June 2021 Non-farm Payroll Forecast: The Growing Bid/Ask Spread Between Employers and Employees

In March and April of last year, as the pandemic swept across the globe, 22 million Americans lost their jobs, either temporarily or permanently.

In March and April of last year, as the pandemic swept across the globe, 22 million Americans lost their jobs, either temporarily or permanently. Between May and the end of last year, 12 million of those jobs were recovered, leaving a net loss of just over 10 million jobs by the end of 2020.

With another 2.4 million jobs having been recovered through May of this year, a deficit of 7.7 million jobs in the U.S. economy remains since the pandemic began. Additionally, as of last month, 9.3 million Americans were still unemployed, 3.6 million more than in February of 2020.

Equally as significant, according to the Bureau of Labor Statistics in their May employment report, 5.3 million people were working part-time but wanted full-time work and another 6.6 million Americans were unemployed but were not officially counted as such because they had not actively looked for work in the previous 4 weeks. That means that over 21 million people in the country are not presently working full-time (or at all) but are definitely or likely willing to return to work should the right opportunity arise.

Given those facts, it is absolutely the case that the country is not suffering from a labor shortage.

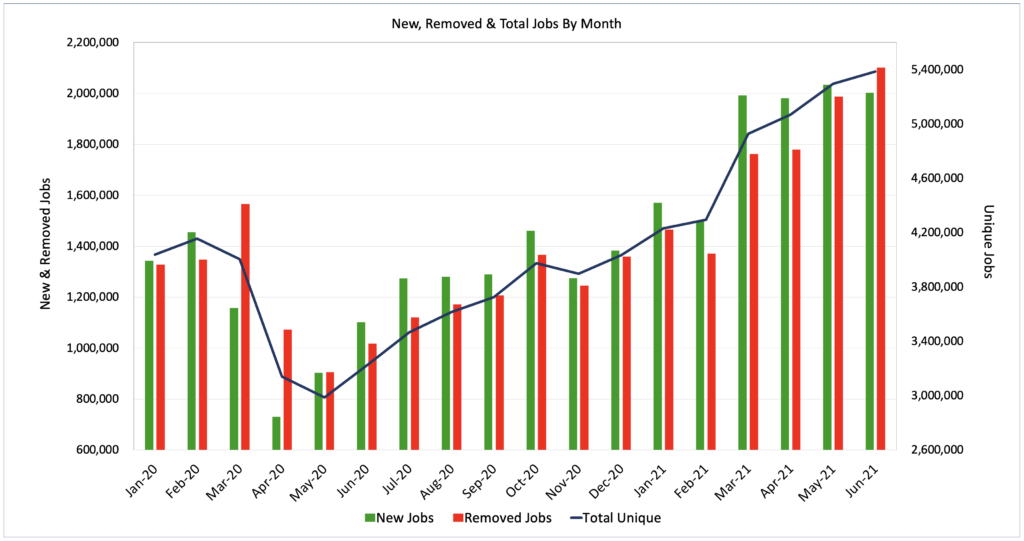

It is also the case that as vaccination rates continue to climb, consumers start spending with enthusiasm, and the economy continues roaring back to life, labor demand is skyrocketing. Since May of last year, total monthly job openings indexed by LinkUp directly from company websites have risen 80%, climbing from 2.98M to 5.39M in June. Since April of last year, unique new U.S. job openings have risen 175%, climbing from 730,000 to 2.00M in June.

So, if there is both abundant supply of labor and plenty of demand for workers, why have job gains over the past few months been so far below expectations?

The first reason is that there are major structural impediments to a perfectly efficient, highly liquid job market, and the second reason is that there is a major bid/ask spread between candidates and employers.

Regarding the structural impediments to a perfect, high-functioning job market, it has always been the case that the job market is far from efficient. First and foremost, the job market, arguably the largest market in the world, centers around people, making it infinitely more complex than traditional markets of any kind, financial or otherwise.

But additionally, the job market is afflicted by a high degree of information asymmetry, nearly a complete lack of transparency, insanely complex, multi-variate motivations, an abundance of subjectivity and far too much bias, little to no standardization, massive decentralization, extraordinarily inadequate market-makers, wildly dynamic pricing, highly variable substitution effects, lagging technology, and above-average regulation. And until recently, jobs were largely location-specific, adding onerous illiquidity factors at a global, national, regional, and local level.

But as imperfect as the job market can often be at a micro level, it tends to operate in a fairly predictable manner at a macro level most of the time. Granular factors impacting specific individuals, companies, occupations, locations, and even individual industries tend to wash out when looking at the economy as a whole. Like the tide, employment levels tend to be quite predictable given their high correlation to economic cycles. And as is the case regarding much of oceanography, labor market trends, for the most part, play out over extended timeframes which allows for elevated levels of investigation and deeper understanding.

But the pandemic rocked the economy like an earthquake and the resulting tsunami not only decimated the job market, it fundamentally transformed the landscape we’re now operating on and further exposed and exacerbated structural deficiencies in how we operate as an economy and a society.

Those structural impediments to an efficient, effective job market include massively inadequate policy around healthcare, childcare, immigration, housing, transportation, and education, among others. As a result, job growth has been increasingly stunted because people are taking care of kids, they can’t or don’t want to come to the U.S., they can’t afford to live in places where there are jobs, or can’t get to the jobs easily or affordably, or they aren’t qualified for the jobs that pay living wages.

And the pandemic, combined with everything else that’s taken place over the past year, has added to the mix racial and social injustice, stagnant wages, and widening income inequality, and even the core fundamentals of both capitalism and democracy. It’s hard to imagine a more tumultuous set of dynamics as the ones buffeting the job market these days.

As to the second reason for the underwhelming job growth over the past few months, there is an enormous bid-ask spread at the moment between what employers are offering to prospective employees and what candidates are demanding from potential employers. This yawning chasm was also the result of the COVID earthquake which, in this case, unleashed a torrent of unrelated tectonic forces that had been building up for years and even decades in some cases.

To be clear, the virus most definitely created its own set of circumstance that have prevented or slowed people from re-entering the workforce. On top of the obvious and severe health risks, the pandemic has created challenges around remote work, childcare, and schooling, to highlight just a few. It’s also generated insane levels of stress, exhaustion, and burn-out, accelerated retirements, and caused serious concern for people who work in consumer-facing industries where interactions with the public can range from irritating to abusive to fatal. As a side note, we’ll also see in the coming months to what extent extended unemployment benefits have created a disincentive for people to re-enter the workforce, but early data indicates that that they have not.

But beyond the COVID-specific issues, the pandemic has noticeably and rapidly altered the balance of power between employers and employees in favor of employees. Granted, it might be little more than a drop in the ocean given the dominance of business these days, particularly big business that employs the vast majority of Americans, but the shift to a job market that so significantly favors candidates has been more dramatic and pronounced than at any point in the last 20 years.

We’ll see what type of analysis and commentary emerges, but it seems as if, coming out of lockdown after the stress and trauma of a pandemic, combined with the isolation and/or self-reflection of being quarantined for such an extended period of time, that there has been a massive, collective, nation-wide reassessment of priorities, passions, careers, work-life-balance, the kind of company people want to work for, and what people want to do with their lives.

The world is vastly different for everyone than it was 18 months ago and a meaningful chunk of the workforce is simply not willing to go back to the same job they had before the pandemic. At the very least, they’re not willing to go back to their old job at the same salary. It’s almost as if we’re watching a stealth revolution of sorts – a collective, nationwide strike against all the inequities and injustices that have built up over so many years.

We’ll see how fleeting or sustained this strike is but for certain it will end eventually, one way or another. Either rapidly or slowly over a torturous, drawn-out process, some sort of equilibrium will be reached. One side or the other (or both) will make the necessary concessions around wages and working conditions and the multitude of other factors that come into play when a job opening is filled with a new hire.

Based on the evidence to date, combined with how quickly labor demand is accelerating and how critical employees are to most businesses, my guess is that on balance, employees are going to come out of this ahead and those gains will have been long overdue.

And LinkUp’s job market data from June in no way alters our view that job gains will continue over the next few months, accelerate dramatically in the fall, and by the end of the year, the U.S. economy will have recovered all the jobs lost since the pandemic began.

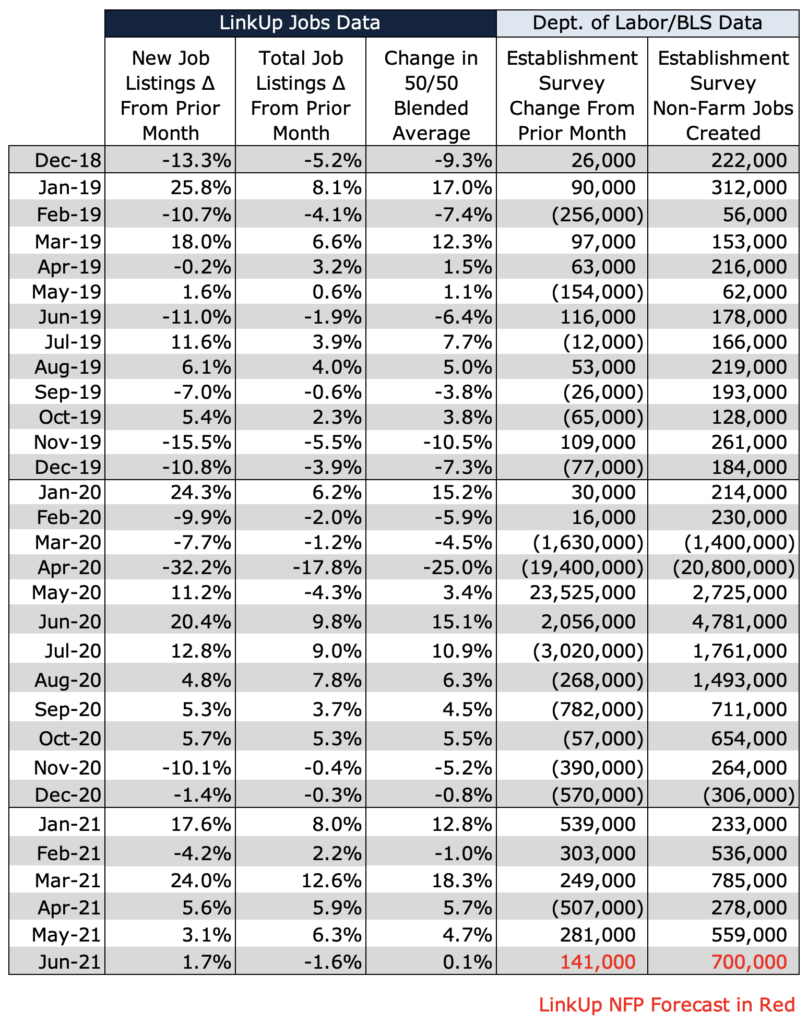

So to jump into the data, looking at the chart we posted above, total U.S. job openings indexed from company and employer websites globally rose 2% in June to 5.39 million. New job listings dropped slightly (2%) to 2.00 million and job openings removed from company websites rose 6% to 2.10 million.

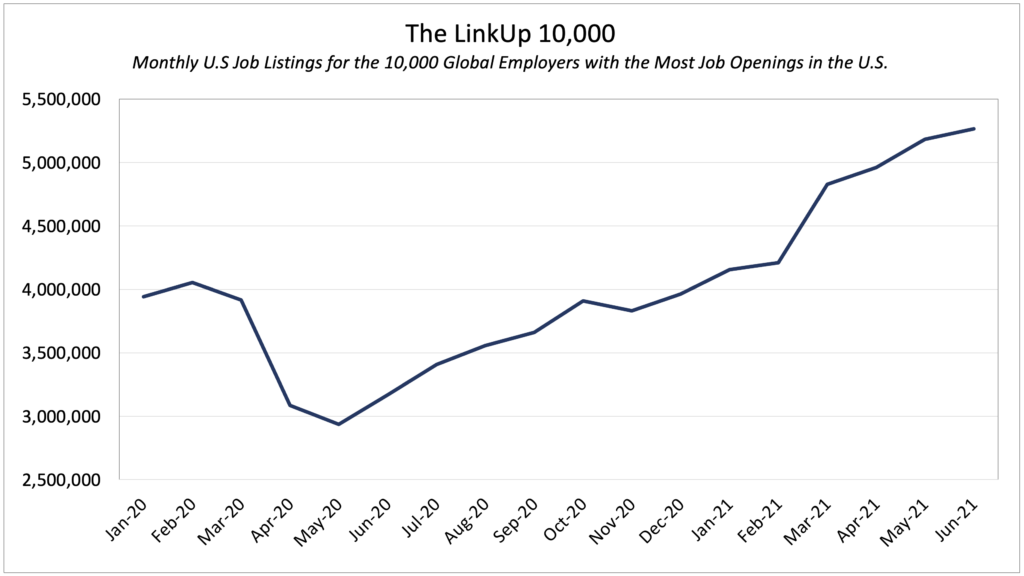

The LinkUp 10,000, a metric that tracks total U.S. job openings for the 10,000 global employers that have the most openings in the U.S., rose 2% to 5.26 million.

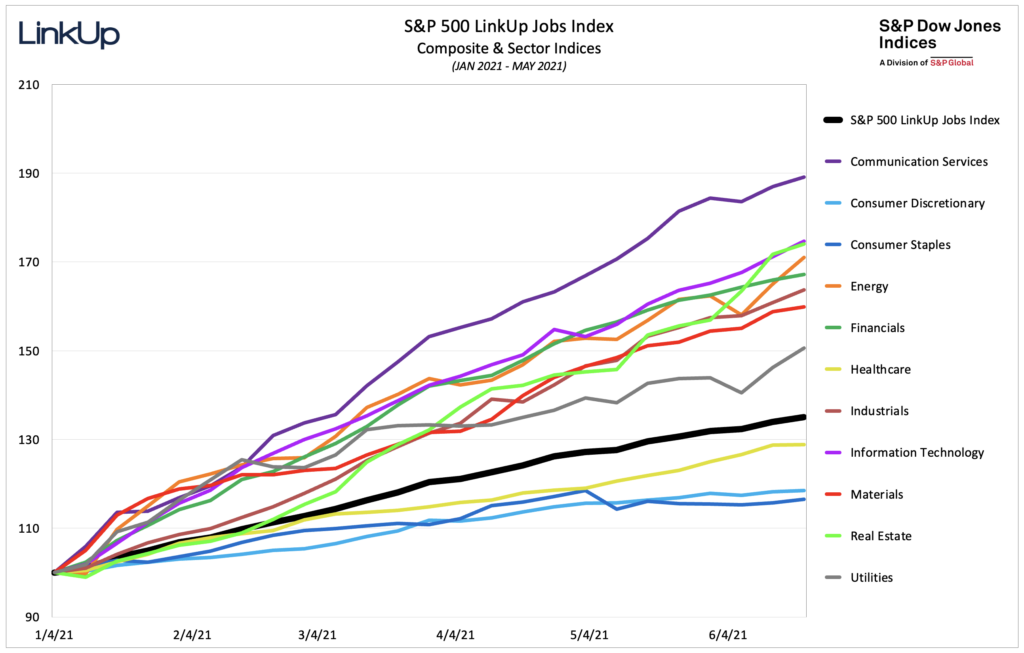

The S&P 500 LinkUp Jobs Index continued its climb as well, rising just under 1% this week. Since the beginning of the year, The weekly index, which measures labor demand for all the companies in the S&P 500, is up 35% with Communication Services leading all sectors.

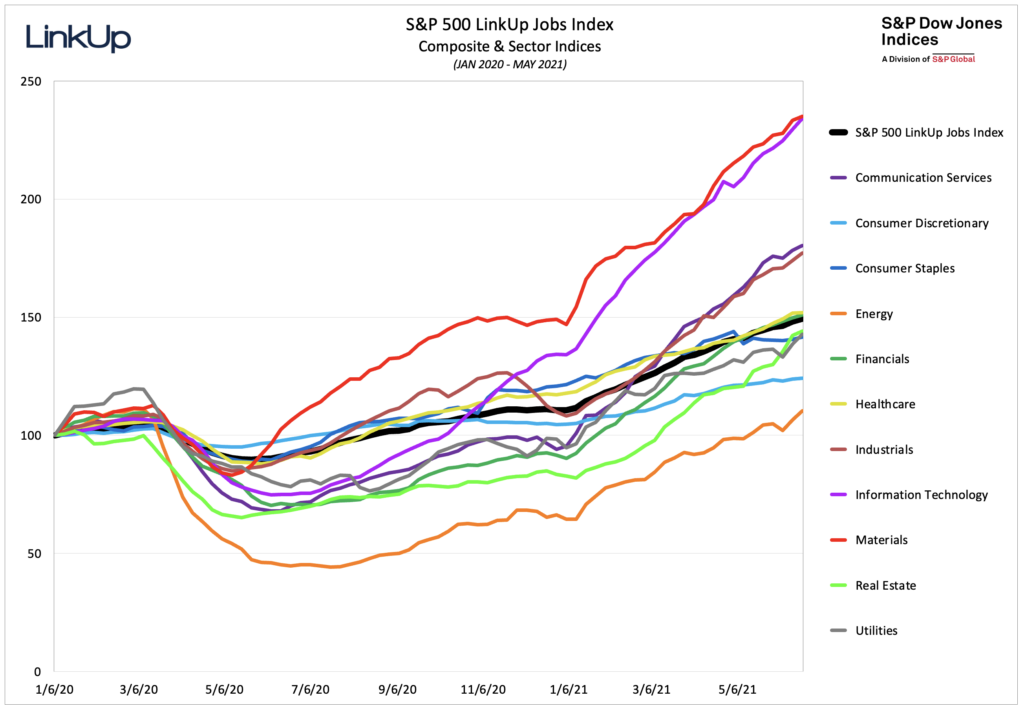

Since January of last year, the S&P 500 LinkUp Jobs Index is up 50%, with the Communication Services and Materials sectors leading the way.

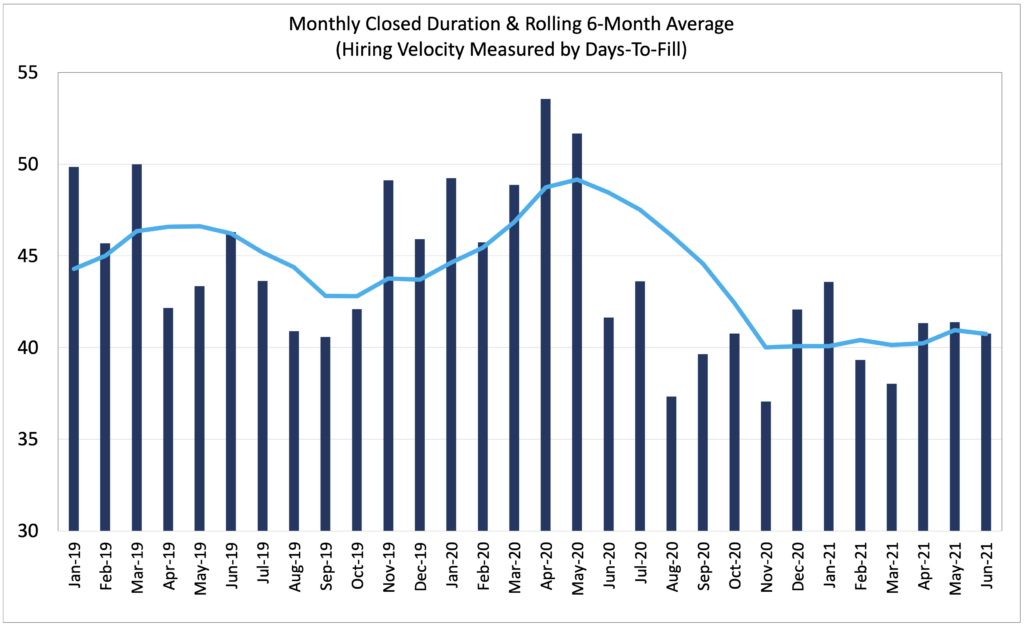

Another metric we track is Monthly Closed Duration which measures the average number of days that openings are posted on employer websites in the U.S. before they are removed, presumably because they are filled. Essentially, duration measures hiring velocity (inversely as fewer days equates to faster hiring), and in June duration fell slightly to just over 40 days meaning that the pace of hiring picked up modestly in June.

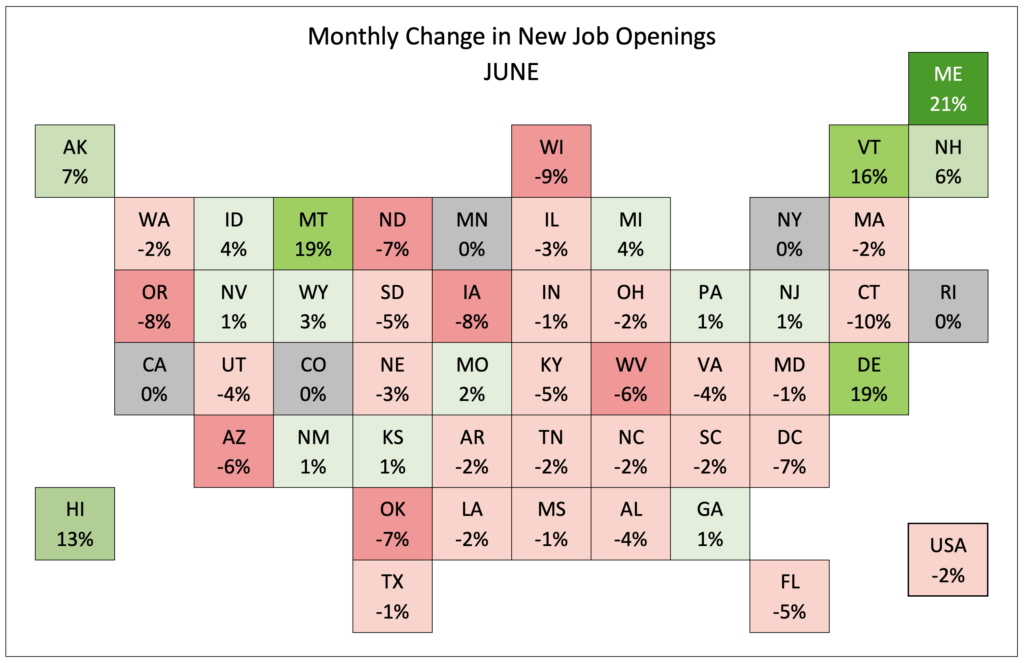

The only data point that might be cause for concern, new job openings in the U.S. fell 2% with more than half the states seeing a drop in new job openings and only 17 states seeing an increase.

Based on our job data, we are forecasting nonfarm payroll report to net job gains of 700,000 in June, just slightly above consensus estimates.

I hope everyone has a great 4th of July.

Insights: Related insights and resources

-

Blog

09.01.2021

Get a Shot and Wear a Mask to Save Lives and Help the Job Market. Jabs and Jobs!

Read full article -

Blog

08.05.2021

Bid/Ask Spread in Job Market Narrowing; July Non-Farm Payrolls Will Surprise to the Upside

Read full article -

Blog

06.03.2021

LinkUp Forecasting Net Gain of 850,000 Jobs In May 2021

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.