Job Market Impact Of Harvey and Irma Pales In Comparison To Hurricane Trump

Given the devastation of hurricanes this fall, both in terms of frequency and ferocity, it’s obvious that their impact is not only still being felt today, but will continue to be felt for months to come.

Given the devastation of hurricanes this fall, both in terms of frequency and ferocity, it’s obvious that their impact is not only still being felt today, but will continue to be felt for months to come. But as Texas, Florida, and Puerto Rico work hard to recover from the decimation, one of the central questions is how fast that recovery will occur. By one small measure, the local labor market in those communities, it appears as if the recovery is already complete. In fact, according to our job market data, it would seem that the hurricanes had essentially no material impact whatsoever on the local jobs markets.

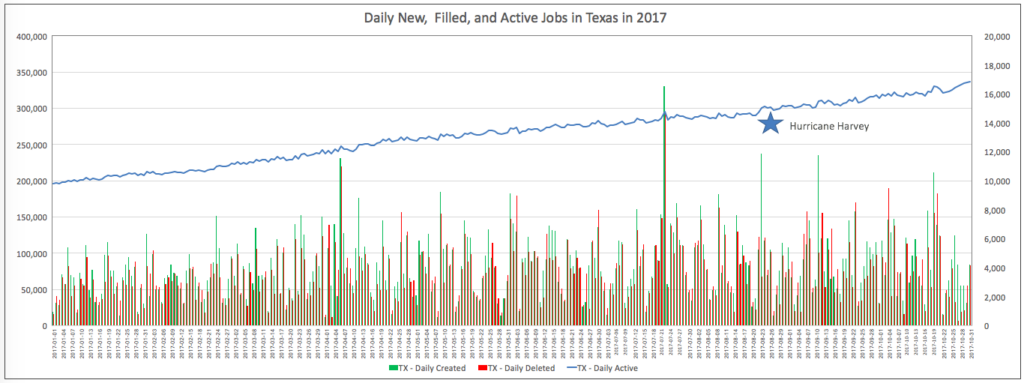

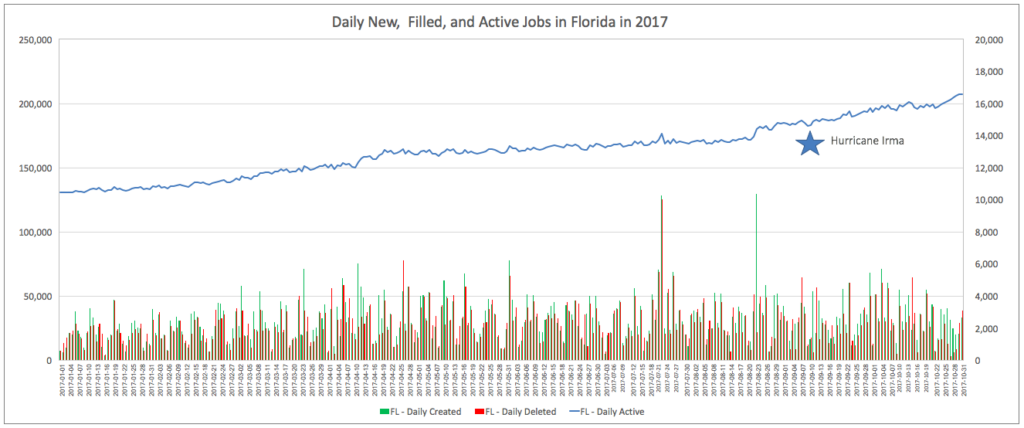

In the charts below, we pulled jobs data from LinkUp’s Jobs Data Engine, our web-based data platform that provides access to our job market data obtained from our search engine that indexes, today, roughly 4.2 million job openings from 45,000 company websites. The data we looked at includes daily active job openings, new job postings published on company websites each day, and job openings deleted each day from company websites, presumably because they were filled with a new hire.

In Texas, the consistent trend of growing labor demand throughout 2017 showed no slowdown whatsoever in early September as Hurricane made landfall and laid waste to Houston and much of the state. While new and deleted job postings showed a slight uptick after the hurricane, that increase is barely visible in the data below, especially in comparison to new and deleted jobs in the summer months immediately prior.

While we don’t have sufficient data to look at the labor market in Puerto Rico, in examining job market data for Florida, the data looks nearly identical to Texas. In both cases, one would be hard-pressed to point to anything that would indicate even the slightest hint that hurricanes had ripped through the two states and left behind so much damage.

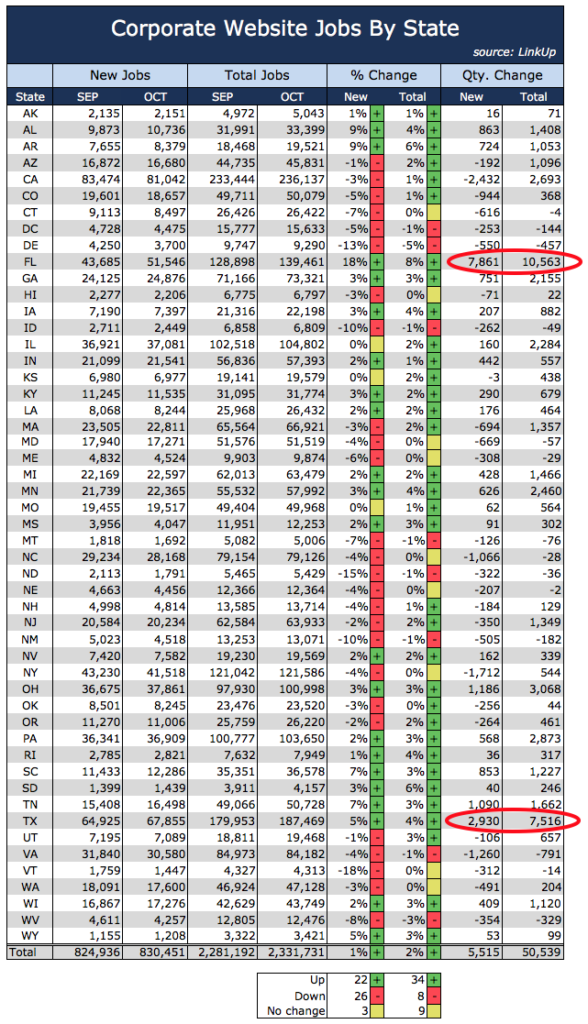

In only one place, our October paired-month data where we measure new and total job listing growth across the exact same employer organizations in both months, could we see any evidence of the hurricanes. In October, new and total job listings gains were higher in Texas and Florida were higher than anywhere else in the country. Though not surprising given the massive need for people required to rebuild, the evidence of a broad-based recovery well underway so soon is a most welcome sight nonetheless.

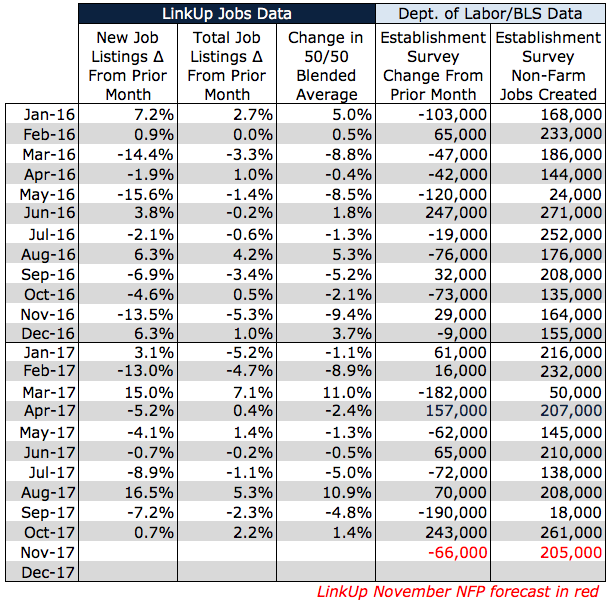

The same paired-month data, shown above for the entire U.S., serves as the primary input into our non-farm payroll forecasting model. The other key input into our model, the prior month’s non-farm payroll figure issued by the Bureau of Labor Statistics (BLS), however, required some modifications related to the impact of the hurricanes.

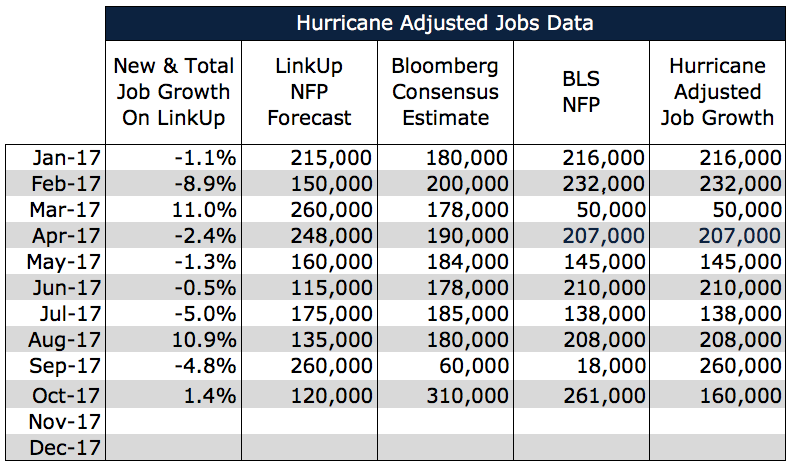

Based on the 11% gain in new and total job listings on LinkUp in August, and not accounting for the hurricanes (because our model doesn’t adjust for weather or seasonality), we forecasted job gains of 260,000 in September. While the actual numbers came in far lower due to the hurricanes, we were encouraged that BLS data for October (a net gain of 261,000 jobs) essentially reflected the strength we anticipated.

With a 5% decline in new and total job listings on LinkUp in September, we believe that October non-farm payrolls are closer to a net gain of just 160,000 jobs.

Using our ‘Hurricane-Adjusted’ data for October as shown above, combined with the 1.4% increase in new and total job gains on LinkUp in October, we are forecasting a net gain of 205,000 jobs in November.

We expect that September’s numbers will be revised up once again, October’s numbers might be revised down, and that November job gains will come in above consensus estimates. Furthermore, we expect that November BLS data will indicate continued wage growth, albeit below the dramatic gains most are desperate to see in the official data. In short, our data indicates that the labor market remains very strong and that all signs point to continued strength through at least the end of the year.

Having said that, however, the real question is when Hurricane Trump will make landfall, so to speak, and how ferocious his devastation will be on the economy in general and the labor market in particular.

Since the beginning of the year, Hurricane Trump has been gaining strength just off the coast, but the blustering and ranting and blowing of hot air is starting to make its way to tangible, solid ground, and while the windbag is only now a somewhat mild disruption to sustained strength in the labor market, the risk is that if the hot air in the White House combines with the potent force of united Republicans in Congress, that tropical depression could turn into a category 5 hurricane. Between trade, taxes, immigration, the environment, education, and judicial nominees, for example, not to mention agency rules and regulations in the Departments of Labor and Commerce, among others, the devastation to the American economy and workforce could be felt for years, even decades, to come.

Insights: Related insights and resources

-

Blog

04.10.2020

Job data highlights from a historic month | March 2020 Recap

Read full article -

Blog

10.26.2017

The New Abnormal Is Wreaking Havoc on Job Market Forecasts; LinkUp Predicting Net Gain of 120,000 Jobs In October

Read full article -

Blog

10.19.2017

Do hurricanes dampen or devastate the job market?

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.