January Jobs Report Will Foreshadow Rocky 2018

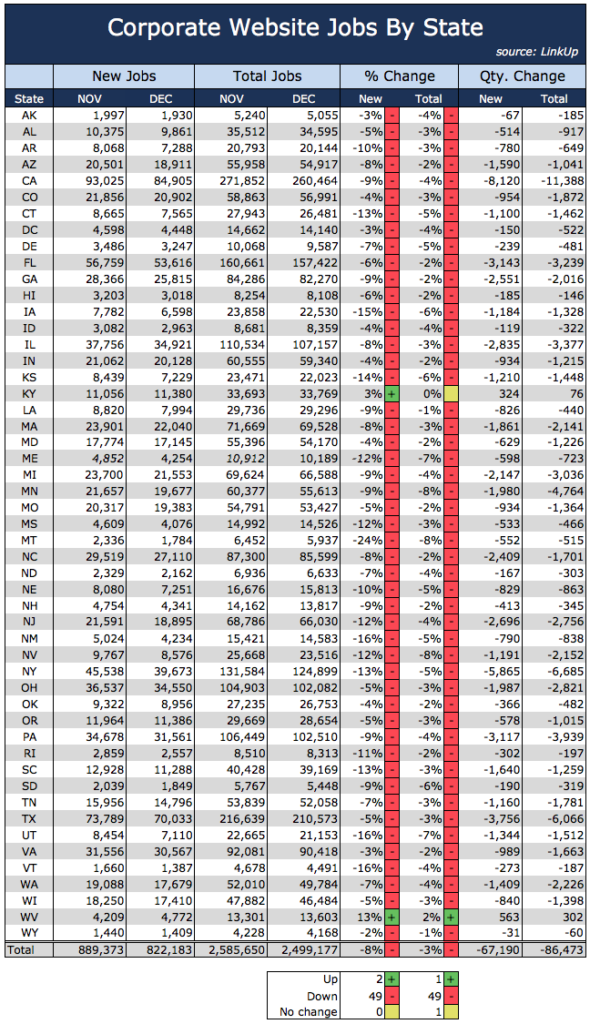

New and total job listings on LinkUp’s job search engine dropped 8% and 3% respectively in December as labor demand fell across the entire country.

New and total job listings from LinkUp’s job dataset dropped 8% and 3% respectively in December as labor demand fell across the entire country. Only 2 states, Kentucky and West Virginia, bucked the national trend, however slightly, with a combined 887 and 378 new and total job listings during the month.

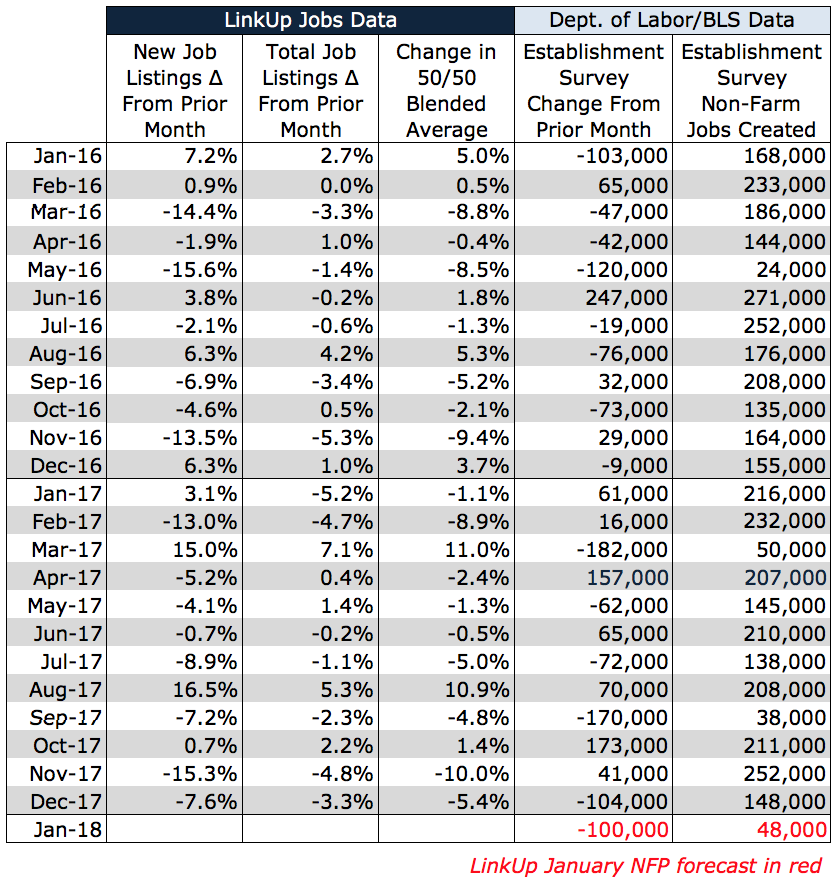

Given the broad decline in labor demand in December, we are forecasting net job gains of just 48,000 jobs in January, well below consensus estimates.

December’s decline in job listings cap off a pretty anemic quarter for labor demand across the country, a quarter in which the 50/50 blend of new and total job listings using our paired-month methodology dropped by an average of 4.7% each month. (In our monthly NFP forecast model, we use a paired-month methodology to compare labor demand across a set of companies that are common to both months being compared. This methodology allows us to normalize the dataset in order to account for the fact that we are constantly adding new companies to the search engine and the dataset).

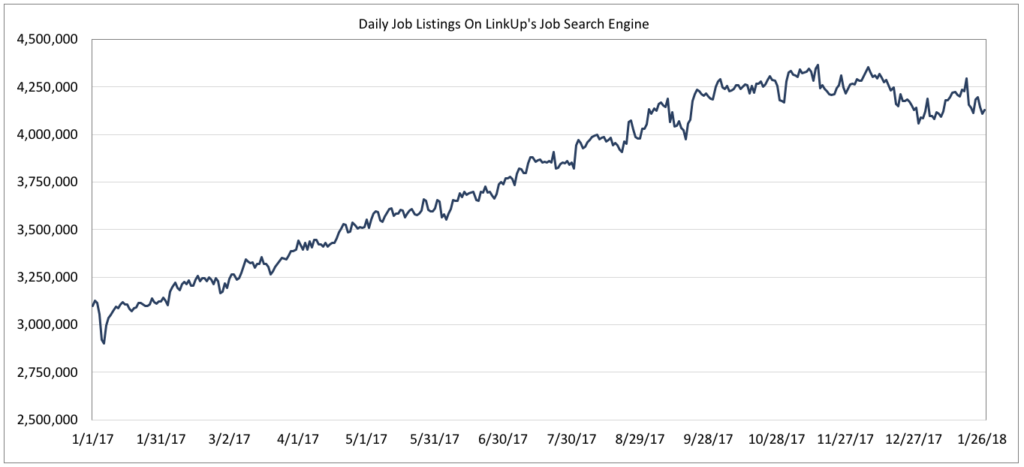

While seasonality is definitely a factor in the decline, labor demand appears to be softening to some extent and monthly job gains will inevitably continue to slow down from the post-recession peak in 2014. Looking at the total number of daily job listings on LinkUp as seen in the chart below, a number that includes new jobs from new companies being added to the dataset each day, one can see that labor demand has fallen by 200,000 jobs since November.

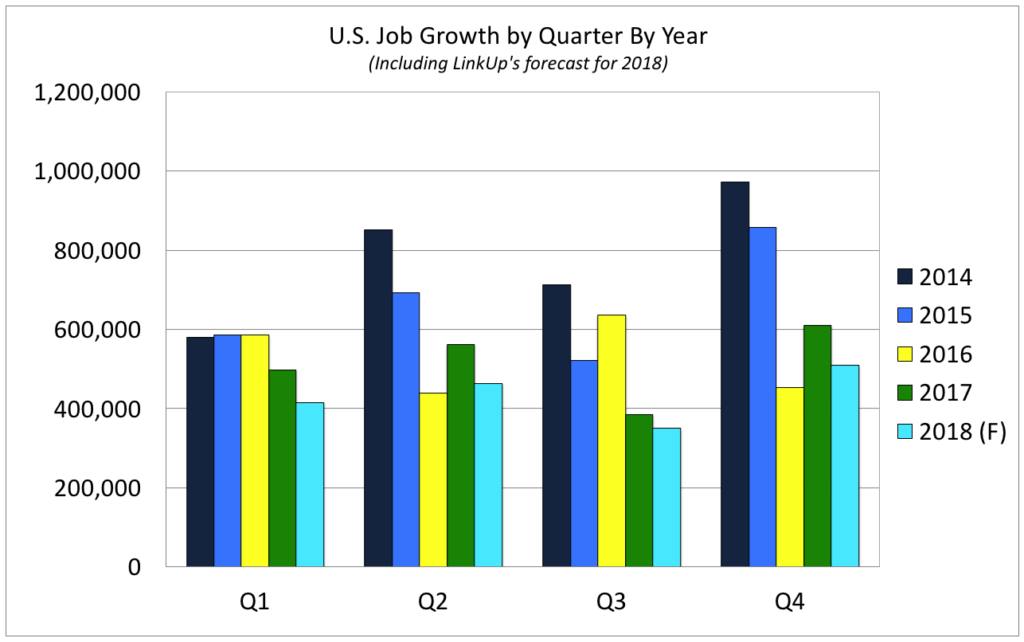

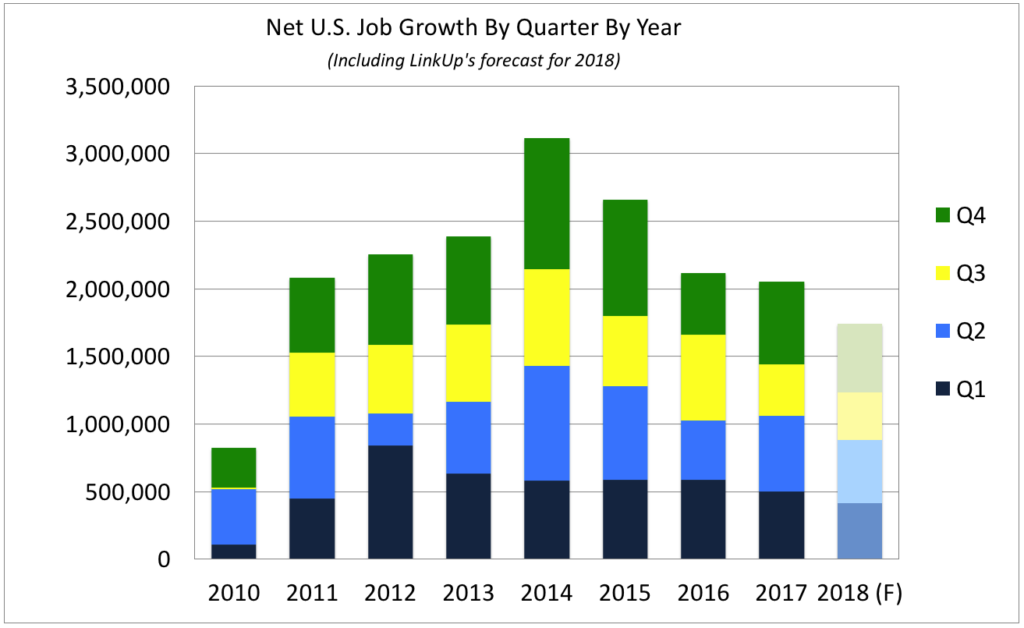

Not only does labor demand appear to be slowing down a bit, but job gains will also be harder and harder to come by as the post-recession recovery continues through a 9th year and monthly job gains extend beyond the current streak of 87 consecutive months. We’ve been in a full-employment environment for nearly 2 years, and job gains will, without question, continue to slow down in 2018. As a result, we are forecasting job gains of just 415,000 in Q1, a decline of 17% from Q1 2017.

For the year, we are forecasting a net gain of 1.74 million jobs in the U.S., a decline of 15% from last year. That equates to average monthly job gains of 145,000 as compared to 171,000 in 2017.

So the picture for 2018 is mixed. The labor market will remain relatively healthy and job gains, while down from 2017, should be quite solid with average monthly job growth that continues to put downward pressure on unemployment and upward pressure on wage growth. We do expect, however, that the year will be characterized by an increase in risk factors and far more volatility that entails some serious surprises both positive (wage inflation) and negative (the first month of negative job growth in 9 years). There will, inevitably, be an increasingly rocky road ahead – let’s just hope we make it through relatively unscathed.

Insights: Related insights and resources

-

Blog

02.03.2023

January 2023 Jobs Recap: Labor demand grows in first month of 2023

Read full article -

Blog

01.10.2023

December 2022 Jobs Recap: Decline in labor demand slows as 2022 closes

Read full article -

Blog

12.15.2022

November 2022 Jobs Recap: November job listings show cooling labor demand

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.