Jobs Data on Dollar Tree Ahead of Earnings Report

Dollar Tree is due to report earnings Wednesday and seems to be in a very interesting position.

On one hand, they announced last quarter they would be raising their prices, after testing and finding customers would tolerate these price increases. On the other hand, reports have been recently released that they will have to shut down 400 stores indefinitely due to a rodent infestation.

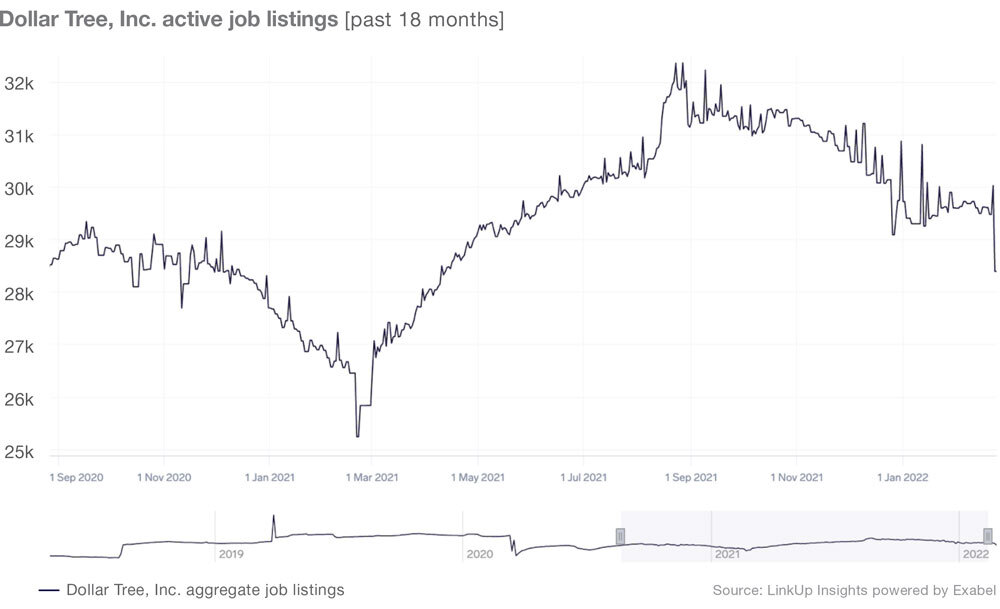

At first, one would expect to see strong sales growth given Dollar Tree’s active jobs relationship with sales 1 quarter forward. In light of the new variables discussed earlier, we thought it would be worth a deeper look into Dollar Tree.

First, let’s take a look at the price increases. Driven by inflation, management has decided to increase the floor price of products to $1.25. This could have a dramatic impact on margins, as that floor previously sat at $1. Management made the following statement on last quarters earnings:

“Our Dollar Tree pricing tests have demonstrated broad consumer acceptance of the new price point and excitement about the additional offerings and extreme value we will be able to provide. Accordingly, we have begun rolling out the $1.25 price point at all Dollar Tree stores nationwide.”

We can use LinkUp’s jobs data to determine if we agree or disagree with this statement. The underlying hypothesis is, if demand has remained stable, we would expect postings to either remain relatively stable or increase, while the opposite would manifest itself as a decrease in postings.

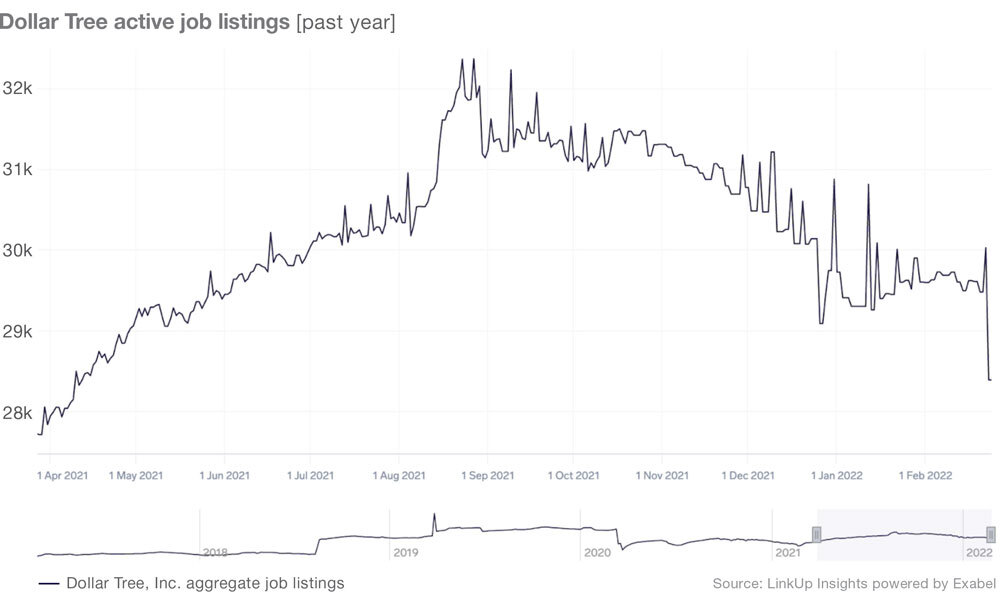

We can see that there seems to be a clear reversal in the trend of active jobs over the last quarter. This alone does not constitute evidence that the price hikes have leveled demand. The possibility remains that this is an industry-wide trend, or that Dollar Tree has become more effective in hiring. To confirm the first we can compare Dollar Tree to its discount retail peer, Dollar General.

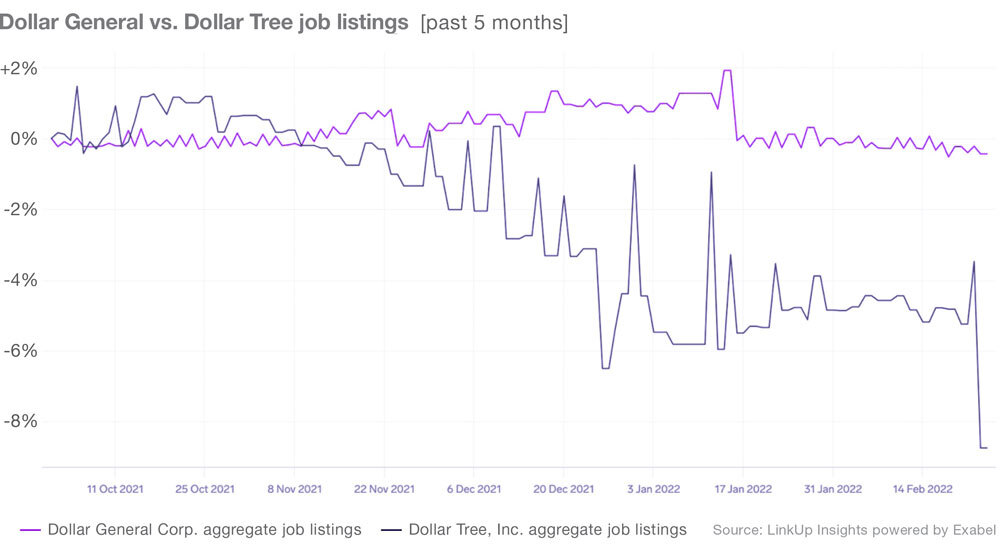

Taking a look at roughly the time these pricing changes went into effect we can see a clear downward trend that Dollar General does not experience. This adds some evidence that it is not an industry trend. There still lies the possibility that Dollar General has become more effective in hiring.

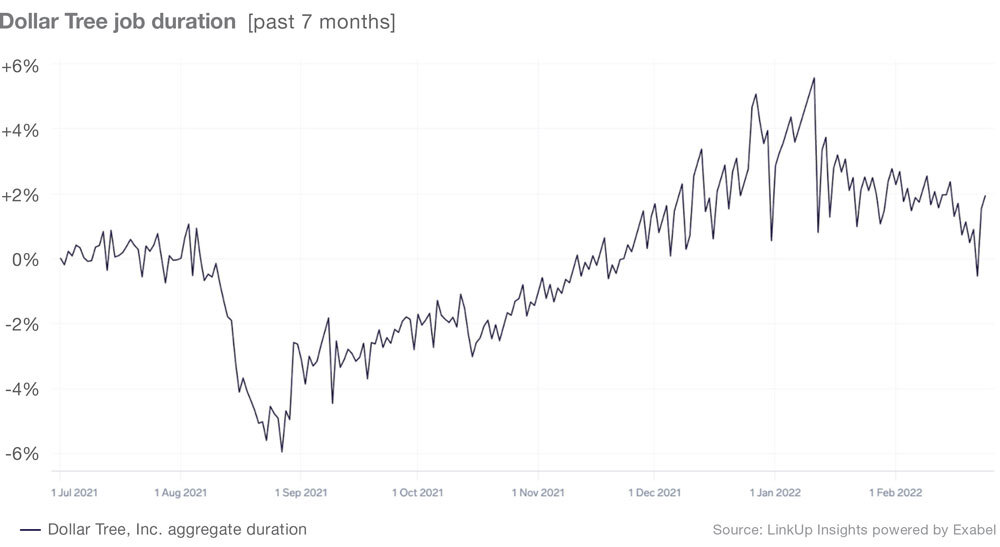

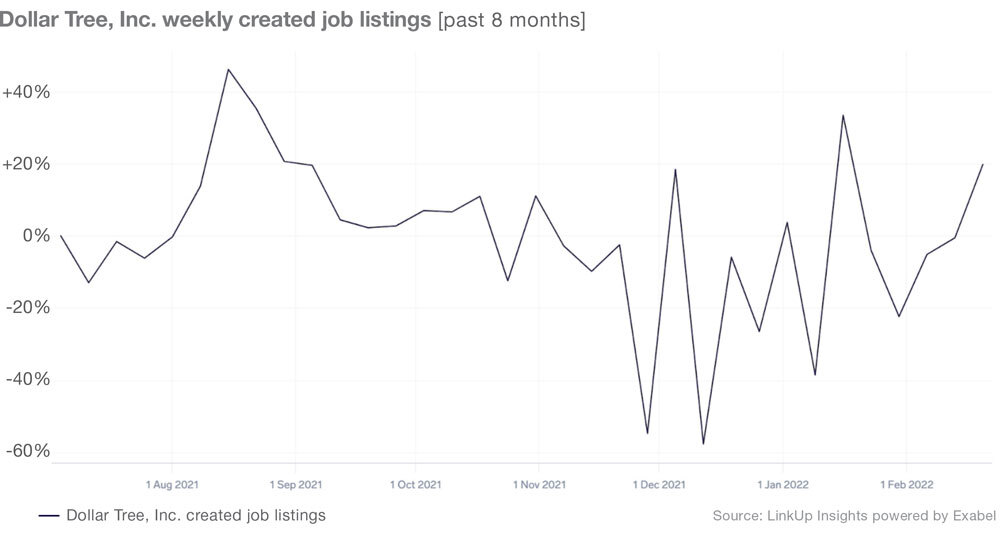

The active duration is rising so this is likely not the case. While created counts seem to be down since the start of price raises, it looks like they are coming back strong over the past 4 weeks. This indicates a possibility that consumers did not immediately adjust to the price increase, but they have since come to terms with the change.

Taking a wider view, it also seems there is some seasonality at play here. We saw basically the same pattern around the same time last year, DLTR missed expectations but announced the opening of 600 new stores, and soon went on a hiring spree.

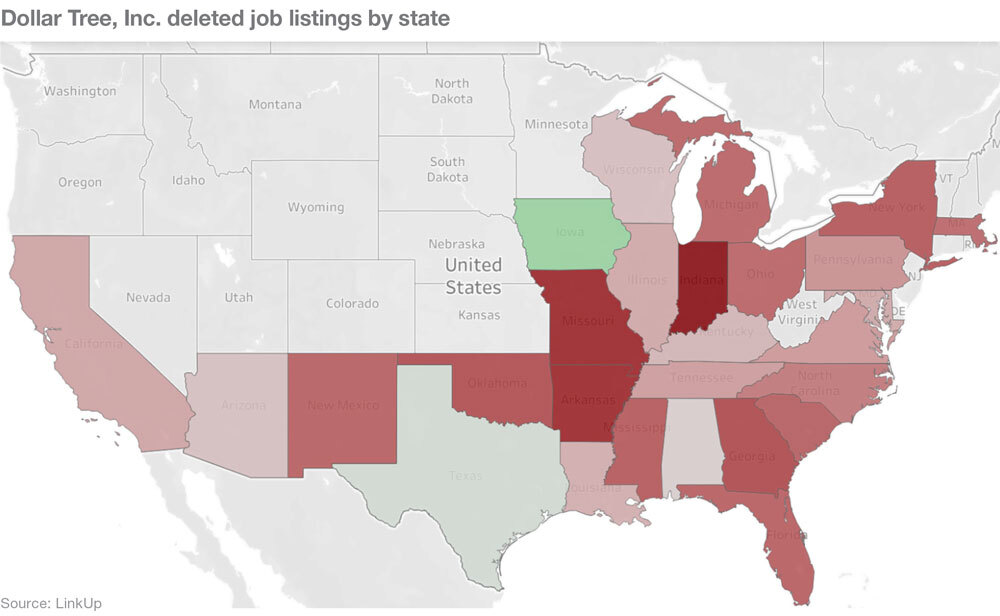

Brace yourselves as we move to the rodent infestation. While having limited knowledge on retail store closures, and even less knowledge on how long it takes to handle such an issue, we can build a hypothesis that says if we see Dollar Tree removing the majority of listings from the states affected by these closures, we can assume it will not be a quick process. Assuming that if they would be back operation in a week, there would be no need to remove job listings

We can see some of the states affected by this certainly have had the biggest changes in listings removed, when filtering out states with less than 30 listings removed. While interesting, this is likely too small of a sample to be meaningful, but still worth keeping an eye on in the future.

Overall, Dollar Tree has a fair amount of uncertainty heading into earnings. Job listings may remove some of that uncertainty, pointing to the possibility that customers did not immediately adjust to the higher prices, but came around towards the tail end of the quarter. The closure of the store still remains uncertain. Heading into next quarter it will be interesting to see if Dollar Tree increases hiring.

Insights: Related insights and resources

-

Blog

04.20.2022

Netflix stock falls, following their jobs trend

Read full article -

Blog

03.01.2022

Shopify’s post-earnings drop worries investors, but it may not be all bad news

Read full article -

Blog

02.22.2022

A look at jobs as Dell and HP prepare for earnings updates

Read full article -

Blog

02.09.2022

Amazon earnings from a job posting perspective

Read full article -

Blog

07.21.2020

Auto Parts driving earnings

Read full article -

Blog

12.16.2019

Is Pier 1 done?

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.