July 2024 Jobs Recap: The job market is cooling, but far from cold.

Despite underwhelming payroll adds in July, the data tells a story of balancing demand and a job market signaling business as usual.

Key Takeaways:

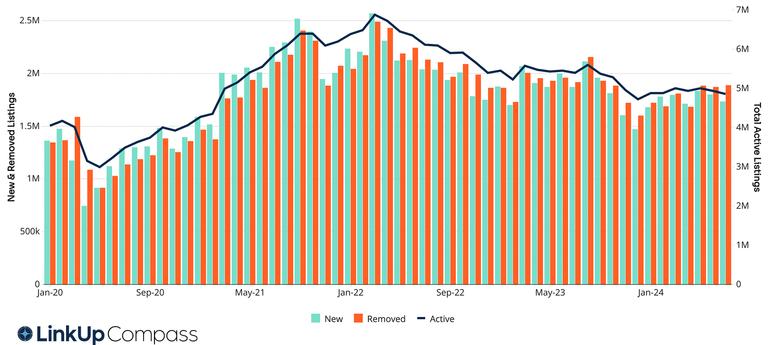

Active listings in July were down 1.4% or ~70,000 from June. Over the first seven months of 2024 we’ve reported small jumps and dips in monthly labor demand, but volatility in job openings is essentially flat since January.

Despite recent stock market panic over a less than hoped-for July NFP number, our argument is the same: labor demand is gradually returning to balance—and a durable balance at that, as key economic indicators remain promising.

While the continued cooldown is likely to move the Fed’s rate needle at their September meeting, last week’s reactive calls for emergency cuts have gone unheeded. The Fed is not designed to quell the concerns of panicked investors, but to address systemic forces within financial markets.

We join lead economists at Goldman Sachs who stress the risk of recession is limited, even after disappointing payroll and unemployment numbers last month. The fundamentals, including a balanced return to pre-pandemic labor demand, remain positive.

U.S. Job Listings by Month | January 2020 - July 2024

LinkUp 10,000

The LinkUp 10,000 is an analytic published daily and monthly that captures the total U.S. job openings from the 10,000 global employers in LinkUp’s jobs dataset with the most U.S. openings.

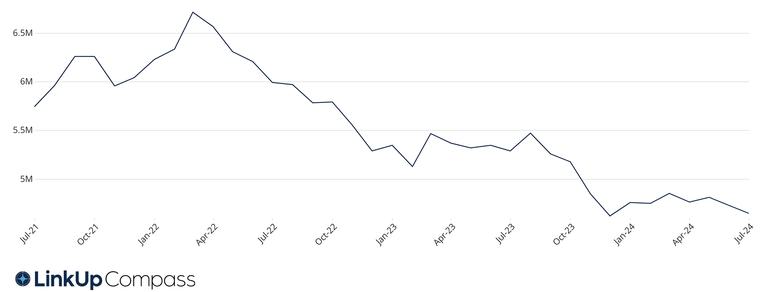

The LinkUp 10,000 dropped 1.8% in July from June, continuing this year’s trend of gradual decline for post-pandemic labor demand. Year-to-date, the measure is down 13.9% and since peak demand in March of ‘22, hiring at the 10,000 largest U.S. employers has dropped over 30%.

With a viewpoint limited to the hiring window after Covid, this plunge seems dire. In reality, it’s an effect of contrast against the pent-up wallop of demand delivered in the years following vaccination and a return to work. What goes up must come down, but the bar’s still considerably higher than it was before all the madness started. Case in point: the LinkUp 10K measure today is up 14% from February of 2020.

Monthly LinkUp 10,000 | January 2021 - July 2024

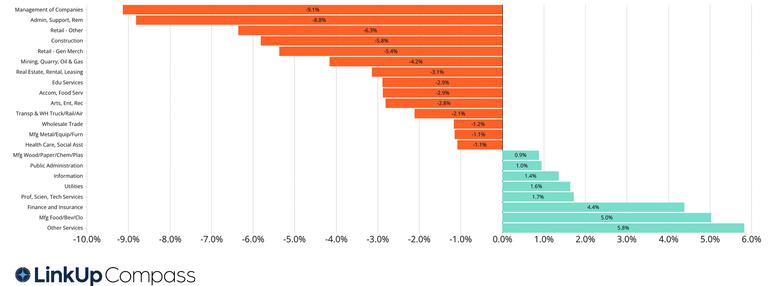

Jobs Data By Industry (NAICS)

We’re clocking decline in open jobs across 77% of industries this month, with largest drops in:

Management of Companies (-9%)

Admin & Support (-8.8%)

Retail (-6%)

Construction (-5.8%)

Mining, Quarry, Oil, and Gas (-4.2%)

Industries that experienced growth:

Manufacturing - Food, Beverage, Clothing (5%)

Finance and Insurance (4.4%)

Professional, Scientific, Technical Services (1.7%)

Job Listings by Industry (NAICS) | July 2024

Industry Spotlight:

Construction

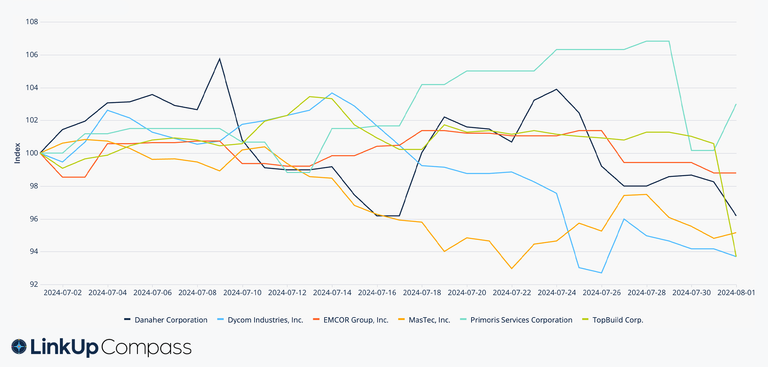

In July, the U.S. job market experienced a notable 5.8% drop in construction jobs from June. This decline is reflected in the hiring trends of several construction companies. Danaher Corporation, Dycom Industries, EMCOR Group, MasTec, Primoris Services, and TopBuild Corp. all showed varying hiring activities, with significant fluctuations throughout the month.

This job market contraction correlates with recent real estate market dynamics as house prices hit record highs while sales dwindled. The combination of elevated home prices and mortgage rates has deterred potential homebuyers, contributing to reduced construction activity and job cuts in the sector. This trend underscores the interconnectedness of housing market conditions and employment in the construction industry.

Company Comparison: Monthly Listings Index for Major Construction Firms

Oil and Gas

In July the oil and gas industry saw a 4% decline in active jobs. The Dow Jones U.S. Oil & Gas Total Stock Market Index shows a downward trend of nearly 10% since April. ExxonMobil stands out with a significant drop in hiring, especially in architecture and engineering roles over the past six months.

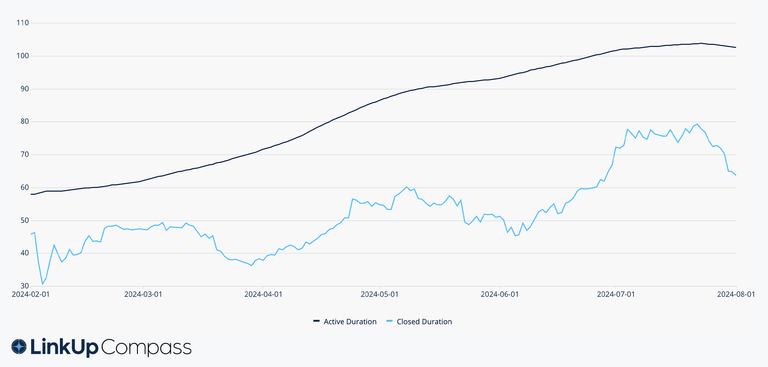

The gradual increase in active and closed job durations suggests a slowdown in hiring activities. This trend could be attributed to fluctuating oil prices and market uncertainties, potentially affecting related sectors such as manufacturing and transportation.

Active and Closed Duration at Exxon Mobil since 2/01/24

Jobs Data By Occupation (O*NET)

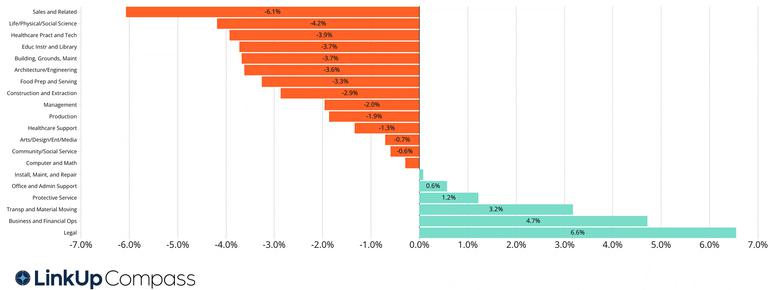

Mirroring the decline in job postings across U.S. industries this month, 70% of occupational groups notched demand dips, including:

Sales and Related (-6.1%)

Life, Physical, and Social Science (-4.2%)

Healthcare Practitioners (-3.9%)

Occupations with rising demand:

Legal (6.6%)

Business and Financial Ops (4.7%)

Job Listings by Occupation (O*NET) | July 2024

Occupation Spotlight:

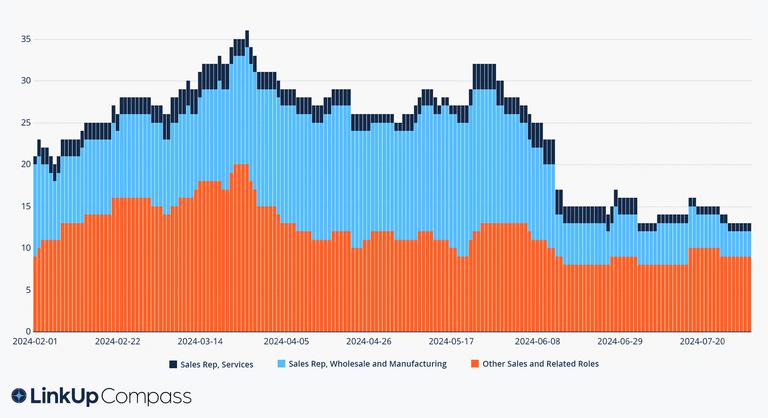

Sales

Leveraging LinkUp data with Compass, we notice the most significant drop in sales-related jobs, particularly affecting the finance and insurance, information, manufacturing, real estate, retail, and wholesale trade industries.

A notable example of this trend on the company level is Intel. Intel's stock plunged 28% last week after disappointing earnings in July. In fact, their stock prices have been on the decline since April, in line with a consistent drop in active sales-related jobs at the company beginning in March. This relationship highlights the correlation between reduced sales job openings and declining company performance and stock prices.

The significant drop in sales jobs can be linked to Intel’s broader financial struggles and restructuring efforts. The firm recently announced thousands of job cuts in an attempt to reduce operational costs and reorganize its business.

Sales Job Listings at Intel since 1/1/24

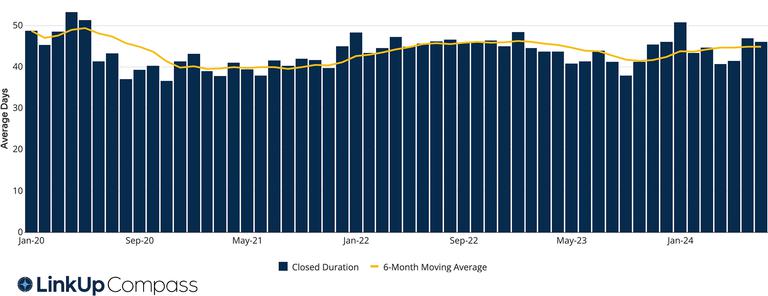

Closed Duration

Closed duration, or the average number of days job listings are posted on company websites before they are removed, tracks hiring velocity across the entire U.S. economy. As the average number of days a job listing remains live increases, hiring velocity slows.

Closed duration stayed essentially flat in July, decreasing by one day over June’s measure to 46 days.

Closed Duration of U.S. Jobs | January 2020 - June 2024

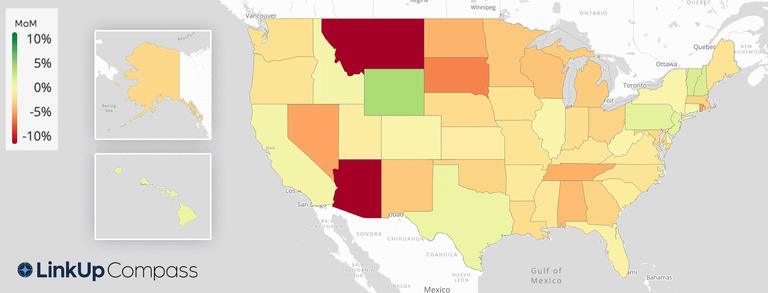

Jobs Data By State

During the month of June, 79% of the United States saw a decline in job listings. The states that saw the largest declines:

Montana (-15%)

Arizona (-15%)

South Dakota (-5%)

Rhode Island (-5%)

The only state with more than 3% growth in labor demand this month was:

Wyoming (4%)

Percent Change in Active Job Listings by State (Month-Over-Month) | July 2024

Companies Added

Every month, LinkUp indexes new companies to our database. In July, LinkUp added 1,835 additional employer websites, the fourth consecutive month of more than 1,000 career sites added.

DATA DISCLAIMERS

LinkUp’s monthly data recaps incorporate revisions to previously-reported monthly data with the purpose of reporting the most accurate and up-to-date data points. For more information on what circumstances may impact data revisions, visit our Data Support Center.

Insights: Related insights and resources

-

Blog

08.01.2024

LinkUp Forecasting a Net Gain of 145,000 Jobs in July

Read full article -

Blog

07.17.2024

Q2 2024 Economic Indicator Report

Read full article -

Blog

07.02.2024

June 2024 Jobs Recap: Job openings dip but maintain “sustainable simmer”

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.