January Job Gains Will Be YUGE! They'll Be Bigger and Better Than Most Loser Economists Predict!

Assuming that there are, in fact, such people, regular readers of my non-farm payroll (NFP) forecast blogs are undoubtedly well familiar with my dependence on politics as a reservoir from which to draw on for multiple purposes in these posts.

Assuming that there are, in fact, such people, regular readers of my non-farm payroll (NFP) forecast blogs are undoubtedly well familiar with my dependence on politics as a reservoir from which to draw on for multiple purposes in these posts. Not only do politics and general affairs in Washington have a direct and meaningful impact on the economy, Wall Street, and the labor market, they also deliver a perpetual, inexhaustible stream of raw material that can be tapped into for analogies, opinions, connections, and commentary. And last night’s Iowa Caucuses certainly didn’t disappoint. The admittedly tenuous connection I’ll attempt to make between last night’s Iowa Caucus and our non-farm payroll forecast for January is that things just might be starting to return to normal.

For months, the 2016 Presidential had been causing fits for pundits and prognosticators as candidates, campaign strategists, and voters repeatedly defied expectations, failed to adhere to historical precedent, and refused to follow any discernible norms or patterns. But last night’s Caucuses in Iowa just might have snapped things back into some form of normalcy.

As in the past two elections, the winner of last night’s Republican Caucus in Iowa has absolutely zero chance of winning the Republican nomination, let alone the general election. Let’s hope that the loathsome Ted Cruz quickly becomes just as irrelevant, forgotten, and pathetic as Mike Huckabee and Rick Santorum.

And on the Democratic side, Hillary was once again surprised by an up-start candidate successfully tapping the passions of younger voters, largely new to politics, looking for a more aggressive catalyst for change. We’ll see what happens next week in New Hampshire, but by all measures, Iowa could not have followed its traditional playbook any more closely.

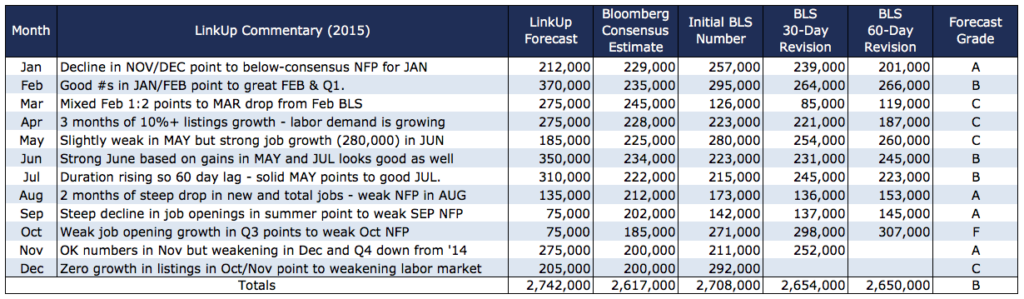

Similarly, both the economy and the labor market over the past few months have been characterized by mixed signals, conflicting information, and contradictory story lines, all of which have caused enormous uncertainty for economists, the Fed, and anyone attempting to predict non-farm payrolls. While we’ve managed to muddle our way through a challenging period with passing grades that included 3 A’s in 5 months (it always helps when you get to grade yourself), the period has been marked by an unsettling amount of fear, doubt, and trepidation.

But with LinkUp's January job data, things have hopefully returned to normal. With full knowledge that we very well could be suffering from precisely the same delusion that drives one to remain absolutely confident in the belief that neither Donald Trump nor Ted Cruz could possibly win the Republican nomination, our data appears to point rather conclusively to solid jobs numbers in January and sustained job growth through at least the end of Q1.

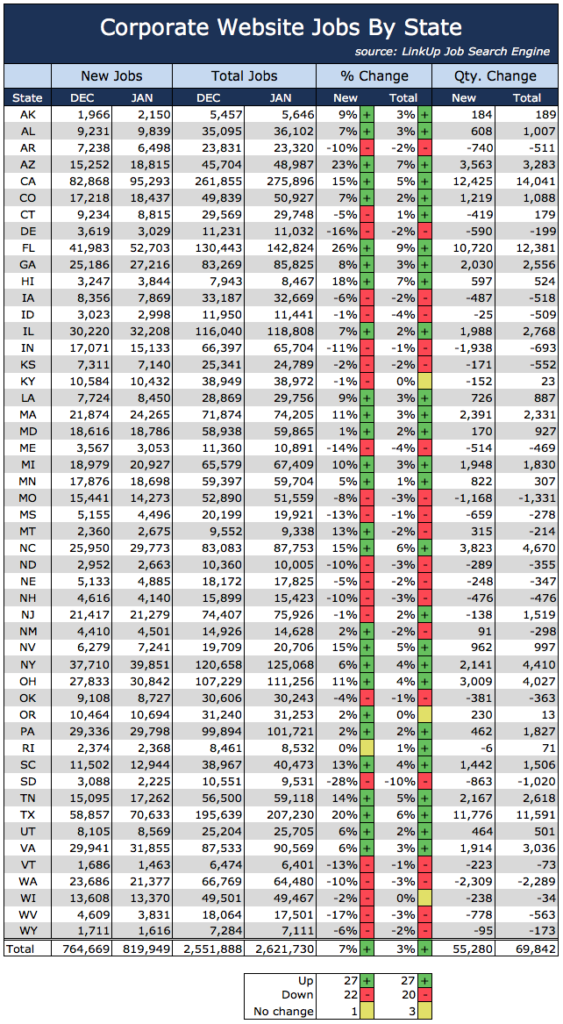

In January, new and total job openings by state in the LinkUp job search engine (which includes 3 million jobs indexed from 50,000 company websites) rose by 7% and 3% respectively.

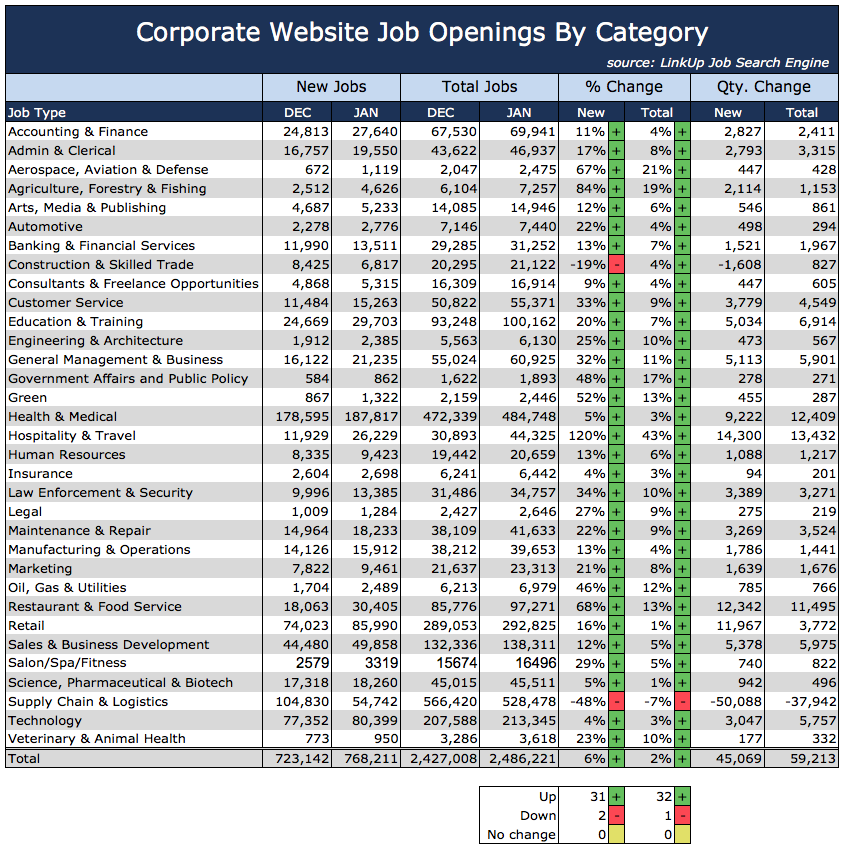

Jobs by category rose similarly, with new and total jobs by category rising 6% and 2% respectively.

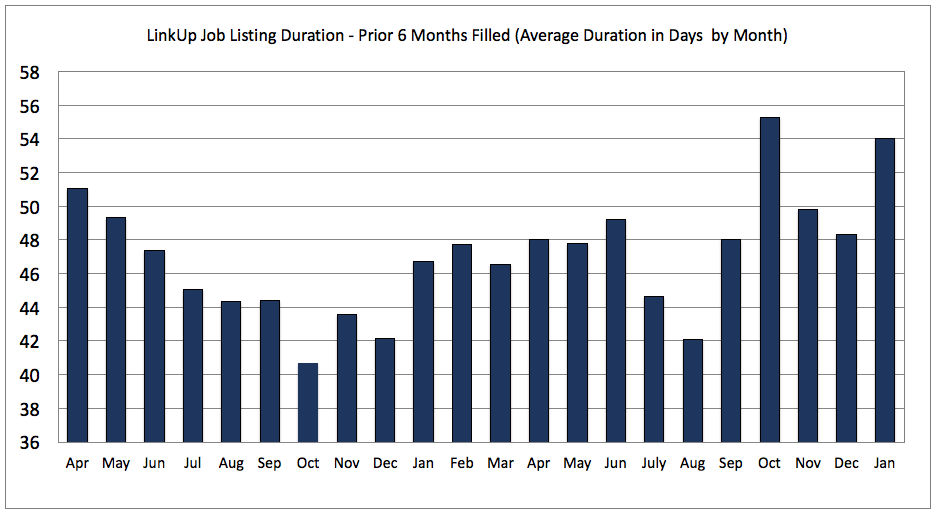

Unfortunately, the increase in new and total job openings was counter-balanced by a slowdown in the velocity of hiring. Each month, we determine Job Duration by calculating the average number of days that a job opening in our search engine takes to get filled by a new hire. And that number rose sharply in January, jumping from 48 days in December to 54 days in January, continuing a trend since last August when Job Duration was 42 days.

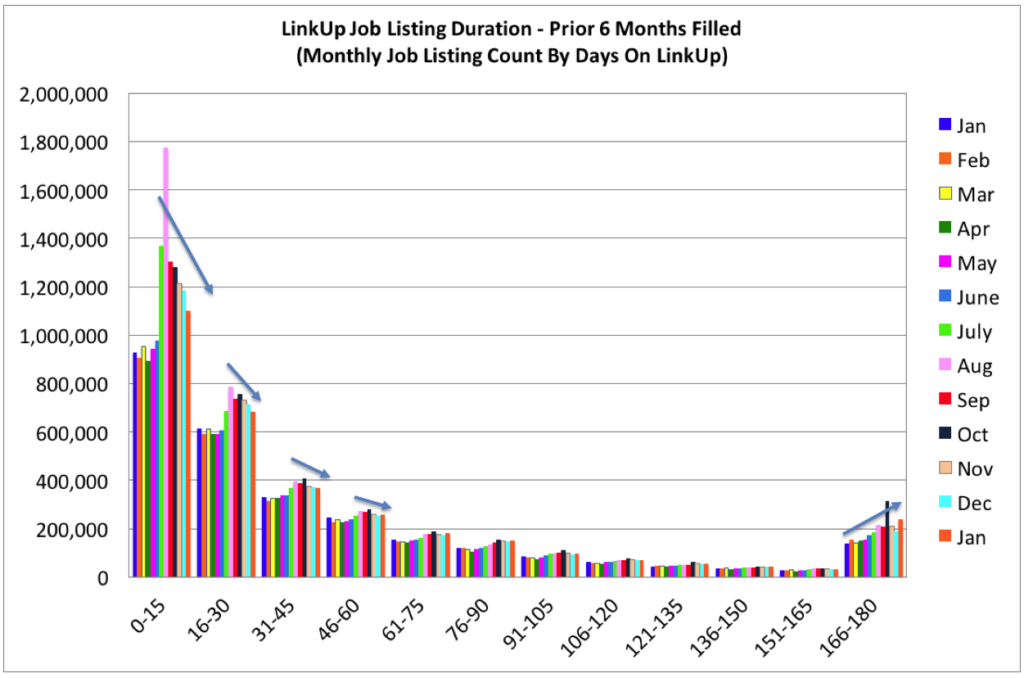

What we specifically look at to calculate Job Duration is all the jobs that have rolled off of our site in the prior 6 months. We then average the number days that all of those jobs had been in our search engine before being removed from the employer’s company website (and therefore LinkUp as well), presumably because they were filled by a new hire. The underlying data that drove up the job duration is the steady decline over the past 6 months in the number of jobs that have been filled in less than 30 days, as evidenced by the downward sloping blue arrows in the chart below.

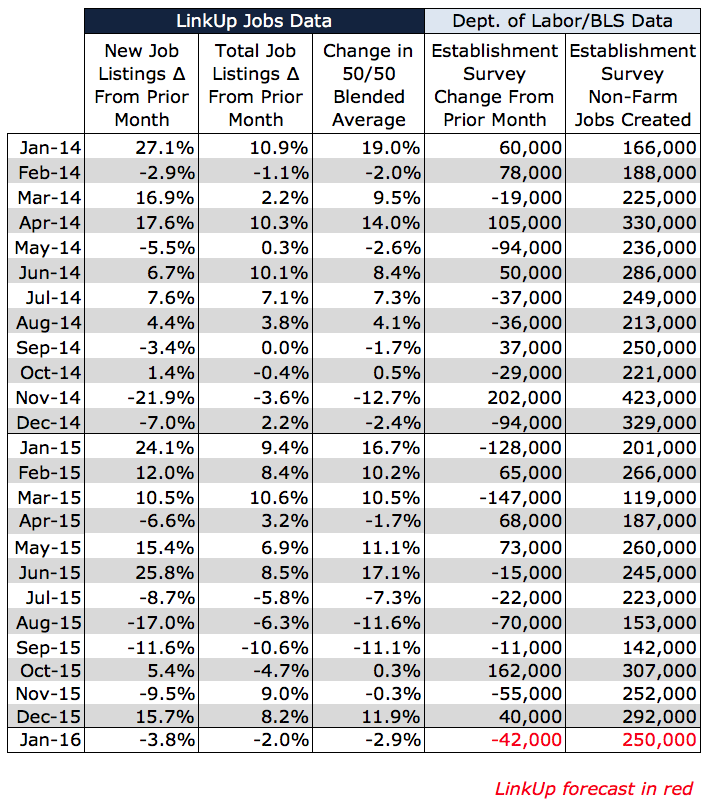

With the clear evidence that hiring velocity has slowed generally since August and sharply in January, it has become clear that we are now in a period where the lag time between a job being posted (LinkUp data) and that job opening translating into a new job in the U.S. economy (Bureau of labor Statistics’ non-farm payroll data) is 60 days. As a result, we need to look at LinkUp’s November data to forecast how many jobs were added to the U.S. economy in January. And because we saw a slight dip of -0.3% in the blended average of new and total job openings on LinkUp in November, we are forecasting net job growth of 250,000 jobs in January, slightly below the 292,000 jobs gained in December (a number that will likely be revised in Friday’s jobs report).

While a net gain of 250,000 jobs represents a slight decline from December, it’s quite a bit stronger than consensus estimates and well above the average monthly job gains of 221,000 seen in 2015. And based on the strong gains we saw in new and total job openings on LinkUp in both December and January, our preliminary forecast for job growth in the rest of Q1 is quite bullish.

So for all kinds of reasons, let’s hope things have, in fact, returned to normal and that the confidence in our Q1 forecast proves on Friday to have been well-founded. Because if it’s not, I might start to get just a little nervous about the unthinkable possibility of Ted Cruz or Donald Trump actually winning the Republican nomination.

Now that would truly be something to be afraid of.

Insights: Related insights and resources

-

Blog

07.07.2022

Job Openings Dropped 3% in June; LinkUp Forecasting Net Gain of Just 265,000 Jobs

Read full article -

Blog

08.30.2021

Labor Demand in Goods Producing Industries Outpacing Labor Demand in Service Industries

Read full article -

Blog

12.03.2020

LinkUp Forecasting Non-Farm Payroll Gain of 490,000 Jobs in November

Read full article -

Blog

06.01.2017

LinkUp's May Jobs Data Points To Slowing Job Market

Read full article -

Blog

05.30.2017

LinkUp Forecasting NFP of 160,000 Jobs For May

Read full article -

Blog

02.02.2017

LinkUp Forecasting Solid Job Gains In January and Continued Strength In February

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.