January 2024 Jobs Recap: Demand Hot as Job Adds Soar

2024 kicks off with a January of stunning job growth, signaling a robust economy after a pattern of cooling in Q4 of last year. The question now becomes: how will the Fed respond?

Key Takeaways:

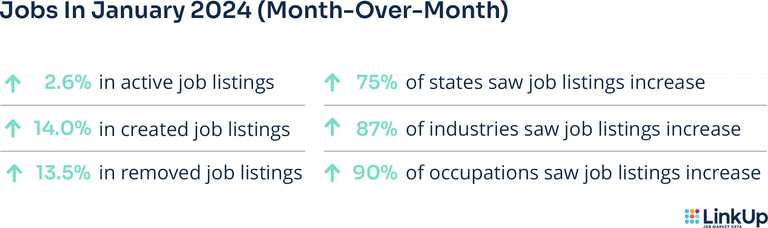

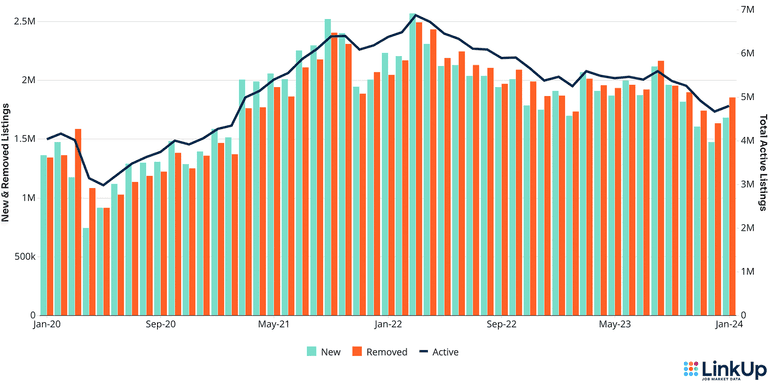

Job listings jumped up across the board in January, with a 2.6% increase in active listings and a 14% bump in created listings over last month. This bump corresponds with the whopper BLS report of 353,000 new jobs in January.

Higher demand touches most of the economy, as listings are up in 75% of U.S. states, across 87% of industries, and for 90% of occupations.

Massive gains coincide with headline-grabbing layoffs in tech, finance, and media as knowledge firms correct for over hiring post-pandemic and align workforces with the highest priority strategic initiatives. Companies in these sectors reported over 82,000 job cuts, the second highest January layoff count since 2009.

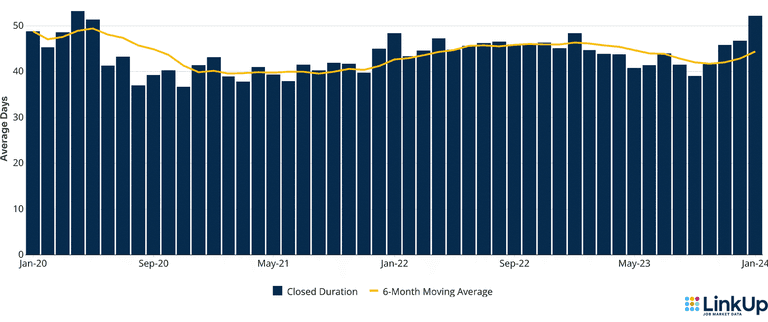

Hiring velocity continues to slow, marking a 4th month of slowing. This is a further signal that we are operating near the high water mark of a full employment environment, even as job adds have surged.

In his roundup of predictions for market trends in 2024, LinkUp CEO Toby Dayton expected a stronger and more resilient job market than consensus estimates following a labor demand slump late last year. LinkUp forecasted job growth of 195,000, outpacing consensus estimates. But even our optimistic expectations were exceeded by the staggering BLS report of 353,000 job adds in January.

Despite the highest interest rates in two decades, the job market remains remarkably hardy. Unemployment held steady below 4% for the 24th consecutive month, marking a 50+ year record of labor participation; wage growth climbed 4.5% YoY; and the Consumer Confidence Index is higher than it’s been since December 2021, when pent up demand exploded in the first waning days of the pandemic.

With such vital growth, we’d expect some anxiety of increased inflation, especially as higher wages might be passed onto consumers. But with higher wages also came a boost in labor productivity which rose 3.2% in Q4 to offset elevated labor costs.

Consumers and employers alike are taking an optimistic turn, as both feel increasingly assured that inflation will continue to ebb. And while the spiking heat of the labor market will likely hold off rate decreases longer than Wall Street’s predicted timeline, cuts are surely on the way sometime in 2024.

LinkUp job data provides advance insight and context around sudden surges and dips in the job market—stay ahead of official economic reports with LinkUp. Read on for a full breakdown of job market data for the month of January.

U.S. Job Listings by Month | January 2020 - January 2024

CLOSED DURATION

The entire U.S. economy tracks hiring velocity by measuring closed duration, or the average number of days that companies post job listings on their websites before removing them. As the average number of days a job listing remains live increases, hiring velocity slows.

Closed duration has continued to rise from 47 days in December to 52 days in January; a 10.6% increase. This is the fourth consecutive month our data shows a slow down.

Closed Duration of U.S. Jobs | January 2020 - January 2024

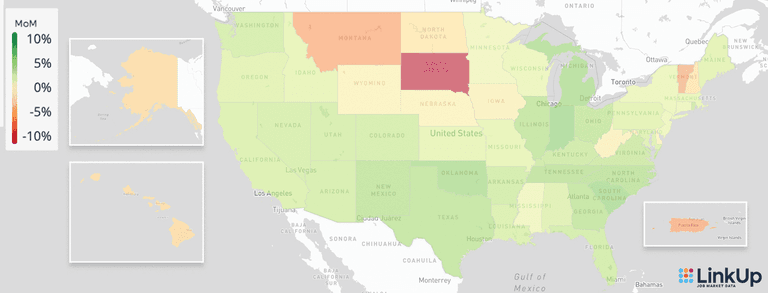

JOBS DATA BY STATE

Three fourths of all U.S. states/territories experienced an increase in job listings in January. The four states with the an increase greater than 4.5% include:

Indiana (+5.0%)

South Carolina (+4.8%)

Michigan (+4.6%)

Oklahoma (+4.6%)

The four states/territories experiencing the largest drop in labor demand include:

South Dakota (-9.0%)

Puerto Rico (-5.0%)

Montana (-4.8%)

Vermont (-4.2%)

Among the nine other states with a decrease, the decline was less than 3%.

Percent Change in Active Job Listings by State (Month-Over-Month) | January 2024

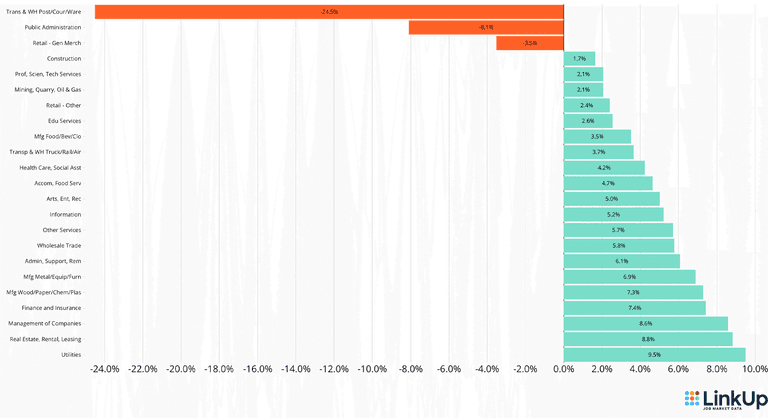

JOBS DATA BY INDUSTRY (NAICS)

87% of industries showed a rise in job listings compared to last month. Three industries that saw growth exceeding 8% included:

Utilities (+9.5%)

Real Estate, Rental, Leasing (+8.8%)

Management of Companies & Enterprises (+8.6%)

The only 3 industries that encountered a dropped in demand were:

Transportation & Warehousing Postal/Couriers/Warehousing (-24.5%)

Public Administration (-8.1%)

Retail - General Merchandise (-3.5%)

The 24.5% decline in the Transportation & Warehousing industry is attributed to a decrease in positions with FedEx and UPS, a natural occurrence following the holiday season.

Job Listings by Industry (NAICS) | January 2024

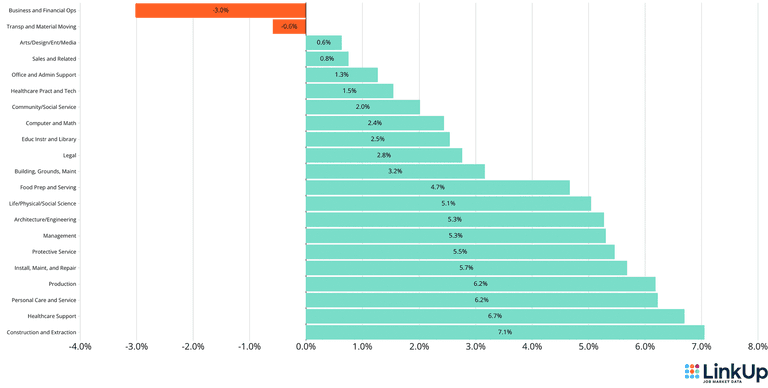

JOBS DATA BY OCCUPATION (O*NET)

90% of industries showed an increase in job listings compared to last month. Occupations that experienced a growth of over 6% in January 2024 were:

Construction and Extraction (+7.1%)

Healthcare Support (+6.7%)

Personal Care and Service (+6.2%)

Production (+6.2%)

The only 2 occupations that encountered a drop in demand were:

Business and Financial Operations (-3.0%)

Transportation & Material Moving (-0.6%)

Job Listings by Occupation (O*NET) | January 2024

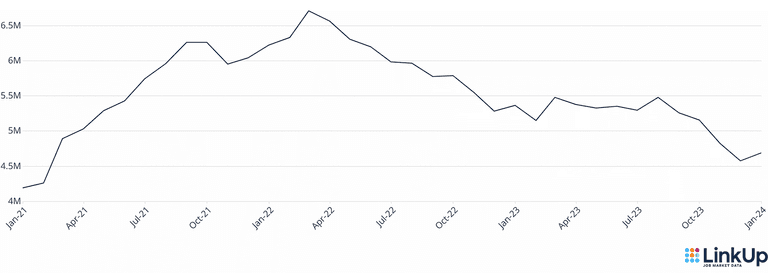

LINKUP 10,000

The LinkUp 10,000 is a daily and monthly analysis that shows the number of job openings from 10,000 global employers with the most U.S. job openings in LinkUp’s dataset.

The LinkUp 10,000 showed a similar increase in January 2024. Since December last year, job listings from the top 10,000 global employers have declined by 12.6%, while last month it increased 2.5%.

Monthly LinkUp 10,000 | January 2021 - January 2024

If you’d like more granular economic data or would like to look deeper into specific industries, occupations or companies, trial our job data or request a sample.

COMPANIES ADDED

LinkUp collected job listings on 751 new employer websites during the month of January 2024. Every month we index new companies to our LinkUp job listing database and have been steadily increasing with the current 6 month moving average. Contact us if you are interested in obtaining the complete list of recently added companies. |

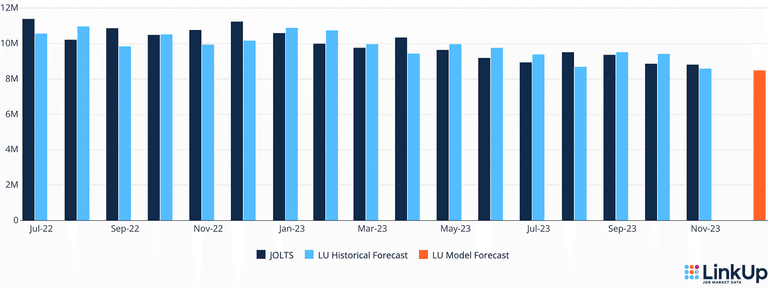

LINKUP MONTHLY FORECASTS

Stay tuned for our monthly forecast of the BLS JOLTS report which drops next Wednesday, ahead of the release of JOLTS data from the Bureau of Labor Statistics (BLS). The data includes estimates of the number and rate of job openings, hires, and separations for total jobs from private employers, by industry and by establishment size class.

Also, each month we publish a nonfarm payroll report forecast ahead of the BLS release, which is based on our RAW LinkUp job listing data. The NFP report is based on total U.S. job vacancies and provides insight into anticipated growth or decline in job listings.

HR TECH 2024 CONFERENCE

Plan ahead! Visit the LinkUp booth at the 2024 HR Tech Conference September 24-27 at Mandalay Bay in Las Vegas. Registration opens on March 1.

DATA DISCLAIMERS

LinkUp’s monthly data recaps incorporate revisions to previously-reported monthly data with the purpose of reporting the most accurate and up-to-date data points. For more information on what circumstances may impact data revisions, visit our Data Support Center.

Insights: Related insights and resources

-

Blog

02.02.2024

Mapping the AI Revolution with LinkUp (Part I)

Read full article -

Blog

02.01.2024

LinkUp Forecasting a Net Gain of 195,000 Jobs In January

Read full article -

Blog

01.31.2024

10 Predictions Around the Job Market and the U.S. Economy for the Coming Year

Read full article -

Research

01.30.2024

AI Maps | Rise of the Rest: The Changing Geography of AI Jobs in America

Read full article -

Research

01.24.2024

Where Did the Workers Go?

Read full article -

Blog

01.24.2024

Where’s My AI Revolution?

Read full article -

Blog

01.10.2024

LinkUp's December 2023 JOLTS Forecast

Read full article -

Blog

01.04.2024

December 2023 Jobs Recap: Continued Labor Cooling

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.