Both the Job Market and the Economy Are In Near-Perfect Balance; The Fed Will Sit Tight Until Forced To Do Otherwise

Even with diminished expectations around rate cuts, we'll happily take the under on three rate cuts this year.

Back in January, we made 10 predictions for the coming year that included the following:

7. There will not be a recession in 2024 but fear and loathing will be severe

While the prescience of the first half of that sentence remains an open question, it’s the fear and loathing, along with the expected volatility and anxiety that we noted in the sub-title of that post, that’s starting to make its way onto the stage these days.

And the noteworthiness of that appearance, while not unexpected in the least, is testament to how quickly sentiment has shifted around the U.S. economy over the past year, especially over the past three months.

A little over a year ago, 100% of economists surveyed by Bloomberg predicted a recession by the end of the year. But the economy, powered by a solid job market, kept outperforming and as the soft landing became too obvious for all but the last few die-hard skeptics to dismiss, the consensus view at the start of the year was that the Fed, with inflation firmly under control, would cut rates 6 times in 2024. No doubt, a portion of that consensus outlook was due to some who held the view that a severe recession was imminent and the Fed would be forced to cut rates aggressively.

But armed with accurate, real-time, and forward-looking labor demand data, we, however, included the following in our 2024 predictions:

8. The Fed will cut later and less often than the markets expect

And with sticky inflation and strong job numbers in January and February that surprised nearly everyone, most people quickly moderated their expectations for rate cuts, trimming them back from 6 to 3 or 4 and pushing the start date out from March to May. A small but growing chorus have even started voicing the possibility that we might not see a rate cut this year.

As Mike Best, a high-yield-bond portfolio manager at Charlotte, N.C.-based Barings said in a WSJ article recently, “Every day you don’t see softer growth data is another day that cuts are pushed back. At the start of the year, if you said there won’t be any rate cuts this year, people would’ve looked at you as if you had three heads. Now, it’s a real possibility.”

No wonder, then, that markets breathed such an audible sigh of relief last week when the Fed Chair, during his congressional testimony, reassured everyone that rates were, most assuredly, coming down this year.

But rate cuts, plural, can only come as a result of two scenarios:

- The economy continues its current trajectory, the Fed, confident it can cut rates without triggering resurgent inflation, does so, they’re right, and they cut again two or three more times with inflation staying mute throughout.

- The economy shifts from slowing gradually to deteriorating rapidly, the Fed assertively cuts the Fed Funds rate, they do not stem the decline, and they cut rates again two or three more times

We don’t see either of those scenarios playing out anytime soon. Even with diminished expectations for rate cuts, we’ll double down on our ‘higher for longer’ prediction for 2024 and happily take the under on three cuts this year.

While data across the economy continues to be extraordinarily mixed, and even worse, official data becomes more and more volatile and less and less reliable, it’s critical to tune out the noise, including both the initial releases of data as well as the commentariat cacophony, and keep the larger narrative front and center.

As John Williams, New York Fed President, said in late February in a speech at Cradle of Aviation Museum:

Last year was a turning point for the U.S. economy. Global supply chains, which were severely disrupted during the pandemic and early in the recovery, returned to normal. Demand came into better balance with supply. And the economy grew far faster than anyone expected a year ago, boosted by increases in the labor force and productivity.

At the same time, the labor market remained strong, with the unemployment rate under 4 percent—a mark it’s held for the past two years, the longest stretch in five decades. And inflation—as measured by the personal consumption expenditures (PCE) price index—continued to decline from its 40-year high of about 7 percent in mid-2022, reaching about 2-1/2 percent last year.

A very nice, concise definition of the soft landing to be sure, and the location of Williams’ remarks couldn’t have been more fitting. So that’s where we are - the starting point of any discussion on what the Fed is likely to do. That’s the base case - the soft landing has occurred, the economy remains solid, and the job market, the key driver behind it all, remains in perfect equilibrium.

As Williams noted later in his speech:

As you’ll recall, when the economy recovered from the pandemic, the labor market turned red hot. Demand for workers far exceeded supply, and that imbalance contributed to rapid wage growth and high inflation.

Now, the labor market—both in the nation as a whole and here in the Second District—has shown signs of returning to something closer to normal. Nationally, many indicators—such as quits rates and surveys of perceptions of availability of workers and jobs—have returned to around pre-pandemic levels.

Throughout this process of getting into better balance, the labor market has remained strong. The current unemployment rate of 3.7 percent is near my estimate for the unemployment rate that is likely to prevail over the longer run. And job growth continues to be solid.

Despite the very real progress in restoring balance, two important indicators point to lingering tightness in the labor market: job openings and wage growth. Job vacancies, which reached all-time highs in the red-hot labor market of 2022, have trended lower since then, but are still quite elevated relative to pre-pandemic norms. And while we have seen measures of wage growth come down from their pandemic-era peaks, they remain above pre-Covid averages.

So Williams’ viewpoint is centered around a material overweight on the labor demand side of the job market - job openings and wage growth are both still too high from his perspective.

First, off, it’s always nice to hear from someone who shares our view that job openings are the first thing one should look at when attempting to measure the state of the economy. But secondly, Williams doesn’t sound like someone ready to cut rates anytime soon.

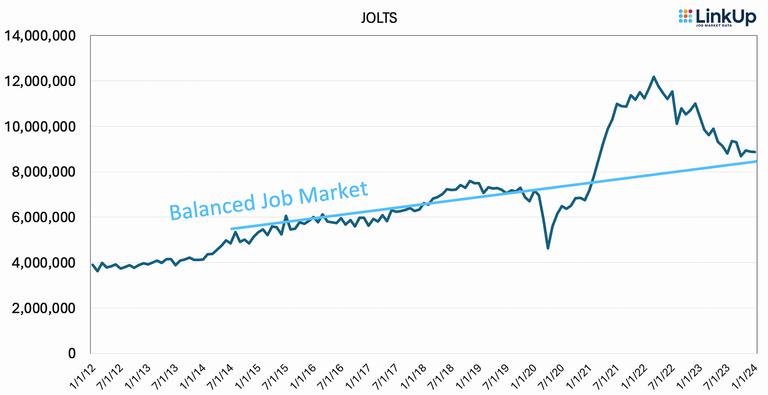

Undoubtedly, Williams is basing his conclusions on job vacancies from JOLTS data with a balanced job market trend line over the past 9 years that would look something like this:

The light blue line above, growing annually at 5% since January of 2015, tracks what we’d posit as a balanced job market during that period. Having managed a job search engine and job market data company during the ‘Jobless Recovery’ of 2010-2014 and a very balanced job market from 2015-2019, the line above is plotted precisely where it should be. And, not surprisingly, Williams is correct in concluding from the data above that labor demand, at the moment, as measured by JOLTS, is slightly higher than neutral.

But of course, we’d argue that relying on a synthetic measure of job openings constructed from survey data (JOLTS) as opposed to using real counts of actual U.S. job openings sourced every day directly from employer websites around the world (LinkUp), inevitably leads to a flawed outcome.

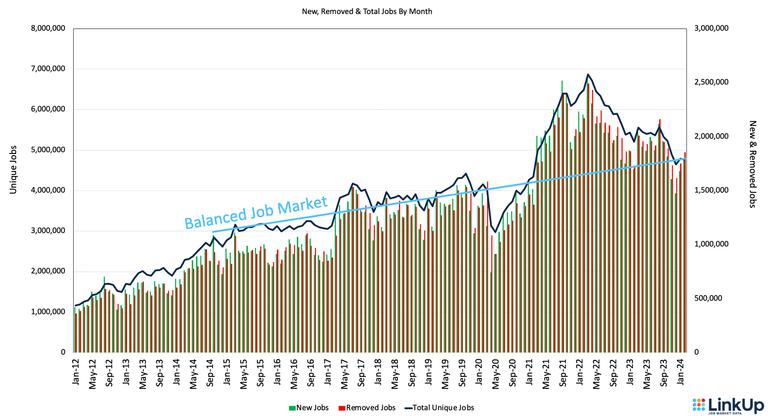

Looking at the same balanced job market indicator with the same CAGR of 5% overlaid on LinkUp’s data, it’s clear that the current job market is perfectly balanced.

While one could argue that the two charts are quite similar at a high level, I’d note that LinkUp data is more accurate, reliable and, by 30 days, more timely.

More importantly, given the criticality of correctly assessing the balance of the job market and properly determining a decision’s impact on both the job market and the U.S. economy as a whole, not to mention the global economy more broadly, accuracy matters, to say the least.

But in any event, the point here again is that Williams gives no indication whatsoever that he’s got his finger on the rate cut trigger. One can safely assume, as well, even as he regards labor demand and wage inflation as being too high, that he’s not itching to raise rates either. So he’ll sit tight, just like everyone at the Fed, and wait until there is seriously sufficient signal in the data indicating, with prejudice, that rates need to be adjusted, one way or another.

Things at the moment are quite well balanced everywhere throughout the U.S. economy and neutral rates are rapidly becoming a hot topic.

That is the prerequisite for effectuating another of our predictions for 2024:

9. The discussion around raising the inflation target to 3% will become normalized

We’ll cover this in much greater detail in a later post, but our view is that wage inflation will and very much needs to remain locked in at 4%. That would put the rate of broader inflation at roughly 3%. And given that that is where things roughly sit today, with job opening growth at 5% and everything pretty much in harmonious balance, we may have bumped into one of the great natural laws of a job market and an economy in perfect equilibrium. 5-4-3. A Pythagorean Triple, no less.

So here we’ll sit, waiting for data that will indicate the best course of action. As Williams said in concluding his remarks:

I will be focused on the data, the economic outlook, and the risks, in evaluating the appropriate path for monetary policy that best achieves our goals. Or, to paraphrase the words of the astronaut Alan Shepard, we’ll assess incoming data until it’s clear all systems are go.

The key, of course, is looking at the right data.

Insights: Related insights and resources

-

Blog

03.14.2024

Dollar Tree to Prune 1,000 Stores After Year of Hiring Decline

Read full article -

Blog

03.13.2024

LinkUp Forecast: February JOLTS report by the BLS

Read full article -

Blog

03.11.2024

Netflix Beefs Up Hiring for Live Entertainment Push

Read full article -

Blog

03.07.2024

Crypto Jobs Flat Despite BitCoin Rally

Read full article -

Blog

03.06.2024

February 2024 Jobs Recap: Job Market To Stay Hot Despite Slight Dip

Read full article -

Blog

03.04.2024

Better-Than-Consensus Jobs Report Friday Could Lead Fed to Go Either Way on Rates

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.