Jobs 101 (Part Three): How the job market functions

Read the LinkUp blog for a deep dive on how the job market functions and how alternative data can provide insight into what’s causing unexpected patterns.

As goes the job market, so goes the economy. Or maybe it’s the other way around.

There’s no question that the link between the job market and the economy is complex and messy, with plenty of external and hidden influences. With this ambiguous flow of causality in mind, it is critical to understand the function (and dysfunction) of the job market to make sense of the state of labor and the economy.

Understanding Job Market Function at the Macro Level

At the macro level, the two key concepts driving job market function are classic market theory and the cyclical model of the job market:

Classic market theory

The job market encompasses all interactions and transactions between job seekers (supply) and employers (demand). Classic market theory holds that supply and demand will naturally move toward equilibrium or balance, with price (wages) as the mechanism. In other words, wages will naturally rise when demand is greater than supply, bringing more workers into the job market to meet demand. Wages will fall when supply exceeds demand, with workers willing to accept lower pay as they compete for scarce job opportunities.

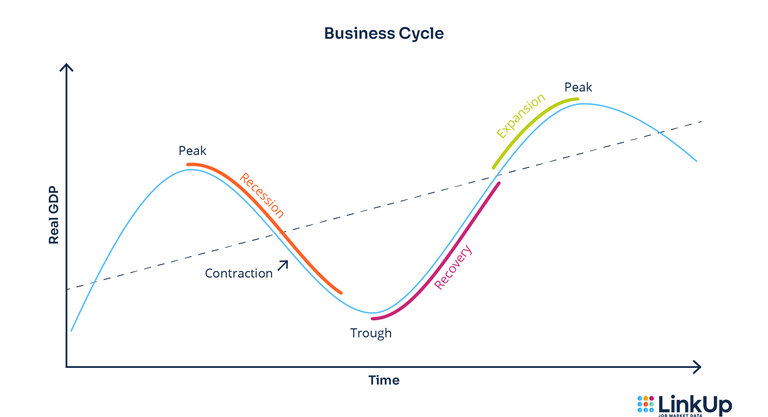

The cyclical model of the job market

The cyclical model sees the job market as a reflection of the broader business cycle. The model posits that the job market is driven by the overall state of the economy, and that job market metrics will serve as lagging indicators that reflect the expansion, peak, contraction, and trough phases. A growing economy will drive a strong demand for labor, leading to declining unemployment, higher labor force participation, and rising wages. Meanwhile, a slowing or stagnant economy will see unemployment on the rise, downward pressure on wages, and eventually a decrease in labor force participation.

Job market function at the micro level

The micro level looks at particular employers, employees, and job-seekers. Rising demand for labor at the macro-level sees particular employers posting new job listings at the micro-level. Rising supply of labor at the macro-level sees an influx of particular workers seeking work or actively working at the micro-level.

Yet these relatively straightforward processes have changed dramatically in the last decade:

Online job postings reduce barriers for employers

Employers used to rely on print advertisements, job fairs and word of mouth to find additional labor. The internet brought rapid advances and expansions in the online channels for job postings, greatly reducing the friction, effort and costs associated with posting a job, evaluating candidates and finding a match.

Company websites: Employers can post a new job opening on their website in near-real time, with virtually no cost.

Job aggregators: Online job boards that aggregate job posts directly from company websites expand the reach to a large labor supply pool.

Pay-to-post job boards: More premium job boards allow employers to pay to place job postings, with built-in advertising and marketing functionality to get the posting in front of more eyes.

Syndicated job postings: Syndicated posts enable employers to make a single posting that goes out across multiple online job boards—with different niche audiences, for example.

Sponsored job postings: An evolution of the pay-to-post model, sponsored postings give employers the opportunity to pay extra for featured or premium placement of their job postings.

In today’s sophisticated micro-market around online job postings, employers can choose how much they want to spend to expand and/or hone the reach of a job posting, potentially increasing the quantity and quality of candidates and increasing the speed of filling the position.

This reduced friction and diversification of the job posting ecosystem also complicates traditional ways of measuring labor demand, job openings, vacancy rates, etc. On the one hand, the ease of posting a job on a company website provides a more immediate signal of increased labor demand. But that lower friction means a new job posting does not necessarily correlate with urgent labor demand. The multitude of online job boards also present high levels of redundant job postings, as well as inaccurate signals (for example, the limited lifespan of a sponsored job post means that a post disappearing does not indicate that the position was filled).

Digital job hunting reduces barriers for job seekers

The various online channels of job posting also reduce friction for job seekers. Workers can more easily and more immediately see a much broader range of job opportunities. With a much lower opportunity cost to apply for jobs, job seekers can explore opportunities in new sectors, opportunities at the edge of their skill sets, qualifications or experience levels, and across geographic regions.

Why tightness misconstrues job market function

Part 1 of the Jobs 101 series discussed the concept of tightness in the job market—and why that concept provides limited insight into how the job market actually functions. Discussions of a tight or loose labor market suggest a black and white view of winners and losers.

But classic market theory says that the job market naturally inclines toward equilibrium. Rather than a zero-sum game of winners and losers, equilibrium leans the market towards a harmonious point where all parties get the best—and, critically, most sustainable—outcomes.

Job market liquidity

“Tightness” is too static and one-dimensional a term to capture the complex dynamics of the job market. Rather, the concept of job market liquidity provides a more comprehensive and nuanced understanding of the dynamics of the job market. Put simply, job market liquidity asks: How efficiently can labor supply flow to match labor demand? How easily and efficiently can workers find employment and employers find suitable candidates for job openings?

A highly liquid labor market is characterized by smooth transitions between jobs, low barriers to entry or mobility, efficient matching of workers to job openings, and minimal friction in the labor market. A highly liquid labor market is a win-win for all parties.

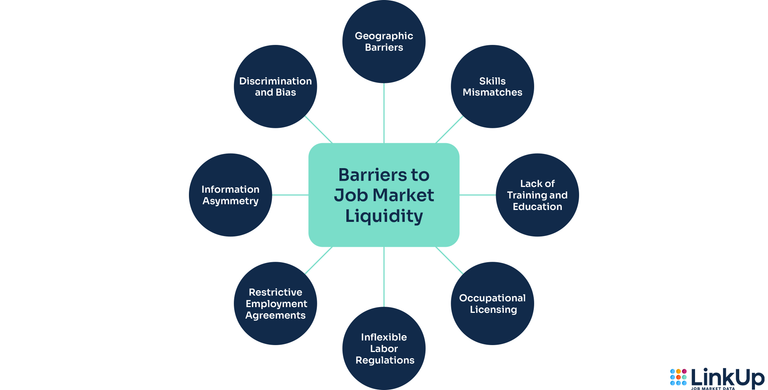

What are the barriers to liquidity in the job market?

Liquidity also provides a more nuanced lens on what’s impeding job market function and how to make it work better. For example, the major changes in the micro functioning of the job market brought about by online job posting and seeking point to one driver of higher liquidity in today’s job market. Online job posting makes it easier for job seekers to find a broader range of jobs—and easier for employers to connect with a broader range of candidates. It lowers opportunity costs for those seeking/applying for jobs, as well as for employers posting jobs.

But plenty of other factors continue to hinder the smooth flow of workers, and the efficient allocation of labor resources across the job market as a whole.

Geographic Barriers:

The geographic distance between labor supply and labor demand is a very intuitive barrier to liquidity. This can involve regional disparities in job opportunities, as well as transportation limitations or challenges. Connected technologies and the massive embrace of remote and flexible work arrangements have reduced geographic barriers in many companies and for entire sectors or job categories. But it remains true that labor supply in Wichita, Kansas cannot fully and immediately access all labor demand in Manhattan.

Skills Mismatches:

Mismatches between the skills demanded by employers and the skills possessed by job seekers can hinder labor market liquidity. When job openings require specialized skills that are not readily available in the workforce, employers struggle to fill those positions, leading to prolonged job vacancies and reduced labor market liquidity.

Lack of Training and Education:

Additional training and education can resolve skills mismatches. But inadequate access to those training and education programs limits the ability of workers to acquire new skills or to adapt to changing job market demands. A lack of opportunities for upskilling or reskilling can reduce labor market liquidity by trapping workers in occupations with declining demand or limited growth prospects.

Occupational Licensing:

Tangential to barriers to upskilling and reskilling, occupational licensing restricts labor supply from fluidly moving toward certain types of labor demand. While licensing aims to protect third parties from negative externalities (ensuring work product meets certain public safety and quality standards), it also limits the labor supply. Excessive or unnecessary licensing presents a major source of illiquidity, limiting job mobility and artificially reducing labor supply in certain fields.

Inflexible Labor Regulations:

Labor regulations like strict employment protection laws or cumbersome dismissal procedures heighten the costs of hiring and add friction which can disincentivize hiring and discourage labor market mobility. When it is difficult for employers to adjust their workforce or adapt to changing market conditions, it can hinder job creation and mobility, limiting labor market liquidity.

Restrictive Employment Agreements:

Restrictive employment agreements like non-compete clauses, non-disclosure agreements, and non-solicitation agreements can hinder labor market liquidity by imposing constraints on the mobility and flexibility of workers. These restrictive agreements can significantly limit the pool of available labor supply and demand for given workers.

Information Asymmetry:

Perfect market function depends on information transparency—fully informed buyers and sellers. When one party in a transaction possesses more information than the other, that exclusive information throws off the balance of power. This imbalance occurs on both sides of the job market. Despite the expansion of the sophisticated online job posting/seeking ecosystem, job seekers may still not have complete knowledge of all available job opportunities. Moreover, they frequently lack transparent information on compensation, obstructing optimal decision-making processes. Employers also cannot see the total available pool of labor, and struggle to get reliable visibility into candidates’ skills and experience levels.

Discrimination and Bias:

Discrimination based on factors such as gender, race, ethnicity, or age creates barriers to labor market liquidity. Biases in hiring practices or unequal treatment in the workplace can hinder equal access to employment opportunities and impede the efficient flow of labor into available opportunities.

Looking beyond traditional data to understand job market liquidity

Analysts, investors, policymakers and business decision-makers all look to the job market for insights on what the economy is doing at a macro and micro level. Now, more than ever, they’re getting mixed signals that paint a confusing picture, with traditional job market metrics increasingly deviating from conventional paradigms. Resolving this dissonance requires a deeper look—beyond the relative tightness of the job market. Decision-makers need to examine liquidity in order to understand how the job market is functioning right now. A more granular understanding of the economic, societal, and policy factors that are impeding or enabling the efficient function of the job market enables a much more holistic and confident forecast of where the job market is headed.

The challenge is that liquidity can’t be captured in a single metric, nor is it well-represented in conventional BLS job market data. Increasingly, decision-makers are seeking out alternative data sources that reveal additional dimensions (as well as more real-time information) that can bring aspects of labor market liquidity into the light. Combining these alternative data sources with traditional job market data can paint a much more complete and current picture of the complex and rapidly evolving dynamics shaping the job market—and the broader economy.

Insights: Related insights and resources

-

Blog

08.15.2023

Employment Cost Index Trend Analysis

Read full article -

Blog

08.09.2023

LinkUp's July 2023 JOLTS Forecast

Read full article -

Blog

08.03.2023

Jobs 101 (Part Two): 7 Key job market trends

Read full article -

Blog

08.03.2023

LinkUp Forecasting Continuation of the Soft Landing With Above-Consensus Job Gains in July But Smaller Gains in August

Read full article -

Blog

08.02.2023

Impact of Yellow Corp. Closure on U.S. Job Market

Read full article -

Blog

07.20.2023

Jobs 101: What is the job market?

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.