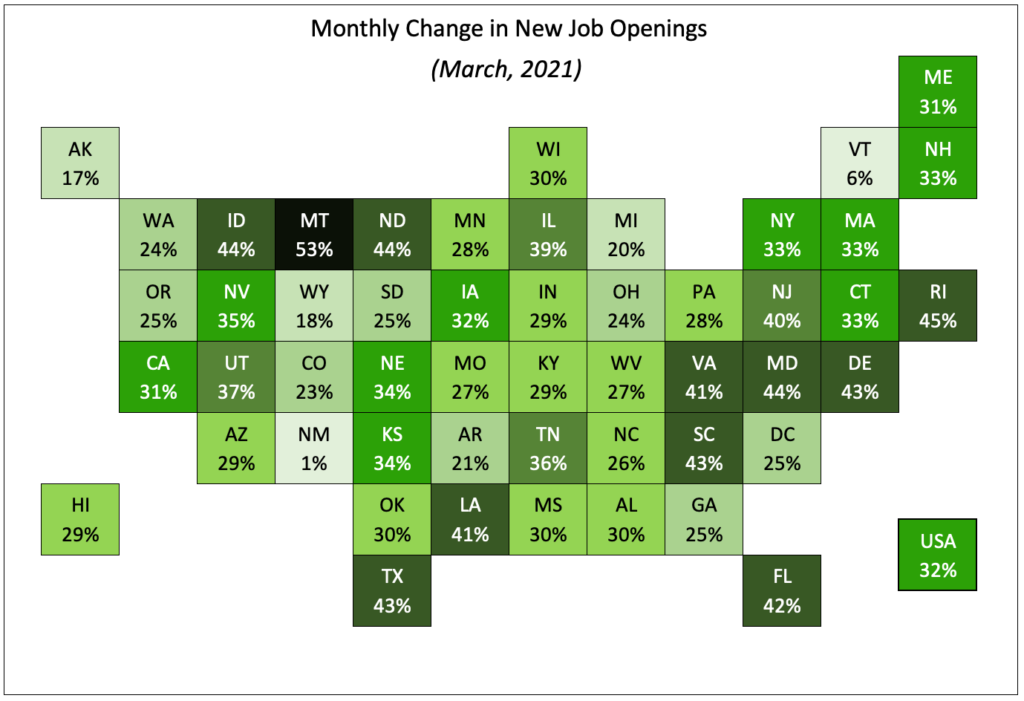

New job openings rose 32% in March with significant gains spread throughout the country and not a single state recording a decline in new job openings.

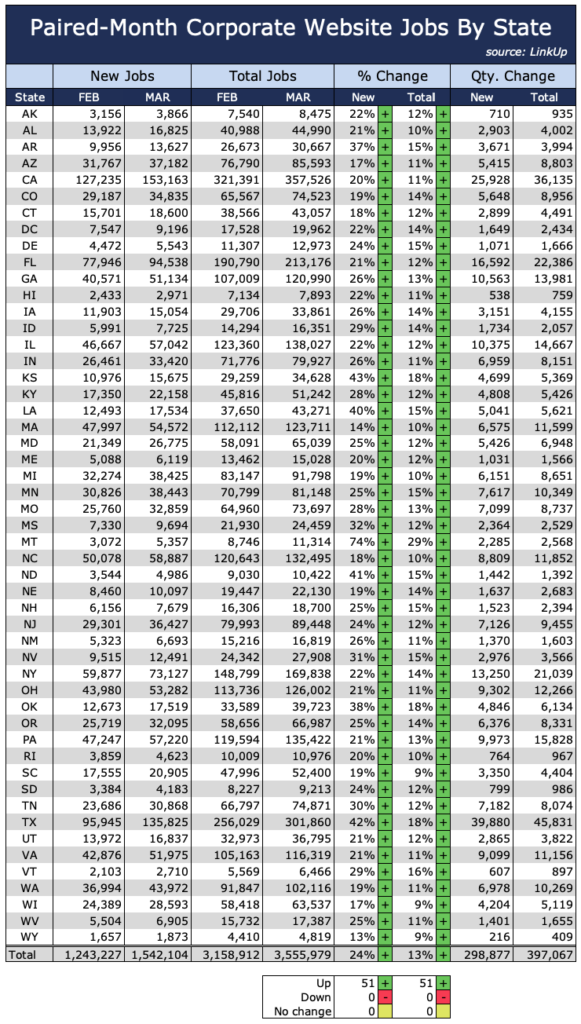

Similarly, new and total jobs in our Paired-Month data rose 24% and 13% respectively, with every state showing gains in both. We use paired month data in our non-farm payroll forecasting model to account for the fact that we are always adding new companies to the index. In the paired-month data, we track job openings for a common set of companies that are hiring in two consecutive months, in this case February and March.

Based on our data, we are forecasting job gains of 800,000 in March, well above the consensus estimate of 650,000 jobs.

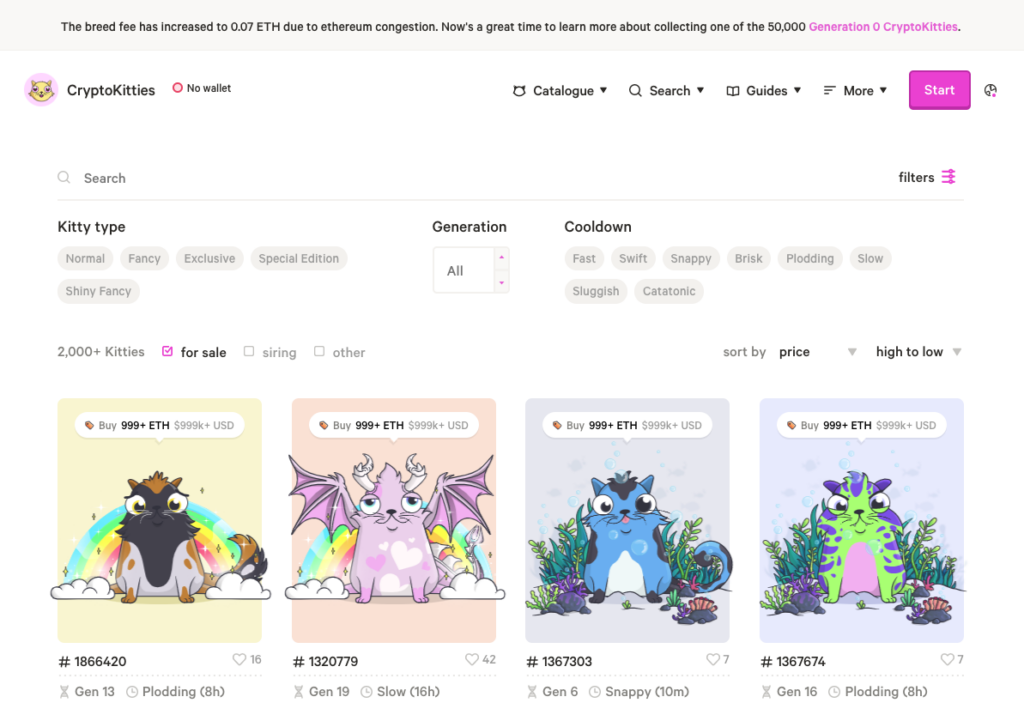

And while the reemergence of Republican obstructionism and debates over full employment and the correlation between unemployment and inflation might lull one into a comforting sense that things have returned to normal circa 2015, kitten NFTs selling for $1,000,000+ should serve as a reminder that things are anything but normal.

Oh, and there’s also a pandemic raging so stay safe, wear a mask, and get vaccinated. And boycott Georgia, too.

Insights: Related insights and resources

-

Blog

08.04.2022

Heads I Win, Tails You Lose; Reflections on the Still-Cooling But Strong Job Market

Read full article -

Blog

07.15.2021

June 2021 Jobs Recap: Summer starts off with a slowdown

Read full article -

Blog

06.04.2020

Is The Job Market Beginning To Recover Or Still Deteriorating? Yes

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.